Can You Refinance Your Mortgage With Bad Credit

While it isnt impossible to refinance your home with bad credit, it could be more difficult. Here are some options to consider:

- Contact your current lender. Because youre an existing customer, your current lender might be willing to give you some wiggle room when it comes to credit requirementsespecially if youve been a good customer and made all of your payments on time and in full. However, be sure to also shop around and compare your options from as many other lenders as possible. This way, you can find the most optimal loan for your situation.

- Check the VA refinance program. Servicemembers, veterans and qualifying spouses might be able to refinance through the VA. Keep in mind that while the VA doesnt have a specific minimum credit score, lenders typically require a score of at least 620.

- Consider the FHA refinance programs. Another government-backed option to explore is refinancing through the FHA. The requirements for an FHA refinance are generally much less stringent than other options, and you might be able to qualify with a credit score as low as 500, depending on the program.

- Find a co-signer. Applying with a creditworthy co-signer could make it much easier to qualify for refinancing. A co-signer can be anyone with good creditsuch as a parent, another relative, or a trusted friendwho is willing to share responsibility for the loan. Keep in mind that this means your co-signer will be on the hook if you dont make your payments.

Can I Get A Mortgage With A Credit Score Of 745

Yes, you can get a mortgage with a credit score of 745. This score sits between a Fair and Excellent credit rating, depending on which credit reference agency you check. You shouldnt struggle to get a mortgage with a score of 745, but it’s always best to understand all of your options by talking to a mortgage broker before applying for a mortgage.

Check Your Credit Score And Reports

Knowing where you stand is the first step to preparing your credit for a mortgage loan. You can check your credit score with Experian for free, and if it’s already in the 700s or higher, you may not need to make many changes before you apply for a preapproval.

But if your credit score is low enough that you risk getting approved with unfavorable terms or denied altogether, you’ll be better off waiting until you can make some improvements.

You can get a free copy of your credit report from Experian, which is updated every 30 days, or from each of the three national credit reporting agencies weekly at AnnualCreditReport.com through December 2022, then every 12 months after that.

Once you have your reports, read through them and watch for items you don’t recognize or you believe to be inaccurate. If you find any inaccuracies, you can ask your lender to update their information with the credit reporting agencies or dispute the items directly with the agencies. This process can improve your score quickly if it results in a negative item being removed.

Read Also: What Is An Origination Fee On A Mortgage Loan

What If Your Credit Score Isnt Good Enough

If youre nowhere near 660, you may want to take some steps to raise your credit score for a home loan application by reducing the amount of debt you owe or paying your bills on time. Its not a fast process, so dont expect to see results for at least a few months.

Send me news, tips, and promos from realtor.com® and Move.

If you dont have time to boost your credit score into a more acceptable range before buying a home, all is not lost. You may still be able to get a mortgage through a government-backed program like those offered by the Federal Housing Administration. The FHA accepts credit scores for home loans as low as 580and may even go as low as 500 if you can throw down a larger down payment.

If you are an active or former military member, you may also qualify for a loan program backed by Veterans Affairs. Such programs can be particularly forgiving on the credit score front, so its worth checking out if you qualify.

Last but not least, if your , it may make sense to work with a mortgage broker or credit union. Often, small institutions like these are more willing to look at your whole financial picture and work with you if your past mistakes are really in the past.

Credit unions dont flat-out deny somebody immediately, Williams-Barrett says. To me, it is the whole picture, not just the score by itself.

How Credit Reporting Bureaus Affect Your Score

As many consumers already know, there are three major credit reporting agencies.

- Equifax

- Transunion

- Experian

While its possible your scores will be similar from one bureau to the next, youll typically have a different score from each agency.

Thats because its up to your creditors to decide what information they report to credit bureaus. And its up to the creditors to decide which agencies they report to in the first place.

Since your credit scores depend on the data listed on your credit reports, more than likely you wont see the exact same score from every credit reporting agency.

Fortunately, most agencies look at similar factors when calculating your credit scores. As long as you manage credit cards and loans responsibly, your credit scores should be fairly similar to one another.

But different credit reporting agencies arent the only challenge. There are also different credit scoring models. And, as if that didnt already complicate matters, there are also different versions of these models.

Recommended Reading: What Is The Monthly Payment On A 50000 Mortgage

Is A Credit Score Of 595 Good

This depends on what credit reference agency youre using to check your credit score. If youre checking Experian, a score of 595 is categorised as Poor. That means you might struggle to get a mortgage approved by a lot of the high street banks, so we’d recommend talking to one of our bad credit Mortgage Experts and we can help with that.

If youre checking on Equifax, 595 is categorised as Excellent. If youre checking on TransUnion, 595 is categorised as Fair.

How Much Deposit Do I Need To Get A Mortgage With A Poor Credit Score

It may be the case that to access your chosen lenders rates and meet their terms, you have to deposit a higher percentage of the properties market value. That being said, the amount of deposit you need to get a mortgage will vary depending on a whole host of factors including your age and the type of property you want to buy.

There isnt a typical deposit size, but some lenders ask applicants to deposit as much as 30% for a mortgage if they have a poor credit score or low affordability.

For a home valued at £200,000 that would equate to a £60,000 deposit. Large deposits arent a viable option for a lot of borrowers and thankfully there are a handful of lenders that appreciate this and may be more willing to lend under more flexible terms.

Read Also: How Are Home Mortgage Rates Determined

How Does Credit Score Affect Eligibility And Rates When Applying For A Mortgage

Qualifying for a mortgage

Traditional mortgage lenders, like banks, follow CMHCs rules and wont consider applications that fall above the maximum debt-service ratio or below the minimum credit score.

Secondary/non-traditional lenders are free to set their own criteria. This means that they may consider approving you for a mortgage, even without good credit.

Mortgage lending and insurance rates

If you qualify for a mortgage but your credit score isnt ideal, the biggest impact will be on your mortgage rate and insurance premiums.

Lenders set their rates and premiums based on the risk to cover themselves from losses in case of customer non-payment. If you can prove youre a low risk for them to lend to, youll get more attractive rates and also save on fees.

The difference adds up significantly a one-percent change in your interest rate could be worth a few hundred dollars a month on your mortgage payments.

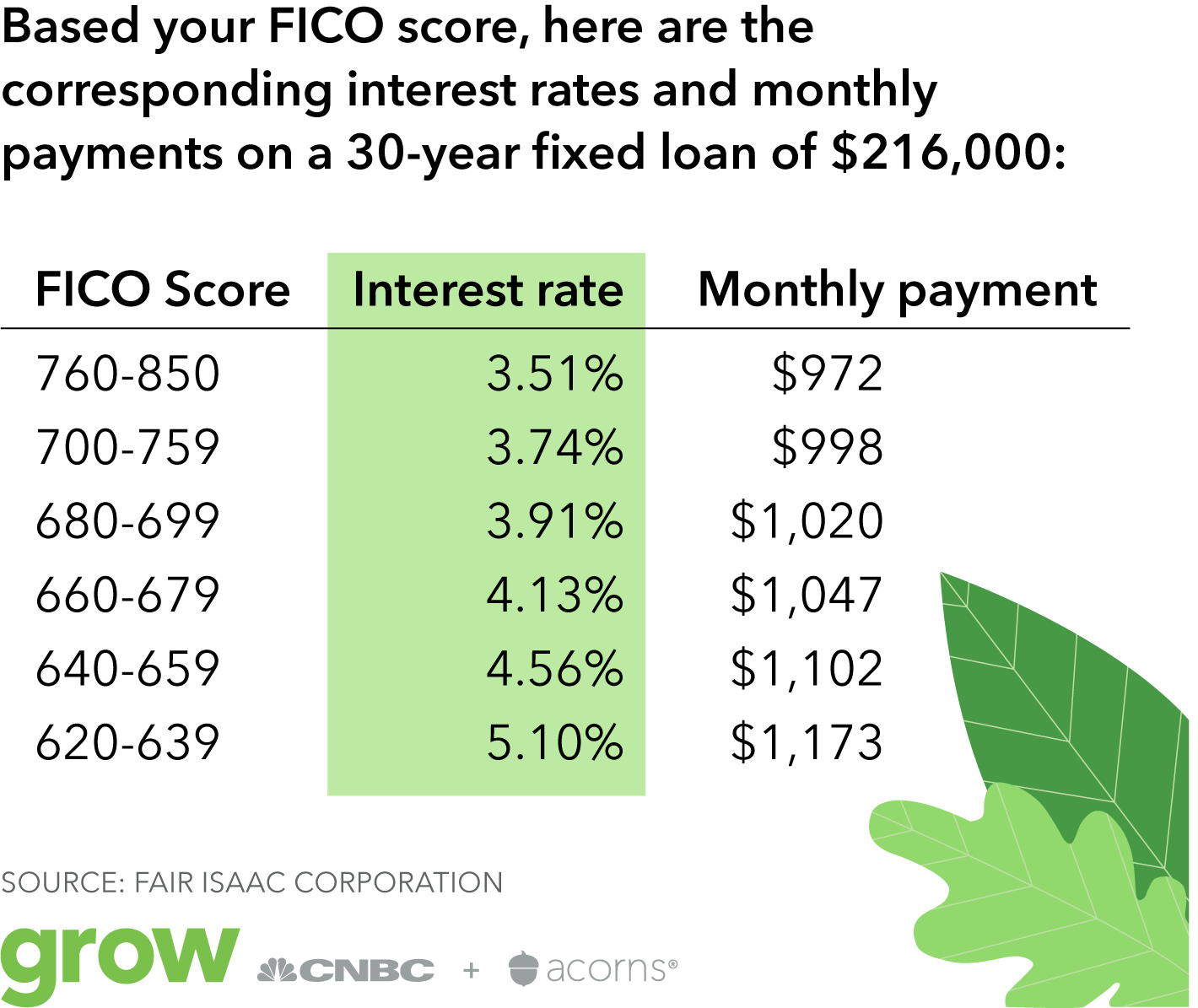

How Credit Score Impacts Your Mortgage: Examples

Theres often a stark difference between mortgage interest rates at the highest and lowest ends of the credit score spectrum. And that equates to a big difference in monthly mortgage payments and long-term interest costs for homeowners.

Here are a few examples to show how your those differences in credit score can impact your mortgage costs.

You May Like: How Long For Mortgage Pre Approval

What Credit Score Do You Need To Be Approved For A Mortgage In Canada

When it comes to getting a mortgage, the higher your credit score, the better. A good credit score will ensure that you:

In Canada, credit scores range from poor to excellent . Anything above 660 is considered to be a good credit score, which means that your risk for defaulting on your mortgage is low and youre a safe candidate for a loan.

While it will vary by lender and type of mortgage, in general, the minimum credit score to be approved for a traditional mortgage is around 680. Some lenders may go a little lower, but again, higher is better. A credit score above 700 is considered optimal when applying for a mortgage.

Several factors can impact your credit score, including:

- Payment history. Do you pay your on time?

- . You should use less than 35% of your available credit.

- The longer you have had your credit accounts, the better.

- New credit requests. How recently and often have you applied for new loans or credit cards?

- Types of credit. Having a mix is best, such as a .

If youre unsure of your credit score, you can get it from one of the two credit-reporting agencies in Canada: Equifax Canada or TransUnion. You can request a free copy of your credit score each year .

Boosting Your Credit Score

If you have bad credit but are a first-time home buyer, start maximizing your score before you begin house hunting. Check your credit score so you know where you stand, review your credit history to make sure its accurate and remember to consistently pay your bills on time. You can check your credit score for free with our tool if youre a current U.S. Bank customer.

When lenders see multiple applications for credit reported in a short period of time, it can discourage them from giving you a loan. So heres a short list of things to try to avoid when applying for a mortgage so that you can keep your options open.

- Avoid opening new credit cards.

- Avoid closing credit cards .

- Avoid applying for new loans.

- Avoid co-signing on any new loans.

Looking for more ways to improve your credit score? Here are some .

You dont have to have a top credit score to get a mortgage, but it will help you compete for the house you want by potentially giving you more financing options. So, take steps to try to boost your credit, avoid applying for credit products at the same time youre house hunting and talk over your options with a mortgage loan officer who can help.

Connect with us to make homeownership a reality.

An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home-buying question.

Don’t Miss: What Does A Mortgage Loan Officer Make

Applying For A Mortgage With Bad Credit

Bad credit can definitely limit your ability to get a mortgage, but there are a few different things you can do if you find yourself worrying about a lenders perception. Its important to note that the options presented when applying for a mortgage with bad credit will all come with higher interest rates, so if you can wait and give yourself time to improve your credit score, thats always advisable.

Credit Score: Good Or Bad Mortgage Credit Cards

You mightve just checked your credit and found out you have got a 545 credit score. Theres good and bad news. The bad news is technically a score of 545 means poor credit.

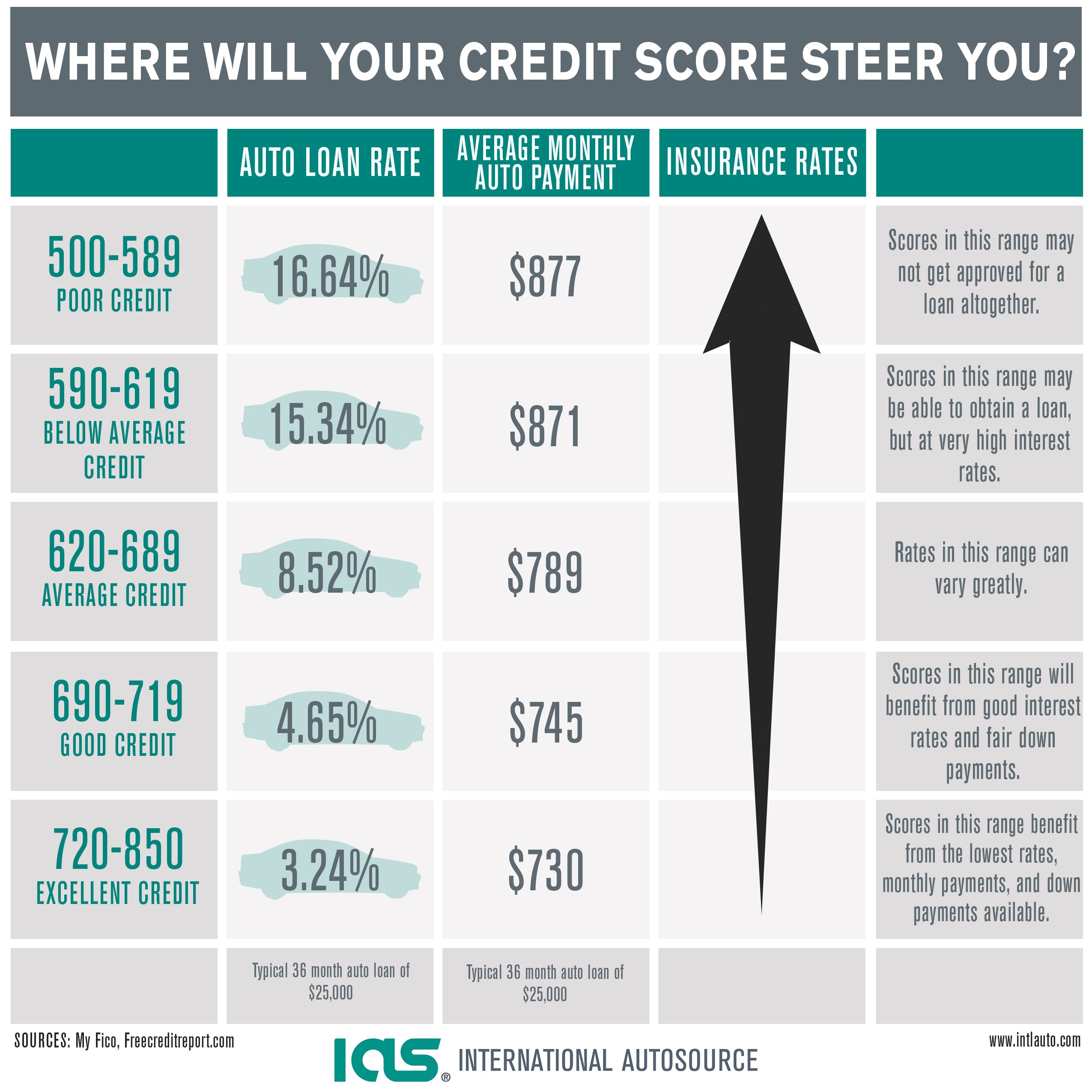

There are a few disadvantages that come along with having poor credit . These disadvantages include difficulty when it comes to getting some jobs, finding suitable housing, or even just receiving a good loan.

In Short: Having a 545 credit score will mean higher rates on an auto loan or mortgage, and you will likely need to put more down as a security deposit. Lenders are typically more about skeptical lending money to someone with poor credit.

There are still a ton of different ways to raise your 545 credit score. Given enough time, you could go from 545 to 600, 700, or even 800+ credit.

Below, youre going to find every possible step to improving your credit. You will also find out if its possible to get a personal loan, mortgage, or auto loan with a score of 545.

Read Also: How Is A Mortgage Payoff Calculated

How Credit Scores Affect Mortgage Rates

A loan savings calculator, such as the one offered by myFICO, can demonstrate the impact of credit scores on mortgage rates. Enter your state, mortgage amount, and credit score range, and get an idea of what your mortgage terms would be. Such calculators provide only estimates. Your mortgage lender can give you exact terms after reviewing your complete financial details and down payment.

Enter a $200,000 principal on a 30-year fixed-rate loan, and your credit score ranges, mortgage rates, and overall costs, might look something like this :

- 760 to 850: APR of 5.132% with a monthly payment of $1,090. The total interest paid on the mortgage would be $192,341.

- 700 to 759: APR of 5.354% with a monthly payment of $1,117. The total interest paid on the mortgage would be $202,237.

- 680 to 699: APR of 5.531% with a monthly payment of $1,139. The total interest paid on the mortgage would be $210,210.

- 660 to 679: APR of 5.745% with a monthly payment of $1,167. The total interest paid on the mortgage would be $219,944.

- 640 to 659: APR of 6.175% with a monthly payment of $1,222. The total interest paid on the mortgage would be $239,810.

- 620 to 639: APR of 6.721% with a monthly payment of $1,293. The total interest paid on the mortgage would be $265,604.

You can experiment with your own numbers, including down payment amount, loan term, and property taxes, using our mortgage payments calculator.

Is There A Minimum Credit Score For A Mortgage

There isnt a minimum credit score needed to get a mortgage. This is quite a common assumption but getting a mortgage is possible with any credit score. Of course, a low credit score can make it difficult but a mortgage is still very much possible.

Your credit score is used by lenders as part of their mortgage assessment. If you have a low credit score, but otherwise have a strong application, then your mortgage chances shouldnt be affected too much.

A good credit score can give lenders the impression that youre a reliable borrower and are more likely to repay your mortgage on time. That being said, each lender has its own unique scoring system to calculate what a good credit score is. This means that the same credit score may be considered good by one lender, but average or bad for another.

Also Check: Can I Get A Mortgage Loan After Chapter 7

Tips To Boost Your Credit Score

And, of course, you can boost your credit score through your own efforts. Read How to raise your credit score fast for helpful tips.

A few of the most impactful steps you can take to raise your credit prior to applying for a mortgage include:

You should also order a copy of your credit report from AnnualCreditReport.com. That site is owned by the Big 3 credit bureaus. And youre legally entitled to a free copy of your report each year.

Many reports contain errors. And it can take months to get them corrected. So start the process early.

What Else Do Mortgage Lenders Look At To Determine Mortgage Terms

Your credit scores can be an important factor in getting approved for a mortgage and the rates you’re offered. However, mortgage lenders also go beyond your credit scores when evaluating a potential borrower’s application.

They’ll also take a close look at the information within your credit reportsnot just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on. Or if you owe too much money to collection agencies.

Mortgage lenders may also request various financial records, including recent bank statements, investment account statements, tax returns and pay stubs. They can use these to determine your income, debts and debt-to-income ratio, which can be an important factor.

Other factors, such as the loan amount, the home’s location, your down payment and loan type can all play into whether you’ll be approved and your mortgage’s terms. Lenders may also have unique assessments, which is one reason shopping for a mortgage can be important.

Recommended Reading: Does Getting Pre Approved For Mortgage Hurt Credit

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.