What’s The Difference Between A 15

Unlike a fixed-year mortgage where the interest rate stays the same, an ARM or adjustable-rate mortgage changes after a set number of years. For example, if you choose a 15-year fixed-rate mortgage, your interest rate will never change. You benefit from the stability of a low, fixed rate and the same monthly payment unless you refinance.

The main appeal of an ARM loan is the lower interest rate that often comes with it. So, you might be able to take advantage of a low rate for several years until it adjusts every year for the remainder of the loan. The concern with ARMs is that it’s impossible to predict future market trends and your financial situation, for that matter.

A 15-year ARM, also known as a 15/15 ARM, has a fixed interest rate for the first 15 years before adjusting once and then staying the same for the rest of the loan. While a 15-year ARM might sound better than more common ARM loans, it could still leave you significantly higher payments than the first 15 years. You may be better off avoiding such risk and selecting a 15-year fixed mortgage.

Shop For Todays Va Loan Rates

Finally, its always a good idea to comparison shop. Before deciding on a particular loan and mortgage lender, have a look at the products offered by various financial institutions. Some lenders offer shorter and longer-term mortgages in addition to 30- and 15-year mortgages. Who knows? You might find that a 20-year mortgage or a 10-year mortgage is better suited to your lifestyle and personal finance strategy.

Please contact our support if you are suspicious of any fraudulent activities or have any questions. If you would like to find more information about your benefits, please visit the Official US Government website for theDepartment of Veteran Affairs or the US Department of Housing and Urban Development.

MilitaryVALoan.com is owned and operated by Full Beaker, Inc. NMLS #1019791.

Full Beaker, Inc. is not licensed to make residential mortgage loans in New York State. Mortgage loans are arranged with third-party providers. In New York State it is licensed by the Department of Financial Services.Please click here if you do not wish us to sell your personal information.

Pros And Cons Of A 30

There are many reasons why the 30-year mortgage is the staple for helping a homebuyer achieve the American dream. Although it comes with twice as many mortgage payments as a 15-year mortgage, and more of your money goes toward paying interest, the lower monthly payments are what make this option so popular. A lower mortgage payment means more money you can put toward other expenses or savings each month.

Another benefit of a 30-year mortgage is that you may be able to afford a more expensive home than you would be able to buy with a 15-year mortgage. This is because you have 30 years to pay it off instead of 15 years, which may qualify you for a higher loan amount.

The downside of a 30-year mortgage is its more extended term, which means youll be paying more in interest over the life of the loan. Additionally, 30-year loans come with higher interest rates than the mortgage rates on 15-year loans.

Read Also: Should I Have A Mortgage In Retirement

Pro: Youll Save Thousands Of Dollars

One advantage of a 15-year mortgage is all the money youll save on interest. Lenders charge a lower interest rate for 15-year loans because its easier to make predictions about repayment over a 15-year horizon than it is over a 30-year horizon.

Another reason for the savings? Home buyers are borrowing the money for half the time, which dramatically reduces the cost of borrowing.

Youve Maxed Out Your Retirement Savings

If youve maxed out your retirement contributions and know you can continue to do so each year and still have extra money, refinancing to a 15-year loan might make sense. Youll use up your free capital by paying your mortgage down faster and paying less interest. In the end, youll have more money at your disposal because youll have more equity in the home much quicker.

Don’t Miss: Can You Use A Mortgage To Build A House

Choose Your Debt Amount

Home > Real Estate > How to Get a Mortgage > 15-Year Fixed Mortgages

Theres a lot to think about when buying a house. Deciding between a 15- or 30-year-mortgage may not seem like something you want to use a lot of mental energy on when everything else is so overwhelming.

But actually, its one of the most important decisions you will make, one that will determine your financial well-being for decades to come. In fact, for the rest of your life. Thats not hyperbole, its a fact.

There are advantages and disadvantages to both, depending on everything from how you see your career arc, whether you have kids, if you expect an inheritance or some other windfall, and how you plan to retire. If youre 10 or 20 years from retirement age and buying a house, the decision is even more crucial.

You dont have to be a financial whiz to figure it out. Weighing the advantages of 15-year-mortgages against 30-year-mortgages is as easy as taking a look at where you are, and where you want to be.

Most Homeowners Benefit From A ‘super

Adcock’s point of view isn’t actually unpopular. Financial experts agree that the flexibility of lower monthly mortgage payments is important for many homeowners.

“I’ve explained it to clients this way,” says Mark La Spisa, a certified financial planner and president of Vermillion Financial Advisors in South Barrington, Illinois. “If you had a 15-year mortgage and a 15-year super-duper flexible mortgage, which one do you think you would choose?”

Most them then ask what a “super-duper flexible” mortgage entails. “If you need cash, the payments can drop 20% if you want any time you want,” he says, “and the rate is only about a quarter of a point higher” than the typical 15-year loan.

The punchline, La Spisa says, is the “15-year super-duper flexible mortgage” is a 30-year mortgage that, like Adcock suggested, you pay back more quickly as your finances allow.

When your financial situation allows, you can put extra money toward your balance and pay off the loan faster as Adcock put it, turning it into a 15-year. But when money is tight, then you can take advantage of the 30-year’s lower payments and use the difference to help with other bills, says Greg McBride, chief financial analyst for Bankrate. You’re not locked into that large payment.

“Money in the bank will pay the bills home equity will not,” McBride says.

You May Like: Can You Add Closing Costs Into Your Mortgage

Apply For A Home Loan Online

Assurance Financial aims to help people achieve the American dream of homeownership. If youre ready to make the first step towards buying your home, were here to help. Abby, our online mortgage assistant, can walk you through the process of putting together your application.

You can get started with Abby today or set up an appointment to put together your application at a time that works for you. If youd rather talk to a representative right away, you can connect with a loan advisor in your state who can help you review your mortgage options and choose the one that works for you.

Easier To Get Positive Cash Flow On A Rental Property

If youre buying a rental property, or if you might convert your personal residence into a rental later, itll be easier to turn a monthly profit on the property with a longer mortgage term and a lower monthly mortgage payment.

In order to get positive monthly cash flow from a rental property, the rental income needs to exceed the propertys monthly expenses, repairs and mortgage payment, explains Mescher. With a 30-year mortgage, the monthly payment is less, so you can achieve positive cash flow even when the rental income is lower, she adds.

Recommended Reading: How Much Income For A 250k Mortgage

You Care About Building Equity

If building home equity fast is a concern for you, the 15-year mortgage will help you build equity faster. Youll pay more principal toward the loan each month, which allows you to own the home much faster. The 30-year term offers a slow and steady pace with a more affordable payment, but it takes longer to see equity in the home.

On the other hand, just because you care about building equity doesnt mean you have the resources to do it rapidly. Here are some reasons to not refinance to a 15-year loan.

How Can I Pay Down A 30

You have options to pay off your mortgage faster even with a 30-year mortgage. You can choose to make biweekly payments instead of the regular monthly payment, meaning youll make one extra full payment over the course of the year. You can also choose to make a larger payment each month. Be sure to ask your lender to apply your extra payments to your principal balance.

One word of caution: Double-check that your mortgage doesnt have a prepayment penalty before going this route. Most of the time, such a penalty only applies if you pay off your entire mortgage early. But in some cases, you might face a fee if you make small payments toward principal ahead of time.

You May Like: How Many Years Can I Knock Off My Mortgage Calculator

What Makes Up Your Mortgage Payment

One miscalculation many aspiring homebuyers make is to assume their monthly mortgage payment only includes the principal and interest. In reality, your mortgage payment includes multiple components. When you take out a 15-year home loan, your monthly payments can be divvied up in the following ways:

You Can Break Even On Your Closing Costs In Three Years Or Less

The breakeven timeline is a key thing to think about with any mortgage refi.

Refinancing comes with a variety of closing costs and other fees that eat into your savings at first.

If you can recoup your costs in three years or less, it almost always makes sense to do it unless youre going to sell in less than three years, Lazerson says, adding, Its really hard to look at your horizon beyond three years. You might get a job transfer, you might end up hating your next door neighbor and you want to move. Maybe you want to do a room addition on your house and youre going to refinance later anyway.

Not recouping your costs soon enough could put you in a more precarious financial situation down the road if an unexpected expense comes up, or if you need to change your housing situation on short notice.

Read Also: Can I Get A Mortgage With A 730 Credit Score

Do Extra Mortgage Payments Go Towards The Principal

When you make an extra payment or a payment that’s larger than the required payment, you can designate that the extra funds be applied to principal. Because interest is calculated against the principal balance, paying down the principal in less time on a fixed-rate loan reduces the interest you’ll pay.

Is It Better To Get A 15

For many, a 30-year fixed-rate mortgage loan is the ideal product. Thats because, quite simply, it allows for more affordable monthly payments. The downside is, it can take longer to accumulate equity and pay off your loan.

Thats why some homeowners opt for a shorter loan term in the form of a 15-year mortgage.

You can pay off the loan twice as quickly, over the life of the loan you pay much less in interest, and you grow home equity at a much faster rate, says Robert Johnson, professor of finance at Heider College of Business, Creighton University.

That doesnt mean that a 15-year loan is always the best choice, however.

The main drawback to a 15-year mortgage is that monthly payments are much higher since you have to pay off the same amount in half the time. As a result, many homeowners simply cant swing the monthly payments.

Its up to you and your loan officer to compare the costs and potential savings of a 15 vs. 30-year mortgage, then chose the right one for your financial situation.

Read Also: How To Get Mortgage Forgiveness

How Do I Qualify For A 15

To qualify for a 15-year fixed-rate mortgage, youll need great credit and a low debt-to-income ratio. In addition, because youll pay the loan off much faster, you need a better credit score and DTI than you would for a 30-year loan because the risk of default is much higher.

You must prove that you are at low risk of default and can afford the mortgage payment beyond a reasonable doubt. A credit score of 700 and a debt-to-income ratio of around 36% are usually required to secure a 15-year loan.

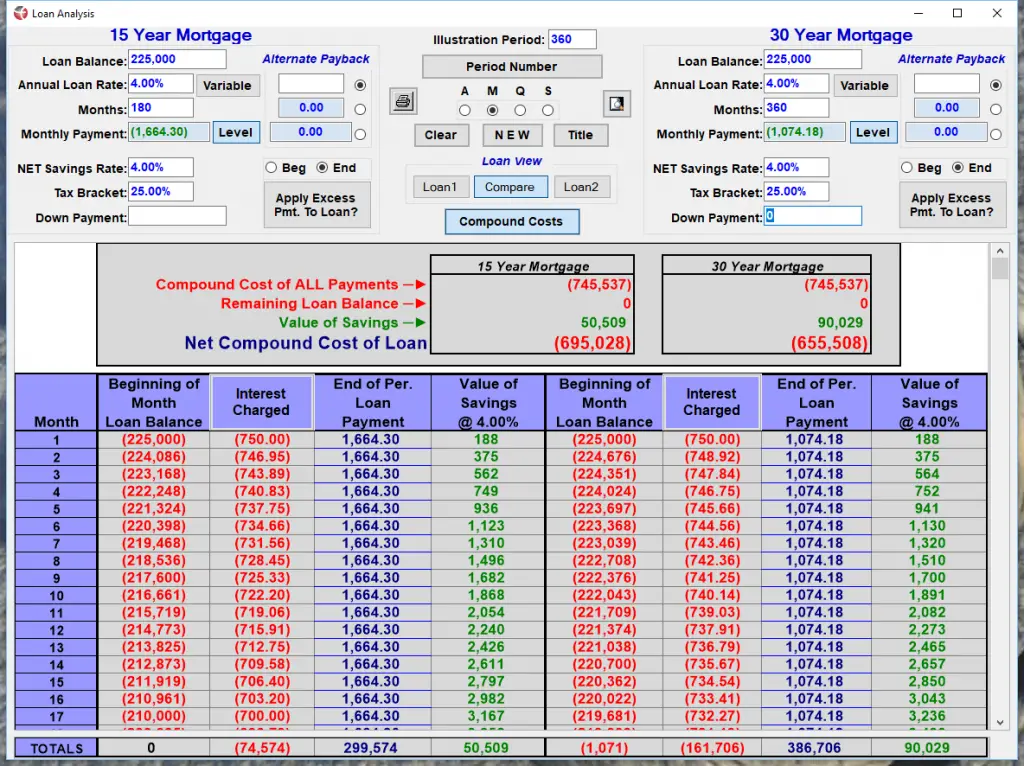

How Does Your Mortgage Term Impact Cost

When you pay back a mortgage, your monthly loan payment is split between paying down the principal balance and paying interest. As you pay off your loan, your interest payments are recalculated based on the remaining balance, and over time, less of your monthly payment will go toward interest and more toward principal. This concept is called amortization. Depending on your mortgage term, the amount of each monthly payment that goes toward either the interest or the principal balance can be altered.

The length of your mortgage term can affect costs in several ways, but one of the biggest factors is how it can influence your interest rates. The current national average rates stand at around 2.64% for a 15-year mortgage and 3.34% for the 30-year option. The rates for your specific mortgage will vary based on factors like your home’s price, your and income.

As a result, a 15-year mortgage costs less in the long term, but a 30-year term requires lower monthly payments. The 15-year mortgage’s principal will be paid down faster with the shorter timeline and higher monthly payments.

Suppose you’re approved for a $500,000 mortgage with a 10% down payment. For simplicity’s sake, let’s say the interest rate is 3.5% for the 15-year loan and 4% for the 30-year term .

In this example:

Check out our mortgage calculator to crunch the numbers for your own situation:

Also Check: When You Refinance A Mortgage What Happens To Your Escrow

How To Pay Off Your Mortgage Fast

Remember, the goal with any mortgage is to pay it off fast. You dont want that thing weighing down your budget for the rest of your life. Knock it out in 15 years or less so you can move on to building extraordinary wealth and living and giving like nobody else.

Here are some tips on how to pay off your mortgage early:

- Make extra house payments. When you find extra money in your budget at the end of the month, its too easy to spend it on something you dont really need. Instead, what if you committed that surplus to paying off more of your mortgage each month?

- Trim your budget. Imagine how much more money you could throw at your mortgage if you eat out less and trim down other unnecessary spending.

- Refinance. If you already made the mistake of getting a 30-year mortgage, you could refinance to a 15-year term and pay off your mortgage in half the time!

- Downsize. If you bought a house you feel like youll never pay off, an extreme way to crush that mortgage is to sell the house and downsize to something more affordable.

The Right Loan Term Depends On Your Homeownership Goals

To select the mortgage thats best for you, begin by defining your goals. What are you trying to accomplish? Do you plan to live in the house for decades, or is it merely a starter house? Is the house an investment that you plan to flip or rent? Is it likely that youll want to refinance?

Usually, when people plan to live in a house with their families, they want a 30-year mortgage. Knowing theyll be there for a long time, they want a comfortable monthly payment. Conversely, an investor who plans on holding a property for just a few years might want an ARM or a 15-year mortgage to minimize the total interest. On the other hand, investors might opt for the low monthly payment of a 30-year loan to avoid cash-flow problems when nobody is renting the house.

Don’t Miss: What Is My Credit Score For A Mortgage

Tips For Managing Your Housing Costs

- Work with a professional. While financial advisors typically associated with investment advice, they can also evaluate your housing costs and help you potentially find savings in your budget. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Mortgage rates are more volatile than they have been in a long time. Check out SmartAssets mortgage rates table to get a better idea of what the market looks like right now.

- Consider your options. Dont know whether now is the time to buy or continue renting? SmartAssets Rent vs. Buy Calculator can help you determine which is the better financial move based on where you live.

- Don’t forget about property taxes. If youre thinking of buying a home, dont forget to consider property taxes. Depending on where in the U.S. youre planning to buy, property taxes can vary dramatically. Use SmartAssets Property Tax Calculator to get a sense of how much your annual tax bill may be.

Don’t miss out on news that could impact your finances. Get news and tips to make smarter financial decisions with SmartAsset’s semi-weekly email. It’s 100% free and you can unsubscribe at any time. .

For important disclosures regarding SmartAsset, please click here.