Apply For A 250000 Mortgage

To find out more about our range of £250,000 mortgages simply make an application with our approved mortgage experts found here on the website. Rates are available from across the market either on a fixed rate or variable rate deal. Mortgages and lenders to suit most credit types and applicants including buy to let property.

Explore this product

Use This Va Mortgage Calculator To Get An Estimate

This VA loan calculator provides customized information based on the information you provide. But, it assumes a few things about you. For example, that you’re buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lenders fees and other costs, which can be significant.

Estimated monthly payment and APR example: A $225,000 base loan amount with a 30-year term at an interest rate of 4.125% with no down-payment would result in an estimated monthly payment of $1,126.45 with an Annual Percentage Rate of 4.471%.1

Your Total Interest On A $250000 Mortgage

On a 25-year mortgage with a 4% fixed interest rate, youll pay approximately $144,515 in interest over the life of your mortgage. Thats about two-thirds of what you borrowed in interest.

If you instead opt for a 15-year mortgage, youll pay approximately $82,117 in interest over the life of your mortgage or about 57% of the interest youd pay on a 25-year mortgage.

-

See how much you’d pay in total interest based on the interest rate.

Interest

Read Also: What Of Salary Should Go To Mortgage

How Much Do I Need To Make To Buy A 500k House

The Income Needed To Qualify for A $500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

Costs To Expect When Buying A Home In California

One of the costs youll want to consider during the home-buying process is a home inspection. Before you close the deal on a house, theres usually a period where you can arrange a home inspection to determine the state of the house and any potential problems with the property. If problems are found, you generally have some negotiating power over the seller for repairs or price. Typical costs range from $300 to $550, with larger houses falling on the higher end of the price range. Some types of mortgages will require additional tests such as termite inspections. Any additional services will cost extra, but may help you discover serious issues prior to moving in, such as a mold infestation. One last consideration for testing is radon. California doesnt have as high of risk for radon as some regions in the U.S. However, there are some areas, such as Tulare, that are depicted as having high concentrations of radon, according to the California Department of Conservations indoor radon potential map. Youll want to check to see if your property is in one of those high-risk areas.

If the inspection goes well and you set a closing date for the home, youll have to budget for the additional fees that are called closing costs. These costs vary based on the location and value of the home, your mortgage lender and a number of other factors. On a county to county basis, closing costs in California range from 0.81% to 2.57% of your homes value.

Don’t Miss: How Do Banks Calculate Mortgage Payments

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

Why Should I Use A Mortgage Calculator

Don’t Miss: What Is The Rate For A 15 Year Mortgage

What Is The Total Interest On A 250000 Mortgage

On a 30-year mortgage with a 4% fixed interest rate, youll pay £179,673.77 in interest over the life of your loan. Thats about two-thirds of what you borrowed in interest.

If you instead opt for a 15-year mortgage, youll pay £82,859.57 in interest over the life of your loan or about 46% of the interest youd pay on a 30-year mortgage.

-

See how much you’d pay in total interest based on the interest rate.

Interest £261,010.10

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

Don’t Miss: How Much Mortgage Can I Afford In Retirement

Trying To Predict Mortgage Rates

One of the biggest misconceptions is that mortgage rates should follow and equal the Federal Reserves benchmark interest rate in fact due to the intricate nature of the markets the opposite is actually far more likely. The market conditions that are good for the Federal Reserve are often not so favorable for mortgage borrowers. Its important to understand the function, and differences, of the two rates. The Federal Reserve has a far shorter-term outlook whereas mortgage rates are based on a much longer economic outlook the most commonly held US mortgage is a 30-year term loan and requires a far deeper analysis. Far more accurate is to follow the 10-year United States Treasury note as a predictor of the movement of mortgage rates.

How Much Is A Downpayment On A 300k House

If you are purchasing a $300,000 home, you’d pay 3.5% of $300,000 or $10,500 as a down payment when you close on your loan. Your loan amount would then be for the remaining cost of the home, which is $289,500. Keep in mind this does not include closing costs and any additional fees included in the process.

Don’t Miss: Can You Use Collateral For A Mortgage

How Much Mortgage Loan Insurance Would You Need If You Make The Minimum Down Payment

As mentioned, CMHC mortgage loan insurance is mandatory for any down payment thats less than 20%. Mortgage default insurance protects your lender if you default on your payments. Luckily, it can also help you qualify for a mortgage with a minimum down payment starting at 5%.

Your mortgage default insurance premium is calculated using your loan-to-value ratio . You can then pay your full premium upfront or ask your lender to add it to your mortgage payments.

Here is how much your premiums will cost you based on different LTVs:

| LTV | ||

| Up to and including 95% | 4.00% | $9,500 |

Do note, that lenders may still take our CMHC insurance on your mortgage for down payments of 20% or more

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Don’t Miss: What Are The Different Types Of Mortgage Loans

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

How Much A $250000 Mortgage Will Cost You

Theres more to a mortgage than just the monthly payment. Before you take out a $250,000 mortgage, youll need to account for things like interest, insurance, taxes, closing costs, and more.

Edited byChris JenningsUpdated August 8, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

The monthly payment isnt the only cost youll want to think about when taking out a mortgage. To gauge the real cost of your loan, youll need to think about interest, too or how much it costs to borrow the money over time.

Learn more about how much a $250,000 mortgage will cost you throughout the life of the loan:

Also Check: How To Lock In Mortgage Rate For 6 Months

Cut Your Loan Costs By Prepaying Principal

This PITI calculator offers another feature that can help you cut your loan costs. See how adding additional principal payments can shorten the life of the loan by years. Determine if you could add to your payment on a monthly or yearly basis, or even just one time. Hit “view results” to see a side-by-side comparison of your regular payment schedule versus the prepayment payment schedule.

This mortgage calculator with taxes and insurance will show you just how much you’ll be paying in interest for the life of the loan under both scenarios, as well as how much you can save by making extra principal payments along the way.

Learn more about specific loan type rates| LOAN TYPE |

|---|

Why You Should Consider Repayments On A 250k Mortgage

Whether your income allows you to secure a mortgage for £250k is one thing. Affording the repayments on that mortgage is another. As well as calculating if you can get a mortgage of this size, its also worth trying to calculate how much the repayments will cost you every month. This will determine whether you can realistically afford a loan of this size as much as an affordability check will.

There are a number of factors that will determine exactly how much those payments would be, of course, such as what interest rate you get, the term length and whether you get an interest-only or repayment mortgage, but a broker will be able to help you with these figures.

As a guide, have a look at our repayment calculator below. Just input a target mortgage amount along with an interest rate and term to see what the repayments could look like.

Read Also: Can I Add Someone To My Mortgage Without Refinancing

Mortgage Affordability And Your Down Payment

Because Canada has minimum down payment rules in place, the amount of money youve saved for a down payment can limit your maximum mortgage affordability. The minimum down payments in Canada are:

- 5% of the purchase price up to $500,000, plus

- 10% of any part of the price between $500,000 and $1 million, or

- 20% of the total purchase price for homes valued at over $1 million.

Lets consider an example. If your down payment amount is fixed at $15,000, the maximum home price you will be able to afford is $15,000 divided by 5%, or $300,000. If your down payment is $30,000, then your maximum affordability will increase to $550,000. You can run the numbers yourself on our mortgage affordability calculator.

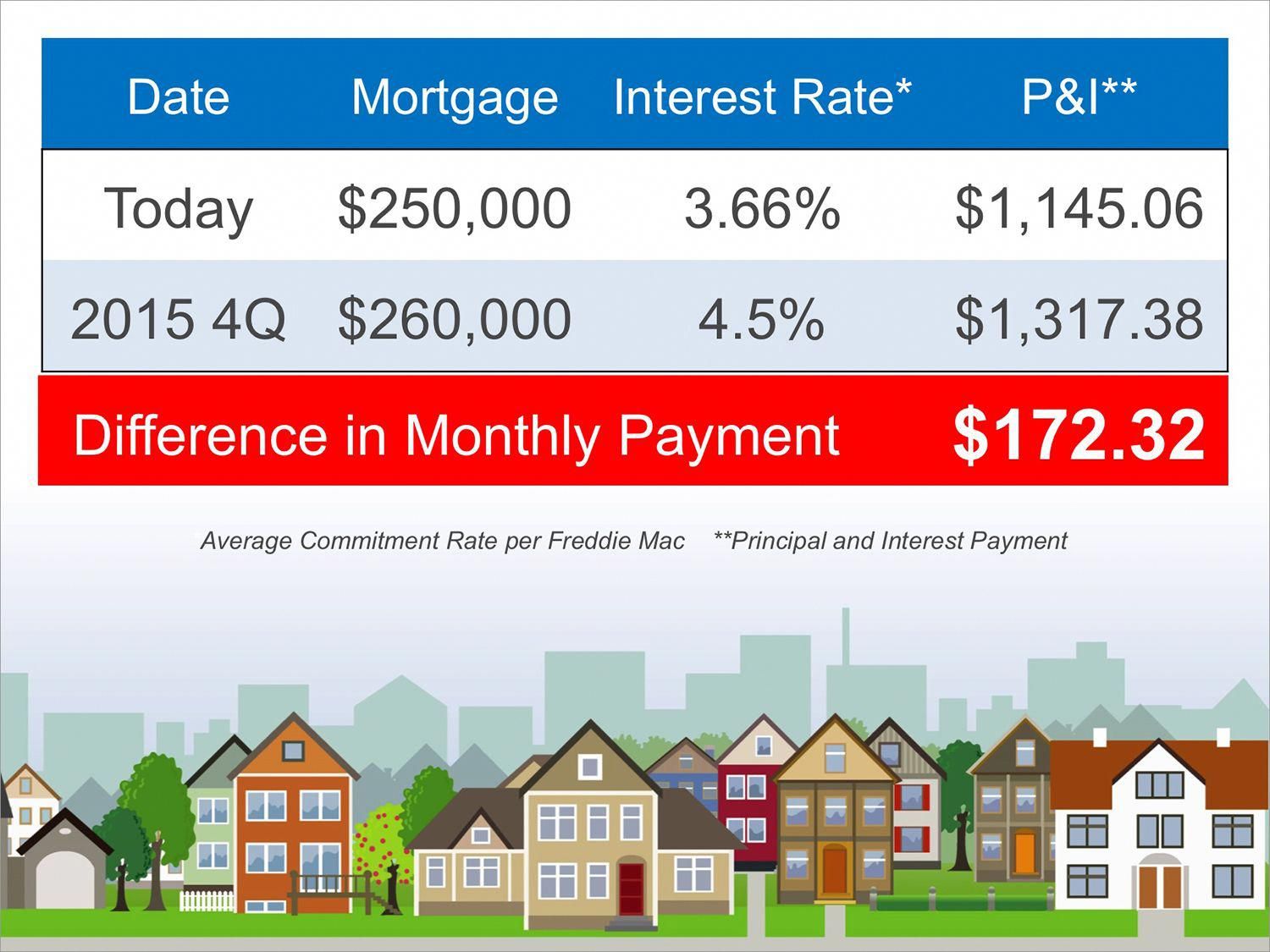

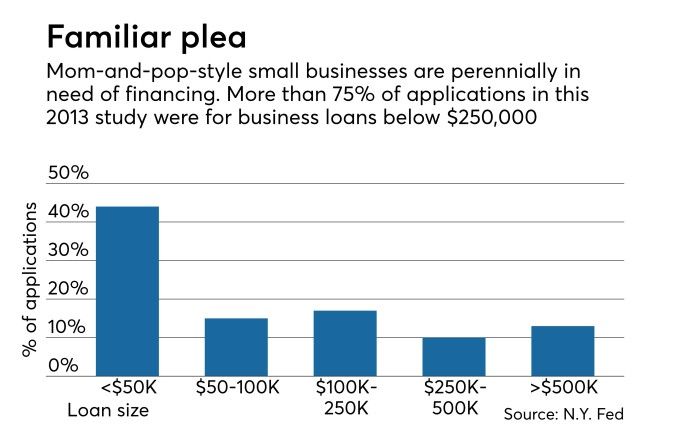

Common Misconceptions About Homeownership

There are many misconceptions about how difficult it is to become a homeowner. Its important to understand the facts before you start and how they apply to your individual situation so that you dont get overwhelmed or discouraged.

If you have less than 20 percent saved for a down payment, you should add PMI to the list of housing costs when youre figuring your budget.

Low income families can get down payment assistance from the government and non-profits. Before you go all-in with your house hunting. Decide if now is the right time for you to buy a home.

In any event, mortgage rates are currently at a historic low, the average rate on 30-year mortgages stood at 3.04 percent this week, unchanged from last week, according to Bankrates weekly survey of large lenders. If youve been thinking about becoming a homeowner, it may be time to take the plunge and buy now before interest rates rise again.

Most first-time buyers have to dip into savings or investments to have enough for a down payment. And if you have or student loan debt, be aware that some lenders may not approve your mortgage application because of how high the total monthly payment is.

Dont wait to start saving for a down-payment on your home. The sooner you begin putting money towards this goal, the easier it will be for you to become a homeowner.

Also Check: Is Sebonic A Good Mortgage Company

Do Your Own Research For A $250k Mortgage

Our final piece of advice is simple: do your own research. Were confident that weve put together a solid guide here for a 250k mortgage, but its not the be-all and end-all. We dont tackle your specific financial or personal situation , nor can we provide advice for every single location on the planet. And ultimately, a lot of what weve said is subjective and a matter of opinion.

We recommend taking the resources and advice weve pointed you to and then doing some more leg work. That final call to buy a home is ultimately yours to make.

- Provides an entirely digital mortgage application

- Get $20 just for viewing your rate

- Mortgage rates tend to be on the low side

Cons: