How To Calculate Mortgage Interest Using An Amortization Table

To calculate how much interest you’ll pay on a mortgage each month, you can use the monthly interest rate. Generally, you’ll find this by dividing your annual interest rate by 12. Then, multiply this by the amount of principal outstanding on the loan. Note that this means you’ll pay less interest later in the life of the mortgage, but keep in mind that this won’t always hold true for adjustable rate mortgages.

TL DR

Divide you annual mortgage interest rate by 12 to get your monthly rate. Multiply this number by the total amount outstanding on the loan to get how much interest you owe for the month.

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

How To Calculate Your Monthly Mortgage Payment

You can calculate your monthly mortgage payments using the following formula:

M = P /

In order to find your monthly payment amount “M,” you need to plug in the following three numbers from your loan:

- P = Principal amount

- I = Interest rate on the mortgage

- N = Number of periods

A good way to remember the inputs for this formula is the acronym PIN, which you need to “unlock” your monthly payment amount. If you know your principal, interest rate and number of periods, you can calculate both the monthly mortgage payment and the total cost of the loan. Note that the formula only gives you the monthly costs of principal and interest, so you’ll need to add other expenses like taxes and insurance afterward.

Also keep in mind that most lender quotes provide rates and term information in annual terms. Since the goal of this formula is to calculate the monthly payment amount, the interest rate “I” and the number of periods “N” must be converted into a monthly format. This means that you must convert your variables through the following steps:

Example

N = 30 years X 12 months = 360

Recommended Reading: How To Get A Higher Mortgage With Low Income

Monthly Interest Accrual Versus Daily Accrual

The standard mortgage in the US accrues interest monthly, meaning that the amount due the lender is calculated a month at a time. There are some mortgages, however, on which interest accrues daily. The annual rate, instead of being divided by 12 to calculate monthly interest is divided by 365 to calculate daily interest. These are called simple interest mortgages, I have discovered that borrowers who have one often do not know they have one until they discover that their loan balance isnt declining the way it would on a monthly accrual mortgage. Simple interest mortgages are the source of a lot of trouble.

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

You May Like: What Is Your Mortgage Rate

Fixed Payments With A Variable Interest Rate

If the interest rate goes up, more of your payment goes towards the interest, and less to the principal.

If the interest rate goes down, more of your payment goes towards to the principal. This means, you pay off your mortgage faster.

If the market interest rates increase to a certain percentage or trigger point, your lender may increase your payments. This payment increase will make sure that you pay off your mortgage by the end of the amortization period. The trigger point is listed in your mortgage contract.

How To Calculate The Total Cost Of Your Mortgage

Once you have your monthly payment amount, calculating the total cost of your loan is easy. You will need the following inputs, all of which we used in the monthly payment calculation above:

- N = Number of periods

- M = Monthly payment amount, calculated from last segment

- P = Principal amount

To find the total amount of interest you’ll pay during your mortgage, multiply your monthly payment amount by the total number of monthly payments you expect to make. This will give you the total amount of principal and interest that you’ll pay over the life of the loan, designated as “C” below:

- C = N * M

- C = 360 payments * $1,073.64

- C = $368,510.40

You can expect to pay a total of $368,510.40 over 30 years to pay off your whole mortgage, assuming you don’t make any extra payments or sell before then. To calculate just the total interest paid, simply subtract your principal amount P from the total amount paid C.

- C P = Total Interest Paid

- C P = $368,510.40 – $200,000

- Total Interest Paid = $168,510.40

At an interest rate of 5%, it would cost $168,510.40 in interest to borrow $200,000 for 30 years. As with our previous example, keep in mind that your actual answer might be slightly different depending on how you round the numbers.

Read Also: How Much Income For A 250k Mortgage

Amortized Loan: Fixed Amount Paid Periodically

Many consumer loans fall into this category of loans that have regular payments that are amortized uniformly over their lifetime. Routine payments are made on principal and interest until the loan reaches maturity . Some of the most familiar amortized loans include mortgages, car loans, student loans, and personal loans. The word “loan” will probably refer to this type in everyday conversation, not the type in the second or third calculation. Below are links to calculators related to loans that fall under this category, which can provide more information or allow specific calculations involving each type of loan. Instead of using this Loan Calculator, it may be more useful to use any of the following for each specific need:

| Personal Loan Calculator |

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how much your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

Also Check: What Is The Monthly Payment On A 500 000 Mortgage

Get A Handle On What A Loan Costs You Each Month

If you own a home, you probably know that a portion of what you pay the lender each month goes toward the original loan amount while some gets applied to the interest. But figuring out how banks actually divvy those up can seem confusing.

You may also wonder why your payment stays remarkably consistent, even though your outstanding balance keeps going down. If you understand the basic concept of how lenders calculate your payment, however, the process is simpler than you might think.

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

Recommended Reading: How Much Would Payments Be On A 45000 Mortgage

How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

Changes In Mortgage Interest Rates

Most new mortgages are sold in the secondary market soon after being closed, and the prices charged borrowers are always based on current secondary market prices. The usual practice is to reset all prices every morning based on the closing prices in the secondary market the night before. Call these the lenders posted prices.

The posted price applies to potential borrowers who have been cleared to lock, which requires that their loan applications have been processed, the appraisals ordered, and all required documentation completed. This typically takes several weeks on a refinance, longer on a house purchase transaction.

To potential borrowers in shopping mode, a lenders posted price has limited significance, since it is not available to them and will disappear overnight. Posted prices communicated to shoppers orally by loan officers are particularly suspect, because some of them understate the price to induce the shopper to return, a practice called low-balling. The only safe way to shop posted prices is on-line at multi-lender web sites such as mine.

You May Like: How To Get A Contractor Mortgage

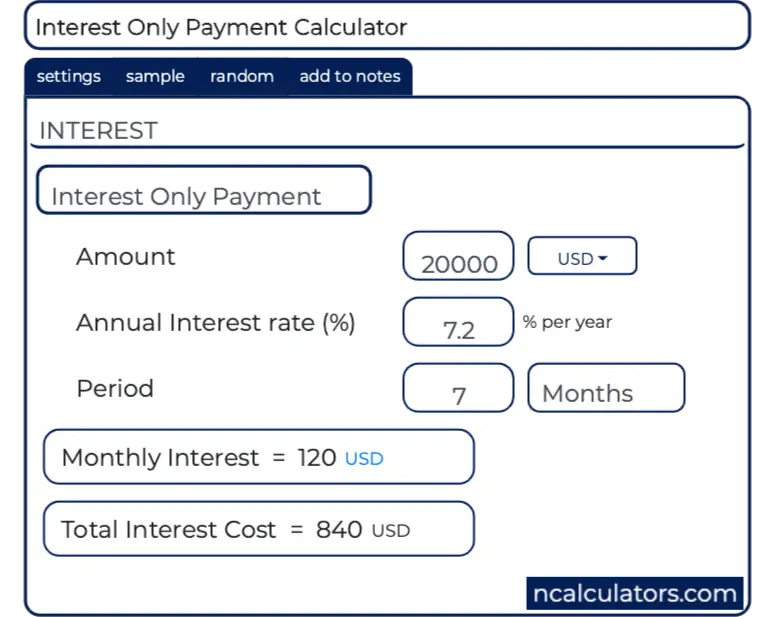

A Quick Primer On Repayment Vs Interest Only Mortgages

There are two main types of mortgage: repayment and interest only. Both types usually assume repayment of the capital over the length of the mortgage, which in and of itself is usually twenty-five to thirty years.

Interest only mortgages tend to be most popular for buy to let purchases or investment properties. The main benefit of these types of mortgages is that monthly repayments tend to be relatively low since you will only be paying off the interest and not any capital in the property. Characteristically, repayment is via an arrangement with a pension plan or investment savings scheme. With a few exceptions, the number of home loans of this type has declined over recent years due to lenders concerns about inadequate repayment planning.

In contrast, monthly repayment mortgages look to progressively reduce the outstanding loan balance to zero by the end of the mortgage term. To achieve this, each payment includes some capital as well as interest. During the first few years of the mortgage term, a large portion of the monthly payment amount relates to interest charges. As mortgage payments progress, the proportion of interest decreases. Correspondingly, the ratio of capital repayment increases until in the final year or two, almost all the monthly payments relate to repaying the principal loan.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Also Check: How To Get First Mortgage

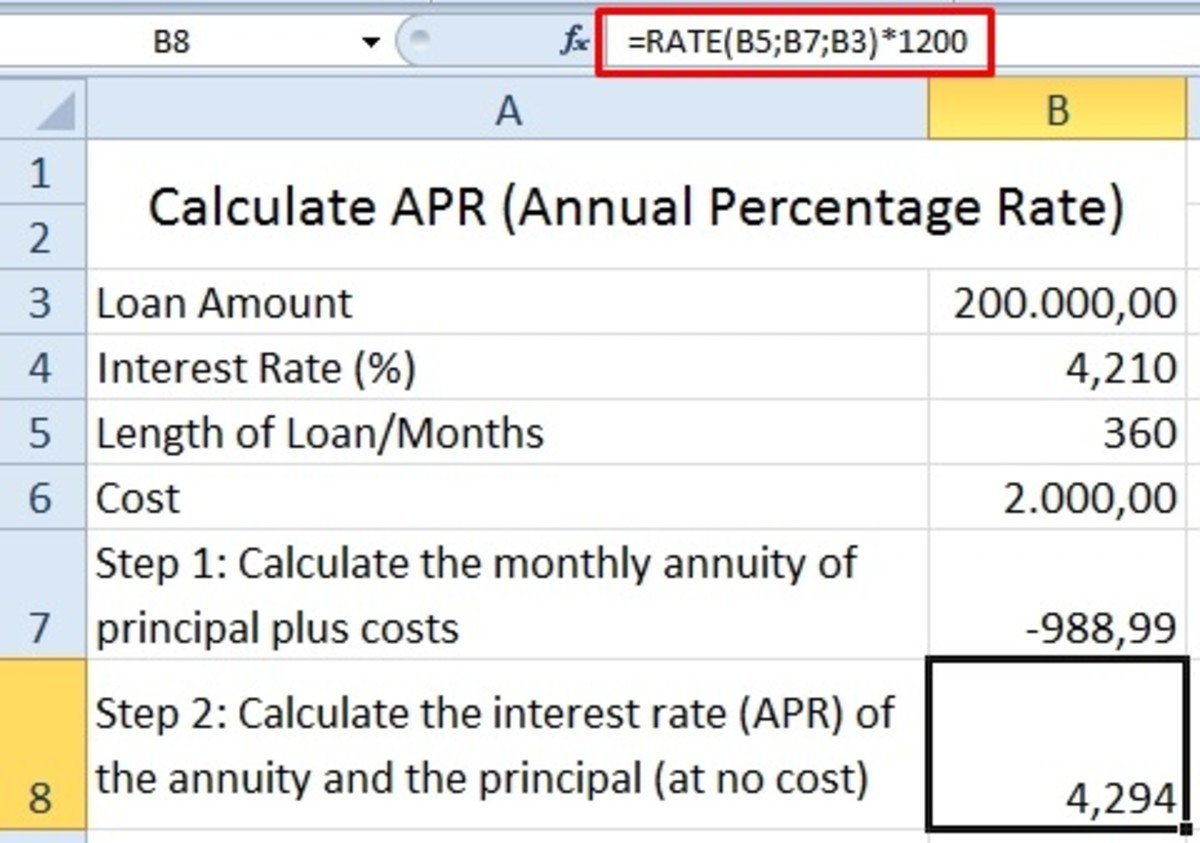

Mortgage Effective Annual Rate Formula

To account for semi-annual compounding, you can calculate your mortgages effective annual rate . The number of compounding periods in a year is two. To use the effective annual rate formula below, convert your interest rate from a percent into decimals.

For example, if your mortgage lender quotes a mortgage rate of 3%, then your effective annual rate will be:

If your mortgage lender quotes a mortgage rate of 5%, then your effective annual rate will be:

This calculation assumes that interest will be compounded semi-annually, which is the law for mortgages in Canada. For a more general formula for EAR:

Where n is the number of compounding periods in a year. For example, if interest is being compounded monthly, then n will be 12. If interest is only compounded once a year, then n will be 1.

Calculating The Numbers Yourself

If you don’t want to use a premade calculator, you can do the math yourself with a pocket calculator, a calculator app or a spreadsheet program.

First, you’ll want to compute yourmonthly interest rate. This is found by dividing your annual interest rate by 12, since there are 12 monthly payments in a year. For example, if your annual interest rate is 6 percent, your monthly interest rate is 6 / 12 = 0.5 percent. Once you have that rate, determine how much principal is currently owed on your mortgage. You should be able to see that on your most recent mortgage statement or through an online banking site or app.

Then, multiply the principal amount by the monthly interest rate to get the monthly interest amount. If the principal is $200,000 and the monthly interest rate is 0.5 percent, for example, the monthly interest amount is $200,000 * = $200,000 * = $1,000.

Your monthly mortgage payment minus the interest portion is the amount of principal you are paying down in that particular month.

Recommended Reading: How Many Payments Left On Mortgage

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |