Get A Lower Mortgage Payment Without Refinancing By Recasting

By Brandon Cornett | May 24, 2016 | © HBI, all rights reserved

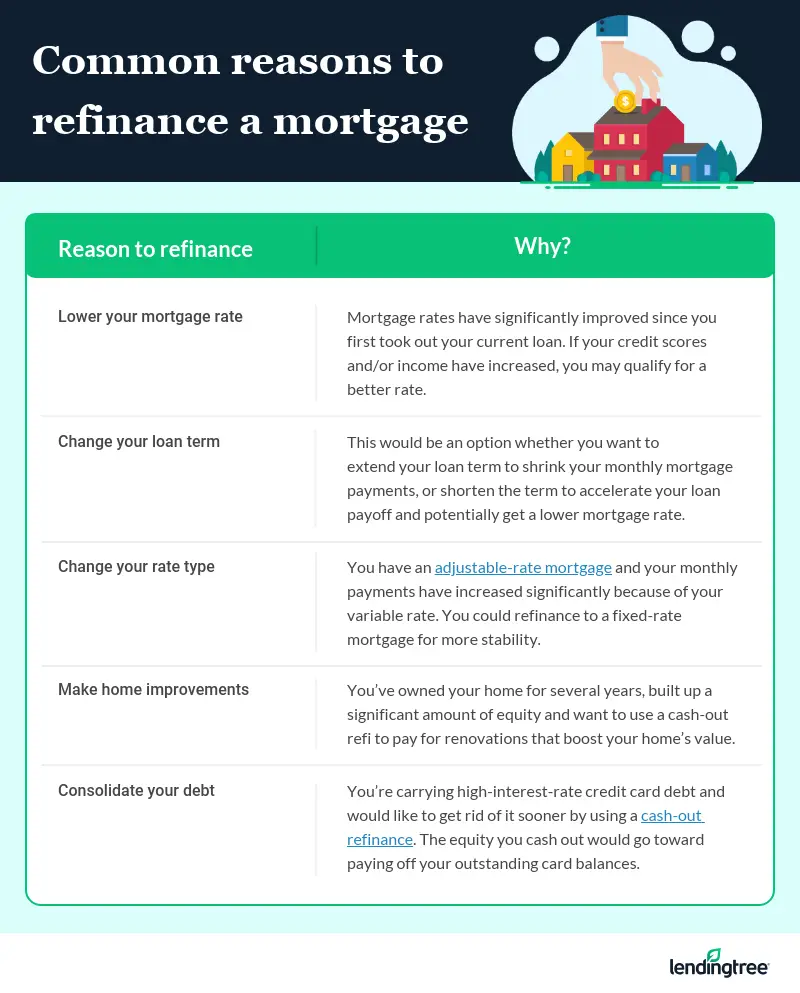

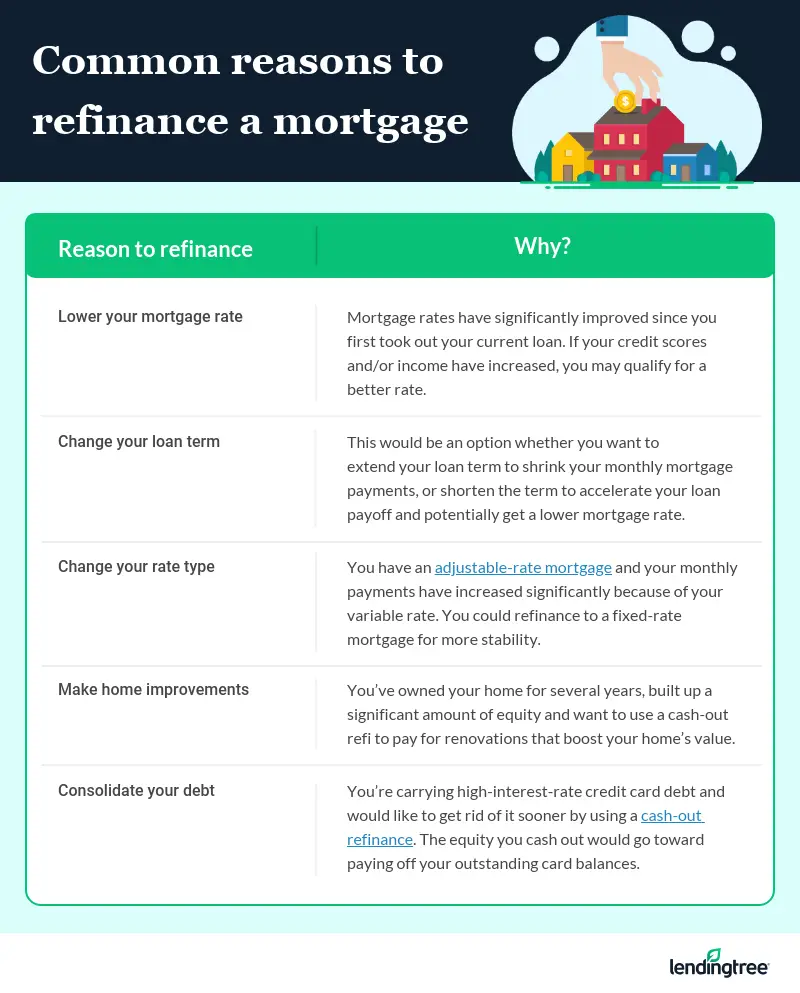

Refinancing is a popular strategy for homeowners who want to lower their monthly mortgage payments. But what if you dont want to go through the hassle and cost of a refinance? How can you lower your mortgage payment without refinancing your home? There are several ways to accomplish this goal. Recasting is one of them.

Refinancing To Access Your Homes Equity

In the first quarter of 2020, 42% of all refis involved an increased principal balance by at least 5%, indicating the owners took cash out, financed closing costs or both. While cash-out refi rates can be a bit higher than rate-and-term refinance rates, there still may be no cheaper way to borrow money.

You can access your home equity through a cash-out refinance if you will have at least 20% equity remaining after the transaction. Heres an example.

What Happens If I Pay An Extra $100 A Month On My Mortgage

In this scenario, an extra principal payment of $100 per month can shorten your mortgage term by nearly 5 years, saving over $25,000 in interest payments. If you’re able to make $200 in extra principal payments each month, you could shorten your mortgage term by eight years and save over $43,000 in interest.

Don’t Miss: Can A Mortgage Loan Be Used For Renovations

Prepaying Your Way To A Lower Rate

It’s a bit of a mathematical construct, but prepaying your mortgage can lower the effective interest rate on your mortgage. Although the math is complicated, the concept is pretty simple: Retiring your mortgage more quickly saves interest cost… and lower interest cost is usually what’s achieved with a refinance.

HSH’s PreFism Prepayment-is-equivalent-to-Refinance calculator can do the math for you. For example, you have a $200,000 loan at a 3% rate you took out in August 2017. You start making prepayments of $100 per month in October of 2021. Your prepayment will save you $13,118.81 over the remaining term of your loan, creating an equivalent 2.574% interest rate for your mortgage.

If you want to achieve these savings by refinancing you would need to start the “amortization clock all over again at a new 30 years and get a new interest rate of 2.217% — and you’ll likely need to pay closing costs again, too.

It’s technically possible to engineer any interest rate you want via prepaying all that matters is the amount. Pick a rate you would like to create for your mortgage and our LowerRatesmPrepayment Calculator will tell you the amount of prepayment you’ll need to create the same savings as a refinance at that interest rate. From the example above, if you want a 2% effective rate, you’ll need to prepay $165.56 per month.

How To Lower Your Monthly Mortgage Payment Without Refinancing

HOUSTON Your mortgage is probably one of the biggest bills you pay every month. Most people lock in their interest rate and monthly payment for 15 or 30 years.

But you may be able to lower your monthly payment without increasing the length of your loan by recasting. Recasting is re-amortization of your mortgage.

It’s different from refinancing because you won’t have to pay all those hefty fees or go through another credit check. What you will need is some sort of lump sum payment, like money you money have received from a tax refund or a year-end bonus.

If your bank agrees to recast your mortgage, it will refigure your monthly payment based and your current principal balance using the same interest rate you already have.

Let’s say you have $160,178.87 of principal left on a 30-year fixed-rate loan for $200,000 taken out at 4.5% in 2009.

You have been paying $1,013.37 a month in principal and interest. If you put in $20,000 toward that principal and ask your lender to recast your payments over the remaining 20 years on the loan, your monthly payment would drop by $126.53 to around $886.84.

In this scenario, recasting your mortgage would save you $10,367.20 over the life of your loan. JP Morgan Chase and Wells Fargo offer this option with no charge, while Bank of America charges an extra $250.

Not every loan qualifies. FHA and VA loans cannot be recast by anyone.

Copyright 2019 by KPRC Click2Houston – All rights reserved.

About the Author:

Recommended Reading: How Long Do You Have To Pay For Mortgage Insurance

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Switch From An Arm To A Fixed

When used wisely, an ARM can be an effective home loan option. Just be sure you know when the interest rate is scheduled to fluctuate. ARM rate changes tend to move upward, resulting in higher monthly payments for you. A good way to avoid this is to refinance out of the loan as youre nearing the end of the initial fixed-rate period.

Ensure youâre getting the best advice with these mortgage refinancing tips.

Recommended Reading: 10 Year Treasury Yield And Mortgage Rates

Read Also: What Are Mortgage Rates Based On

What Documents Do I Need To Refinance My Mortgage

To refinance your mortgage, youll need to supply identification, income verification and credit information. Be sure to ask your lender for a list of documents youll need. The faster you can give the lender everything they need to process your loan, the quicker youll be able to close.

Heres a general checklist:

Lowering Your Monthly Mortgage Payment When You Buy

If you’re looking to nab a lower monthly mortgage payment when buying a home, focus on the ways you can decrease how much you borrow, how much interest you’ll pay or the amount you’re charged for the other expenses that make up your monthly mortgage payments.

Figuring out which mortgage offers will be best when you’re buying a home is an important decision, but know that there will also be ways to lower your monthly mortgage payment after you’ve moved in.

Recommended Reading: How Do I Get A Mortgage Statement

Loan Mods To Lower Mortgage Rates For Non

Some financial institutions may offer to reduce mortgage rates for their customers with a loan modification even when they are not having trouble making payments. In most cases, the program would be available only on loans the bank owns and services — typically ARMs, jumbos and other “non-QM” products. In general, a borrower must be up-to-date on their payments, meet minimum credit score requirements and pay a fee to lower their interest rate. The loan payments are recalculated based on the new interest rate for the remaining years of the loan.

What Is A Loan Modification

When a lender agrees to modify a loan, they typically do so because you are facing default. Whether you are already behind or are about to become behind, the lender can modify the terms of the original loan to make the mortgage payments more affordable for you.

Lenders arent under any type of obligation to agree to a loan modification. If they do agree to modify your loan, though, they can change the interest rate, term, or even lower the principal balance in an effort to make your loan more affordable.

Lenders are sometimes willing to do this rather than face foreclosure. The last thing that banks want is to take possession of your home. They would rather than you stayed in it, but in order for you to do so, you may need more favorable terms, which is where the loan modification helps.

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

You May Like: What Is Aag Reverse Mortgage

Use A Second Mortgage To Pay Off The First

One final trick some folks use to reduce their mortgage interest expense is opening a second mortgage to pay off the first.

This way they dont need to refinance, which can be a bit more involved than taking out a second.

Its basically a form of arbitrage where interest rates are lower on the second than the first for one reason or another.

For example, if the interest rate on your first mortgage is well above going rates today, it could make sense.

This can be done with either a fixed-rate home equity loan or adjustable-rate HELOC. But it takes a bit of tinkering and money management skills to get it done.

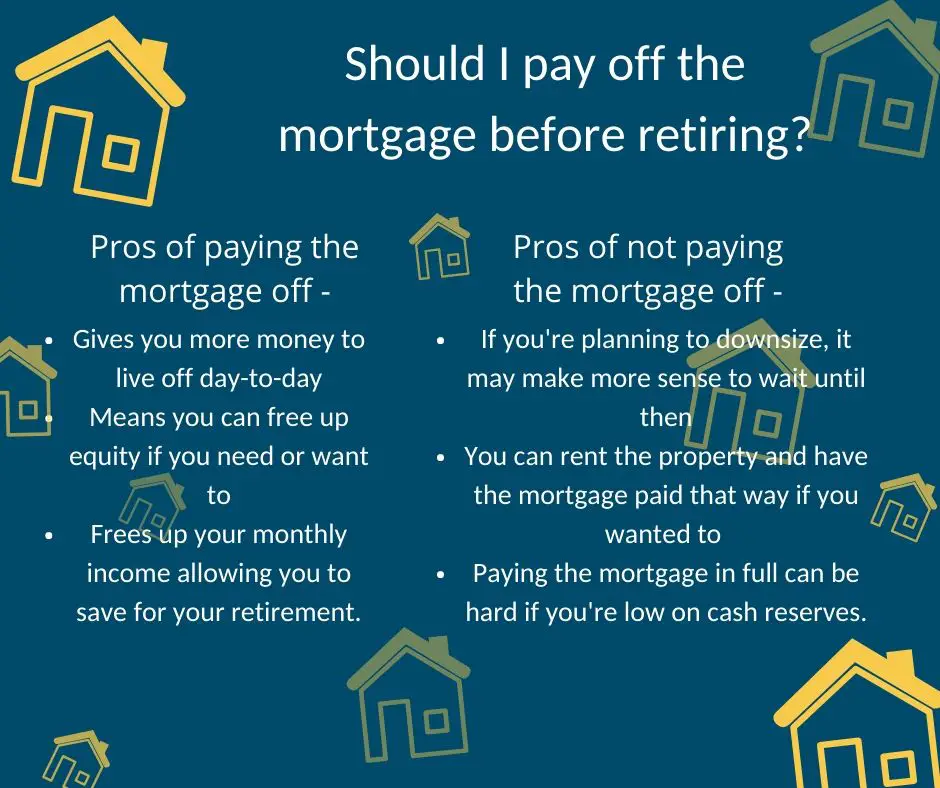

So in the end, you might just be better off refinancing your mortgage or sticking to some of the alternatives discussed above.

What Is A Recast Loan

A mortgage recast is when a lender recalculates the monthly payments on your current loan based on the outstanding balance and remaining term. When you purchase a home, your lender calculates your mortgage payments based on the principal balance and the loan term. Every time you make a payment, your balance goes down.

You May Like: What Are Interest Rates On A 15 Year Mortgage

Can I Lower My Mortgage Payment Without Refinancing

So, youre stuck with a high monthly mortgage payment. But youd rather not refinance and pay thousands in closing costs.

How can you lower your monthly mortgage payment without refinancing?

One option may be a mortgage recast.

Recasting lets you reduce your monthly bill, and usually only costs a few hundred dollars in lender fees.

The catch? Youll need a large cash sum you can put toward your mortgage right now to lower the balance. Heres how a mortgage recast works.

Original Vs New Monthly Payment When Refinancing

| Original principal | |

|---|---|

|

3.25% |

$870 |

Dont just look at the monthly payment, though. How much will each loan cost you in total interest assuming you pay off the mortgage and dont sell your home or refinance again?

To get this information, select the calculators option to view the amortization table. At the bottom, youll see the total interest for the new mortgage. Write that number down.

Then, do a new calculation with the mortgage calculator. Enter your:

- Original principal amount

- Current interest rate

- Current loan term

Then, view the amortization table for that calculation and see what your current total interest over the life of the loan will be. How much will you save in the long run by refinancing?

Don’t Miss: How To Estimate My Mortgage Payment

Shop Around For A Lower Homeowners Insurance Rate

When was the last time you shopped around for homeowners insurance? Even if you havent had any issues with your current provider, better rates may be available elsewhere.

Consider shopping around with reputable providers to get quotes. Be sure to inquire about rate discounts that may be available to you. Also, review the rate quotes to ensure the coverages included are comparable to your current policy, and ask about other ways to curb costs, like increasing your deductible.

Jumbo Loan Interest Rate Goes Up +021%

The average jumbo mortgage rate today is 6.31 percent, up 21 basis points since the same time last week. Last month on the 20th, jumbo mortgages average rate was below that, at 5.89 percent.

At the average rate today for a jumbo loan, youll pay principal and interest of $615.07 for every $100k you borrow. Thats $15.52 higher compared with last week.

Recommended Reading: What Is Usda Mortgage Insurance

/1 Arm Rate Trends Upward +024%

The average rate on a 5/1 ARM is 4.78 percent, rising 24 basis points over the last week.

Adjustable-rate mortgages, or ARMs, are home loans that come with a floating interest rate. In other words, the interest rate can change from time to time throughout the life of the loan, unlike fixed-rate loans. These loan types are best for those who expect to refinance or sell before the first or second adjustment. Rates could be much higher when the loan first adjusts, and thereafter.

While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen.

Monthly payments on a 5/1 ARM at 4.78 percent would cost about $517 for each $100,000 borrowed over the initial five years, but could ratchet higher by hundreds of dollars afterward, depending on the loans terms.

Find The Best Refinance Rates

To find the best refinance rates, youll have to do some work, but it wont take much time. Look at banks, credit unions and online comparison sites. You also can work with a mortgage broker if you want someone to do the legwork for you and potentially get you access to lenders you wouldnt find on your ownlenders that might offer you better terms.

Submit three to five applications to secure formal loan estimates. The government requires the loan estimate to show your estimated interest rate, monthly payment and closing costs on a standard form that makes it easy to compare information across lenders.

On page 3 of the loan estimate, youll see the annual percentage rate, and on page 1, youll see the interest rate. When youre buying a car, it usually makes sense to pick the loan with the lowest APR, because APR includes a loans fees.

With mortgages, its different. The APR assumes that you will keep the loan for its full term. As weve already seen, that doesnt usually happen with home loans. You might be better off with a loan that has a higher APR and a higher monthly payment but no fees.

Instead of putting cash toward closing costs, you could keep that money in your emergency fund or use it to pay down debt with a higher interest rate than your mortgage.

Another problem is that if youre comparing the APRs on a 30-year and a 15-year loan, the 15-year loan might have the higher APR despite being much less expensive in the long run.

Read Also: How Long Is A Normal Mortgage

Refinance To A Fixedrate Mortgage

Perhaps you have an adjustablerate mortgage , which offers a fixed rate for the first few years of your loan with a variable interest rate thereafter. While your rate may go down, it can also spike up, leading to much higher monthly payments than you can comfortably afford.

But if you refinance to a new fixedrate mortgage loan, you eliminate the uncertainty of variable rates and can possibly save more money over the life of your loan.

Say you have an adjustablerate 30year mortgage loan with a $200,000 original balance and a 2.5% interest rate that is about to jump, after your first five years, to a 3.5% interest rate, says Derks.

In this scenario, your monthly payment would increase from around $790 to approximately $881 nearly $100 more per month because of the rate adjustment.

But if you refinance to a new 25year fixedrate loan, which would not add any extra years to your term, and locked in at a 2.75% interest rate that rolls in your $4,000 closing costs, your monthly payment would be $830. This would allow you to save $50 per month compared to not refinancing.

Refinancing from an ARM to a fixedrate mortgage might not yield huge monthly savings. But it does give you additional financial security because you wont have to worry about your rate or payment increasing in the future.

How Much Will It Cost To Complete The Refinancing

Depending on your lender and your loan terms, you may pay as little as a few hundred dollars or as much as 2% to 3% of the new loan value to complete a refinancing. If its going to cost you $3,000 to complete the refinance and it will take four years to recoup that money, it may not make sense for you.

Alternatively, if you can refinance and pay only $1,000, and have no plans to sell anytime soon, its very likely worth paying that $1,000 to save over time. In addition, some lenders allow you to roll your closing costs into the amount of the loan, so you dont have to come up with money out of pocket for closing costs.

Also Check: Can You Add Debt To Your Mortgage

How Can I Make My Monthly Mortgage Payment Lower

To recap, here are 9 ways you can lower your monthly mortgage payment with or without a refinance:

Lower Your Interest Rate

If you bought your home at a time when interest rates were higher overall, or if your is stronger today than it was when you applied for your current mortgage, refinancing may give you access to a lower interest rate compared to when you got your initial mortgage. Itll just depend on whether your current mortgage is up to date and if you have a history of making on-time payments.

It may not seem like 1% could make that much of a difference, but if you have a 30-year mortgage at 4% interest, and you refinance after 3 years into a 3% mortgage, youll see a noticeable change.

Lets assume you bought your house 3 years ago, for $250,000 with 10% down. That means that you borrowed $225,000. At 4% interest, your monthly mortgage payment just the principal and interest for now, for simplicitys sake is $1,074.

After 3 years, the principal you owe on your current mortgage is $212,622. If youre approved for a mortgage in that amount at 3%, your new monthly payment will be $846. Thats a monthly savings of $228.

Lets say you take out that same 30-year fixed rate mortgage as described above, but now lets assume youve been paying that mortgage back for 10 years. At 10 years, your remaining balance would be $177,263.91. With a new 30-year fixed rate mortgage, at 3%, your monthly payment would decrease to $747 per month, for a savings of $327 per month.

This savings on your monthly payment could be used to accomplish other financial goals.

Also Check: How Do You Shop Around For The Best Mortgage