Close On The New Mortgage

If all goes well, the loan will get approved, and you can close on your new loan, which includes the lender paying off your old mortgage and starting your new one.

During closing, the lender will share what’s called a Closing Disclosure, which has the final loan details that you can compare to the loan estimate. After signing the closing paperwork for refinancing, you’ll still have three business days to cancel if you change your mind.

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youâll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

You May Like: How Much Are Mortgage Payments On 150 000

Where Should I Stash My Down Payment

You could stash your down payment in a simple money market savings account. Youre not going to make tons on interest, but you wont lose money either. Keep in mind: Saving a down payment is not the same as investing for retirement. Saving a down payment should only take you a year or twoso you want to keep your savings in a place thats easy for you to access.

How To Choose A Mortgage Lender

You have many options when it comes to choosing a mortgage lender. Banks, credit unions and online lenders all offer mortgages directly, while mortgage brokers and online search tools help you compare options from different lenders.

Itâs important to make sure you feel comfortable with the broker or company youâre working with because youâll need to communicate with them frequently during the application processâand in some cases, after the loan closes.

You may want to start with the banks or other institutions where you already have accounts, if you like their service. Also, ask your network of friends and family, and any real estate professionals youâre working with, for referrals.

Don’t Miss: What Are Today’s Mortgage Rates 30 Year Fixed

How Much Should You Save For A Down Payment

Save up a down payment of at least 20% so you wont have to pay private mortgage insurance . PMI is an extra cost added to your monthly payment that doesnt go toward paying off your mortgage. If youre a first-time home buyer, a smaller down payment of 510% is okay toobut then you will have to pay PMI. No matter what, make sure your monthly payment is no more than 25% of your monthly take-home pay on a 15-year fixed-rate mortgage. And stay away from VA and FHA loans!

Saving a big down payment takes hard work and patience, but it’s worth it. Here’s why:

- Youll have built-in equity when you move into your home.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Don’t Miss: Can You Get A Mortgage With Fair Credit Score

How To Choose The Best Mortgage

If you’re like most people, a mortgage represents the largest long-term debt obligation you’ll ever have. Choosing the right mortgage can set you up for success and help minimize the overall costs of buying the home. Here are four tips to help you shop for the best mortgage:

1. Determine how much you can afford. A home is a large purchase, and you may wonder how much you can realistically afford. Try various scenarios on a mortgage calculator to find out what your optimal loan might look like. No matter how much loan you qualify for, keep in mind that you don’t have to borrow the entire amount.

2. Compare mortgage loan term lengths. A 30-year fixed-rate mortgage is the most popular loan type, but it’s not your only option. Use a mortgage calculator to see how various loan terms impact your monthly payment, the amount of interest you’ll pay, and the total cost of the home. Remember, a longer loan term means lower monthly payments, but you’ll end up paying more interest over the life of the loan. This chart compares how monthly payments and total interest differ for a fixed-rate $250,000 loan at 4%, depending on the loan term:

| Loan Term | |

|---|---|

| $53,735.41 | $303,735.60 |

Mortgage Disability Insurance Premium Calculation

Mortgage disability insurance premiums are based on a rate per $100 of coverage. This is known as your fixed monthly benefit amount, which is rounded to the nearest $100. For example, if your monthly mortgage payment is $1,385, then your fixed monthly benefit amount when calculating for the cost of insurance would be $1,400.

Using this same example, your monthly premium is:

That would be $1,400/10, or 14, multiplied by the premium rate. For someone aged 50 with CIBC, the premium rate is $4.45 That means the monthly premium would be 14 x $4.45, or $62.30. You can refer to the premiums table above to find your premium rate with your lender, or use the mortgage disability insurance calculator on this page.

You May Like: Is Rocket Mortgage And Quicken Loans The Same

How Much Does Disability Insurance On A Mortgage Cover

Mortgage disability insurance can cover up to 100% of your regular mortgage payment. This includes the principal and interest payments, and may also include property tax payments included in your regular mortgage payment as well asmortgage life insurancepremiums.

You can choose the coverage amount. For example, you might only need 50% of your mortgage payments to be covered. This reduces your monthly insurance premiums.

Lenders and insurers will have a coverage limit. For example, the maximum coverage might be up to $3,000 per month for 24 months. Manulife covers up to $10,000 per month for up to 24 months. If your regular mortgage payment is over this maximum coverage limit, youll still have to pay the leftover amount.

Maximum Mortgage Disability Insurance Coverage

| RBC |

|---|

| 24 months |

Browse And Compare Mortgage Details

Requires Energy Performance Certificate rating A or B

This product is only available for properties with an Energy Performance Certificate rating of A or B.

To check the rating of the property please visit:

EPC Register in England, Wales and Northern Ireland.

Scottish EPC Register in Scotland .

What is Help to Buy?

Help to Buy is a UK Government initiative to help people buy a new build property.

For further info, please visit:

.

We don’t currently offer Help to Buy Shared Equity online, so please give us a call or visit us in branch.

What is Shared Equity?

With a Shared Equity mortgage, you’ll receive an equity loan which we’ll treat as part of your deposit. This loan is repaid either on the sale of the property or the end of the mortgage term, whichever comes first.

We don’t currently offer Shared Equity schemes online, so please either give us a call or visit us in branch.

What is the Mortgage Guarantee Scheme?

The Mortgage Guarantee Scheme is a UK Government initiative to help people with a low deposit buy a property.

For further info and eligibility, please visit our Mortgage Guarantee Scheme pages .

Also Check: Does Spouse Have To Be On Mortgage

Los Angeles Homebuyers Can Take Advantage Of Historically Low Mortgage Rates Today

Own your very own piece of Los Angeles. Lock in low rates currently available in and save for years to come! In spite of the recent rise in rates current mortgage rates are still below historic averages. If you secure a fixed mortgage rate your payments won’t be impacted by future rate hikes. By default we show 30-year purchase rates for fixed-rate mortgages. You can switch over to refinance loans using the radio button. Adjustable-rate mortgage loans are listed as an option in the check boxes. Alternate loan durations can be selected and results can be filtered using the button in the bottom left corner. You can select multiple durations at the same time to compare current rates and monthly payment amounts.

Help your customers buy a home today byinstalling this free mortgage calculator on your website

As Seen In

How To Get Rid Of Fha Mortgage Insurance

One of the main ways to get rid of FHA MIP is to make at least a 10% down payment at closing. Youll still pay the premiums, but just for 11 years.

Another way to get an FHA MIP removal it is to refinance into a conventional loan however, there are several things youll need to do to prepare for a refi, including:

- Having a credit history thats free from any blemishes that could stop you from qualifying for a refinance

- Improving your credit score to 620 or higher

- Building at least 20% home equity

Still, FHA mortgage insurance may not bother you much if youre a first-time homebuyer. The benefit of making a small down payment and achieving homeownership sooner rather than saving up for a 20% down payment may outweigh the disadvantage of carrying this extra loan cost.

Recommended Reading: How Much Is A Mortgage Per Month

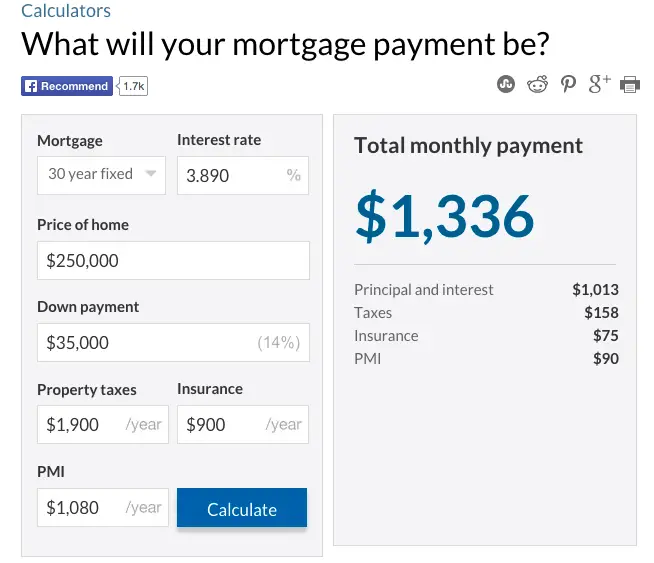

How Smartasset’s Mortgage Payment Calculator Works

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Explore All Of Your Mortgage Options

Believe it or not, there are severaltypes of mortgage loansavailable to homebuyers. You may want to explore conventional mortgages,FHA loans, and other government-backed financing options, like VA or USDA loans, to help determine which may be right for your situation. There are also manyfirst-time homebuyer resources, which could reduce your upfront costs or help you more easily qualify.

Read Also: A Mortgage Loan Originator Is Defined As

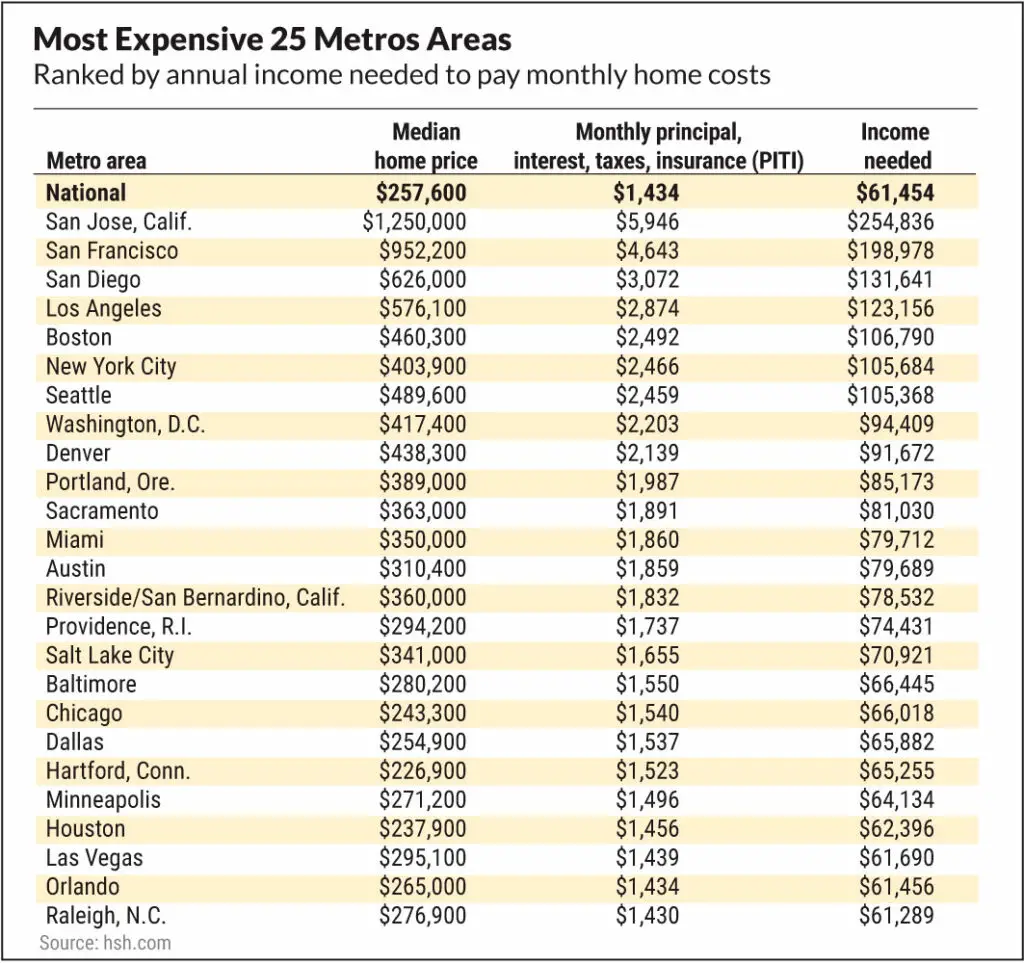

Buy In Less Inflated Real Estate Markets

Real estate markets have been hot all across the country for much of the last two years, pushing prices higher and higher as buyers have been forced to compete with each other for a limited stock of homes.

And while this has led to an increase in home prices across the board, certain real estate markets have seen less price appreciation than others. Buying a home in one of these less inflated markets can lead to real and significant savings.

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Read Also: How To Add A Mortgage Calculator To My Website

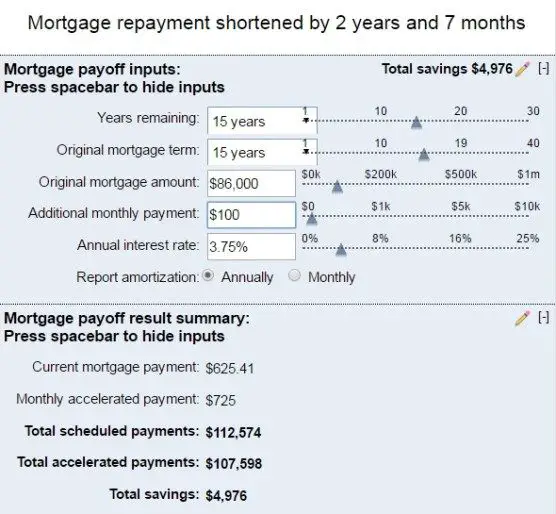

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

How To Calculate Your Mortgage Payments

The calculus behind mortgage payments is complicated, but Bankrate’s Mortgage Calculator makes this math problem quick and easy.

First, next to the space labeled “Home price,” enter the price or the current value of your home .

In the “Down payment” section, type in the amount of your down payment or the amount of equity you have . A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. You can enter either a dollar amount or the percentage of the purchase price you’re putting down.

Next, you’ll see Length of loan. Choose the term usually 30 years, but maybe 20, 15 or 10 and our calculator adjusts the repayment schedule.

Finally, in the “Interest rate” box, enter the rate you expect to pay. Our calculator defaults to the current average rate, but you can adjust the percentage. Your rate will vary depending on whether youre buying or refinancing.

As you enter these figures, a new amount for principal and interest will appear to the right. Bankrate’s calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts or even ignore them as you’re shopping for a loan those costs might be rolled into your escrow payment, but they don’t affect your principal and interest as you explore your options.

You May Like: How Much Mortgage Can You Get

How Much Will My Mortgage Cost Calculator

You must be asking yourself, how much will my mortgage cost? No worries, you can find out now using our mortgage calculator below. If you have any other questions just get in touch with our advisors who will be happy to help!

Your mortgage is likely to be your biggest outgoing so you are bound to be asking how much will my mortgage will cost early on in your mortgage research.

Our mortgage calculator will give you an indication of how much a particular mortgage will cost you each month. Simply input how much you want to borrow, the interest rate and the number of years you will borrow it over. Our mortgage calculator will do the rest for you and tell you your monthly payments.

You can then review your payment details including total interest and an amortisation schedule below. Please note that this calculator assumes you are taking a repayment mortgage .

This is your principal + interest payment, or in other words, the money you pay to the lender each month based on a repayment mortgage type.Remember, you will have to budget for other monthly running costs like utilities, home insurance, life insurance, property taxes such as council tax and your other day to day expenses.

| Monthly Principal & Interest | Total Interest paid over the term |

|---|---|

This illustrates how your outstanding mortgage balance will decrease over the term of your loan.This does not account for interest rate changes or other fees such as early repayment charges.

Mortgage Fees Youre Likely To Pay

- Appraisal : An appraisal by a licensed appraiser will almost always be required by the lender. The price varies depending on the size of the property and the type of loan youre getting. A lot of lenders will require payment for the appraisal upfront, says Oehler. The appraisal fee goes directly to the appraiser. If the loan doesnt close, but the appraisal was completed, then the appraisal fee is nonrefundable.

- Closing fee : A representative from the title company will come to your closing to supervise the transfer of title, and youll have to pay for the service.

- This is the fee to pull your credit report.

- Inspection : The inspection isnt a requirement for the loan, but it is highly, highly recommended. This is another cost that is paid before you reach the closing table. Generally, you can negotiate either fixes, concessions, or a drop in sales price based on any problems the inspector finds.

- Lenders title insurance : This protects your lender if something was missed in the title search. The cost depends on the size of the policy and is set by the state.

- Survey : Most states require a survey of your property before you can get a loan. If a survey doesnt already exist that can be used, youll have to pay someone to do it.

- Title search : Your lender will do a search to ensure there are no liens on the property or anything that could prevent you from purchasing it. Sometimes this will be bundled with other title fees in your closing document.

You May Like: When Will My Mortgage Be Paid Off With Extra Payments