So Should I Buy A Home

The answer to that question depends on your financial status and your goals. Just because a lender is willing to give you money for a home doesnât necessarily mean that you have to jump into homeownership. Itâs a big responsibility that ties up a large amount of money for years.

Itâs important to remember that the mortgage lender is only telling you that you can buy a house, not that you should. Only you can decide whether you should make that purchase.

Can I Buy A House Making 30k A Year

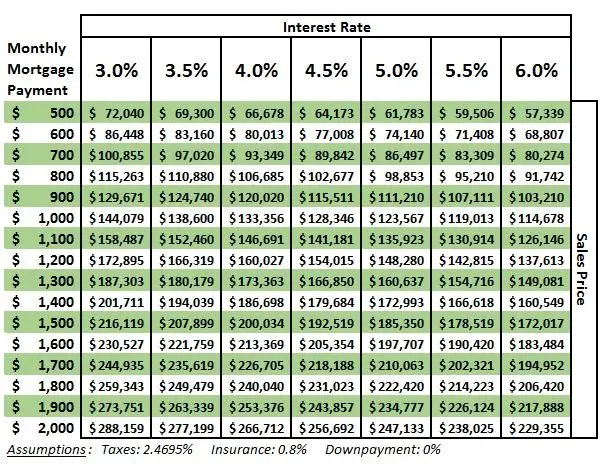

If you were to use the 28% rule, you could afford a monthly mortgage payment of $700 a month on a yearly income of $30,000. Another guideline to follow is your home should cost no more than 2.5 to 3 times your yearly salary, which means if you make $30,000 a year, your maximum budget should be $90,000.

Can I Still Get A Good Mortgage With 1000 A Month Repayments If I Have A Bad Credit History

Even if you have a bad credit history, the ability to repay £1,000 a month on a mortgage should allow you to secure a mortgage. How good or large that mortgage is, depends on other factors, as detailed above.

If you want to know more about exactly what mortgage you can get with a bad a credit history but the ability to make £1,000 monthly mortgage repayments, then why not speak with an experienced mortgage advisor, like those we work with.

The right mortgage advisor can answer all your questions and help you understand just what mortgage is available to you with a £1,000 per month for repayments, with or without a bad credit history.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

How Much Mortgage Can I Afford

Even though Martin can technically afford House #2 and Teresa can technically afford House #3, both of them may decide not to. If Martin waits another year to buy, he can use some of his high income to save for a larger down payment. Teresa may want to find a slightly cheaper home so sheâs not right at that maximum of paying 36% of her pre-tax income toward debt.

The problem is that some people believe the answer to âHow much house can I afford with my salary?â is the same as the answer to âWhat size mortgage do I qualify for?â What a bank is willing to lend you is definitely important to know as you begin house hunting. But ultimately, you have to live with that decision. You have to make the mortgage payments each month and live on the remainder of your income.

So that means youâve got to take a look at your finances. The factors you should be looking at when considering taking out a mortgage include:

- Income

- Private mortgage insurance

- Local real estate market

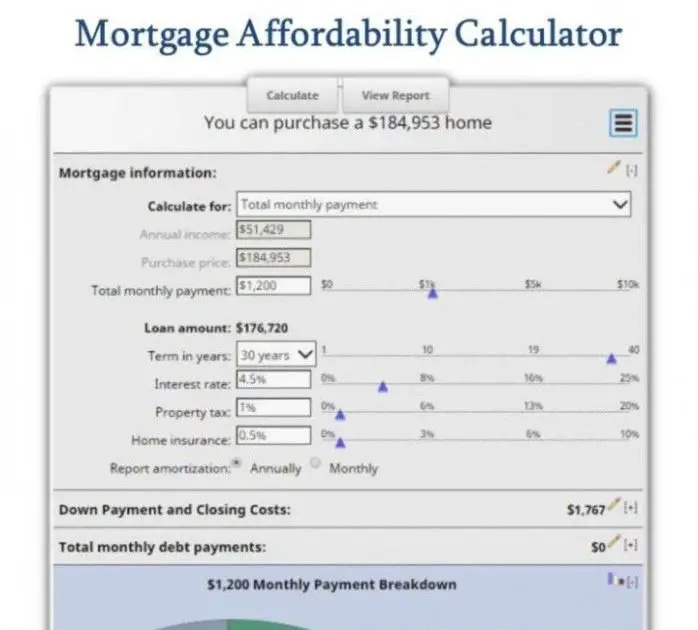

Plugging all of these relevant numbers into a home affordability calculator can help you determine the answer to how much home you can reasonably afford.

But beyond that youâve got to think about your lifestyle, such as how much money you have leftover for travel, retirement, other financial goals, etc. You might find that you donât want to buy the most expensive home that fits in your budget.

Why You Should Consider Buying Below Your Budget

There is something to be said for the idea of not maxing out your credit possibilities. If you look at houses that are priced somewhere below your maximum, you leave yourself some options. For one, you will have room to bid if you end up competing with another buyer for the house. As an alternative, youâll have money for renovations and upgrades. A little work can transform a home into your dream house â without breaking the bank.

Perhaps more importantly, however, you avoid putting yourself at the limits of your financial resources if you choose a house with a price lower than your maximum.

You will have an easier time making your payments, or you will be able to pay extra on the principal and save yourself money by paying off your mortgage early.

Recommended Reading: Who Is Rocket Mortgage Owned By

Save For A 20% Down Payment

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you have a VA loan and pay the funding fee upfront.

What Is My Maximum Monthly Housing Payment

The general rule of thumb is that your monthly home payment should not exceed 28% of your gross monthly income to live comfortably. For example, lets say you and your partner together earn $7,000 per month. In this scenario, your monthly home payments should not exceed $1,960 per month . In some cases, this dollar amount may include not only your mortgage, but also your homeowners insurance, property taxes, or sometimes even association fees.

Again, if we assume your combined monthly income is $7,000, then your maximum monthly debt payment is $2,520 . When you consider your maximum total housing payment, using the numbers from above, that leaves $560 in other monthly debts . If your car payment and credit card bills exceeded $560 per month, you would want to consider lowering your maximum monthly housing payment to prevent feeling strapped for cash.

Don’t Miss: Chase Recast Calculator

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in interest over time, it can free up more cash to keep your DTI low.

Get The Best Interest Rate You Can And Pick Your Mortgage Term

Dont start worrying about exact interest rates until you find a place you love, advises Davis. Then start speed dating mortgage lenders to get at least three different quotes. Each quote will likely include different closing costs as well.

Some will pad the interest rate to give you no closing costs, said Davis. Some people will pad the closing cost to give you a lower interest rate. Not all quotes will look the same, so the more your shop around, the more likely you are to find a lender that fits your needs.

Dont be afraid to source quotes from a variety of different sized lenders as well, says Watson who notes:

Sometimes the local bank in your area will have special discounts for first-time homebuyers or young families moving into certain neighborhoods.

Typically, a larger down payment will lead to a lower interest rate, since your loan is smaller and less of a risk to take on. The bigger your down payment, the less youll borrow overall, meaning youll save money in the long term. For a closer look at how your down payment influences interest rate, check out the Consumer Financial Protection Bureaus interest rate calculator.

Your credit or FICO, score, on the other hand, can have a much larger impact on your interest rate. Heres how much youd pay in interest on a median-priced home based on your credit score:*

| FICO Score |

- Mean less wiggle room for savings, emergencies, or job instability.

30-year mortgages:

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

About Your Maximum Home Price

Your maximum home price is calculated by looking at the maximum mortgage you can afford, your loan terms and your .

Once you know how much house you can afford, be sure to look at your loan’s amortization schedule here.

Tip: Don’t overlook PITI when determining what you can afford each month. For example: if you can afford $2,400 per month, this must include your principal, interest, AND taxes and insurance.

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How We Calculate Your Home Value

Mortgage data: We use current mortgage information when calculating your home affordability.

Closing costs: We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home.

Homeowners insurance: We assume homeowners insurance is a percentage of your overall home value.

Debt-to-income threshold : We recommend that you do not take on a monthly home payment which is more than 36% of your monthly income. Our tool will not allow that ratio to be higher than 43%.

Mortgage Type: The type of mortgage you choose can have a dramatic impact on the amount of house you can afford, especially if you have limited savings. FHA loans generally require lower down payments , while other loan types can require up to 20% of the home value as a minimum down payment.

…read more

| * Includes a $ required monthly mortgage insurance payment.Other Expenses |

| Accuracy Grade*=A |

Rent vs Buy

Consider Your Mortgage Options

Lastly, it might not be anything you’re doing wrong. It’s important to consider all your mortgage options. Different lenders have different loans available. The also set their own terms and pricing, so it’s important to be aware that you won’t always get the best deal by going to the first lender you see.

One other key thing to look at is the difference between the interest rate and the annual percentage rate associated with the loan. The bigger the difference, the more the lender is charging you in closing costs.

Read Also: Rocket Mortgage Vs Bank

How To Calculate How Much House You Can Afford

To produce estimates, both Annual Property Taxes and Insurance are expressed here as percentages. Generally speaking, and depending upon your location, they will generally range from about 0.5% to about 2.5% for Taxes, and 0.5% to 1% or so for Insurance.

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all your regular obligations . The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%.

An Example Of What You’ll Pay With A Va Loan

Let’s say that the mortgage calculator determined that you can spend as much as $275,000 on a home. Since you’re taking out a VA loan, you won’t need to put anything down or pay for mortgage insurance.

However, you will need to pay a one-time VA funding fee at closing. This fee can be rolled into the loan amount and paid monthly, but we’ll include it as an upfront cost in this example. If you put 0% down, the fee is 2.3% for first-time VA loans and 3.6% for subsequent loans. The fee decreases if you put more money down, but let’s assume that it’s your first VA loan and you’re not making a down payment in this scenario. In that case, your funding fee would equal $6,325.

With a 4% closing cost, you’ll need to pay another $11,000 upfront. That comes out to a total of $17,325.

Upfront costs

You can learn more about VA loans here.

Don’t Miss: Mortgage Recast Calculator Chase

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Is $40000 A Year Good Money

While a $40,000 a year salary might categorize you in the lower-middle class and below the median individual income in America, it’s still plenty of money for you to survive on. However, there are tons of factors that determine if you will struggle with $40k or live more comfortably than you expected.

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

What Effect Will Interest Rates Have On My 1000 A Month Mortgage

Interest rates, as set by the Bank of England, are used by lenders as a way of setting their own mortgage, loan and savings interest rates. When it comes to the effect interest rates have on your £1,000 a month mortgage, this is something you should be interested in.

When interest rates are low, in recent years some mortgage interest rates have been around the 2% mark, then your £1,000 per month can go further as the rate of interest you must pay to your lender for your mortgage is lower.

However, when the Bank of England raises its key interest rate, most banks follow suit and raise theirs. That means your £1,000 a month for your mortgage repayments cant buy you as much debt and the mortgage you can secure is lower.

How Much House Can I Afford 80k Salary

So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

Don’t Miss: Recast Mortgage Chase

Follow These Pro Tips To Make The Most Of Your Mortgage

Choosing the right mortgage is individual to each homebuyer Dont forget to keep these tips in mind as you calculate how much mortgage you can afford.

- Pay off debt before you take on more Mike Scott the mortgage pro suggests that buyers shouldnt borrow more money until theyve got their existing debts under control. In a high debt-to-income ratio situation, you may be better off swallowing your pride, moving back in with family, and focusing on paying off those debts first.

- Play it safe with the single-income challengeWhen you shop for a house youll have the option to factor in both you and your partners income. But Watson challenges budget-conscious buyers to shop with a single income, instead of combined.That way, if one of you loses a job or stops working to have kids, you arent facing a crisis, says Watson.

- Some expenses save you elsewhere.In some cases you can responsibly spend more than 30% of pretax income on housing payments. Davis gives the example of a case where homeowners association fees push you over the mark.If the association takes care of things like lawn and pool maintenance, or its state of the art gym will eliminate your need for a monthly membership, the additional payment could make sense.I think thats where it can get tricky, says Davis. When theres HOA dues, it can cost buyers more than they were planning on, but when you really consider what they take care of and pay for, it can be worth it for some.

What Size Home Can I Buy For A 1000 Per Month Mortgage

Again, the answer to this question depends on a number of different details and variables associated with each individual mortgage application. If you live in an expensive part of the UK and have only a small deposit, then you may only be able to afford something small in a popular area, or something a little larger in an up-and-coming area.

However, even if you have only a small deposit and a short credit history, if the area you live in is more affordable, then the size of property you can afford to buy with a £1,000 per month mortgage will probably be bigger than in many more expensive locations.

To find out more about exactly what size mortgage you can secure with a £1,000 per month for repayments and taking into account all the other important details a lender considers, speaking with a mortgage advisor is a good idea.

If you talk to a fully qualified and experienced mortgage advisor, like the ones we work with, they can answer all your questions about what size of mortgage you can get with a £1,000 per month repayment.

Also Check: Can I Get A Reverse Mortgage On A Condo