Important Questions To Ask Yourself Before You Put In An Offer

If the answer to any of these is I dont know then speaking to a mortgage advisor might be a really good first step for you, and its not as stressful as you may think.

With the right advice and the perfect lender, you could have your £150 000 mortgage-in-principle in no time, ready to start looking for your dream home.

Get Started With A Broker

Maximise your chances of approval and secure the best deal with a specialist broker

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

We are an information-only website and aim to provide the best guides and tips but cant guarantee to be perfect, so do note you use the information at your own risk and we cant accept liability if things go wrong. Please email us at if you see anything that needs updating and we will do so ASAP.

*OMA Mortgage Approval Guarantee is subject to you providing satisfactory documentation. See T& Cs.

Maximise your chances of approval, whatever your situation – Find your perfect mortgage broker

That Makes Sense I Think My Credit Score Is In Good Shape Thankfully Is There Anything Else That Happens Before I Get The Mortgage

As far as the lenders work goes, not really. When determining the answer to How much mortgage can I afford?, the lender can tell you what theyre willing to give you, but it is very important that you take stock of your current situation and assess your future before committing to a loan. In other words, were back to the question of what size debt are you comfortable taking on.

Read Also: How To Calculate Total Mortgage Payment

How Much Is A 150000 Mortgage A Month Final Thoughts

When considering what mortgage amount to apply for ask an expert to assist you. Affording the repayments each month comfortably should be a number one priority.

If youre ready to take the leap, were ready to help you with your first time buyer mortgage application.

As a first time buyer, its natural to have a lot of questions. Ask away, one of our friendly advisors would love to talk things through with you.

Call us today on 01925 906 210 or complete our quick and easy First Time Buyer Mortgage Application.

Consolidate Today!

Also Check: What Are 30 Year Mortgage Rates

What Mortgage Can I Afford On 125k Salary

Under this law, if you make $ 125,000 before tax, you should be able to afford up to $ 35,000 in housing costs per year â or about $ 2,916 per month. Read also : Can I buy a house making 30k?.

How much house can I afford if I make 120k?

If you make $ 50,000 a year, your total housing expenses for the year should not exceed $ 14,000, or $ 1,167 per month. If you earn $ 120,000 a year, you can grow up to $ 33,600 a year, or $ 2,800 a monthâ ilaa unless other debts push you over 36 percent.

You May Like: How Soon Can You Lock In A Mortgage Rate

How Much Deposit Do I Need For A 150000 Mortgage

A 150000 mortgage will mean you have at least between 5% 20% for a mortgage deposit.

This means if you want a 150000 mortgage you already have between £7,500 and £30,000 for your mortgage deposit.

This will be the first basis of your affordability of a 150000 mortgage.

You can improve your mortgage affordability by using one of the governments first-time buyer schemes.

This will mean you can put down a smaller mortgage deposit or be eligible for a reduction in the property price.

Some of the mortgages you could get with a 150000 mortgage include:

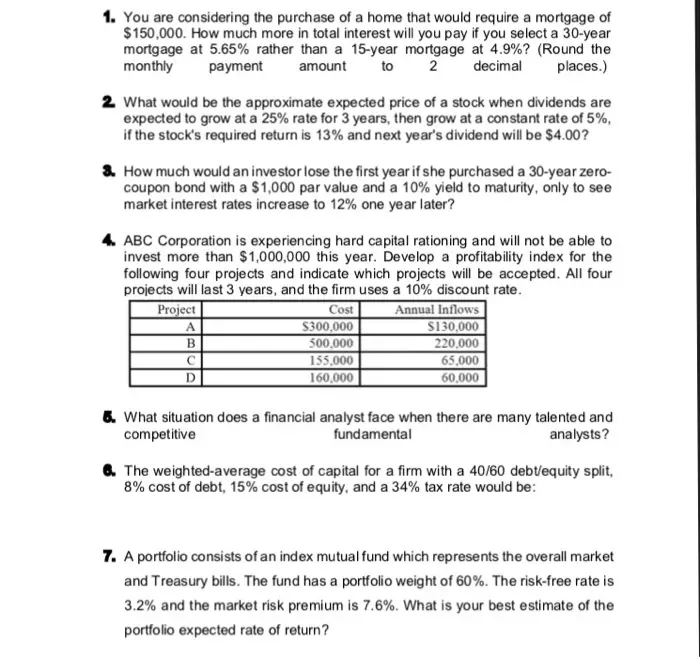

Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

You May Like: What Is The Payment On A 60000 Mortgage

What Is The Minimum Deposit

The amount you are willing to borrow is proportional to the propertys value. This is called the loan-to-value ratio.

You can borrow 90% if you have a £15,000 down payment on a £150,000 property. Your LTV ratio will be 90%.

For residential mortgages, the minimum deposit required is currently 5% or 95% LTV. For a 150,000 mortgage, you will need to have a minimum deposit of £7.5K.

How Much Money Do I Need To Afford A 500 000 House

How Much Money Do I Need to Make a $ 500,000 Home? Typically, home loan repayment should not exceed one-third of your monthly income. So with a 20% 30-year discount and a 4% interest rate, you will need to make at least $ 90,000 a year before tax.

How much should I make to afford a 400k house?

What is the income required for a 400k loan? To be able to afford a $ 400,000 home, lenders need $ 55,600 in cash to make a 10 percent reduction. When you have a 30-year loan, your monthly income must be at least $ 8200 and your monthly repayment of existing debt should not exceed $ 981.

How much do I need to make to buy a $300 K House?

What is the required income for a 300k loan? $ 300k loans with 4.5% interest rate over 30 years and $ 10k downward will require an annual income of $ 74,581 to qualify for the loan. You can even calculate further variations on these dimensions using the Loan Required Income Accountant.

Don’t Miss: How To Apply A Mortgage Loan

Can I Get A 150000 Secured Loan

Yes. As long as you have enough equity in your home. Secured loans are often referred to as secured home loans, home-owner loans or second charges.

Secured loans are often easier to obtain than an unsecured loan, but be aware that your property could be repossessed if the loan isnt repaid.

If youre seriously considering a secured loan, its important that you get the right advice, so get in touch with us today.

Dont Miss: How Does Rocket Mortgage Work

How Do Lending Multiples Work

When it comes to households with two incomes, some lenders offer a choice:

- The option to add the second income on top of the multiple, so if the main breadwinner earns £30,000 and the second persons income is £15,000 a lender might offer 4x the first income, plus the second income or

- A slightly lower multiple for two incomes than for one. So £30,000 + £15,000 = £45,000. Then £45,000 x 3 = £135,000

Many lenders now only use income multiples as an overall maximum that they will lend, conducting a detailed affordability assessment to decide how much they will actually let you borrow. All income you declare in your mortgage application will need to be proven, usually through you providing your latest pay slips, pensions and benefits statements.

Dont Miss: Reverse Mortgage Mobile Home

Also Check: Why Do Banks Need Bank Statements For A Mortgage

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers home price, down payment, loan term, interest rate and your total debt payments to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

Dont Miss: How Much Can You Get On A Reverse Mortgage

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Recommended Reading: Why Is My Credit Score Different For A Mortgage

How Do You Compare Loan Offers

In any loan scenario, you have to make underlying assumptions such as:

- If you are likely to remortgage the loan again.

- When you are likely to remortgage.

- Where you think interest rates are headed.

- If you think you will sell the home soon.

- If rates head higher and your rate resets well above the initial offer, will your wages be enough to cover payments?

Look Beyond the Monthly Payment

Its important to consider the overall mortgage costs, not just the monthly payment amount. Borrowers will find interest-only payments affordable. However, compared to a full repayment mortgage, you immediately build equity in your home. This bring you closer to home ownership, stability, and grants you further life flexibility. In contrast, interest-only payments do not build equity. It does not provide financial cushion which helps protect you against shifting market conditions.

If one loan amortises and the other does not, then you have to look at how much equity you build in a home. This is a key factor in determining value. Most people also do not want to pay mortgages for the entire lifetime, or until they hit a tough patch and risk foreclosure.

Example Loan Comparison from a Reader

The key to being able to accurately compare mortgage offers is to only adjust a single variable at a time. This way you can easily see the differences between offers, instead of trying to compare apples to oranges.

The example below is based on a question from one of our users named Dan.

| Year |

|---|

can700can

How To Lower Your Monthly Payments

If your mortgage calculator results are not yielding the lower monthly payments you hoped for, here are several techniques to try:

- Lower purchase price: The less you borrow, the lower your mortgage payment

- Bigger down payment: Putting more money down means youll borrow less. Also, the best mortgage rates generally go to borrowers with larger down payments, among other qualifying factors

- Avoid private mortgage insurance: When you put at least 20% down on a conventional loan or 20% home equity on a refinance you can avoid paying monthly private mortgage insurance premiums

- Longer loan term: A longer loan term means lower monthly payments. However, you will pay more in total interest over the life of the loan

- Shop for a lower rate: Rate shopping doesnt have to take long, and its well worth the savings. Here are tips to get your best mortgage rate

Read Also: Do Mortgage Lenders Look At Medical Collections

How Much Income Do I Need For A 150k Mortgage

You need to make $55,505 a year to afford a 150k mortgage. We base the income you need on a 150k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $4,625.

You may want to be a little more conservative or a little more aggressive. Youre be able to change this in our how much house can I afford calculator.

How To Calculate Annual Income For Your Household

In order to determine how much mortgage you can afford to pay each month, start by looking at how much you earn each year before taxes. Consider all your earnings for the year, which could include salary, wages, tips, commission, etc.If you have a spouse or a partner that has an income which will also contribute to the monthly mortgage, make sure to include that as well into your gross annual income for your household. Then take your annual income and divide by 12 to determine your monthly income.

Follow the 28/36 debt-to-income rule

This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income against all debts, including your new mortgage. Keeping within these parameters will ensure you enough money left over for food, gas, vacations, and saving for retirement.Example: Lets say you and your spouse have a combined monthly income of $5,000. Applying the 28/36 rule, you wouldnt want to spend more than:

$1,400 on house related expenses

$1,800 on total debt

Don’t Miss: How To Own A Home Without A Mortgage

How The Term Affects The Cost Of A 150000 Mortgage

The mortgage term significantly affects how much a £150,000 mortgage costs a month and what you ultimately pay in total. Most lenders in the UK offer between 5 to 30 years to repay a £150,000 mortgage.

How long youll need to pay off the mortgage will depend on how much you can realistically afford to pay each month. Youll get cheaper monthly repayments with extended periods, but the overall cost will be higher at the end of the loan term.

Youll have higher monthly repayments with a shorter mortgage term but a lower overall cost. A £150,000 mortgage with a term of 30 years will cost you thousands more than a mortgage for 20 years or less. However, the cost of the more extended period may be worth it if you need cheaper monthly repayments you can easily afford.

Its wise to choose a term based on how much you can afford each month without getting into financial hardship. Based on a 3% interest rate, the table below can give you a rough idea of how the term affects how much a £150,000 mortgage costs a month and in total.

| Term |

| £161,712 |

Form An Llc For Real Estate

If you are planning on purchasing real estate, consider starting an LLC for your real estate investments.

Not only will an LLC for your real estate protect your assets, but it can also result in tax benefits which could save you a ton of money each year.

Starting an LLC is also incredibly simple and easy to do. If you are thinking about getting a $150,000 mortgage for your real estate, forming an LLC might be the right decision. It will most likely end up saving you both time and money.

Don’t Miss: How To Become Mortgage Loan Underwriter

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

Dont Miss: Does Rocket Mortgage Sell Their Loans