Limitations Of A Mortgage Rate Lock

While locking in a specific interest rate protects borrowers against rising interest rates, it may also prevent them from taking advantage of falling interest rates. Some lenders offer a mortgage rate lock float down, which enables borrowers to make a one-time election to exchange their current rate for a lower rate if rates have fallen. Find out whether a lender offers a float down before entering into a rate lock agreement.

Even with a rate lock and a mortgage rate lock float down, it is possible to end up paying a higher interest rate than the rate that you agreed to when you signed for the lock. This occurs because many lenders include a “cap” with the lock agreement. The cap permits the guaranteed rate to rise if interest rates rise before settlement. Because the cap sets a limit on the amount the rate can rise, it does provides some protection against rising interest rates.

Consequences Of Failing To Lock In Your Mortgage Rate

If you donât lock in your interest rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement. When you pay an up-front feeâor mortgage pointsâto a lender, youâre providing more money initially in order to get a lower interest rate.

For example, the cost for a $200,000 loan at a 30-year fixed rate could go up by more than $60 per month if the rate goes up from 5% to 5.5%, resulting in $22,000 more in interest over the loan term.

âRate locks provide consumers certainty when it comes to the economic terms of their loanâmost importantly, their monthly payment,â says Sebastian Hart, capital markets associate at online homeownership company Better. âWithout rate locks, borrowers would not know the final terms of their loan until the very end of the process.â

Get To The Right Point In The Process

Make sure you know when in the home buying process to expect the rate lock to come into play. You’ll lock your mortgage rate at the time you get your loan offer. For a home purchase, its usually when a purchase agreement has been signed. For a refinance, its usually when you are submitting your documentation for loan approval.

The point of the lock is to protect you during the period between when you agree to a loan’s terms and when your lender is ready to officially close on it. Once you’ve gotten your loan approval, that’s the time to lock.

Also Check: How Accurate Are Mortgage Calculators

Should I Lock In My Mortgage Rate Today

Mortgage rates repeatedly set record lows in 2020 and 2021, falling into the low 2s for some lucky borrowers.

Rates have rebounded since then, but theyre still low. Todays borrowers can find cheaper home financing than almost all borrowers in U.S. history .

But if youre still not comfortable locking in quite yet, theres always the option of locking with a lender that offers a float-down provision as a safeguard.

Shop around and compare your options today.

How Long Should I Fix My Mortgage For

If you have a low loan-to-value then you will almost certainly benefit from fixing, as you will be able to secure a low fixed-interest rate.

The longer your fixed term, the longer you are locked into a lower interest rate. Although there is no limit to how many times you can remortgage if you opt for a long fixed-term period you may have exit penalties and early redemption fees if you want to repay your mortgage or move. In addition, if the BOE base rate is cut you won’t benefit either. These factors have to be traded off against the cost of exiting your current deal and the certainty that a fixed-term mortgage provides.

A recent development in the market has been the introduction of longer-term fixed-rate mortgage deals, including a 40-year fixed-rate from Kensington Mortgages and Habito. These attract a higher rate, but give certainty over the amount you will have to pay over the long term. It also removes the cost and effort of having to remortgage every few years. There are more details in our article “Which are the best long-term fixed rates mortgages – and should you get one?“

Read Also: Is My Homeowners Insurance Included In My Mortgage

How To Lock In A Mortgage Rate

You wont get the opportunity to lock your mortgage rate until your lender has at least had a chance to do a preliminary review of your finances.

After verifying your credit score and getting a sense how much you plan to put down and other factors, your lender will be able to give you a quote for your rate. At this point, its wise to ask for details on its rate-lock policy. If things look good to you, simply submit a request to lock in the rate.

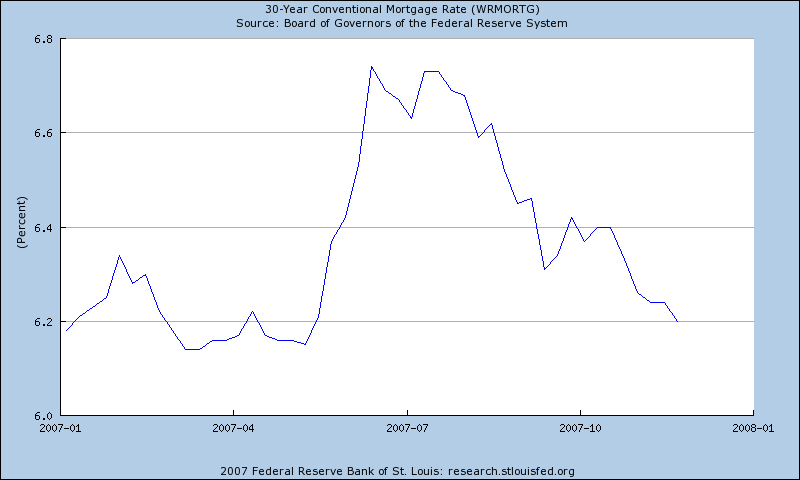

Mortgage Interest Rates Forecast For August 2022

Rising inflation and the Federal Reserves moves are all putting pressure on mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

Experts are forecasting that the 30-year, fixed-rate mortgage will vary from just above 5% to as high as 7% by the end of 2022. Here are their more detailed predictions, as of late July 2022:

You May Like: Does Applying For Mortgage Affect Credit Score

What If My Rate Lock Will Expire Before My Loan Closing Date

If your rate lock will expire prior to closing and disbursement of funds, a rate lock extension will be required to close your loan. We will extend your rate lock at no cost to you. Please be sure to respond promptly to all requests for information and documentation so we can move closer to closing your loan.

Some common reasons a rate lock extension may be needed include:

- Information you provide us is incomplete or delayed.

- The property is not ready to be occupied.

- There are issues clearing the title.

If your closing date becomes unknown or uncertain and you need more time to close the loan, you may be able to return to float by unlocking your rate.

You may cancel/withdraw your loan application at any time.

If youre using a Bond program and your loan will not close by the rate lock expiration date, contact your home mortgage consultant to see if the bond program youve chosen allows your rate to be extended, or you may cancel/withdraw your loan.

How To Calculate The Blended Interest Rate

This method of calculating a blended interest rate is simplified for illustration purposes. It does not include prepayment penalties. Your lender can combine the prepayment penalty with the new interest rate or ask you to pay it when you renegotiate your mortgage.

Example : Calculate the blended interest rate

Suppose interest rates have gone down since you signed your mortgage contract. To take advantage of these lower rates, youâre considering terminating your mortgage and renegotiating a new mortgage with your current lender.

Suppose you have:

| Steps to calculate a blended interest rate | Example | Enter your information |

|---|---|---|

| Step 1: multiply your current interest rate by the number of months remaining on your current term | 5.5% x 24 months = 132 | |

| Step 2: subtract the number of months of the new term from the number of months remaining on your current term | 60 months 24 months = 36 months | |

| Step 3: multiply todays interest rate by the difference between the number of months of the new term and the number of months remaining on your current term | 4% x 36 months = 144 | |

| Step 4: add the results of Step 1 and Step 3 | 132 + 144 = 276 | |

| Step 5: divide the results of Step 4 by the number of months in the new term | 276 / 60 = 4.6 |

Recommended Reading: How To Take Money Out Of Mortgage

What If My Loan Is An Adjustable

If your loan is an adjustable-rate mortgage , the interest rate disclosed on the Interest Rate Lock Agreement will be the initial interest rate effective until the first change date of your loan. After that, your interest rate may vary in accordance with the change dates and index provided on your mortgage note and loan documents. You’ll find additional information about ARMs in the Consumer Handbook on Adjustable-Rate Mortgages that you’ll receive when you apply.

Should You Lock Your Mortgage Rate

Many borrowers often wonder if they should lock their mortgage rate now or wait until their closing process is underway. If youre happy with your rate when you get approved, locking it in is a smart choice. It’s best to lock your rate when youre comfortable with the amount of your monthly mortgage payment.

If youre thinking about floating your mortgage rate, make sure to consider the impact a higher rate may have on your finances. Even a slight increase in the rate can add hundreds of dollars to your mortgage payments each year. Locking your mortgage rate provides security in knowing how much youll pay each month.

While locking your rate can save you money over time, you should also check with the mortgage lender beforehand to learn if there are any charges associated with this option. Some banks and financial institutions charge rate lock fees, depending on the type of mortgage youre using. You can pay this fee upfront or include it in with your closing costs.

Don’t Miss: What Is The Mortgage Rate At The Moment

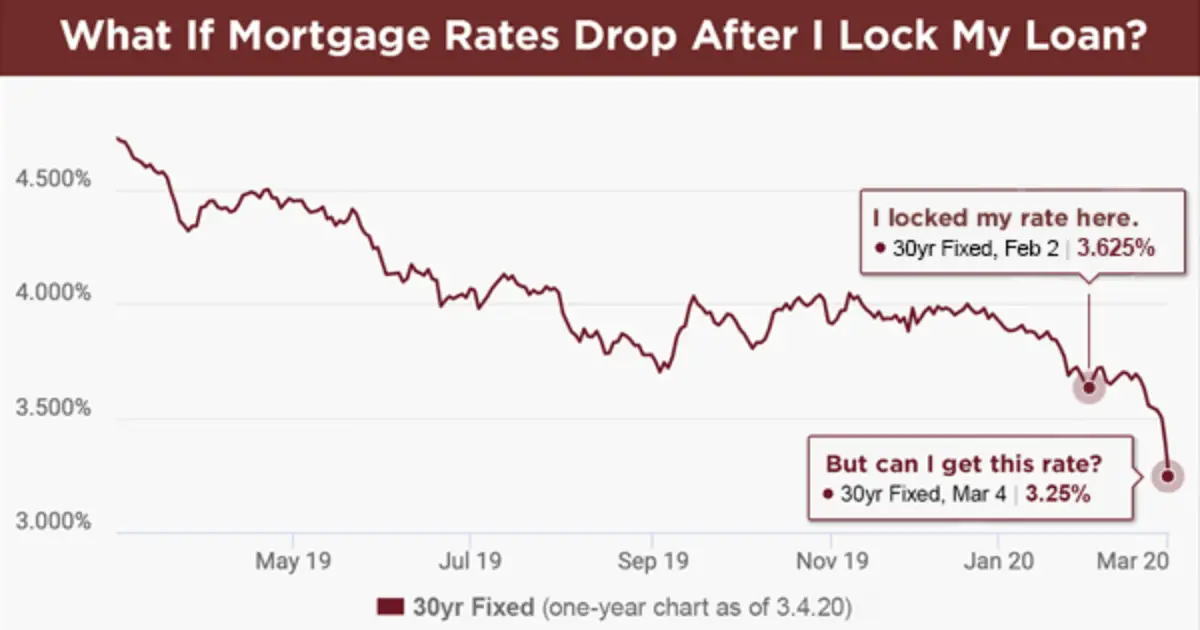

What Happens If You Lock In A Mortgage And Then Rates Go Down

If you lock a mortgage and then rates rise, youre in luck: You get to keep the lower interest rate you locked in. But what if you lock a mortgage and then rates fall?

Unfortunately, you cant just unlock your rate. Your best option is to ask your lender about a rate float down, although this will cost you an additional fee.

Switching lenders last minute is also an option for refinancers. But it means starting over from square one, so make the decision carefully and be sure your new rate is low enough to be worth it.

In this article

What Happens If The Rate Lock Expires Before Closing

Real estate transactions dont always close on time, but if the mortgage rate lock expires before the keys are yours, dont panic. Your mortgage lender might offer to extend the rate lock, either free or for a fee.

Its important to note that the rate lock extension fee might not be your responsibility, either. Depending on whos to blame for the loan failing to close in the expected timeline, the lender might cover or pay a portion of the cost.

If your lender wont extend the rate lock, the combination of rate and points you had expected might no longer be available. In that event, the loan would be based on the new prevailing rate.

Typically, an extension costs 0.375 percent of the loan amount, explains Greene. If the loan is $100,000, then a 15-day extension would cost $375 and then you can extend again. If rates have gone up, it might be cheaper to pay the extension fee upfront.

Find out when your loan is expected to close and work backward to determine when to lock the rate. Try to give yourself some cushion: If you think you need 45 days to close your loan, find out what the interest rate and cost would be if you locked it for a 60-day period.

Don’t Miss: How Much Do Mortgage Loan Officers Get Paid

Fha Mortgage Rates Change Constantly

The first thing you need to understand is that FHA rates change on a daily basis. The more significant changes usually happen over a period of weeks. But they can also change slightly from one day to the next. This is an important concept to understand when shopping for an FHA loan. You never know if interest rates are going to rise or fall you just know theyre going to change. This is why its so important to lock in a mortgage rate when you get a good one.

Common statement:Ill lock in eventually. I just want to shop around for a bit longer. I figure the FHA rates wont change much within the next couple of months.

This kind of logic could cost you a lot of money over the life of your loan. Sure, its important to shop around for the best rates. Thats why we recommend that you compare rates online before moving forward. But there comes a time when you need to lock the mortgage rate down, to prevent further fluctuations. Theres a fine line between smart shopping and procrastinating. Heres an example of how the latter scenario can cost you money.

This table shows what would happen if I were taking out a $250,000 FHA loan at various interest rates. These calculations do not include property tax or insurance. To keep things simple, Ive only included the principal and the interest.

| Rate |

You May Like: How Big A Mortgage Can I Get With My Salary

Should I Lock My Mortgage Rate In 2022

Housing market predictions forecast that mortgage interest rates will continue to rise in 2022. If you plan to apply for a mortgage this year, a mortgage rate lock could help you keep a more favorable interest rate if mortgage rates increase as anticipated.

Lock your low rate today!

Get approved before interest rates continue to rise.

Don’t Miss: Is There An Advantage To Paying Your Mortgage Bi Weekly

Timing Your New Construction Rate Lock

There have been times in recent history when locking in a 360-day rate would have paid off. For example, a home builder in August of 2021 could have locked in a 30-year fixed rate of 3 percent. Eleven months later, in July of 2022, that same home builder may pay 6% over a 30-year loan term.

Even if that extended rate lock cost $5,000, the extra cost would have paid off many times over the life of the loan.

That said, its very difficult to predict what will happen with mortgage rates in the future.

Theres always a possibility that rates will rise. So if you can afford the home you want now and have a chance to lock a rate, it may be wise to do so. But your lenders policies and rate lock fees will play into the decision.

You should work closely with your loan officer to analyze current interest rates, how the market is moving, and your own home buying budget. Together, the two of you will decide when it makes sense to lock a new construction mortgage rate.

Basic Rate Locks Explained

When an interest rate is locked there is an expiration date associated with it. When the lock expires, the rate is no longer valid.

Rates can be locked for 15, 30, 45, 60, 75, or 90 days. After 90 days the rate locks no longer operate in 15 day intervals. Moreover, rate locks beyond 90 days require up-front money to lock in the rate.

Recommended Reading: What Questions To Ask A Mortgage Lender

Early Renewal Option: Blend

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. If you choose this option, you dont have to pay a prepayment penalty. Lenders call this option the blend-and-extend, because your old interest rate and the new terms interest rate are blended. You may need to pay administrative fees.

Your lender must tell you how it calculates your interest rate. To find the renewal option that best suits your needs, consider all the costs involved. This includes any prepayment penalty and other fees that may apply.

Lock Extensions Cost Money

Locks can be extended beyond their expiration dates however, there is a cost associated with the extension. The cost of the extension depends on the duration of the extension.

Typical extensions are about .125% to .25% for 7 to 15 days, respectively. It gets very expensive the farther out the lock is extended.

Currently, the maximum number of days allowed for an extension is 30 days. After 30 days, the rate and all money collected will be forfeited.

You May Like: Is It A Good Idea To Pay Off Your Mortgage

Make A Rate Lock Agreement

While there are many types of home loans, making a rate lock agreement is something youll always have to do. When it’s time, your lender will likely ask you if you’d like to lock your rate. If they don’t, take it upon yourself to ask. They’ll explain the terms of the agreement with you and you’ll move on in the home buying process while they finalize your home loan.

Ask About A Movement Mortgage Rate Lock

As a buyer, the benefits of a rate lock far outweigh the risks. But its not just about locking in a super attractive rate its about keeping fees down and protecting your home buying power.

If youre starting to shop around for a mortgage and trying to find the best rate, chat with your local loan officer. Theyll be able to look through your finances to give you your options, help you navigate what rates in the market are doing, and can walk you through the home loan process.

Until then, explore our loans for buying or refinancing a home, or if youre ready, get your application started online.

About the Author: Mitch Mitchell

Mitch Mitchell is a freelance contributor to Movement’s marketing department. He also writes about tech, online security, the digital education community, travel, and living with dogs. Hed like to live somewhere warm.

Read Also: How Do You Get A 2nd Mortgage