What’s The Difference Between Mortgage Insurance And Hazard Or Homeowner’s Insurance

Mortgage insurance and hazardinsurance provides different kinds of protection.

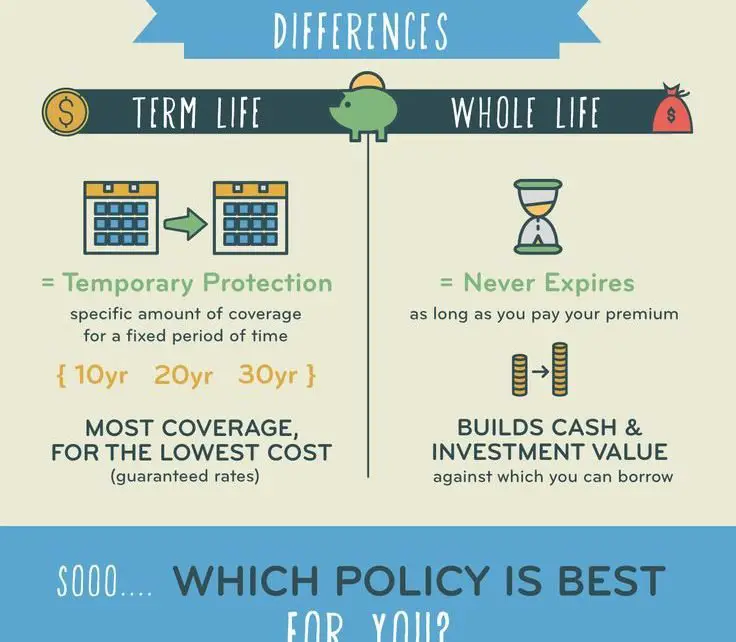

Mortgage insurance protects the loan that the lender provides youwhen you bought the house for less than 20% down payment. In the event that youdefault on paying for the loan, the insurance will pay for the amount that youstill have to pay the lender. But, of course, this does not mean that you canget away with not paying for your mortgage. Your house will still be foreclosedand you will have a bad mark on your credit rating.

Mortgage insurance can be paidmonthly or it can be settled with a one-time payment upon the closing of thesale. If this is paid monthly, you may cancel the coverage if you already have20% equity on the house.

Homeowner’s insurance protects your home against possible hazards thatmay cause physical damage to your home or may result in the loss of the thingsthat are inside your home. In short, it provides insurance protection for your house,in case something happens to it. The hazards covered will include naturaldisasters such as flood, earthquake, hurricanes or storms, as well as fire,acts of vandalism and damage caused by riots and acts of terrorism.

The homeowners insurance will payfor the loss or damage on the property. It will also pay for medical payments and personal property .

If you buya home, we strongly recommend that you get coverage for both homeowners insuranceand mortgage insurance.

| Not a bit |

Is Mortgage Insurance Included In Your Mortgage

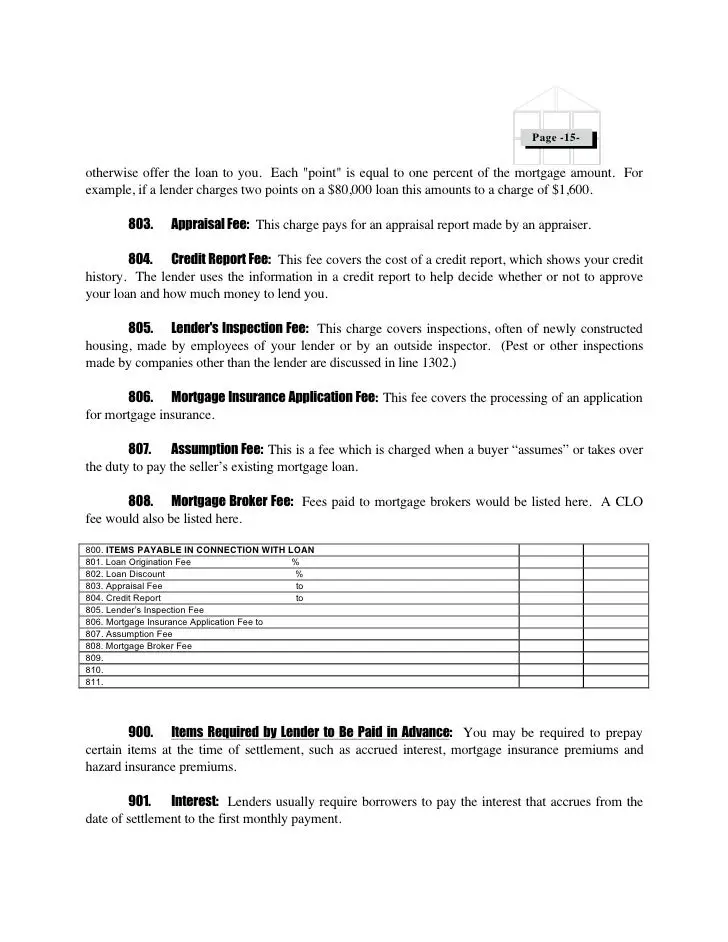

Mortgage insurance isn’t included in your mortgage loan. It is an insurance policy and separate from your mortgage. Typically, there are two ways you may pay for your mortgage insurance: in a lump sum upfront, or over time with monthly payments. That said, its not uncommon to have the monthly cost of your PMI premium rolled in with your monthly mortgage payment. This way you can make one monthly payment to cover both your mortgage loan and your mortgage insurance.

If you want to know whether a lender requires mortgage insurance, how you pay it, and how much it will cost, check the loan estimate1 you get from a lender for details and ask questions. You can also do your own research by visiting an online resource such as the Consumer Financial Protection Bureau. Youll want to look for information that explains the closing disclosures on your loan estimate to better understand what PMI may be required, and whether youd pay premiums monthly, upfront or both.

The good news is, if you do need mortgage insurance, you may be able to cancel PMI after you make enough payments on your loan to reach more than 20 percent equity in your home. Check with your lender to find out when and how you can get out of PMI2 when you no longer are required to have PMI.

Hazard Insurance Vs Homeowners Insurance

Whether you choose hazard insurance or homeowners insurance, you can protect the structure of your home from damage caused by unexpected events like hail and fire. Keep reading to learn about the differences between the two types of insurance.

While hazard insurance only protects the structure of your home from damaging events like windstorms and fires, a homeowners insurance policy provides coverage for personal property, loss of use, liability, and medical payments to others.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

Is Hazard Insurance Different From Home Insurance

Hazard insurance is not a different type of insurance from home insurance. It is the component within a standard comprehensive homeowners insurance policy that covers just the structure of your home. It will pay for repairs if your home is damaged or to rebuild it if the home is a total loss. You cannot purchase hazard insurance as a separate or standalone policy.

Compare Insurance Rates

Ensure you are getting the best rate for your coverage. Compare quotes from the top insurance companies.

Hazard Insurance Vs Homeowners Insurance: Whats The Difference

Before extending you a mortgage, your lender will have a set of requirements that youâll need to meet ahead of your closing date. One of these requirements is proof of a hazard insurance policy to protect the home from unexpected disasters, including fire, windstorms, and vandalism.

This often leaves the impression that hazard insurance and homeowners insurance are two different things, but they actually refer to the same thing. Hazard insurance refers to the part of your homeowners insurance policy that covers the structure of your home â aka your policyâs dwelling coverage.

| Hazard insurance | ||

|---|---|---|

| Pays for damage to the structure of your home | Pays for damage to the structure of your home, personal property loss, and liability-related expenses | |

| When can you use it? | If your home is damaged by a covered peril | If your home or belongings are damaged or stolen, or if you’re legally responsible for someone else’s injury or property damage |

| How do you get it? |

Mortgage lenders often require âhazard insuranceâ â not homeowners insurance â because it only has a financial interest in your home itself. The part theyâre not telling you is hazard insurance is not a separate insurance product â itâs just part of your overall home insurance policy package.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

What Hazards Are Covered By My Homeowners Insurance

Home insurance policies cover a broad range of common perils. Most insurance companies exclude damage that results from lack of maintenance or normal wear and tear. However, sudden and unexpected damage is usually covered, unless it’s a specifically excluded hazard, such as earthquakes. To obtain coverage for excluded perils, you’ll need to add an optional endorsement to your homeowners insurance policy.

Which policies are covered by your specific policy depends on the type of policy you have. Some policies, such as an HO-2, only cover “named perils”those that are specifically stated in the policy. Other policy types, such as an HO-3, cover “open perils.” This means that the policy provides coverage for all perils except those specifically excluded on the declaration page.

What To Look For In A Home Insurance Policy

Check the limits on your personal property and liability coverage

Your belongings, such as clothing, furniture, electronics, and jewelry, are insured under Coverage C on your home insurance policy. Make sure the limit is enough to cover everything you own. Keep in mind that certain items may fall under a specific category with a “sublimit” set by your insurance company. And if you have any expensive items, such as art or jewelry, you may need to add an insurance rider to fully cover them.

Coverage E protects you if you’re liable for an incident that injures someone. Be sure to select a liability limit that properly covers what you have in assets. Most home insurance policies max out at a $500,000 liability limit. If you need additional coverage, you can purchase umbrella insurance, which provides extra liability coverage for home and auto policies.

Be aware of exclusions

Depending on where you are shopping for home insurance, there will be a list of things that won’t be covered on a standard policy. These include earthquakes, landslides, mudflows, and flooding.

If you’re at risk for a peril that isn’t covered on your policy, ask your home insurance agent or company if there’s an option to purchase protection for excluded incidents.

Example

Let’s say you have a wind damage claim for $7,000. If your home is insured for $150,000 and your policy’s deductible is 2%, you’re responsible for paying $3,000, and your insurance company covers the remaining $4,000.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

What Is Hazard Insurance

Policygenius defines hazard insurance as the specific portion of your homeowners insurance policy that protects your home from perils covered in your policy. The critical detail to understand about hazard insurance is that it usually refers to coverage for your homes structure, and thats it. Pro tip: plan on selecting other coverages within your homeowners insurance policy to protect belongings inside the house.

At the beginning of the article, we briefly mentioned that hazard insurance and homeowners insurance go hand in hand. But home buyers must know what their policy entails. While some homeowners insurance policies offer full protection against hazards, some mortgage lenders require supplemental hazard insurance.

This is where those perils we touched on earlier enter the picture.

Do Mortgage Lenders Require You To Buy Hazard Insurance

Qualifying for a mortgage usually requires you to have a certain amount of hazard insurance under your homeowners insurance policy. A lender may require additional hazard coverages, such as tornadoes, depending on the number of natural disasters in your area. Every lender and location has different requirements therefore, this is a consideration when shopping for a mortgage.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

What Does Hazard Insurance Cover

Hazard insurance provides coverage for everything from fire and lightning to hail and theft. If your home is ever vandalized, this type of insurance should cover the damage. The same is true when it comes to an HVAC system freezing or heavy snow damaging your roof.

Our advice for soon-to-be homeowners: dont assume that a policy covers all risks. For example, few hazard insurance policies cover damage from flooding and earthquakes. Those who live in areas prone to these natural disasters must add optional coverages for complete protection.

Features Of Mortgage Insurance

The annual cost of mortgage insurance is usually between .19 and 1 percent of the total loan value. You can pay it up front, or incorporate it into the mortgage payment. It will be affected by your credit score, the size of your loan, whether the property is a first or second home and how the size of the loan compares to the value of your home.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

Should I Purchase Mpi

Again, unlike PMI, this type of insurance is purely voluntary. If you’re in good health, relatively secure in your job, have no unusual lifestyle risks, and are adequately otherwise insuredfor example, you have life insuranceyou might not want or need to purchase this type of insurance.

But if you think that your particular circumstances or risk factors could warrant getting this type of insurance, consider contacting an insurance agent.

Who Needs Homeowners Insurance Vs Mortgage Insurance

Whether you need homeowners insurance, mortgage insurance or both depends on how you finance your property.

- Own your home outright: If you purchase your home or condo with cash, or if you ultimately pay off your mortgage, you can forgo homeowners insurance and mortgage insurance coverage. It’s optional in these scenarios, but we strongly recommend buying a homeowners insurance policy regardless. Your home is likely one of your most significant financial assets, and its value and the value of your belongings could be entirely lost in a catastrophic event.

- Take out a mortgage: If you need to finance your new home, then your lender will almost certainly require homeowners insurance. The lender is doing this to protect its financial stake in your property. If you don’t have insurance and can’t file a claim to cover a loss, you might not be able to repay your lender. However, mortgage insurance is only typically required with FHA loans and with conventional mortgages where the down payment is less than 20% of the purchase price. The lender takes on more risk with smaller down payments and with certain types of loans, and mortgage insurance covers the lender if the borrower falls behind on payments.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

Hazard Insurance And Mortgages

If you have or are taking out a mortgage on your home, it’s common for your lender to require you to carry homeowners insurance. Strictly speaking, what they want you to have is, in fact, hazard coverage since it is the portion of the homeowners insurance directly related to the home structure itself .

Usually, purchasing a general homeowners policy will satisfy the lender’s requirement, though the level of protection required will depend on the laws of the local municipality and other special considerations. If you have a very expensive property in a high-risk area, the lender may require additional coverage.

Guide To Hazard Insurance For Homeowners

If youre relatively new to the world of homeownership, you may have come across a few terms that you dont quite understand. Moreover, you may have encountered concepts that sound similar but that actually serve completely different purposes.

One confusing topic of discussion is insurance. What exactly is hazard insurance, and how is it different from homeowners insurance?

Hazard insurance protects you, the homeowner, against structural damage caused by natural disasters homeowners insurance is a financial protection against theft and damage to your home and belongings sustained in more mundane ways.

The goal of hazard and homeowners insurance is to make sure that your house and belongings are covered in the event of an incident, whether its a kitchen fire that causes smoke damage or one of those ever-increasing forest fires that burns down your home.

Lets take a closer look at the difference between hazard and homeowners insurance and how you know youre getting the right insurance policy to cover you in an emergency.

Read Also: Rocket Mortgage Vs Bank

What Is The Difference Between Mortgage Impairment Insurance And Blanket Mortgage Hazard Insurance

A question often arises among mortgage lenders concerned about uninsured real estate property damage: What is the difference between Mortgage Impairment Policy and Blanket Mortgage Hazard insurance coverage?

Traditionally, there had a been a lot difference in the two forms of coverage, but times have changed, and these days a Mortgage Impairment policy can be endorsed to give coverage similar to that of a Blanket Mortgage Hazard insurance policy.

First lets talk about what is similar: Both a mortgage impairment policy and blanket mortgage hazard policy are designed to protect a mortgage lender from an uninsured loss to real estate property collateral. Both can used to protect the lender from loss due to an uninsured damage to a residential or a commercial real estate property securing a mortgage loan.

Both policies cover the typical hazards of fire and windstorm. Neither policy covers flood to a property in a flood zone. However, the mortgage impairment policy offers limited coverage for flood damage to a property not in a designated flood zone. Bear in mind, whichever policy you choose, you will still need to keep track of flood insurance for real estate properties sited within flood zones, and youre required by financial institution regulations to fore-place a flood policy when necessary.

Blanket Mortgage Hazard Insurance:

Mortgage Impairment Policy:

Latest News

What Is Mortgage Insurance

Mortgage insurance, also known as private mortgage insurance or PMI, is insurance that some lenders may require to protect their interests should you default on your loan. Mortgage insurance doesnt cover the home or protect you as the homebuyer. Instead, PMI protects the lender in case you are unable to make payments.

Recommended Reading: Rocket Mortgage Launchpad

Mortgage Insurance Time Frame

The good news is that you don’t necessarily have to keep paying for mortgage insurance for the entire length of the loan. Although your lender may require you to keep it for a minimum of two to five years, you can then look into eliminating it through refinancing or by getting a new appraisal. With the latter method, if the new appraised value has risen to the point where the amount you owe is now less than 80 percent of the value, you can get rid of the mortgage insurance. However, you’ll want to keep homeowner’s insurance for as long as you own the home.

So What Is Mortgage Insurance

Mortgage protection insurance through a mortgage lender gives you coverage the same way life insurance would, but only for your mortgage debt. The lender owns the coverage and you pay for it, explains Wouters, so the lender gets the insurance proceeds when you die.

Mortgage insurance may be necessary in certain financial situations. For example, you may have to purchase it from the Canada Mortgage and Housing Corporation depending on the amount of your down payment. If you buy a home with a down payment of less than 20%, youll have to pay for mortgage loan insurance, says Wouters. This type of default insurance protects your lender in case you cant make your payments.

Recommended Reading: Rocket Mortgage Loan Types

Find Cheap Homeowners Insurance Quotes In Your Area

When you’re buying a home, your mortgage lender may require you to purchase homeowners insurance, mortgage insurance or both. These insurance policies are not the same, and it’s important to understand the distinction between the two. Homeowners insurance protects the assets of both the borrower and the lender against qualifying events, such as fires or storms, while mortgage insurance protects the lender against borrower default.

What Is The Difference Between Hazard Insurance And Homeowners Insurance

Find out what hazard insurance and a homeowners insurance mean and the difference between them.

Did you know that you can purchase an insurance policy for your home? Just like a car insurance covers damages to your car by paying for any repair jobs, a home insurance offers coverage to your home in cases of fires, natural calamities, vandalism and theft. A home insurance policy helps you keep your home secure and ensures that you have a roof over you and your familys head even when there is structural damage to your house. Home insurance is usually optional, but if you are taking out a loan for your home, then the lender requests a homeowners insurance before they approve your loan.

Whenever a home insurance is discussed, there are two terms that always get thrown around a lot. They are, the hazard insurance and the homeowners insurance. Lets take a look at what these two terms mean.

You May Like: What Does Gmfs Mortgage Stand For