Qualifying Credit Scores If The Borrower Has Co

If the main borrower has co-borrowers, Fannie Mae allows the middle credit scores of the borrower and co-borrowers to get averaged. In the event if the borrower has a 600 FICO and the co-borrower has a 700 credit score, Fannie Mae will allow the two middle credit scores to get averaged on conventional loans.

The Credit Score Needed To Buy A House

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Assess Your Unique Circumstances Before You Decide

On the other hand, applying on your own means the lender will only take into account your income and not your partners. This means you might qualify for a smaller mortgage. Regardless of whether one partner name is on the mortgage, his or her name can still be on the title of the home.

Understanding the ins and outs of credit scores and joint mortgages will help you and your partner take this major step together and get you closer to becoming homeowners. For answers to any questions you might have about joint mortgages, give our home lending advisors a call. Theyre happy to help.

Don’t Miss: Which Credit Report Do Mortgage Lenders Use

Qualifying For A Mortgage With A Lender With No Overlays On Government And Conventional Loans

Based on your credit profile and debt to income ratio, your loan officer will complete the proper pre-qualification steps. If there are credit challenges that need to be addressed, your loan officer will come up with a financial plan to have you qualify as soon as possible. We work with many families for over a year before they qualify for the home they are looking for. We are mortgage experts and deal with many credit challenges. Even if you have been turned down by a lender in the past, we encourage you to call Gustan Cho Associates today. Our team looks forward to helping you understand credit score requirements and mortgage lending. Please reach out to Mike Gracz on 630-659-7644 or send an email to for more information.

Checking Your Credit Score

You should check your credit score well before you begin the mortgage process so you will know where you stand and the mortgage rate you could qualify for. You can check your credit score for free through several online services. Many banks, credit unions, and credit card providers offer credit scores as a regular feature. Since most major mortgage lenders use your credit score in their decision, it’s worthwhile to obtain all three of your reports to make sure the information on your record is accurate.

It’s a good idea to research your credit score and your credit reports well in advance of making a major purchase so you have time to address any errors or other issues you might discover.

You May Like: How To Get Approved For Mortgage With Low Income

Why Is My Mortgage Credit Score So Much Lower

There can be a disconnect between the credit scores you obtain for free and the ones your mortgage lender is using.

Typically banks, credit card companies, and other financial providers will show you a free credit score when you use their services. Also, credit monitoring apps can show free credit scores 24/7.

But the scores you receive from those third-party providers are meant to be educational. Theyll give you a broad understanding of how good your credit is and can help you track overall trends in your creditworthiness. But they arent always totally accurate.

Thats partly because free sites and your credit card companies offer a generic credit score covering a range of credit products.

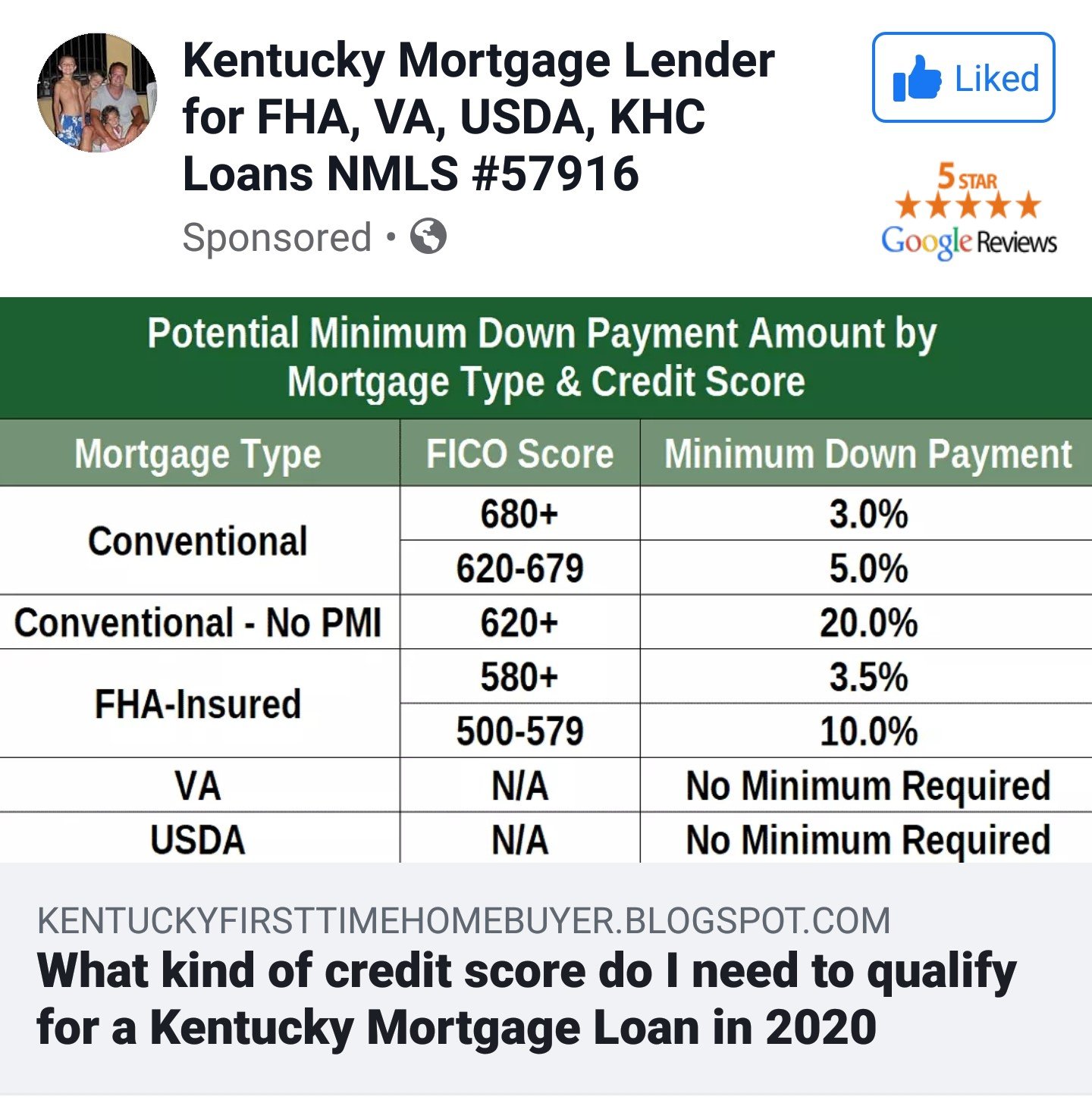

What Does My Credit Score Need To Be For A Mortgage

The minimum credit score required to get a mortgage varies by loan type:

| Type of Loan | |

| 700-740 | 10-20% |

1With a credit score between 500-579 you may still qualify for an FHA loan if you can put at least 10% down.

2No minimum credit score established by either the USDA or VA, but lenders are allowed to set their own requirements.

If youre a first-time home buyer, you may be surprised you could get approved for a mortgage loan with a credit score below 600.

But the score you see in a credit monitoring app, or in your credit card statement, wont necessarily be the score your lender sees when it pulls your credit.

The score your lender sees will likely be lower. So if your credit is borderline, youll want to understand how lenders evaluate your credit score and credit history before moving forward with a loan application.

Also Check: What Are Prepaid Items On A Mortgage

What Qualifies As Good Credit Scores

For those who arent as familiar with their credit scores, its a three-digit number that encompasses all your credit-related activity into one cumulative average. In Canada, credit scores range anywhere from 300 to 900. The higher your credit scores, the better your chances are of getting approved for various loans and other credit products. Generally speaking, credit scores of 660 and above are considered good and means that you are a low default risk and are likely to make your payments on time.

Keep On Top Of Your Credit Score

Everyone is entitled to receive a copy of their credit report from each of the three major credit bureaus free of charge once per year. Apply for your reports by visiting AnnualCreditReport.org. It’s a good idea to check your reports regularly, line by line. Errors such as late payments that were never late and old collection accounts that have been paid off could affect your score and in some circumstances prevent you from getting a mortgage. The Federal Trade Commission encourages consumers to challenge credit report errors using the sample letter on its website.

References

Don’t Miss: What Is P& i In Mortgage

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could fetch lower interest rates, which can save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all. So, it makes sense to check and monitor your credit scores regularly, especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

Improve Your Credit Score With Borrowell And Credit Karma

Instead of going directly through the credit bureau, you can open an account with Borrowell or Credit Karma. Both companies will email your credit score and credit report to you for free every week. It’s free to sign up, and you can access your credit report within minutes of becoming a member. In my opinion, this is the easiest and cheapest way to stay on top of your credit. Borrowell will send you a copy of your Equifax Canada credit report while Credit Karma has partnered with TransUnion.

These companies make money through affiliate partnerships with various loan and credit card companies. You will receive credit offers based on your credit score. You are under no obligation to apply, and I would exercise extreme caution before doing so. Instead, take advantage of the free credit reporting, as well as the educational resources both companies offer to help you improve your credit score.

Don’t Miss: What Questions To Ask About Refinancing A Mortgage

How Important Is Credit Score For Home Loans

Buying a home is a major commitment, both on the part of the buyer and the lender. As a buyer, you agree to take care of your new home and repay your mortgage based on the terms of the loan. The lender is taking a chance by providing you a significant sum of money upfront, with the expectation that youll pay it back with interest.

Lenders use several factors when deciding whether or not to lend money to an individual or group of people. One of those factors is the borrowers credit history and credit score. Learn more about the importance of your credit history when getting a mortgage and what you can do to make the most of yours.

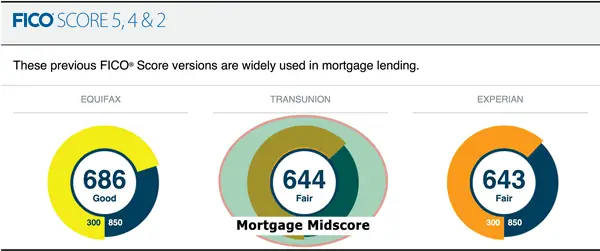

How Mortgage Lenders Pull Credit

When you apply for a mortgage, lenders pull your credit report from all three major credit bureaus: Transunion, Equifax, and Experian.

Whether you get approved for the loan and the terms of your loan will depend on the result of those reports.

Lenders qualify you based on your middle credit score.

For example, if your scores are 720, 740, and 750, the lender will use 740 as your FICO. If your scores are 630, 690, and 690, the lender will use 690 as your FICO.

When you apply with a spouse or co-borrower, the lender will use the lower of the two applicants middle credit scores.

Expect each bureau to show a different FICO for you, since each will have slightly different information about you. And, expect your mortgage FICO score to be lower than the VantageScore youll see in most free credit reporting apps.

In all cases, you will need to show at least one account which has been reporting a payment history for at least six months in order for the bureaus to have enough data to calculate a score.

Also Check: Is The Mortgage Industry Slowing Down

Why Is It So Important To Get A Low Interest Rate On My Mortgage

You probably already know that a lower interest rate means a smaller monthly payment. But do you know just how big of an effect a smaller monthly payment can have?

Lets look at an example. According to the U.S. Census Bureau, in March 2018 the average sales price of a new home sold in the United States was $366,000. If you were to go to the closing table with a 20% down payment and opted for a 30-year fixed-rate mortgage, heres how much it would cost you over time depending on your interest rates.

| $3,408 | $102,183 |

In this example, boosting your credit before you get a mortgage could save you $284 per month, $3,408 per year, and $102,183 over the life of your loan! What would you do with all of that extra cash?

Pro tip: Use our to learn more about what could impact your credit scores.

How Credit Reporting Bureaus Affect Your Score

As many consumers already know, there are three major credit reporting agencies.

- Equifax

- Transunion

- Experian

While its possible your scores will be similar from one bureau to the next, youll typically have a different score from each agency.

Thats because its up to your creditors to decide what information they report to credit bureaus. And its up to the creditors to decide which agencies they report to in the first place.

Since your credit scores depend on the data listed on your credit reports, more than likely you wont see the exact same score from every credit reporting agency.

Fortunately, most agencies look at similar factors when calculating your credit scores. As long as you manage credit cards and loans responsibly, your credit scores should be fairly similar to one another.

But different credit reporting agencies arent the only challenge. There are also different credit scoring models. And, as if that didnt already complicate matters, there are also different versions of these models.

Also Check: Do Credit Unions Give Better Mortgage Rates

When It Comes To Getting A Mortgage There Are Enough Numbers Flying Around To Make Any Mathematician Happy Lenders Will Look At A Number Of Items Which Can Include Your Credit History Your Income And How Much Debt You Have Among Other Things

But one number is perhaps one of the most important numbers of all. Your FICO® scores can impact whether you get a loan or not, and if so, at what interest rate. Thats why its important to understand the nuances of your FICO® scores. Luckily, its not rocket science. Heres the scoop on how your FICO® scores can affect your mortgage.

How Do Lenders Calculate Your Mortgage Score

When they say they use the collective results, it doesnt mean they take the average credit score of the applicants. Instead, they use their lower mid score. Each applicant has three scoresone from each major credit bureauand the lender looks at the middle score for each.

- Heres an example: Applicant #1 has three scores of 725, 715 and 699. Applicant #2 has three scores of 688, 652 and 644. The two middle scores are 715 and 652, and the lowest is 652, so that is the score the lender will go with.

Dont Miss: Chase Mortgage Recast Fee

Recommended Reading: Can I Sell A Home With A Mortgage

What Is The Maximum Credit Score

The maximum credit score for each credit reference agency is:

- Experian: 0999

| 604-627 | 628-710 |

For Experian, a score of 881-960 is considered to be good, while 420-465 is considered to be good for Equifax. TransUnion states that 604-627 indicates a good credit score. Credit scores higher than this are rated as excellent.

Having the best credit score possible doesnt guarantee you a mortgage. In addition, a low credit score doesnt mean you wont qualify. Theres a lot more for lenders to assess, which well take a look at next.

Minimum Credit Score Required For A Conventional Mortgage

A conventional mortgage is one with a downpayment of 20% or more. Conventional mortgages do not require CMHC insurance, so there are fewer restrictions on things like a minimum credit score requirement. Each lender will have guidelines that they follow.

So, it is possible to get approved for a mortgage with a credit score as low as 600, but the number of mortgage lenders willing to approve your mortgage is going to be very small.

Recommended Reading: What’s The Best Mortgage Loan To Get

Why Are My Credit Score Higher When I View It Versus Credit Scores Used By Mortgage Lenders

Over the past few years, we have seen many credit scoring companies emerge such as credit karma. These are great tools for credit score tracking. However, the scoring models are based on consumer data and are not accurate for mortgage lending. Mortgage credit scoring models are commonly referred to as the 2, 4, 5 scoring models. The lender is required to pull a tri-merged credit report. Meaning they pull the report from all three major credit bureaus.

This is due to the fact that not every creditor report to all three bureaus. It is in the lenders best interest to receive as much Credit Data as possible, a report from all three is the best way to ensure they have information from all creditors.

Whose Credit Score Is Used On A Joint Mortgage

A joint mortgage allows two or more people to purchase a home together, and both buyers fill out a joint mortgage application.

One of the main benefits of applying for a joint mortgage is that youll have more income to put toward your home purchase.

Including two earners on your application means you’re more likely to be approved for a mortgage, you may be able to borrow more money and you could purchase a more expensive home.

Read Also: How Much Should Your Mortgage Be In Relation To Income

Interest Rates And Your Credit Score

While theres no specific formula, your credit score affects the interest rate you pay on your mortgage. In general, the higher your credit score, the lower your interest rate, and vice versa. This can have a huge impact on both your monthly payment and the amount of interest you pay over the life of the loan. Heres an example: Let’s say you get a 30-year fixed-rate mortgage for $200,000. If you have a high FICO credit scorefor example, 760you might get an interest rate of 3.612%. At that rate, your monthly payment would be $910.64, and youd end up paying $127,830 in interest over the 30 years.

Take the same loan, but now you have a lower credit scoresay, 635. Your interest rate jumps to 5.201%, which might not sound like a big differenceuntil you crunch the numbers. Now, your monthly payment is $1,098.35 , and your total interest for the loan is $195,406, or $67,576 more than the loan with the higher credit score. A mortgage calculator can show you the impact of different rates on your monthly payment.

How Your Credit Scores Are Made And Why They Matter

Since there are few numbers that matter as much to your financial wellbeing as your credit score, it helps to know what your scores mean and how they work.

First, know that theres a big difference between a credit report and a credit score.

- Your credit report is a record of your borrowing history Each loan or line of credit youve opened, dates on those accounts, payment history , and so on. Overall, it shows how reliably you manage and pay back your debts

- Your credit score sums up your credit report in a single number It weighs every item on your credit report to come up with an overall score that sums up how responsible of a borrower you are

The big three credit bureaus Equifax, Transunion, and Experian operate in the realm of credit reporting.

Each one keeps a separate record of your borrowing history, based on the information your creditors send them.

The other players in the game FICO and VantageScore are responsible for credit scoring. They determine your score based on whats included in those credit reports.

For example, keeping your credit utilization ratio low can help your credit scores, while repeatedly neglecting to pay your credit card bills on time can hurt them.

Also Check: What Is A Mortgage Deposit