Lower Monthly Payments By Reducing Interest

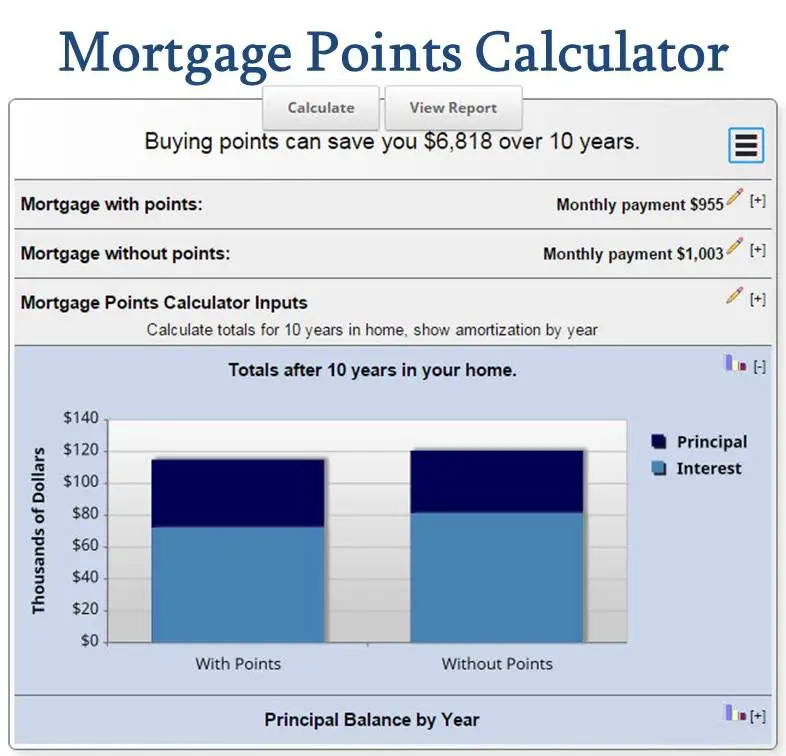

Mortgage points are an investment that you make in your home purchase. You’re essentially paying a fee to lower the interest rate on your loan and save money over the life of your mortgage.

The amount you’ll save depends on how many points you purchase, how long it takes to pay off those points, and what type of interest rate reduction they yield.

Are Two Or Five Year Fixes Currently Cheaper

On average, homeowners will now pay more when fixing for two years than they will for five years, according to Moneyfacts data.

The average two-year deal across all products now costs 5.75 per cent and the average five-year deal costs 5.48 per cent, according to Moneyfacts.

Two years ago, the typical two-year fix cost across all products was 2.38 per cent compared to 2.62 per cent for five year fixed rates.

When looking at the cheapest deals currently available on the open market, the gap between two years and five years becomes even more apparent – though things are changing quickly.

The cheapest two-year fix charges 5.06 per cent, whilst the cheapest five year fix charges 4.49 per cent. Both are offered by Halifax.

Homeowners can check what rates they could get for their mortgage size and home’s value over different fixed rate periods by using our best mortgage rates calculator.

Homeowners will probably face a premium when fixing for two years. But the question is, could the short term pain pay off when they come to remortgage in two years?

The reason why two-year fixed rates are typically more expensive than five-year fixed rates is to do with the expectation around future base rate changes by the Bank of England.

This expectation is again reflected in swap rates. While all swap rates have risen significantly over the past month, the differential between two, five and ten year swaps has also widened.

Are There Limits On Buydowns

If youre interested in a mortgage buydown, you should consult a lender, as some restrictions apply. Buydowns are only eligible when purchasing or refinancing primary residences and second homes. Typically, buyers must qualify for the standard interest rate of the zero-point loan to be able to buy down a home loan.

Also Check: How To Search For Best Mortgage Rates

How We Got Here

To use the Should I buy points? mortgage calculator, type your information into these fields:

-

Desired loan amount

-

Interest rate without points

-

Number of points

-

Interest rate with points This shows what your rate would be if you paid for points. In general, lenders drop the interest rate by a quarter of a percentage point for each point purchased, up to a limit. But maybe a lender has offered you a rate thats different for buying this number of points. If so, type in that rate to ensure the accuracy of your results.

Temporary Mortgage Rate Buydowns

Temporary mortgage rate buydowns are a little more complicated, but can help borrowers afford a home by reducing interest rates dramatically for up to three years.

A 3-2-1 mortgage buydown offers an interest rate 3% lower than the average rate at the time . For instance, if rates are averaging 6% for someone in your situation, you could get a 3% interest rate but only for the first year. On the second year, your rate will go up to 4%, and on the third year, youll pay 5%. By year 4, and for the rest of the mortgage term, youll pay the prevailing 6% rate.

Youll want to compare the buydown price to your savings over three years to determine if a temporary mortgage buydown makes fiscal sense for you.

At the end of three years, if your credit is good and interest rates have dropped, you can refinance for a better rate.

A 2-1 temporary buydown follows the same format, but the lower rate only lasts for two years.

You May Like: How Long Do You Need To Pay Mortgage Insurance

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Build An Emergency Savings Fund

According to a survey by CareerBuilder, 78% of Americans live paycheck to paycheck. Even 9% of people with incomes of $100,000 or more live paycheck to paycheck. If you dont have any savings, you can find yourself in a very difficult position should something unexpected happen. Thats why its a good idea to build some emergency savings. Most experts will recommend a liquid, safe emergency fund covering three to six months of living expenses. The best savings accounts can even give you some decent interest on your fund without exposing it to market risk.

After youve paid down any high-interest debt, you should start an emergency fund . If that still doesnt get you to three to six months of expenses, set up a plan to start contributing regularly. Our simple guide to making a budget can help you find room in your budget for these regular contributions.

As you start investing more or making extra mortgage payments, remember to maintain this savings fund. If you dont always have a liquid fund that you can access at any time, youre exposing yourself to risk. And as your situation changes, you will need to adjust your savings. For example, you should increase how much savings you have on hand as you have kids . So if you dont have enough in savings, forgo investing and extra payments in favor of growing your savings.

Read Also: How To Become A Mortgage Specialist

Should I Buy A House Now Or Wait Until 2023

Theres no guarantee that interest rates will go down next year and buyers shouldnt wait if theyre in a position to buy right now.

Rent prices have also been increasing, but when you own a home, youre also building equity. Every mortgage payment you make reduces what you owe on your loan but increases the amount of your home that you actually own.

Home equity gives homeowners a resource that they can tap into to pay off debt, pay for large expenses, or use in retirement.

However, you shouldnt feel pressured to buy if your financial situation is not ideal. By putting yourself in the best position to buy, you can potentially reduce what you pay on your mortgage.

Total Mortgage has mortgage experts standing by who work with lenders across the nation. Find a banker in your neighborhood today.

Hybrid Or Combination Mortgages

You could choose to opt for a hybrid or combination mortgage. In these mortgages, part of your interest rate is fixed and the other is variable.

The fixed portion gives you partial protection in case interest rates go up. The variable portion provides partial benefits if rates fall.

Each portion may have different terms. This means hybrid mortgages may be harder to transfer to another lender.

You May Like: Can You Get A Mortgage With No Job

Calculating If A Buydown Mortgage Is Worth It

For a mortgage buydown to be worth it, you will want to make sure you end up saving more than the total cost of a buydown. Lets say you have a 3-2-1 buydown that has an original cost of $10,000 and provides $15,000 in total savings over the first 3 years.

To calculate your breakeven point, simply divide the savings achieved in 3 years by the original cost , which gives you a breakeven point of 1.5. This means to make the buydown worth it, you must live in your home for at least 1.5 years .

MoneyFactEstimate How Long Youll Live There

When it comes to mortgage buydowns, the longer you live in your home, the more likely youll break even.

Repayment Or Credit Risk

The most important risk for the lender is that you wont repay the loan. A high credit score can help lessen this concern, as it shows the lender youve been good at repaying your debts. So, you may pay a lower interest rate than those who have a lower score.

If your mortgage is worth more than 80 percent of the value of the home, youll have to buy mortgage default insurance. But since insurance protects the lender from the risk of default, you may get a lower interest rate than if you go for an uninsured mortgage with a bigger down payment.

Read Also: How To Become A Mortgage Processor In Florida

Will Other Investments Beat Paying Off A Mortgage Early

Is it better to pay off your mortgage or invest? Ultimately, its a personal decision, but investing could be more sensible.

Sadly, the math tells us its almost always better to invest in other places than in your mortgage, says Richard Bowen, CPA and owner of Bowen Accounting in Bakersfield, California.

Mortgage rates are lower than theyve been in recent years, so if paying off your mortgage early leads to a return equal to your interest rate, that return would likely be lackluster compared to the annualized return for the S& P 500 roughly 10 percent over the last 90 years.

A potentially better use of the funds might be to take the cash youd use to pay off your mortgage and leverage it into buying a cash flow-positive property like multi-family real estate or single-family homes that have the potential to offer higher long-term returns, Bowen points out.

Any choice poses a risk, however. Even after paying off your mortgage early, real estate prices could plunge, leaving you with a potential loss. Carefully consider which risks youre willing to take. Ultimately, you might be better off not paying your mortgage off early.

The thing is, no one can give you a guarantee on an investment, Bowen cautions. You can put your money in the stock market and lose it. You can put your money in real estate and it doesnt perform as well as you expected it to.

How We Calculate Our Mortgage Rates

NextAdvisors mortgage interest rate averages are pulled from Bankrates daily rate data.. These overnight rates are based on a specific borrower profile, which only includes loans for primary residences where the borrower has a FICO score of 740+. Bankrate is part of the same parent company as NextAdvisor.

The average rates listed below and based on the Bankrate mortgage rate survey:

Current average mortgage interest rates| Loan type |

|---|

Recommended Reading: When Do I Stop Paying Mortgage Insurance

How Is Todays Landscape Different From Two Years Ago

In 2020, the average list price on an American home was $374,500, with average interest rates on 30-year mortgages sitting at 3.11%.

Today, the average interest rate is 7.06%, with average home prices up to $525,000.

That means if you purchased a home two years ago with a 30-year mortgage and 20% down, the average purchase would have cost you $536,551 in principal and interest over the course of your loan.

The average purchase in the current market would cost you $1.11 million in principal and interest over the course of a 30-year mortgage with 20% down. Thats a difference of over half a million dollars by the time youre done paying off your mortgage.

Interest rates are higher today because the Federal Reserve is attempting to curb inflation. Prices are higher for a few reasons. First, the U.S. was in a housing shortage prior to the pandemic. This put us in an already bad position when things took a turn for the worse.

During the pandemic, many white-collar workers decided to relocate with the newfound freedom of remote work. Many moved to less expensive locales. This also increased demand and drove up prices via bidding wars.

Will All Your Cash Be Tied Up In The Mortgage

Before taking a large chunk of your wealth and using it to pay off your mortgage early, dont forget to look at liquidity. Your home is considered a non-liquid asset because it can take months or longer to sell the property and access the capital.

If you start paying down your mortgage too fast, you risk depleting your liquidity, says Amanda Thomas, CFP, a client advisor at Mission Wealth in Santa Barbara, California. The kind of liquidity you have is important, too.

One approach is to have an emergency fund, as well as assets like stocks, mutual funds, U.S. Treasuries, bonds and marketable securities available in a taxable investment account. That way, in addition to having money tied up in tax-advantaged retirement accounts and your home, you still have some liquid cash or other investments that are easy to convert to cash in a pinch.

Bowen suggests maintaining a cushion that protects you for at least six months before you consider using a large portion of your liquidity to retire your mortgage early.

You May Like: How To Get Into Mortgage Processing

How To Buy Down Rate With Discount Points

Discount points, or mortgage points, are a kind of prepaid interest that you pay in exchange for a lower rate and monthly payments when you purchase points, youre buying down your mortgage rate.

When you buy points, youre paying more upfront, but youre receiving a lower interest rate. This may be a good option if you know that you will keep your loan over a long period of time.

Each discount point is equal to one percent of your loan amount for instance, if you purchase one point on a $100,000 loan, it would equal $1,000, which is equivalent to one percent of the loan amount. Depending on your finances, you may be able to buy multiple points to buy down your rate even more.

Its important to note: Buying points to get a lower interest rate does not result in increased home equity, and you will not get the value out of your points unless you stay in the home long enough to benefit from the reduced monthly payment.

The points that are available for purchase will be listed on your Loan Estimate, along with total closing costs and estimated costs of taxes and insurance.

How Much Does A Buydown Mortgage Cost

The exact cost of a mortgage buydown will depend on several factors, including the size of the mortgage, the amount you are buying down the loan by and the various fees associated with the buydown.

Ultimately, the cost of a buydown will be set by the lender, though there may be room for negotiation.

Read Also: How 10 Year Treasury Affect Mortgage Rates

Buydown: A Way To Reduce Interest Rates

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

Its no secret that buying a house is an expensive undertaking. When you get a mortgage, youre not only committing to paying the purchase price of the home, youre also agreeing to pay for the privilege of borrowing money.

While it might seem like you can only hope that interest rates are low, despite predicted trends and rate hikes, when youre ready to obtain a loan, theres actually something you can do to ensure your mortgage payments are more manageable in the future. By paying more money upfront, you can score a lower interest rate on your mortgage.

This financing technique is called a mortgage buydown. Read on to learn what a buydown is, how it works and whether its right for you.

When Is The Right Time To Get A Mortgage

Before you apply for a mortgage, you should have a proven reliable source of income and enough saved up to cover the down payment and closing costs. If you can save at least 20% for a down payment, you can skip paying for private mortgage insurance and qualify for better interest rates.

The best time to apply is when youre ready. But there are other details to consider when timing your home purchase. Home sales slow down during the winter and competition heats up in the spring which can affect prices. However, general nationwide trends dont always apply to every real estate market. Talk with local experts in your home shopping area to get a better sense of the market.

Recommended Reading: Can You Take A Cosigner Off A Mortgage

Example Of How Mortgage Points Can Cut Interest Costs

If you can afford to buy discount points on top of the down payment and closing costs, you will lower your monthly mortgage payments and could save lots of money. The key is staying in the home long enough to recoup the prepaid interest. If you sell the home after only a few years, or refinance the mortgage or pay it off, buying discount points could be a money-loser.

Here is an example of how discount points can reduce costs on a $200,000, 30-year, fixed-rate mortgage:

| Loan principal | |

|---|---|

| None | $20,680 |

In this example, the borrower bought two discount points, with each costing 1 percent of the loan principal, or $2,000. By buying two points for $4,000 upfront, the borrowers interest rate shrank to 3.5 percent, lowering their monthly payment by $56, and saving them $20,680 in interest over the life of the loan.