Do You Qualify For A Home Loan

Numerous factors determine whether youll qualify for a home loan. Your mortgage lender will look closely at your credit history, your debts, cash on hand, and income to gauge affordability.

Mortgage approval isnt onesizefitsall, so its also important to get preapproved for a loan before house hunting. This way, youll know your qualifying amount with your current income. You can then search for properties within this price point.

Improving Your Credit Score Over Time

How Do I Determine If I Can Qualify For A Mortgage

The mortgage approval process is not as difficult as it may appear. Lenders want to know that you can afford to make your mortgage payments based on your income and that you have managed your income to pay other creditors as promised. You can determine your probability of being approved for a mortgage loan.

1

Order a copy of your credit report and a tri-merged credit score from the Experian, TransUnion or Equifax websites. A mortgage lender will review your payment history, as well as your credit score, to determine if you qualify for a home loan. Credit scores are issued to provide a lender with a risk level for an applicant, based on past bill payment history and the current utilization of credit. Each of the three major credit bureaus issues a credit score. A mortgage lender will use the middle score for qualifying purposes. Scores range from 300 to 850 points. Higher credit scores indicate less risk. Determine if you can qualify for a loan by analyzing your credit information to ensure that each of your creditors has been paid on time for the past two years and you have a credit score above 700 points.

2

3

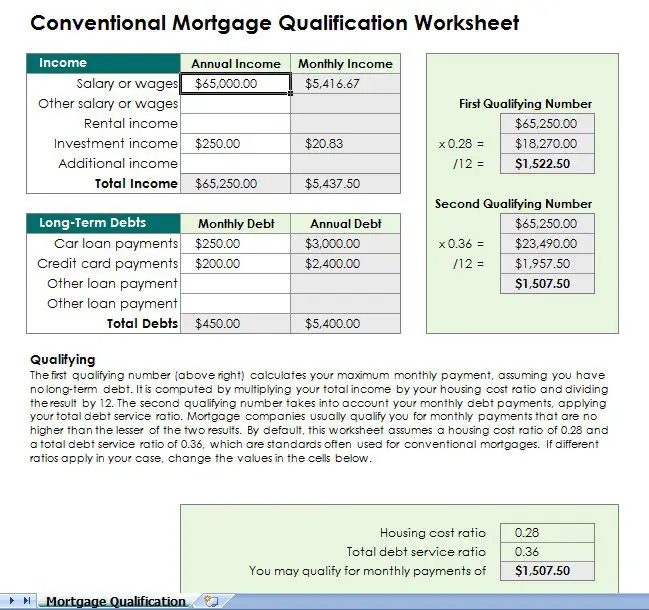

Calculate the loan amount for which you qualify. Go to the Bank Rate website and enter the amount you calculated for your maximum housing expense, an approximate interest rate and the term of your loan.

4

5

References

Also Check: 10 Year Treasury Vs 30 Year Mortgage

How Much House Can I Afford

The old formula that was used to determine how much a borrower could afford was about three times the gross annual income. However, this formula has proven to not always be reliable. It is safer and more realistic to look at the individual budget and figure out how much money there is to spare and what the monthly payments on a new house will be. When figuring out what kind of mortgage payment one can afford, other factors such as taxes maintenance, insurance, and other expenses should be factored. Usually, lenders do not want borrowers having monthly payments exceeding more than 28% to 44% of the borrowers monthly income. For those who have excellent credit, the lender may allow the payments to exceed 44%. To aid in this determination, banks and websites like this one offer mortgage calculators to assist in determining the mortgage payment that one can afford. For your convenience, here is a rate table displaying current mortgage rates in your area & the associated monthly payment amounts. If you adjust the loan amounts and hit the search button, the monthly payment numbers will automatically update.

What You Should Know About Jefferson County Fl

Before purchasing a home, you must research and plan. This research tells you more about the home prices in the area. It also gives you an estimate of the minimum or maximum amount you should have to purchase a property in your most preferred town/city or community.

If you want to buy a property in Jefferson County, you have many great options. Jefferson has plenty of residential suburbs, towns, and neighborhoods you can choose from. We have covered this and more below.

Also Check: Rocket Mortgage Loan Types

Shop Around Among Different Lenders

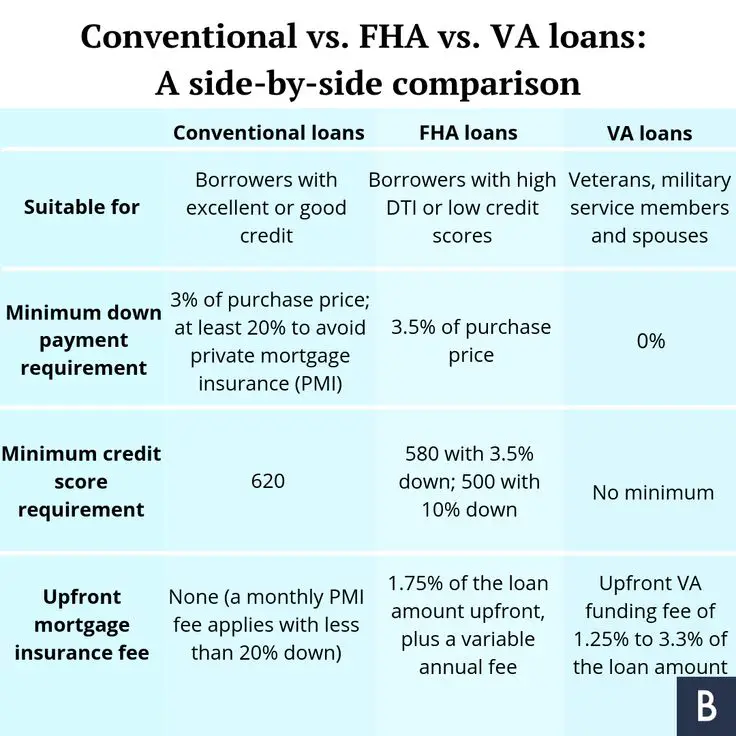

While these factors are considered by all mortgage lenders, different lenders do have different rules for who exactly can qualify for financing.

Be sure to explore all of your options for different kinds of loans and to shop around among mortgage lenders so you can find a loan you can qualify for at the best rate possible given your financial situation.

Which Mortgage Is Right For Me

There are almost as many ways to pay for a house as there are houses to pay for, but the gold-standard has been and apparently always will be the 30-year fixed mortgage.

Lenders have dressed up rates, terms and conditions on 15-year, 20-year, fixed and variable rate offers, but more than 85% of mortgages in 2016 were 30-year fixed rate.

Recommended Reading: Rocket Mortgage Qualifications

Know Basic Mortgage Loan Requirements

In the lending world, minimum mortgage requirements are based on the three Cs of underwriting capacity, collateral and credit reputation. In simpler terms, they refer to your debt-to-income ratio, credit score and assets. If you dont know how to apply for a home loan, knowing the following guidelines will help you better understand how lenders evaluate your application.

DTI ratio. Lenders divide your total debt by your pretax income to determine your DTI ratio. Its an important measure used to determine whether you can repay the loan. The qualified mortgage rule recommends a DTI ratio at or below 43%.

. Although you can get approved for a mortgage with a score as low as 500 , youll snag a lower interest rate with a score of 740 or higher. Paying bills on time and keeping credit balances below 30% may boost your credit score.

Verifying assets. When youre getting a home loan, lenders generally look at three factors related to your assets:

- How much you have for a down payment and closing costs. The more you can put down, the lower your payment will be.

- How much extra money you have. In lending terms, these are called cash reserves. An extra two or three months worth of mortgage payments in the bank could boost your approval odds.

- How the money got there. Large cash deposits can be a red flag. If theres no paper trail for the money, lenders may deny your mortgage approval.

Getting A Mortgage After A Job Or Career Change

Its common for people to stay at a job for less than two years, but how does this affect your mortgage eligibility? The good news is that, in many cases, it wont affect it at all. After all, most mortgage lenders require two years of work history, but they dont require those two years to be with the same employer or even in the same line of work.

First, if youre moving from one job to another within the same industry and for an equal or higher salary, you shouldnt have any problem qualifying for a home loan. That being said, you may run into more problems if you switch to a lower-paying job. While youll still get credit for your two years of employment history, youll qualify for a loan amount based on your lower monthly income.

The situation could also be different if youre switching to a different industry entirely. If youre moving to a new industry with job stability and comparable pay, you may not have any issues. On the other hand, if youre moving to a less stable industry, your mortgage lender may have concerns.

Read Also: Reverse Mortgage For Condominiums

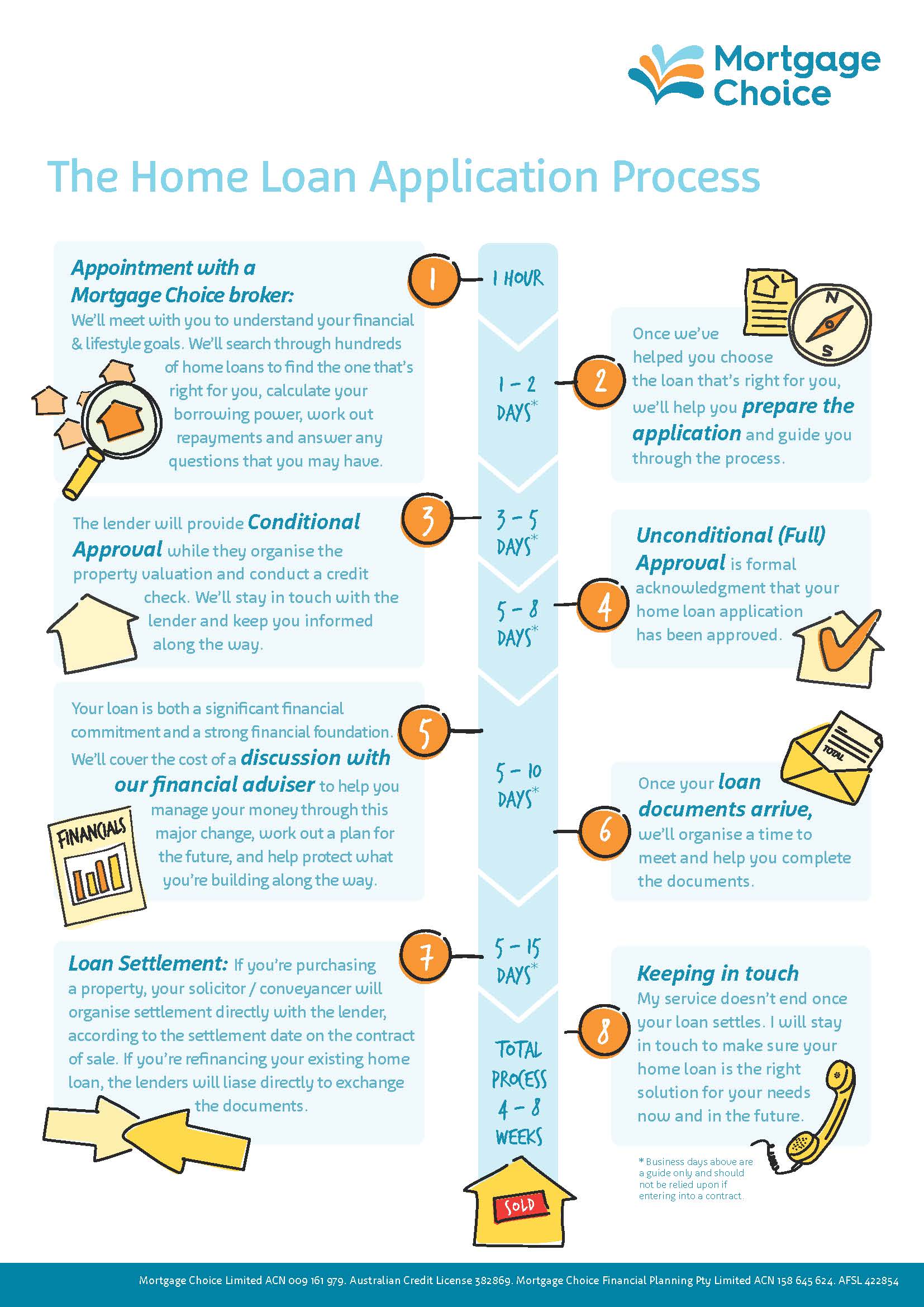

Get Preapproved For A Loan

Once you find lenders youre interested in, its a good idea to get preapproved for a mortgage. With a preapproval, a lender has determined that youre creditworthy based on your financial picture, and has issued a preapproval letter indicating its willing to lend you a particular amount for a mortgage.

Getting preapproved before shopping for a home is best because it means you can place an offer as soon as you find the right home, Griffin says. Many sellers wont entertain offers from someone who hasnt already secured a preapproval. Getting preapproved is also important because youll know exactly how much money youre approved to borrow.

Keep in mind: Preapproval is different from prequalification. Mortgage preapproval involves much more documentation and will get you a more serious loan offer. Prequalification is less formal and is essentially a way for banks to tell you that youd be a good applicant, but it doesnt guarantee any particular loan terms.

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Read Also: Chase Recast

Can I Use A Mortgage Calculator Based On Income +

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Get Money From Your Home Equity Line Of Credit

Your lender may give you a card to access the money in your home equity line of credit. You can use this access card to make purchases, get cash from ATMs and do online banking. You may also be given cheques.

These access cards don’t work like a credit card. Interest is calculated daily on your home equity line of credit withdrawals and purchases.

Your lender may issue you a credit card as a sub-account of your home equity line of credit combined with a mortgage. These credit cards may have a higher interest rate than your home equity line of credit but a lower interest rate than most credit cards.

Ask your lender for more details about how you can access your home equity line of credit.

Recommended Reading: 70000 Mortgage Over 30 Years

What Is Needed For Approval

Understanding conditional approval is one thing, but what do you need to reach that stage and go past it? You will need:

- Several years of financial statements and proof of income

- Income verification with check stubs and bank statements

- Income tax returns from the last few years

- Proper insurance verification

Dont Miss: 70000 Mortgage Over 30 Years

How To Buy A House With No Money

If you want to buy a house with no money, there are two big expenses youll need covered: the down payment and closing costs. Both can be avoided if you qualify for a zerodown mortgage and/or a home buyer assistance program.

Five strategies to buy a house with no money include:

When combined, these tactics could put you in a new home with $0 out of pocket.

Or you might get your down payment covered, and then youd only need to pay closing costs out of pocket which could reduce your cash requirement by thousands.

Read Also: Rocket Mortgage Loan Requirements

What You Need To Qualify For A Mortgage

When you apply for a mortgage, lenders want to know that you have the capacity to repay the loan through a steady income that isnt already consumed by debt payments. They also want to see that you have the credit to repay it, as demonstrated by a multiyear history of reliably making payments.

How Much Home Can I Afford

The answer to the question How much home can I afford? is a personal one and should not be left solely to your mortgage lender.

The best way to determine how much house you can afford is to start with your monthly budget and decide what you can comfortably pay for a home each month.

Then, using your desired payment as the starting point, use a mortgage calculator and work backward to find your maximum home purchase price.

Note that todays mortgage rates will affect your mortgage calculations, so be sure to use current mortgage rates in your estimate. When mortgage rates change, so does home affordability.

You May Like: 10 Year Treasury Yield And Mortgage Rates

The Mortgage Process After You Apply For A Home Loan In 2021

Mortgage lenders made changes to the mortgage process in 2020 to help stop the spread of COVID-19. Heres a list of action items youll need to handle after youre preapproved for a mortgage.

Find a home

After youve been preapproved, youll know exactly how much house you can afford. House hunting is being handled differently since the pandemic: The National Association of Realtors encourages agents to limit the number of in-person visits, so you may first take a virtual tour to check homes off of your list. Work with a real estate agent to find the right home that meets your criteria and fits within your budget.

Make an offer

When you find the right house, your real estate agent can help you submit an offer, which spells out the purchase price, a closing date and any contingencies to the contract. The seller will either come back with a counteroffer, reject your offer or accept it. With housing demand expected to be strong throughout 2021, expect more competition at higher prices.

Lock in your rate

Once your offer is accepted, youll finalize your loan terms. Rates are still at historic lows, but are expected to gradually rise throughout the year. Get a mortgage rate lock to protect yourself against any upticks.

Schedule a home inspection and appraisal

Provide additional paperwork

Review the final figures

A closing disclosure is issued three business days before closing. Compare the final numbers to your loan estimate and discuss any concerns with your loan officer.

Consider Factors That Arent On The Mortgage Application

When you apply for a home loan, youre committing to one of the biggest debts youre likely to take on in your lifetime. These tips may keep you from applying for more loan than your budget can afford and can help you consider the costs of homeownership beyond your monthly payment.

. Just because lenders allow you to borrow up to 43% of your total income doesnt mean you should spend that much. Lenders dont evaluate your lifestyle or daily personal expenses, so when you pick a monthly payment, make sure you leave room for:

- Health care expenses

- Savings goals

Add homeownership costs to your budget. A broken water heater, landscape spruce-ups and regular maintenance are all on your dime as a homeowner. According to HomeAdvisors 2020 State of Home Spending report, homeowners spent $3,192 on home maintenance. Insurance companies suggest you budget 1% of your sales price or $1 per square foot toward these expenses to cushion the blow of unexpected costs.

You May Like: Can You Do A Reverse Mortgage On A Condo

Can You Buy A House With No Money Down

A nodownpayment mortgage allows firsttime home buyers and repeat home buyers to purchase property with no money required at closing, except standard closing costs.

Other options, including the FHA loan, the HomeReady mortgage, and the Conventional 97 loan, offer low down payment options with a little as 3% down. Mortgage insurance premiums typically accompany low and no down payment mortgages, but not always.

Furthermore, mortgage rates are still low.

Rates for 30year loans, 15year loans, and 5year ARMs are historically cheap, which has lowered the monthly cost of owning a home.

Going To A Lender To Get Pre

Once you feel you’re ready to buy a house, getting the right mortgage is the next important decision you’ll make. To be sure you’re getting the best deal, talk with multiple lenders and compare their mortgage interest rates and loan options see types of mortgages.

With pre-qualification, the loan officer will ask for information about your income, job, monthly bills, amount you have available for a down payment, and possibly some other information. They will then provide you with an estimate.

You May Like: Chase Mortgage Recast Fee