Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Hows That Average Calculated

The first thing to keep in mind is that the U.S. Census Bureau reports the median monthly mortgage, which technically isnt the same as the average monthly mortgage payment .

To find the median, you order the numbers you have from least to greatest and take the number in the middle:

$1,450, $1,500, $1,600, $1,700, $4,600

Now, if you average these numbers, you get $2,170. Is that a fair representation? Definitely notnearly every number in that line is below $2,025 by a lot.

But if you look at the median, which is $1,600, you can see its more accurate, isnt it?

Oh yeah, it is. Thats why we take the medianso homeowners with multimillion-dollar mansions or cheaper-than-cheap houses cant skew the final average.

With that in mind, lets take a quick look at the Census Bureaus data.

Costs That Impact A Mortgage Payment

New homeowners may not realize each of the expenses that go into their mortgage payment. Monthly payments include:

- Principal: The principal is the amount of money you borrow when you initially take out your mortgage. This can be calculated by subtracting your down payment from the homes selling price.

- Interest: This makes up the second major part of your monthly house payment and serves as the money you pay your mortgage lender in exchange for their giving you the loan. Interest rates are typically determined using an annual percentage rate .

- Property taxes: The taxes you pay on your property go to your local government to fund road repair, public schools, fire departments and more. New homeowners may be surprised to learn property taxes can be one of the most expensive parts of the mortgage payments.

- Homeowners insurance: Although its not legally required to own a home, most mortgage lenders will not provide a loan without homeowners insurance. This covers damage from home fires, break-ins and more.

- Homeowners association : If your home is in an HOA community, there are certain rules, regulations and fees that come with it. This is most common with townhouses, multi-unit apartment buildings and condominiums. The fees you pay for belonging to an HOA may assist in trash pickup, landscaping, security and maintenance, and also provide access to the amenities on property.

Also Check: What Does Private Mortgage Insurance Cost

How To Save On Your Water Bill

Water is already one of the more affordable utility bills, but water-wise habits can further reduce your monthly costs and your homes environmental impact. Check out these solutions to save more water:

- Turn off the tap: Dont let the water run as you brush your teeth and shampoo your hair. Wait to turn the tap on when youre ready to rinse.

- Install water-saving features: Eco-friendly features like WaterSense-labeled toilets use 20% – 60% less water and can save you $140 a year.9

- Eat less meat: One pound of beef requires 1,847 gallons of water10 to produce. Indirect water reduction may not lower your water bill, but alternatives like tofu and lentils will reduce your grocery expenses.

- Fix household leaks: Dripping faucets or leaking pipes may seem small, but those drips add up. Fixing leaks and updating your home with water-efficient features reduces your water use and protects your home from damage.

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

Recommended Reading: How Do You Calculate Self Employed Income For A Mortgage

Cost Of A 150000 Mortgage A Month

Various things can impact how much a £150,000 mortgage costs you a month. These include:

- The mortgage term or length

- The lenders interest rate

- The loan to value ratio

- Your deposit amount

- Whether its capital repayment or interest-only mortgage

- Your credit history and profile

Remember, every lender is different, and they have different criteria to determine eligibility and the terms and rates they offer you.

Heres How Much The Same Mortgage Costs Now Compared To Last Year

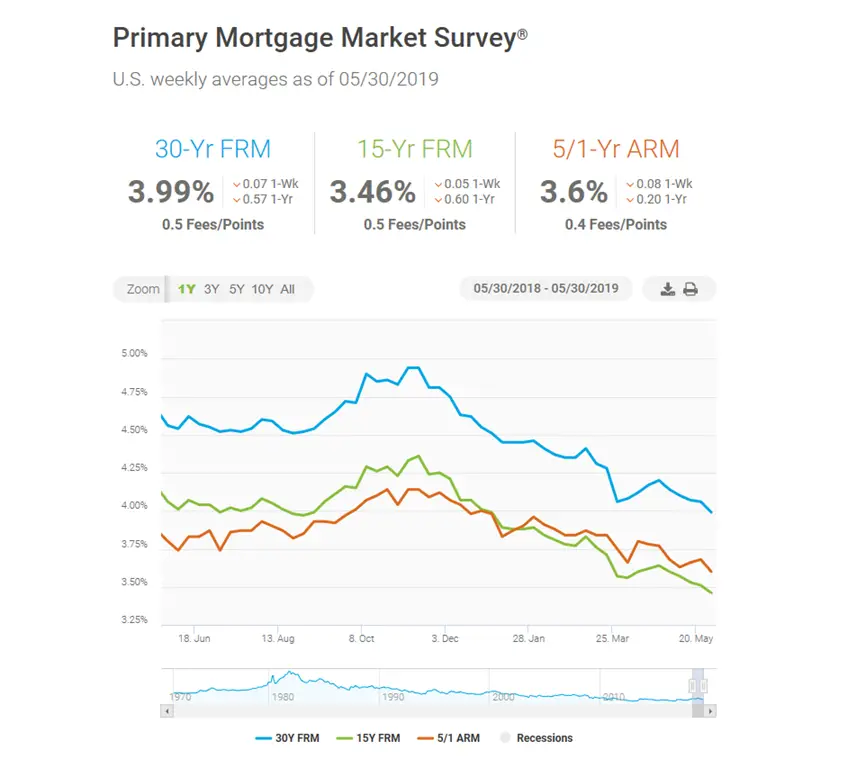

Fewer people are shopping for homes, a sign that homebuyers are getting priced out of the market due to surging mortgage rates, which spiked to an average of 5% this week for 30-year fixed-rate mortgages.

The fixed-rate mortgage rate jumped 0.28% in the last week alone, reaching a high not seen since February 2011, according to government-mortgage company Freddie Mac. A year ago, the 30-year rate averaged 3.04%, which is nearly 2% lower than the rate now.

That 2% difference can add hundreds of dollars to the monthly cost of financing a home, making it unaffordable for some potential buyers.

For a home worth $408,100 the median home price in the U.S. with a 20% down payment, 30-year fixed mortgage and a 5% interest rate, monthly mortgage costs would come to $1,752.62, according to CNBC calculations.

But for the same home purchased last year, when interest rates were 3.04%, monthly mortgage payments would only come to $1,383.51, according to CNBC calculations. That’s nearly $400 less per month, and more than $4,400 less per year.

Recommended Reading: Which Company Has The Lowest Mortgage Rates

What Does Average Represent

The U.S. Census Bureau reports both the mean and the median payment. The mean is the same as average. The median is the middle value in a set of numbers. It divides the lower and higher half of values in the set.

When figuring out a typical monthly mortgage payment, finding the median value can be more useful than finding the average value. Averages can get skewed by extremely high or low values. The median gives a better idea of where the middle is for a broad range of homeowners.

National averages: Looking at averages from another data source, the 2020 National Association of REALTORS Profile of Home Buyers and Sellers, shows a national median home price of $272,500. If we assume a down payment of 10% of the purchase price, we can calculate a loan size of $245,250. Applying current mortgage loan rates, you can estimate the following average monthly mortgage payments:

- $1,700 per month on a 30-year fixed-rate loan at 3.29%

- $2,296 per month on a 15-year fixed-rate loan at 2.79%

First-time homebuyers: The national averages include all homeowners, including those who have built up equity, worked their way up the pay scale and established high credit scores. Those folks are more likely to take on larger loans and get approved for them.

- $1,307 per month on a 30-year fixed-rate loan at 3.29%

- $1,760 per month on a 15-year fixed-rate loan at 2.79%

- $1,077 per month on a 30-year fixed-rate loan at 3.29%

- $1,466 per month on a 15-year fixed-rate loan at 2.79%

Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

Read Also: Is It Better To Get Pre Approved For A Mortgage

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

How Much A $250000 Mortgage Will Cost You

Theres more to a mortgage than just the monthly payment. Before you take out a $250,000 mortgage, youll need to account for things like interest, insurance, taxes, closing costs, and more.

Edited byChris JenningsUpdated August 8, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

The monthly payment isnt the only cost youll want to think about when taking out a mortgage. To gauge the real cost of your loan, youll need to think about interest, too or how much it costs to borrow the money over time.

Learn more about how much a $250,000 mortgage will cost you throughout the life of the loan:

Read Also: What Is The Longest Mortgage Term Available

How Much Can You Spend On A Mortgage

Rather than looking at the total amount of money you can borrow for a house, it’s better to look at how affordable your monthly payment might be. That’s because this is what you’ll be paying each month, so you want to make sure it fits into your budget.

One of the best ways to measure that is the “debt-to-income” or DTI ratio. It’s broadly calculated by dividing your debt payments by your income. More specifically, it can be measured in two ways:

- Front-end DTI ratio: This measures your monthly mortgage payment as a percentage of your total gross monthly income. For example, if your salary is $54,000 per year and your mortgage payment is $1,000, then your front-end DTI ratio is 22% .

- Back-end DTI ratio: This measures your total monthly debt payments, including your mortgage, as a percentage of your total gross monthly income. If you also pay $250 per month for student loans and $200 per month for your credit cards, for example, your back-end DTI ratio would be 33% .

Lenders use these ratios to figure out the maximum monthly mortgage payment you might qualify for. For example, Freddie Mac and Fannie Mae guidelines state that for a conventional mortgage, your back-end DTI ratio shouldn’t exceed 36%. In other words, your debt payments combined shouldn’t be more than 36% of your before-tax income each month.

Lenders look at other factors when deciding whether to approve you for a mortgage too, such as your and how stable your job is.

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Recommended Reading: Can You Combine 2 Mortgages Into One

Whats The Fastest Way To Pay Off My Mortgage

The fastest way to hammer down your loan principal is with big lump-sum prepayments.

Barring that, opting for accelerated mortgage payments is the next best thing.

How do lump-sum payments affect my mortgage?

About 900,000 borrowers made a total of $23 billion in lump-sum mortgage prepayments in 2019, according to MPC.

A lump-sum mortgage payment is a one thats applied directly towards your mortgage principal. Depending on your lender, you may be allowed to prepay up to 5%, 10%, 15%, 20%, 25% or 30% of the original principal amount of your mortgage each year.

Even if you pay small amounts, the effect is magnified over time, reducing your interest expense every month until the mortgage is paid off.

Lump-sum prepayments also help increase your home equity faster. If necessary, that allows you to use your equity for further borrowing someday, such as adding a HELOC.

The average lump-sum prepayment in 2019 was $19,100, reports MPC.

Recommended Reading: Rocket Mortgage Qualifications

How Can We Help You

The Independent review organisation Reviews.co.uk report that 100% of reviewers recommend Lending Expert

Lending Experts

Were mortgage experts. This means we know our stuff when it comes to all types of mortgages. We know where the best rates are and have access to exclusive deals just for Lending Expert customers.

Huge Market Comparison

Were not tied to one lender which means we can search the wider market to find you the cheapest mortgages from across the UK.

Lending Expert is an FCA regulated credit broker which means you can be assured you are dealing with a legitimate and reputable finance company.

Flexible Lending

If you have bad credit or have previously been refused a mortgage we can consider your application. Whatever your circumstances please get in touch and well do our best to help find you the perfect mortgage deal.

Don’t Miss: How Do You Figure Out Mortgage Interest

How Does The Amount Of My Down Payment Impact How Much House I Can Afford

The down payment is an essential component of affordability. For example, if we include down payment on that $70,000 annual salary, your home budget shrinks to $275,000 with a down payment of 10 percent . By making a larger down payment, you would reduce the loan-to-value ratio, which makes a difference in how your lender looks at you in terms of risk.

Bankrates mortgage calculator can help you explore how different purchase prices, interest rates and minimum down payment amounts impact your monthly payments. And dont forget to think about the potential for mortgage insurance premiums to impact your budget. If you make a down payment of less than 20 percent on a conventional loan, youll need to pay for private mortgage insurance, or PMI.

How To Save On Your Electric Bill

While you cant change how much your city charges per kilowatt-hour , you can reduce your energy use and reliance on electrical appliances to cut costs. Generally, heat-related appliances, like your water heater or clothes dryer, consume the most energy and are a good place to start reducing use.

Small changes to your household can also improve your energy efficiency. Steps like improving your homes insulation or installing sun-blocking blinds can help keep your homes temperature consistent without overwhelming your HVAC units.

Here are some great habits to implement at home:

- Hang dry your clothes: Clothes dryers cost between $0.33 and $0.52 a load.2

- Cook outside: Ovens heat your home, requiring more AC to stay cool, and use $0.30 of energy every hour.

- Keep cool with fans: Ceiling fans cost less than $0.01 per hour and can reduce your reliance on AC, which runs at $0.39 an hour.

- Install an energy-efficient water heater: Traditional electric water heaters cost between $49.40 and $65 to run per month.

- Choose a heat pump: Heat pumps are much more efficient than electric furnaces, which cost $1.37 per hour to run.

- Wash clothes with cold water: A hot wash and warm rinse cycle costs $0.82 per load. Compare that to a warm wash and cold rinse at $0.30 per load.

Recommended Reading: How To Buy A Reverse Mortgage Property