Who Is Eligible For A Conventional Loan

Qualifying for a conventional loan generally requires the borrower to show an overall sturdy financial profile to qualify.Compared to FHA, VA, or USDA loans, conventional loans tend to have more stringent standards.

While products like loans guaranteed by the Federal Housing Administration or VA loans that are guaranteed by the U.S Department of Veterans Affairs and are available to active military and veterans only. Or USDA loans that are backed by the U.S. Department of Agriculture and are geared toward buyers of rural properties.), aim to make buying homes more affordable for low- to middle-income families, with relaxed lending standards, conventional loans have somewhat more stringent standards.

A few of the essential eligibility requirements include:

Xavier Financial & Mortgage Group, LLC.

Company NMLS #1933918

Disadvantages Of Conventional Loans

Conventional home loans are usually cheaper than government-backed mortgages, but they are not always the best option. Conventional home loan underwriting guidelines require higher minimum credit scores and lower debt-to-income ratios than those of most government-backed mortgages.

Factors that can make FHA, VA or USDA loans a better choice include:

- Government-backed loans are assumable, which can make it easier to sell when interest rates are higher.

- Some condominium projects are approved for government loans but not conventional loans.

- Government-backed loans allow down payments to be 100% gifted.

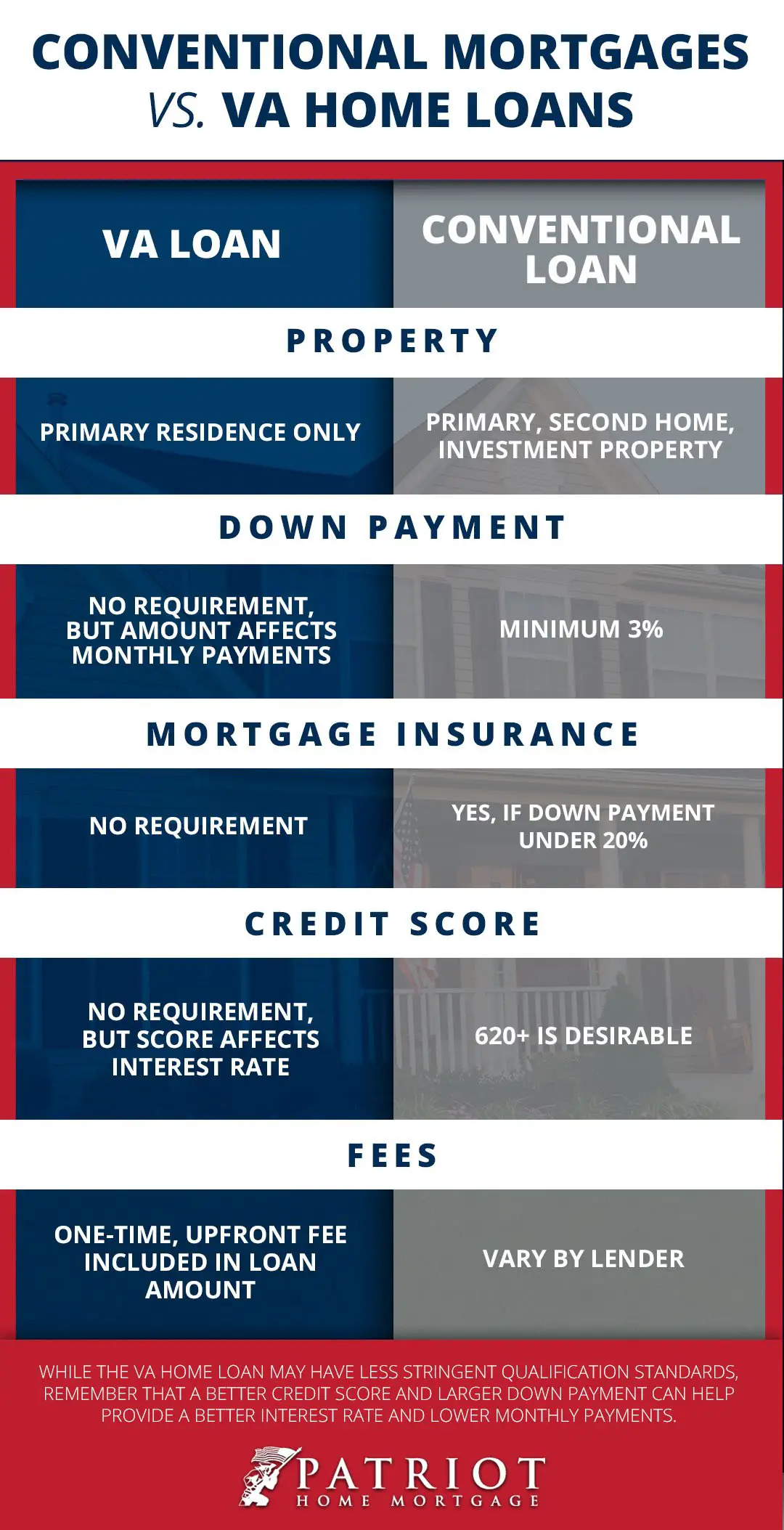

Finally, anyone eligible for VA financing should compare VA home loans to conventional mortgages before committing to a program. The VA mortgage is a benefit earned by service members, and it often comes with a lower mortgage rate than conventional loans. There is no monthly mortgage insurance, even with no down payment.

What Are The Requirements Of A Conventional Mortgage

Qualifying for a conventional loan can generally be a bit harder than it would be for an FHA mortgage or other government-insured loan. Because they lack any sort of government guarantee to protect them from loss, lenders take on more risk with these loans. For this reason, theyre typically pickier about who theyll lend to.

Here are the typical requirements for a conventional home loan:

| 41% |

Don’t Miss: Can You Refinance A Mortgage Without A Job

How Can I Avoid Pmi Without 20% Down

To sum up, when it comes to PMI, if you have less than 20% of the sales price or value of a home to use as a down payment, you have two basic options: Use a “stand-alone” first mortgage and pay PMI until the LTV of the mortgage reaches 78%, at which point the PMI can be eliminated. 1 Use a second mortgage.

Conventional Loan: Benefits And Requirements

Though they can be harder to get, a conventional loan can offer lower interest rates than an FHA loan, which can translate to a lower monthly mortgage payment. This is in part because a conventional loan usually requires you to put down a larger down payment than with an FHA loan, and requires a better creditworthiness picture.

Approval for a conventional loan with a lower down payment even as little as 3% down is possible if you have good credit and dont carry a lot of debt. However, a smaller down payment may prompt your lending institution to require you to carry private mortgage insurance , which can add to the cost of your mortgage.

Unlike FHA loans, which are strictly to be used in purchasing a property, a conventional loan may also allow you to include funds that will go toward home renovation, home improvement, or even furniture. While you still have to pay interest on these items, you wont have to spend the time saving up for these expenses and can fund them at the time of purchasing your house.

As FHA loans are backed by the government, their inspections and appraisal process may be more stringent than what is required for a conventional loan. If you buy a house that needs some work or has some issues you plan to solve, it might not be possible for it to pass the required inspection by an FHA inspector, or it may appraise below the purchase price, and your loan wont get approved. So, a conventional loan is better for these types of properties.

Also Check: How Much Is Mortgage On 1 Million

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Do Conventional And Collateral Mortgages Compare

The biggest difference between a collateral mortgage and a conventional mortgage is in the terms and conditions. Essentially, lenders are able to write in a higher interest rate with a collateral mortgage compared to what was initially offered to borrowers.

With a conventional charge, only the amount of the home loan is registered against the property. If you borrow $400,000, for instance, your lender would register $400,000 as a liability on your home. With a collateral charge, on the other hand, an amount higher than the home loan can be registered against the property.

Want to know what a Cash Back Mortgage is? Look here.

Also Check: How Does 10 Year Treasury Affect Mortgage Rates

Is A Conventional Mortgage Right For You

If youre simply looking for the easiest loan to qualify for, FHA loans might be your best bet for buying a house. Or if you qualify for a special loan program like a VA loan or USDA loan, these are likely the smartest path forward, as they require no down payment and can allow you to secure a mortgage with low interest rates and favorable terms.

However, if youre well-qualified, conventional loans offer a host of advantages. Unlike government-backed loans, you wont have to pay any program-specific fees when taking out a conventional mortgage. And, even if you dont have 20% saved for a down payment, your loan servicer will automatically cancel your PMI once the LTV reaches 78%.

Whatever you decide, make sure you shop around for your loan first. Rates and terms can vary greatly depending on your lender. Credible Operations, Inc. doesnt offer every type of mortgage loan, but you can use us to compare multiple prequalified rates on conventional mortgages. It only takes at once in just a few minutes and wont affect your credit score.

Credible makes getting a mortgage easy

Requirements For A Conventional Loan

Lenders view conventional loans as a higher risk because the government doesnt guarantee them. As a result, lenders stand to lose all of the remaining principal and interest on a mortgage if the borrower ends up unable to make payments.

Important!

All conventional loans have to meet certain baseline requirements set by Fannie Mae and Freddie Mac. Each lender, however, is free to impose its own, higher standards, which are known in the business as lender overlays. What lenders cannot do is impose standards that would qualify as mortgage discrimination.

As a borrower, these are the minimum conventional loan requirements you should be prepared to meet:

Credible makes comparing prequalified conventional loan rates quick and easy you can see personalized rates from our partner lenders in just three minutes.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

Fixed Or Adjustable Rate

Conventional home loans can have fixed mortgage rates or adjustable rates. With a fixed-rate loan, the interest stays the same over the entire life of the loan, and the borrower makes the same principal and interest payments every month. With an adjustable-rate mortgage, the interest rate remains the same during a set period of time at the beginning of the loan. After that time, the rate can go up or down, and the amounts owed each month for the principal and interest can also change.

Why Are Conventional Loans Important For Realtors

Conventional loans are a topic every realtor should be discussing with their clients. First time home buyers, especially, will rejoice at the flexible down payment options. Conventional loans can also account for the range in home prices that borrowers will be interested in purchasing because these loans can be either conforming or nonconforming. If a loan amount needed exceeds the loan limit for an area, a borrower can apply for a nonconforming conventional loan for the true amount they need to borrow. The flexibility in choices and options that innately comes with conventional loans is something every realtor should be speaking about with their clients.

Also Check: Can You Do A Reverse Mortgage On A Condo

Heres What You Need To Get A Conventional Loan

Conventional loans have to meet certain baseline requirements set by Fannie Mae and Freddie Mac and can be harder to qualify for than a government-backed loan.

Edited byChris JenningsUpdated January 4, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Conventional loans are one of the most popular types of mortgages: almost all lenders offer them. In August 2020, 82% of all closed mortgages were conventional loans, according to a report by Ellie Mae, making them far more popular than FHA, VA, or other home loans.

Conventional loans tend to have stricter requirements than government-backed mortgages. But with so many homeowners meeting these requirements, a conventional loan might be more accessible than you think.

Heres what you should know about conventional loans before you apply:

Conventional Loan Refinance Options

If youre looking to reduce your mortgage payments or otherwise refinance your home loan, there are a number of conventional loan refinance options.

These include but are not limited to:

- Rate and term, which let you change your loans interest rate or loan term

- Cash-out, which allow you to borrow cash against your home equity to pay for home renovations or other expenses

- High loan-to-value /enhanced relief, which are options if you have a very high loan-to-value ratio

The best refinance option depends on your goals, budget, and the terms of your existing mortgage. If youre not sure which ones right for you, a mortgage lender can advise you on the best options for your financial situation.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

What Is A Conventional Mortgage

The term conventional mortgage refers to a mortgage that does not carry any form of high-ratio or lender insurance premium. The Bank Act of Canada controls many facets of the finance industry, and the mortgage industry is not immune to its effect.

As a law, no chartered bank or is able to offer mortgage financing without insurance beyond a certain percentage of the value of the property. This limit used to be 75 percent, but was changed on April 20th, 2007 to 80 percent for most residential single-family mortgages.

A high ratio mortgageexceeds 80 percent of the property value, and must therefore be insured by CMHC, Genworth or AIG . The price of the insurance premium IS added directly to the mortgage amount, going on TOP as an insurance premium vs. being deducted like a lender fee in trust company or private mortgages.

As conventional mortgages do not exceed this 80 percent maximum of the propertys value, an ample cushion of 20 percent remains. As such, the basic principle is that the financial institution is insulated enough from risk in order to provide such a loan without any 3rd party insurance coverage.

By insuring a mortgage loan, Canadian banks are able to reduce the capital allocation required on a per dollar basis as a result of reduced capital requirements due to the insurance component.

Property Appraisal Verifying The Homes Value And Condition

Lenders commonly require a home appraisal before theyll approve a mortgage. The appraisal reveals whether the homes value is at, above, or below the price youve agreed to in your purchase contract. The lender will only be willing to approve the mortgage if the home is valued at or above the purchase price.

Remember:

What happens if the appraisal says the home is worth less than the contract price? Suppose you have agreed to buy a house for $300,000 and the appraisal says it is only worth $280,000. Here are several options to keep the deal from falling through:

- Make up the difference by putting an additional 20% down.

- Convince the seller to lower the purchase price to $280,000.

- Meet in the middle at $290,000. This way you only have to bring an extra $10,000 to the table, and the seller doesnt lose as much.

- Appeal the appraisal if it makes sense to do so.

Don’t Miss: Requirements For Mortgage Approval

Advantages Of Conventional Loans

Since conventional loans come with higher interest rates and strict requirements, you might wonder why youd want to opt for this option. Well, theyre useful for several reasons:

-

More flexibility

Once you get a conventional loan, youre not restricted to the house that you can finance. Conventional loans have a much higher amount you can borrow .

Also, you tend to get more options with regards to loan length and terms. You can find 15 or 20-year mortgages if you dont want to opt for the standard 30-year loan. Lenders are also free to offer flexible terms and adjustable-rate home loans.

-

Faster applications

Applying for a conventional mortgage is much faster than getting approved for a government-backed loan. Private lenders have loans readily available with generally less demand. If you need to finance your home fast, conventional loans are the way to go.

-

Negotiable mortgage insurance

You can often cancel your private mortgage insurance prematurely after your loan balance covers the down payment. Compare this to government-loans, like FHA, where youll need to pay insurance premiums throughout the loans life.

-

Lower fees

You can lower the funding fee on your conventional loans by up to 1.4%, depending on the down payment. In contrast, FHA loans will charge you an upfront flat fee of 1.75% for insurance premiums.

What: Loan Payment Model

Like all home mortgages, a conventional home loan is paid off in two partsan initial down payment and interest-rate based monthly payments.

Down payments for conventional loans vary wildly, from as low as 3% to over 20%. Your down payment percentage will depend on a few factors, including:

- Conventional loan type

- Personal finances

- Property value

Keep in mind that for down payments under 20%, lenders usually require purchasing private mortgage insurance, costing about 0.5% to 1.5% of your loan annually.

For your future budget, expect your monthly payment plan to last about 15 to 30 years on conventional loans. Typically, the interest rate on these payments sits around 3%however, a higher credit score can lower that rate.

You May Like: Rocket Mortgage Conventional Loan

Whats Good About Conventional Loans

Theres a reason why conventional loans are so popular. This type of loan has several features that make it a great choice for most people:

- Low interest rates

- Various term lengths on a fixed-rate mortgage, ranging from 10 to 30 years

- Reduced private mortgage insurance

Because conventional loans offer so much flexibility, there are still some decisions you have to make even after you choose this loan type. Youll also have to consider how much you can put down, how long you want your loan term to be, and how much house you can afford.

Is A Conventional Loan Worth It

In general, conventional loans best fit buyers with financial security. With a high credit score or hefty down payment, a conventional loan can waive costs from mortgage insurance or fees.

That said, depending on your personal finances, every home loan has its pros and cons. Its always best to compare all home loan options. That way, youll find the deal that ensures your homeowner success.

Ballinger, Barbara. Conventional loan rates and requirements for 2021.

Bucyznski, Beth Wood, Kate. Conventional Loan Requirements for 2021.

Federal Housing Administration. FHA Loan Requirements.

US Department of Veterans Affairs. Purchase Loan.

Folger, Jean. What Can I Expect My Private Mortgage Insurance Rate to Be?

Investopedia. Conventional Mortgage or Loan.

Luthi, Ben. What is a Conventional Loan?

US Census Bureau. Quarterly Sales and Price by Financing, 2020 Q4.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

How To Get A Conventional Loan From Assurance Financial

Assurance Financial makes the process of securing a loan simple and fast. You can pre-qualify in 15 minutes online or by speaking with a loan officer, and we will give you your free quote on a rate. Once you are ready to buy, simply fill out our full application.

Assurance Financial takes care of end-to-end processing in house â we donât send your mortgage or underwriting somewhere else. This allows our process to be timely and ensures we have answers. Once processing is complete, you close your loan by signing with a notary. We walk you through the process so you can focus on moving.