How Does An Interest

When you get an interest-only mortgage, youll just pay the interest at a fixed rate for a fixed amount of time, giving you a lower payment than a more traditional mortgage on the same loan amount. However, after the initial period expires, the mortgage rate on an interest-only mortgage becomes adjustable, which can significantly drive up your monthly payments. In addition, the payment will also be much higher because it will include principal that must be repaid over a shorter period than the original loan term. That can lead to sticker shock for homeowners who dont make any principal payments during the initial phase.

Once the interest-only period ends, you can refinance the loan, pay it off in full or begin paying down the principal in monthly installments for the remainder of the loan term. Unless you were disciplined about making routine principal payments throughout the early payment period, your loan balance wont go down.

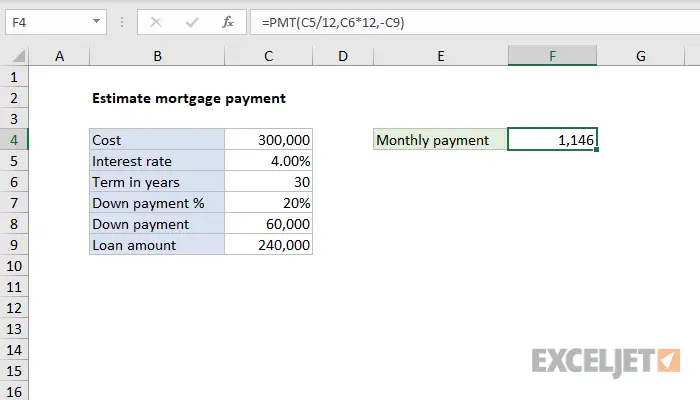

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

How Much Of The Mortgage Payment Is Interest +

In an Interest-only Mortgage, During the initial period, you’ll be required to pay interest only. That changes during the amortization phase, where the borrower must make a payment on both interest and loan principal. However, the mortgage calculator keeps you abreast of whatever expenses you’ll be making even before you take the loan.

Read Also: Can You Get A Reverse Mortgage On A Condo

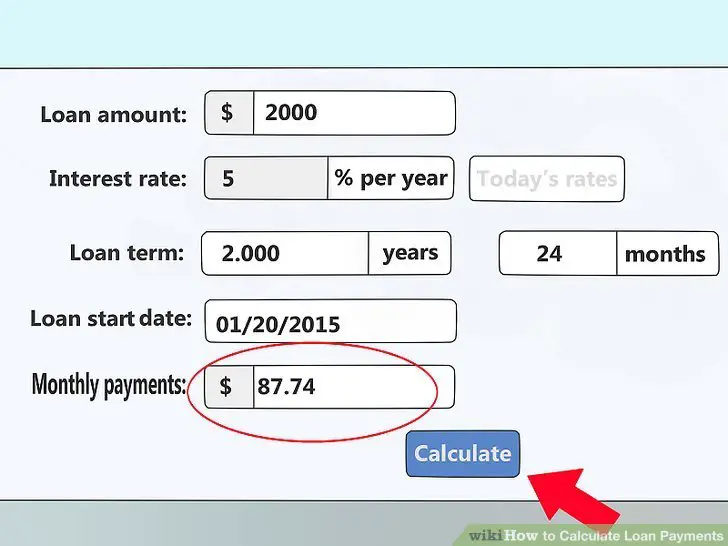

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

Why Is The Total Interest Higher Than That Of A Standard Mortgage

The total interest paid is higher on interest-only mortgages because during the first phase of the loan, you’re not reducing the loan principle . And if you’re not paying down the principle, you’re still paying interest on the full amount of the loan each month. So 4% of $250,000 is the same in the first year of the term as it is in the fifth, unless you make prepayments.

You May Like: Does Rocket Mortgage Service Their Own Loans

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

Don’t Forget Taxes Insurance And Other Costs

If you’re buying a home, you’ll also need to consider some other items that can significantly add to your monthly mortgage payment, even if you manage to get a great interest rate on the loan itself. For example, your lender may require that you pay for your real-estate taxes and insurance as part of your mortgage payment. The money will go into an escrow account, and your lender will pay the bills as they come due. These costs are not fixed and can rise over time. Your lender will itemize any additional costs as part of your mortgage agreement and recalculate them periodically.

Don’t Miss: Will Mortgage Pre Approval Hurt Credit Score

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

You May Like: Reverse Mortgage Manufactured Home

Notes On The Interest

This Interest Only Mortgage Calculator will work out your payments for both phases of an interest-only mortgage: both interest-only and full amortization, the latter being when you’re paying both interest and principle. These calculations are based on your loan amount, interest rate, the loan term and the length of the interest-free period. You can also use the interest-only calculator to determine the effects of making prepayments against mortgage principle during the interest-only phase. The calculator will show you how much faster you can pay off the loan by making prepayments, as well as how much interest you can save by doing so. For example, on a $250,000 mortgage amortized over 30 years with the first 10 years interest-free, with a 4 percent mortgage rate, you could save almost $36,000 in interest by paying an extra $200 a month during the interest-only phase.

The calculator’s amortization table can also show you how much equity you can build up by making prepayments. This is helpful if you think you may relocate or refinance before the end of the prepayment phase.

What Are The Cons Of Using An Interest

- If you dont pay on your principal during the initial interest-only period, you wont build equity in the property, though it may or may not increase in value with the market.

- Once the interest-only period expires, your monthly payment can go way up.

- While you could gain equity if your homes value increases , the opposite is true as well. If home prices plummet, you may owe more than your home is worth, which will work against you if you plan to refinance before the end of the interest-only term. You could be potentially be stuck with the house unless you can come up with the cash to make the difference between what you can sell the house for and the amount owed on the mortgage.

Also Check: How To Get Preapproved For A Mortgage With Bad Credit

How Long Youll Stay In Your Current Home

When you refinance, there are origination and other closing costs associated with taking out the new loan. Because of this, its important to have a decent idea of the number of years you might stay in the home.

Your time in the home will help you calculate the breakeven point and determine whether its worth it for you to do the refinance. For instance, if it takes you 2 years to break even in payment and interest savings after paying closing costs, you know you have to stay in the home longer than that for the refi to make sense.

The key here is to have an idea of your situation. If you have some sense of what your future plans might be, then you can sit down and do the math.

Get A Handle On What A Loan Costs You Each Month

If you own a home, you probably know that a portion of what you pay the lender each month goes toward the original loan amount while some gets applied to the interest. But figuring out how banks actually divvy those up can seem confusing.

You may also wonder why your payment stays remarkably consistent, even though your outstanding balance keeps going down. If you understand the basic concept of how lenders calculate your payment, however, the process is simpler than you might think.

Read Also: What Does Rocket Mortgage Do

How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

How To Calculate The Total Cost Of Your Mortgage

Once you have your monthly payment amount, calculating the total cost of your loan is easy. You will need the following inputs, all of which we used in the monthly payment calculation above:

- N = Number of periods

- M = Monthly payment amount, calculated from last segment

- P = Principal amount

To find the total amount of interest you’ll pay during your mortgage, multiply your monthly payment amount by the total number of monthly payments you expect to make. This will give you the total amount of principal and interest that you’ll pay over the life of the loan, designated as “C” below:

- C = N * M

- C = 360 payments * $1,073.64

- C = $368,510.40

You can expect to pay a total of $368,510.40 over 30 years to pay off your whole mortgage, assuming you don’t make any extra payments or sell before then. To calculate just the total interest paid, simply subtract your principal amount P from the total amount paid C.

- C P = Total Interest Paid

- C P = $368,510.40 – $200,000

- Total Interest Paid = $168,510.40

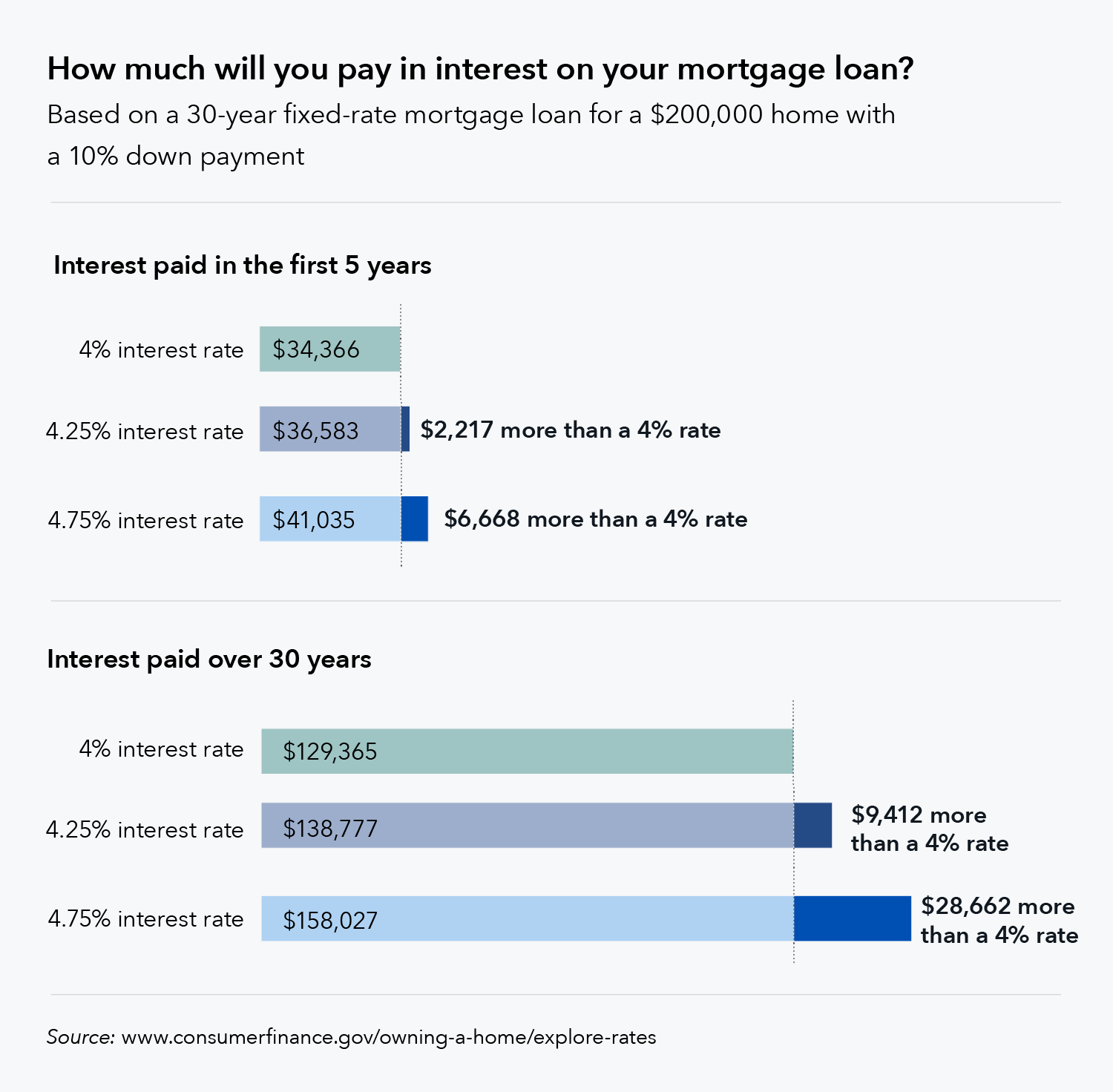

At an interest rate of 5%, it would cost $168,510.40 in interest to borrow $200,000 for 30 years. As with our previous example, keep in mind that your actual answer might be slightly different depending on how you round the numbers.

Don’t Miss: Chase Mortgage Recast

How To Save Interest On Your Mortgage

Now that you know a bit more about how interest is calculated lets look at the ways you can actually pay less of it.

- Get the best rate. Shopping around for a better interest rate can save you thousands of dollars. If you already own a home, you may want to consider refinancing with your current lender or switching to a new lender.

- Make frequent payments. Make frequent payments. Because there are a little over 4 weeks in a month, if you make bi-weekly payments instead of monthly payments, youll end up making 2 extra payments a year.

- Make extra payments. The quicker you pay down your loan amount, the less interest youll need to pay on your smaller outstanding balance. If you have a variable interest rate, you can save even more by making extra payments when interest rates are low. Be mindful of early repayment penalties on closed mortgages.

- Choose a shorter loan term. The longer you take to pay off your loan, the more interest youll end up paying. Remember, banks calculate interest on your loan amount daily, so choosing a 25-year loan term instead of 30 years can make a big difference.

Understanding The Different Rate Structures

In a fixed-rate mortgage, the interest rate for the life of the loan is established before any payments begin. There is only a single interest rate for the duration of the mortgage, regardless of what may happen in the future that could influence the rate. For many borrowers, this represents an attractive form of security. In a variable-rate mortgage, it is quite likely that your lender will outline a series of mortgage rate increases over the life of your loan, typically at periodic yearly intervals. Although your interest rate may change over time, you should be given the information you need to plan your finances well ahead of time throughout the life of the mortgage.

Recommended Reading: Rocket Mortgage Conventional Loan

Who Might Use This Calculator

An interest-only mortgage calculator is useful for a variety of situations, including the following

- Are thinking of an interest-only mortgage but want to see how the costs will play out

- Figuring out what your monthly payments will at different stages of the loan

- Seeing the effects of prepayments on how much interest you’ll pay over the life of the loan

- Calculating how varying the length of the interest-only period affects your loan payments later on

- Want to see how much faster you can pay off your loan by making prepayments

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.

Also Check: How Does 10 Year Treasury Affect Mortgage Rates