Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Make Extra Principal Payments

Another way to pay off your home loan faster is to simply payextra when youre able.

Most mortgage loans issued after Jan. 10, 2014, do not chargeprepayment penalties.

This means you can pay extra money toward yourmortgage balance each month or make a larger, lump sum payment on yourprincipal each year without facing a penalty for paying off your loan early.

Many homeowners make extra payments on their loans principal when they get an income tax refund. Extra principal payments can have a big impact.

Heres an example.

- Lets say you took out a home loanfor $300,000 on a 30-year term and rate of 4%

- Thats a principal and interest payment of$1,370

- 360 payments of $1,370 per month meansyoull have paid $492,500 over the life of the loan thats $192,500 in interest payments over 30 years

Using the same numbers for theloan amount and interest rate:

- If you make extra principalpayments of $250 per month, youd shave seven years and four months off yourterm

- And, youd save more than $59,000 total ininterest payments

There are benefits aside from interest savings, too.

Paying off your mortgage early lets you use the money youwould have paid each month for other purposes, like investing.

Lets continue with the example above. Instead of paying$1,370 per month on the mortgage, you could put the same amount of money in aninvestment account.

Also Check: How To Calculate Principal And Interest For Mortgage

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Also Check: Chase Mortgage Recast

Keep Your Payments The Same When Changing Your Mortgage

When you renew your mortgage, you may be able to get a lower interest rate.

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. Lenders call this early renewal option the blend-and-extend option. They do so because your old interest rate and the new terms interest rate are blended.

When your interest rate is lower, you have the option to reduce the amount of your regular payments. If you decide to keep your regular payments the same, you can pay off your mortgage faster.

Round Up Your Mortgage Payments

Keep in mind, though, that any extra amount paid to reduce your principal balance can knock years off your mortgage term. So if you cant afford an extra mortgage payment, round up your scheduled payments to the nearest $100 amount instead. This small move pays off in a big way.

To illustrate, if you have a mortgage payment of $1,140 and make an extra principal payment of $60 each month . In this example, youll shorten your mortgage term by three years.

Recommended Reading: Rocket Mortgage Payment Options

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Extra Mortgage Payments Calculator

If you want to pay a lump sum off your mortgage or start paying more every month, use this calculator to see how much money you could save and whether you can shorten the term of your mortgage.

Our mortgages section has lots more information on mortgages and paying extra off your mortgage.

Please see our disclaimer for more information.

Your browser must have JavaScript enabled to use the calculators.

The results from this calculator are estimates only and may differ slightly from some financial institutions, as interest may be calculated in a slightly different way. Use our Mortgage Rate Change Calculator to see the impact of a rate change or a change of term on your mortgage.

Please see our disclaimer for more information.

Your browser must have JavaScript enabled to use the calculators.

You May Like: Reverse Mortgage For Mobile Homes

How To Pay Off Your Mortgage Faster

You can do this by making overpayments, but you can clear your mortgage even quicker if you switch to a cheaper deal.

Remortgaging to a lower interest rate means your monthly payments could go down. But if you keep overpaying, you could pay your mortgage off sooner and with less interest.

You can find a new mortgage here or get help switching to a cheaper deal with RateSwitch.

Biweekly Mortgage Payment Calculator For An Existing Mortgage

Hudson Valley Credit Union137 Boardman RdPoughkeepsie, NY 12603

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Also Check: Does Rocket Mortgage Sell Their Loans

Retiring A Mortgage With Extra Payments

Many homeowners invest in home security systems to protect their property and personal assets. However, a security system will not protect the homeowner against financial disaster or bankruptcy. Making additional mortgage payments will shrink the total amount of interest paid over the life of the loan, and the borrower will pay off the debt more quickly. In addition, the home equity will grow at a faster pace when extra payments are applied to the loan. This provides for a margin of protection by lowering the interest costs. This method gives the property owner a home free and clear of debt. More payments on the principal of the loan equate to assets earning interest at the same rate as the interest rate on the loan.

Using The Mortgage Payoff Calculator

To use this calculator, begin by entering the years remaining on your mortgage, the length of your mortgage, the full amount you originally borrowed, the additional amount you’d like to pay each month and your mortgage rate.

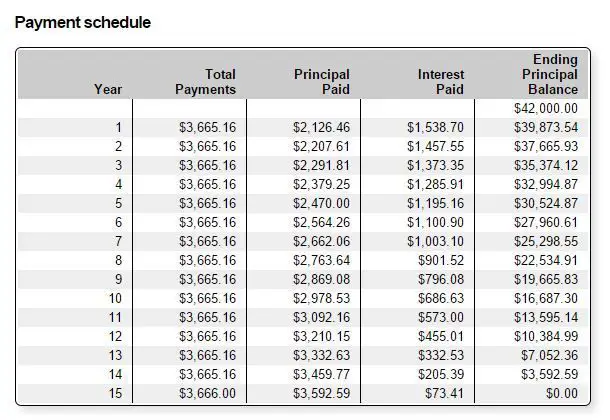

For purposes of the amortization report, check whether you wish to see it displayed as a month-by-month or year by-year breakdown.

The length by which your mortgage will be shortened will be seen in the blue box above the imputs and your total interest savings will appear to the right. You can use the green triangles to adjust any of the figures you enter and the results will update automatically.

A few things to note: It’s important to enter the original amount of your mortgage and not your current mortgage balance. The calculator will figure where you currently stand based on how long you’ve been making payments.

Include any closing costs that were rolled into the original mortgage you want to enter the total amount you borrowed. Likewise, be sure to enter your mortgage rate and not the APR in the interest rate box to get a correct report.

The “Mortgage Balances and Interest” section is a graph that compares how your mortgage principle balance will decline over time with making additional monthly payments compared to making just your regular monthly payments. It also shows how your accumulated interest costs will accumulate over time as well for both options.

Read Also: How Much Is Mortgage On 1 Million

Pay A Little More Toward Your Principal Each Month

Another trick is to divide your current mortgage payment by 12, and then add this much to each monthly payment. So if your mortgage payment is $1,400 a month, make an extra principal payment of $116 each month. At the end of the year, you would have made the equivalent of one extra mortgage payment.

Also Check: Should You Buy Down Mortgage Rate

Can You Pay Off Your Mortgage Early

In most cases, homeowners can pay off their mortgage early, provided you follow certain ground rules and make sure the terms of your loan.

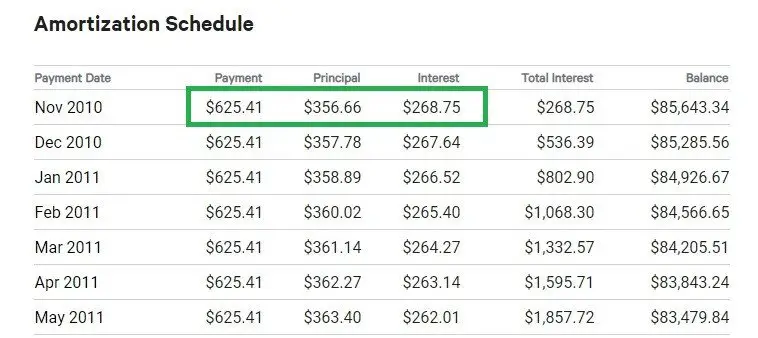

The first step is to recognize how your payment works. Early in a 30-year loan, the bulk of the payment goes toward loan interest. As the loan is closer to completion, the bulk goes toward the amount you borrowed, or the principal. But if the principal is lowered through extra early payments, the interest paid also is lowered. Paying down principal in the long run will reduce the total interest paid on the loan.

The more the principal is paid, the more the homeowner builds equity in the home. To easily figure the equity, calculate a fair price you feel the home is worth then subtract the loan balance. If a home could be sold for $300,000 and you have $150,000 left on the loan, you have $150,000 in equity.

When considering paying the mortgage early, be sure you know the answer to a question that many, especially first-time homebuyers, often do not consider: Is there a prepayment penalty on your loan? Many lenders do not have this penalty, but those that do will charge for making early payments. If you have any uncertainty, call your lender to ask specifically about prepayment penalty.

Once that question is answered, be sure to tell your lender if and when you make extra payments that you want that money applied to principal.

Read Also: Does Rocket Mortgage Service Their Own Loans

Paying Extra Is The Cheap Easy Way To Pay Off Your Mortgage Early

If you have a mortgage, chances are its a 30year loan. And thats a long time to pay interest.

Many homeowners cant afford refinancing to a shorter, 15year loan term because payments are quite a bit higher.

But theres a way to pay off your mortgage early without any fees or penalties.

Just pay a little extra on your mortgage when youre able.

Use A Lump Sum To Pay Off Your Loan Faster

Tax refund, bonus, commission, inheritance, yard sale, gift or lottery win? Whatever it may be, an unexpected windfall can be used to pay off a chunk of the principal in one fell swoop.

So there you have it. Check out our loan payoff calculator to see how overpayments can help you save money in the long run.

Also Check: Reverse Mortgage Mobile Home

Choose An Accelerated Option For Your Mortgage Payments

An accelerated payment option lets you make weekly or biweekly payments. With this option, youre putting more money toward your mortgage than with a monthly payment.

Accelerated payments can save you money on interest charges. By accelerating your payments, you make the equivalent of one extra monthly payment per year.

Should I Pay Off My Mortgage

Just because you can pay off your mortgage early doesnt necessarily mean that you should. Of course, it would feel great to rid yourself of a huge financial burden like a mortgage. But if you really want to know if its a good decision, you have to look at the math.

There are pros and cons to paying off your mortgage early. Whether the pros outweigh the cons will depend on your overall financial situation.

You May Like: 10 Year Treasury Yield Mortgage Rates

Calculate What Will Happen If I Pay $100 Extra On My Mortgage:

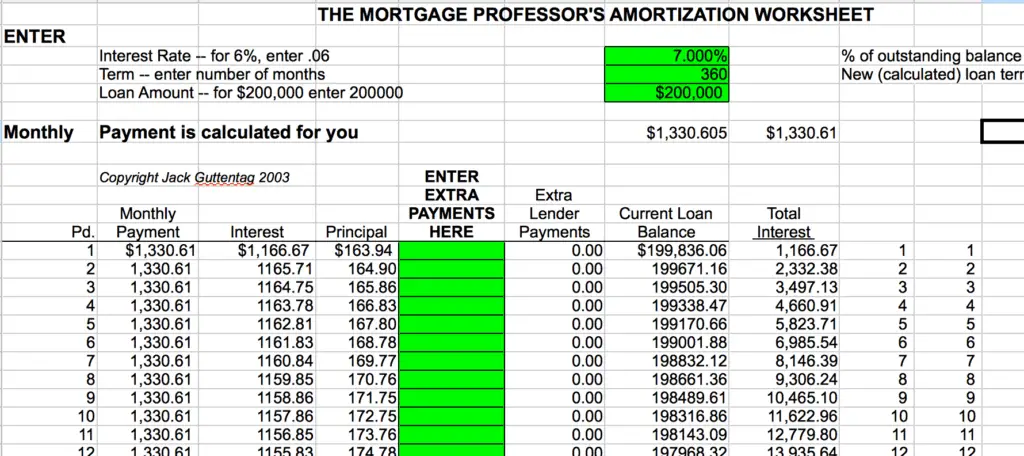

I started paying $100 extra on my mortgage about 3 years into my mortgage, which causes the numbers to be different from starting right at the beginning. After a few months I increased it from $100 a month to $200 per month and now I currently pay $300 per month extra on my mortgage plus a large payment at the end of each year. To calculate changes like these you need to use my mortgage planning spreadsheet to find out exactly what paying $100 extra on your mortgage will do to shorten your term and save you on interest expense. I track mine every month and I am able to see in real time how many months I have taken off of my mortgage and how much interest I have saved. My mortgage planning spreadsheet is available for download by clicking this button.

Calculating Your New Payoff Date

Using the above calculator can help you get a clear picture of how much more quickly you can pay off your loan based on how much extra you plan to pay each month. The above calculator is also useful if you are trying to figure out how much extra you would need to pay if you want to have your house paid off by a certain date to meet financial goals, such as being able to retire early.

To use the calculator, just put in the amount of the original loan, the interest rate, the length of the loan, and the monthly payment that you propose. The results will be e-mailed directly to you within moments with a plain-English analysis. If you are trying to figure out how much you need to pay to meet a pay-off goal, you will just need to keep experimenting with the monthly payment until you get the results you want.

Of course, the calculator can only give you an estimate to help guide your financial planning. You will need to talk directly with a loan counselor to understand how your payments impact your particular loan. For example, you loan may include a penalty for early re-payment. By talking to a loan counselor, you can understand all the circumstances that may affect your loan so that you can make the best decision to meet your financial goals.

Recommended Reading: What Does Gmfs Mortgage Stand For

What If I Pay $100 Extra On My Mortgage With A 15 Year Duration:

With a 15 year mortgage you are already paying an extra $100 or more dollars per month to cut the length of the mortgage in half. Because of this the effects of adding extra principal payments onto a 15 year mortgage are not nearly as drastic as paying $100 extra on a 30 year mortgage. On The $50,000 loan instead of taking 13 years off like it did on a 30 year mortgage paying $100 extra on your mortgage per month will only take off 4 years, however that makes the total loan only 11 years instead of the 17 years when starting with a 30 year mortgage.

Create Room In Your Budget

One of the most effective ways to pay off your mortgage faster is to pay more than the monthly amount due. That might seem obvious, but you might not realize just how far a little extra money can go.

For example, say you took out a 30-year fixed-rate mortgage of $250,000 at 5% annual percentage rate and have 25 years left on the loan. That would mean you owe $1,342.05 per month. Now imagine that you tack on just $20 extra to each payment. Youd shorten the repayment period by eight months and save $5,722 in interest. Use a mortgage calculator to help you do the math.

For an extra $20 per month, youd simply need to cut out one fancy coffee a week or a couple of takeout lunches. Obviously, putting even more money toward extra payments will result in even more savings.

Just keep in mind that you dont want to go overboard here and sacrifice other financial goals to pay down your mortgage faster. Mortgages are some of the cheapest loans out there, so be sure youre paying off other higher-interest debt and investing before you start cutting back in other areas of your budget.

Also Check: 70000 Mortgage Over 30 Years

When To Consider Refinancing

Aside from making extra payments, mortgage refinancing is another strategy to shorten your term. But other than that, it can help you obtain lower interest rates. You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. If you have a 30-year mortgage, you can refinance to a 15-year mortgage with reduced interest. Moreover, it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage , and vice versa. But dont forget: It should be done early enough into the loan term.

Heres when its good to refinance from a 30-year to 15-year term:

- If interest rates are low

- If you have a qualifying or high credit score

- If youve paid your loan for just a couple of years

- If you are not planning to move out of the house

- If you are able to make higher monthly payments Refinancing to a shorter term makes your monthly payment higher even with a reduced interest rate. This yields significant interest savings.

Moreover, refinancing is taking out a new loan to replace your old one with more favorable terms. This means you need to go through all the credit checks and paper work. It requires a high qualifying credit score , with the best rates going to consumers with 740 credit scores. On top of this, you must shoulder many fees, including inspection, recording fees, origination fees, and housing certifications.

Refinancing is not ideal under the following circumstances:

Whats the Ideal Interest Rate to Refinance?