How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

How Much Should My Mortgage Be In The Real World

All this math can come across as a bit theoretical. And your goal when deciding on your mortgage amount should be more practical. You want a loan that will fit neatly within your lifestyle, needs, and ambitions.

The fact that a lender will give you $x amount because of your DTI, credit score, down payment, and personal finances doesnt necessarily mean you should borrow $x amount.

Yes, most of us borrow up to the maximum were allowed. But that doesnt mean you should.

What are your spending priorities?

It all depends on your lifestyle and priorities. Suppose you love foreign travel or gourmet eating or sailing or shopping. Borrowing the max amount might mean youre sacrificing other luxuries for years to come.

It could be best to settle on a more modest home and a smaller mortgage if that allows you to maintain your current lifestyle.

How secure is your income?

You should also bear in mind how secure your earnings are.

You likely dont want to be saddled with the biggest mortgage possible if youre in a job where firings are commonplace or if you plan to change jobs soon and youre not sure youll earn the same amount.

Lenders have these questions in mind, too. Thats why they typically want to see two years employment history on your mortgage application. They also want to know any income youre using to qualify for the loan will continue for at least three years.

How Much Can You Spend On A Mortgage

Rather than looking at the total amount of money you can borrow for a house, it’s better to look at how affordable your monthly payment might be. That’s because this is what you’ll be paying each month, so you want to make sure it fits into your budget.

One of the best ways to measure that is the “debt-to-income” or DTI ratio. It’s broadly calculated by dividing your debt payments by your income. More specifically, it can be measured in two ways:

- Front-end DTI ratio: This measures your monthly mortgage payment as a percentage of your total gross monthly income. For example, if your salary is $54,000 per year and your mortgage payment is $1,000, then your front-end DTI ratio is 22% .

- Back-end DTI ratio: This measures your total monthly debt payments, including your mortgage, as a percentage of your total gross monthly income. If you also pay $250 per month for student loans and $200 per month for your credit cards, for example, your back-end DTI ratio would be 33% .

Lenders use these ratios to figure out the maximum monthly mortgage payment you might qualify for. For example, Freddie Mac and Fannie Mae guidelines state that for a conventional mortgage, your back-end DTI ratio shouldn’t exceed 36%. In other words, your debt payments combined shouldn’t be more than 36% of your before-tax income each month.

Lenders look at other factors when deciding whether to approve you for a mortgage too, such as your and how stable your job is.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Aim To Put 20 Percent Down

The amount of mortgage you can afford also depends on the down payment you make when buying a home. In a perfect world, we recommend a 20 percent down payment to avoid paying mortgage insurance, Neeley says.

When your down payment is less than 20 percent, your costs rise. You typically have to pay private mortgage insurance, which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your home. On a $240,000 mortgage, thats $200 per month.

Keep in mind that you will have other ongoing costs related to homeownership as well, including taxes, insurance, and utilities. All of these expenses need to be estimated before you settle on a monthly mortgage payment.

What Is Included In A Mortgage Payment

A mortgage payment is made up of four components, often referred to as PITI: principal, interest, taxes and insurance. Heres a breakdown of each component:

- Principal: The original amount of your loan before interest.

- Interest: A percentage of the principal that you pay to the lender. Mortgage interest rates can be fixed or variable.

- Tax: Yearly property taxes are paid monthly and are considered part of your mortgage payment.

- Insurance: Your monthly homeowners insurance payment is also considered part of your mortgage payment.

Understanding what is included in a mortgage payment will help you accurately budget a percentage of income for mortgage. For example, if you forgot to include insurance and tax payments in your mortgage payment estimate, you might budget for more than you can afford. Note that your mortgage payment does not include home repairs and maintenance costs. Those are personal expenses youll have to budget for separately.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

How Much House Can I Afford With A Va Loan

If you’re an active member of the U.S. military or a veteran, you may qualify for a VA loan. A VA loan is a mortgage that’s backed by the U.S. Department of Veterans Affairs. With a VA loan, you don’t need to put any money toward a down payment, and you may be eligible to get a mortgage even with a lower credit score.

As is the case with an FHA loan, you’ll need to be careful with a VA loan to make sure you don’t take on too high a mortgage, especially if you’re not putting any money toward a down payment. Use a mortgage calculator to play with the numbers based on your loan amount and interest rate.

How Do You Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator above. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the top amount you can pay for a house, as well as your estimated monthly payment.

Also Check: Rocket Mortgage Qualifications

Find The Number Thats Right For You

Whether your situation is closer to that of John, Jane, or our couple in Houston, the great thing about the 50/30/20 rule is that it can adjust to fit your personal financial situation. Its an excellent guide to help you target a monthly dollar amount for rent, while also keeping you on track for your other financial goals. This 50/30/20 budget template might help you get started.

No matter where you are on your financial journey, budgeting and being aware of your monthly expenses will help you live within your means for a more a secure future. That means you can relax in your place, knowing youre paying a percentage of your income thats right for you.

The Traditional Model: 35%/45% Of Pretax Income

In an article on how the mortgage crash of the late 2000s changed the rules for first-time home buyers, the New York Times reported:

If youre determined to be truly conservative, dont spend more than about 35% of your pretax income on mortgage, property tax, and home insurance payments. Bank of America, which adheres to the guidelines that Fannie Mae and Freddie Mac set, will let your total debt hit 45% of your pretax income, but no more.

Lets remember that even in the post-crisis lending world, mortgage lenders want to approve creditworthy borrowers for the largest mortgage possible. I wouldnt call 35% of your pretax income on mortgage, property tax, and home insurance payments conservative. Id call it average.

You May Like: Recasting Mortgage Chase

How Lenders Decide

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back. Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

How Does My Debt

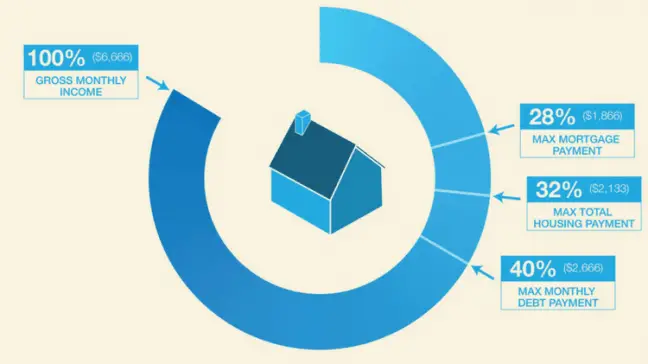

Your debt-to-income ratio measures your monthly debt compared to your monthly income. A mortgage lender will use your gross income when calculating your debt-to-income ratio for mortgage approval. Generally, lenders like to follow the percentages above so that your monthly mortgage payment does not exceed 28% of your gross monthly income, and your total debt doesn’t exceed 36% of your gross monthly income. However, if your debt makes it so your ratio is higher, you might still get approved for a mortgage, especially if you have a great .

Keep in mind, though, that there’s a difference between qualifying for a mortgage and being able to afford it comfortably. If you already have a lot of monthly debt payments before taking on a mortgage, you may find that it’s difficult to keep up.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

Account For New And Ongoing Expenses

Buying a home comes with additional expenses that are easy to overlook. Be sure to talk with your lender about all anticipated costs throughout your homebuying process, and work with them to create your initial budget.

Depending on your situation, you may want to prepare for these initial expenses:

Once youre in the home, youll be responsible for making monthly mortgage payments that may include:

- Your mortgage principal.

Youll also need to save for regular maintenance expenses in your new home, such as:

- Appliance upkeep.

Consider The 50/30/20 Rule

Since the economy has changed over the past 40 years, it makes sense that the guiding principles for how you should manage your money should change as well. Instead of using the 30% rule as a static guideline for how much you should pay in rent, we recommend you consider the 50/30/20 rule.

This rule breaks down your finances into three categories:

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Recommended Household Budget Category Descriptions

Heres a little more detailed breakdown with what goes in each category according to Dave Ramsey:

Giving

The cornerstone of Dave Ramseys approach to budgeting starts with giving to your church or other charitable causes you care about. I 100% agree on this point, and I believe giving is a big part of changing your mindset about money.

Saving

Money set aside for the future, whether building up your emergency fund or saving for retirement in a 401 or IRA.

Food

Dave Ramseys food budget recommendations include groceries and eating out. This can be one of the hardest categories to for people to budget for, and I know personally we have to keep an eye on it every month so that it doesnt get out of control. If you dont plan ahead, it can be easy to spend a lot of money on convenience foods or grabbing take out on the way home from work.

If you need some help, here are 7 ways we save money on groceries without sacrificing quality, and here is a detailed breakdown of how much you should spend on groceries.

Utilities

This includes electricity, water, natural gas, and trash service. While not specifically mentioned by Dave Ramsey, I would put your cell phone here too.

Housing

Transportation

Anything you need to spend money on to get to work, the store, or your other weekly activities. If youre lucky enough to live in a big city and not need a car, this could be subway tickets or Uber rides. If youre like most of us, this money goes toward your car payment, gas, and insurance.

Are You Ready To Buy A Home

Do you need help buying a home? Cadence Banks mortgage experts are happy to help. Contact us today to learn about our mortgages and the competitive rates we offer.

This article is provided as a free service to you and is for general informational purposes only. Cadence Bank makes no representations or warranties as to the accuracy, completeness or timeliness of the content in the article. The article is not intended to provide legal, accounting or tax advice and should not be relied upon for such purposes.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Make Sure That No More Than 36% Of Monthly Income Goes Toward Debt

Financial institutions look at your debt-to-income ratio when considering whether to approve you for new products, like personal loans or mortgages. To calculate this number, divide your total monthly debt payments by your gross monthly income . Then multiple by 100 to get the percentage.

For example, say your gross monthly income is $6,000 and you have $2,000 in debt payments each month across your mortgage, auto loan and student loans. Your debt-to-income ratio is 33%.

“From a lender’s standpoint, they typically don’t want to see more than 36% of gross monthly income being spent on debt,” says Douglas Boneparth, CFP, president of Bone Fide Wealth and co-author of The Millennial Money Fix.

Don’t stress too much if your debt-to-income ratio is higher than 36% if you factor in your mortgage you’re not alone. Data shows consumers are spending close to that just on non-mortgage debt.

The latest findings from Northwestern Mutual’s 2021 Planning & Progress Study reveals that among U.S. adults aged 18-plus who carry debt, 30% of their monthly income on average goes toward paying off debt other than mortgages. By far, the top source of debt after mortgages is , accounting for more than double any other debt source.

Like most rules of thumb in personal finance, Boneparth warns that how much you spend each month to pay off your debt is ultimately subjective. You should consider your income, the type of debt you have, your savings and your broader financial goals.

First How Much Do You Make

Before you can even begin to make an estimate of how much rent you can afford, you first need to know how much money you have to work with. While your annual salary might sound good on paper, thats your gross annual income, not your net monthly income.

For instance, someone with a taxable income of $50,000 a year might take home approximately:

- $50,000 taxable income 22% tax rate = $39,000 annual net income

When divided by 12, we arrive at $3,250 as the amount you have available to work with for your monthly budget. Keep this calculation in mind, as it is how you will determine the dollar amount from which you can deduct your monthly rent.

Also Check: 10 Year Treasury Vs 30 Year Mortgage

Example : John The Recent College Grad

First, lets see how much John, a recent college grad living in a big city like New York City, might want to pay for rent.

John makes an annual salary of $50,000. After deducting 22% for taxes, that leaves him with a monthly take home pay of $3,250. Like many recent grads, John has student loan debt. His total debt is $46,000, with a minimum monthly debt payment of $500 each month.

Because he lives in the city, John doesnt own a car, and uses public transportation to get around his monthly unlimited pass costs $100. And finally, as he only recently set out on his own, John does not have any credit cards, and therefore, no credit card debt.

Given these inputs, we can then determine the following:

Using the 50/30/20 rule, John should spend no more than $775 on his total housing expenses, including rent, utilities, and rental insurance. In New York City, that can be a difficult goal to achieve. However, by living with roommates he could increase his chances of living within his means.