So Are They Really Evil

A reverse mortgage is a tool, just like a hammer. It is amoral. A hammer can be overpriced or used to beat someone over the head or used to build homes for the poor and needy. Reverse mortgages can likewise be used well or inappropriately.

For senior citizens needing cash, they are an option. Often the only other option is selling the home and downsizing, renting, moving in with family, or moving to a lower cost-of-living area. The right choice will depend upon each persons unique needs and priorities.

Dave Ramsey hates them because he thinks they are a rip-off and he hates debt. Magnum, P.I. loves them because he gets paid to sell them. So, whose side are you on, Dave Ramsey or Magnum, P.I.?

You Intend To Move Closer To Family A Few Years Down The Road

If you have any desire to move in the near term, whether it be closer to family or to a residence that is better equipped for aging, taking out a reverse mortgage today may not be the best idea. The loan becomes due and payable as soon as the borrower moves from the home or passes away, so if you have plans to move in the next few years, you may want to also wait on getting the reverse mortgage.

There is a type of reverse mortgage available, the Reverse Mortgage for home purchase, that allows a borrower to take out a reverse mortgage and purchase a new home within a single transaction. This may be a solution when the time comes to move, and its a way to avoid paying two sets of closing costs both for the purchase and the new reverse mortgage.

When A Reverse Mortgage Doesn’t Make Sense

We’ve already touched on some scenarios when a reverse mortgage may be the wrong choice: you’re not sure how long you’ll keep living in the home, your spouse can’t be a co-borrower, you’d struggle to maintain the home, or the home has sentimental value to your loved ones. Let’s further discuss some scenarios where a reverse mortgage might not suit your circumstances.

Also Check: How Long After Bankruptcy Can You Get A Mortgage

How Much Does A Reverse Mortgage Cost

The closing costs for a reverse mortgage arent cheap, but the majority of HECM mortgages allow homeowners to roll the costs into the loan so you dont have to shell out the money upfront. Doing this, however, reduces the amount of funds available to you through the loan.

Heres a breakdown of HECM fees and charges, according to HUD:

- Mortgage insurance premiums There is a 2 percent initial MIP at closing, as well as an annual MIP equal to 0.5 percent of the outstanding loan balance. The MIP can be financed into the loan.

- Origination fee To process your HECM loan, lenders charge the greater of $2,500 or 2 percent of the first $200,000 of your homes value, plus 1 percent of the amount over $200,000. The fee is capped at $6,000.

- Servicing fees Lenders can charge a monthly fee to maintain and monitor your HECM for the life of the loan. Monthly servicing fees cannot exceed $30 for loans with a fixed rate or an annually adjusting rate, or $35 if the rate adjusts monthly.

- Third-party fees Third parties may charge their own fees, as well, such as for the appraisal and home inspection, a credit check, title search and title insurance, or a recording fee.

Keep in mind that the interest rate for reverse mortgages tends to be higher, which can also add to your costs. Rates can vary depending on the lender, your credit score and other factors.

Fraud By Relatives Or Financial Planners

This type of reverse mortgage scam involves a crooked financial planner or advisor talking you into getting a reverse mortgage when you dont need one. They may tell you to let them handle your proceeds to invest them for you, but then use the money for their own financial gain.

Unfortunately, this can happen with relatives of the borrower as well. A loved one may convince you to get a reverse mortgage and give them the proceeds. Or they may coerce you into giving them power of attorney, which allows them to make financial decisions for you, including getting a reverse mortgage and putting the loan proceeds into their own accounts.

You May Like: How To Find Remaining Mortgage Balance On A Property

What Are The Different Types Of Reverse Mortgages

There are three types of reverse mortgages:

- Home equity conversion mortgages are the most common type, and they are insured by the Federal Housing Administration .

- Single-purpose reverse mortgages are issued by some state and local governments and nonprofit organizations. They must be used for a specific purpose, such as home repairs or paying taxes.

Your Spouse Is 62 Or Older

Any borrower on a reverse mortgage must be at least 62 years old. If youre married and your spouse isnt yet 62, getting a reverse mortgage is not ideal. Though new laws may protect your non-borrowing spouse from losing the home if you die first, non-borrowers can’t get money from the loan after the borrower dies. That means no more credit draws or monthly payments and the surviving spouse might lose an important source of income.

If you and your spouse are each 62 or older and named as owners on your home’s title, getting a reverse mortgage together might be a good choice.

Don’t Miss: How To Make Biweekly Payments On Your Mortgage

Where To Learn More

For anyone considering a reverse mortgage, its a good idea to consult a trusted advisor. A good place to start is looking at a simple reverse mortgage calculator to get an idea of the amount you may be able to borrow. Consult ARLO, the All Reverse Loan Optimizer to help gather some of the loan options available in the market today.

What Is Shared Appreciation And Equity Participation

In exchange for a lower interest rate the lender and the borrower may agree to equity participation. Participation mortgages are so named because the lender participates, or has the right to a share in any increase in the value of your home.

A Shared Appreciation Mortgage takes into account the appreciation in value of the house between the time the loan is signed and the end of the loan term. The lender receives an agreed-to percentage of the appreciated value of the loan when the loan is terminated.

Recommended Reading: How To Lock Mortgage Rate For 6 Months

Senior Housing Bubble Held Together By Glue And Tax Dollars

Executive Summary

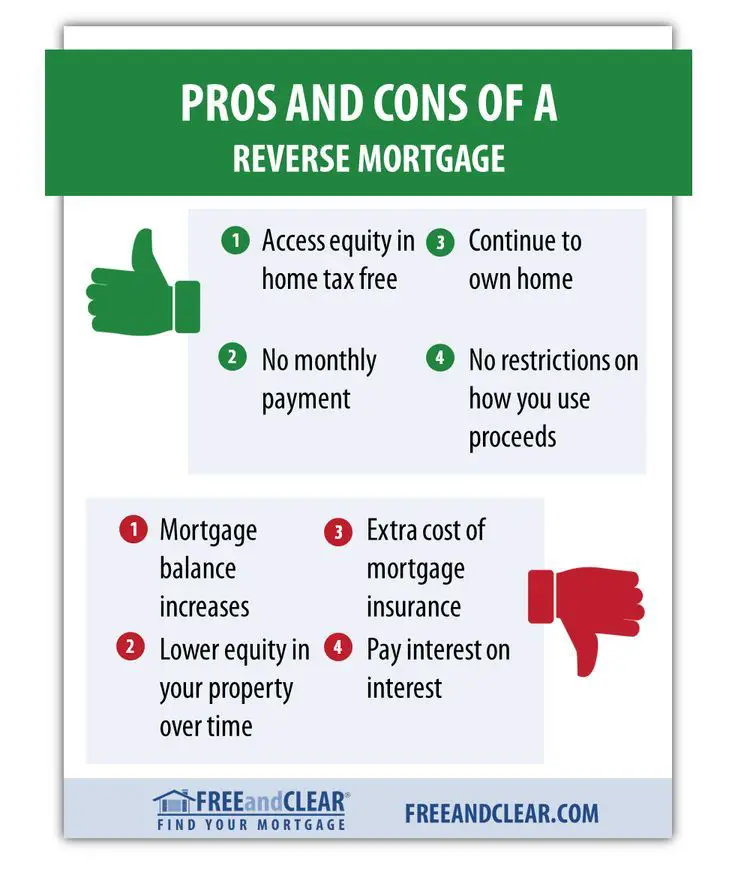

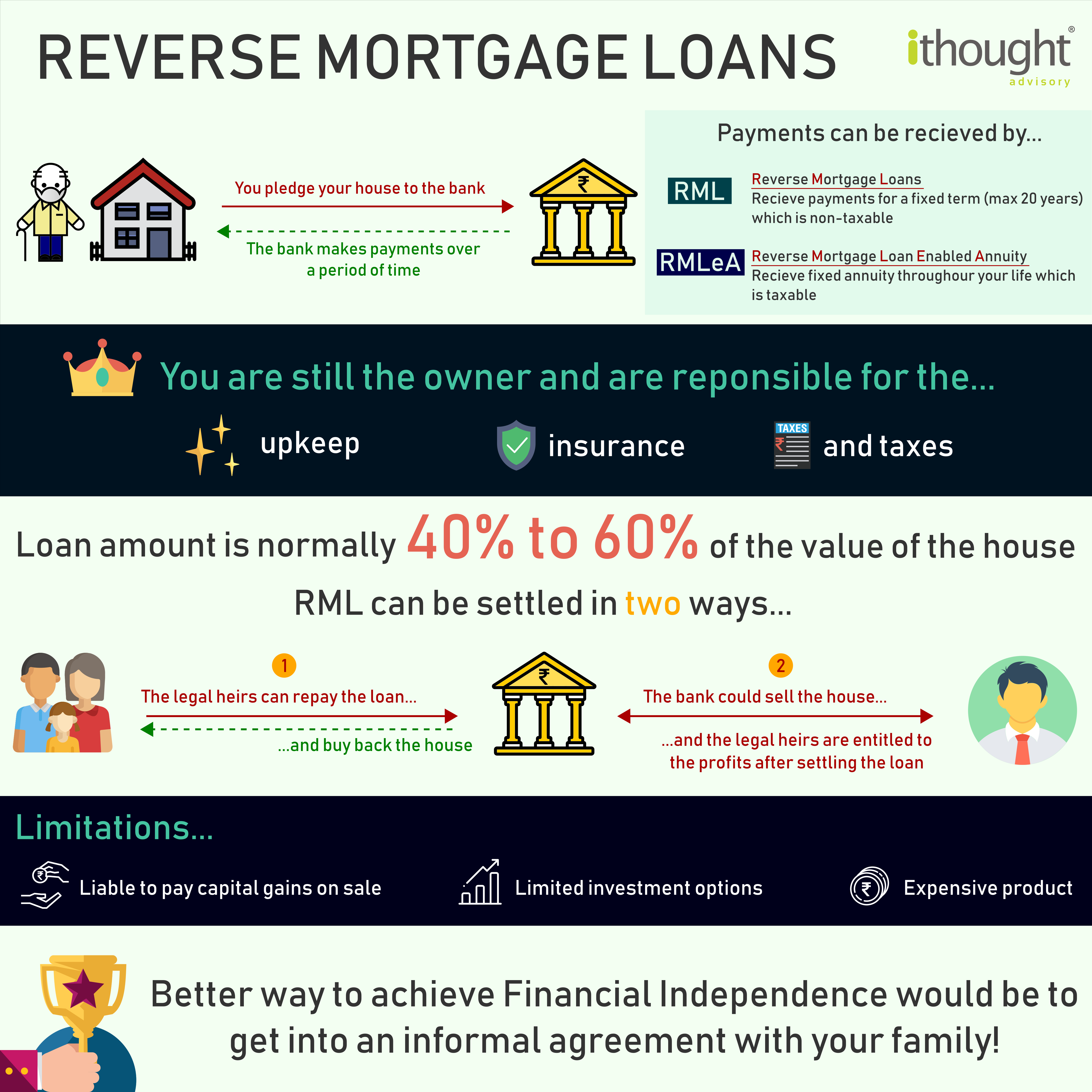

Reverse mortgages are loans that allow seniors to take equity out of their homes to help pay for living expenses or other costs. As the equity in their home decreases, the amount of the loan increases. Unlike a traditional mortgage, seniors do not make monthly payments. The loan becomes due when the borrower dies, moves out of the house, or fails to maintain the property and pay homeowners insurance and property taxes. This type of loan is almost always insured by the Federal Housing Administration.

As financial pressures on seniors have increased, the numbers of reverse mortgages have grown, and so have the opportunities for unscrupulous lenders to take advantage of seniors. These loans are complex, expensive, and drain equity from the property, leaving seniors with very few options later in life.

I. BackgroundWhat is a reverse Mortgage?

Payment OptionsThe Role of the Federal Government.Why Seniors Take Out Reverse Mortgages Reverse Mortgages Are Bad for SeniorsReverse Mortgages are Expensive Reverse Mortgages Strip Equity from Homes and Leave Seniors without OptionsCelebrity Spokespeople

- Fred Thompson for American Advisors Group :A government insured reverse mortgage allows seniors to stay in their own home and to turn their equity into tax-free cash.

Misleading Marketing

Who Owns The House In A Reverse Mortgage

Just like any other type of mortgage, you own the home in a reverse mortgage situation.

When the borrower dies or moves, however, the mortgage is payable in full. If you cant, or wont, pay off the debt, the lender can sell the home to recoup the money its owed, explains Michael Sullivan, personal financial consultant with nonprofit credit counseling and debt management agency Take Charge America.

Typically, the homeowner or beneficiaries are not responsible for any costs if the house is sold for less than the amount owed, adds Sullivan.

Recommended Reading: How Much Work History For Mortgage

How Does A Reverse Mortgage Work

A reverse mortgage works like a regular mortgage in that you have to apply and get approved for it by a lender. Theyll use a bunch of details about you and your homefrom your age to the value of your propertyto figure out how much they can lend you.

To qualify for a reverse mortgage, you must:

- Be at least 62 years old

- Own a paid-off home

- Have this home as your primary residence

- Owe zero federal debts

- Have the cash flow to continue paying property taxes, HOA fees, insurance, maintenance and other home expenses

And its not just you that has to qualifyyour home also has to meet certain requirements. Single-family dwellings and multi-family units up to fourplexes are eligible for a reverse mortgage.

The Home Equity Conversion Mortgage program also allows reverse mortgages on condominiums approved by the Department of Housing and Urban Development.

Where To Get A Reverse Mortgage

You can get a single-purpose reverse mortgage from a state or local agency. In this case, the lender will specify that the loan can only be used for one specific purpose for example, to help you afford your property taxes. This type of reverse mortgage is for low- and moderate-income borrowers.

Private lenders also offer certain reverse mortgages. Those are called proprietary loans, and each lender sets its own terms and conditions. You may be able to borrow more with this kind of loan, and there are typically no restrictions on how you use the money.

Most reverse mortgages are Home Equity Conversion Mortgage loans, which are insured by the federal government. This loan is available from FHA loan lenders. There is no restriction on how you use the money.

Don’t Miss: What Is The Monthly Payment On A 150 000 Mortgage

With A Reverse Mortgage You Are Risking The Loss Of Your Home

The largest risk of taking a reverse mortgage is losing a home. This is a big danger of taking any type of loan out on the equity of a home. For this reason, a reverse mortgage is almost always a bad idea.

Most of the time people take a reverse mortgage in the first place because they are having some issues with money. The problem is a reverse mortgage does have terms that do require some items to be kept up with in order to stay in the home. This includes keeping up with insurance payments and taxes. If a homeowner falls behind on these and is not able to pay them, the lender can take the home.

Taking a reverse mortgage is often where a person at retirement turns when they are tight on money and have nowhere else to turn. The problem is bills always do seem to pile up. Take a reverse mortgage and then your taxes and insurance go up how will these bills be maintained?

Having a place to live is a necessity in life. We all need a roof over our head. For a retiree on a fixed income, a home loss is a real possibility with a reverse mortgage and a chance that should not be taken.

Interest Rates Are Really High Compared To Traditional Mortgages

One truth about reverse mortgages is that, in general, the interest rates are often a little higher than a conventional mortgage, but not excessively so. Reverse mortgages are not conventional mortgages, so they have slightly higher rates because you dont have to make monthly mortgage payments.

Many retired Canadians cannot afford monthly mortgage payments and many of them may not even qualify for a regular mortgage, based on income. Reverse mortgages require no regular mortgage payments and qualification is typically easier than with a conventional mortgage.

Don’t Miss: What Fees Are Associated With Refinancing A Mortgage

Your Home Is Just An Asset

Some homes have sentimental value. If your home has been in the family for decades or generations, your children might hope to keep it that way.

While there are ways for heirs to pay off a reverse mortgage and keep the house, the loan does complicate things. If your home is just an asset, though, then leveraging it for a more comfortable retirement might be the best way to use it.

Mortgage lending discrimination is illegal. If you think you’ve been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau or with the U.S. Department of Housing and Urban Development .

Why Dave Ramsey Is Wrong About Reverse Mortgages

Financial Guru Dave Ramsey helps and influences millions of people. His following continues to grow via the many videos and resources online. Unfortunately, Daves opinions are not always right. I believe the powerful Dave Ramsey persona is causing unnecessary fear and harm to American Seniors.

Im referencing Daves strong stance against the HECM Reverse Mortgage. Moreover, Dave grossly misrepresents the HECM Reverse Mortgage. For example, he presents false opinions, explanations, and information on how Reverse Mortgages Work.

Many of Dave Ramseys followers are blindly accepting his opinions as fact due to the good things he has done. As a result, they are ignoring an opportunity that could dramatically improve their lives for the better.

False explanations from Dave Ramsey

The following are some of the impressions Daves videos portray:

- Reverse Mortgages are bad

- If you have a Reverse Mortgage there is a high probability that youll lose your home to the bank

- If you didnt have a Reverse Mortgage you wouldnt lose your home for not paying your property taxes

- Thousands of Seniors are being evicted from their homes seemingly at random

- Reverse Mortgage Interest rates are excessively higher than normal mortgage rates

Basic Reverse Mortgage Requirements to avoid foreclosure

If you have a Reverse Mortgage these are the primary terms to prevent you from going into foreclosure:

Why Dave Ramseys Reverse Mortgage comments are wrong

Trevor Carlson

You May Like: How Often Are Mortgage Rates Updated

If You Still Cannot Afford The Taxes And Insurance You Need To Consider Other Alternatives

You are still responsible to pay the property taxes and hazard insurance and maintain your home, even though you no longer have any monthly mortgage payments.

If this is still a struggle and you cannot afford to live comfortably, even after you get a reverse mortgage, then you have to make some hard decisions and sooner is better than later.

A reverse mortgage will allow you to live for the rest of your life in your home as long as you can maintain it and pay the taxes and insurance. If you cannot, eventually you will default on the taxes and/or insurance which would also be a default on the reverse mortgage loan.

If this is inevitable because you still cannot afford them, then even though no one wants to move out of the house they love, it may be time to make that tough decision before a default situation and you have even less equity to re-establish yourself elsewhere.

Are Reverse Mortgages Really Evil

A look at what a reverse mortgage is, how do they work, and when they would be used. Then, do they really deserve the terrible reputation that they have?

Who is right, Dave Ramsey or Magnum, P.I.? Dave rails against reverse mortgages on a regular basis and Magnum, or more accurately, actor Tom Selleck, sells them. Instead of just taking some celebritys word for it, lets take a look at what reverse mortgages are all about before forming our own opinions.

Don’t Miss: What Is Excellent Credit Score For Mortgage

Option #3 Move In With Family

Selling the home and moving in with family members is another great option to consider. Often seniors have difficulty with this decision because they do not want to be a burden to their family. While I understand this, I doubt your children or family members want to watch their loved one starve to death because they ran out of money in retirement.

Hard conversations need to be had in these situations. With the sale of the house, you could help support your family members financially to ease any type of added financial burden. Family needs to stick together and if this is something that is possible, it should be considered before a reverse mortgage is an option.

You May Like: Rocket Mortgage Conventional Loan

Can You Lose Your House With A Reverse Mortgage

As with any mortgage, there are conditions for keeping your reverse mortgage in good standing, and if you fail to meet them, you could lose your home. The ways you could violate the terms of a reverse mortgage include:

- The home is no longer your primary residence.As part of the reverse mortgage agreement, the home must be your primary residence. This means that you cannot leave the home for more than 12 consecutive months, explains Michael Micheletti, spokesperson for Unlock Technologies, a company that helps homeowners access their equity. This rule doesnt bar you from leaving your home to travel or to come and go as you please, but if you vacate the property for 12 consecutive months, the reverse mortgage loan becomes eligible to be called due and payable.

- You decided to move or sell your home.If you have to move and put your home up for sale as part of the move, youre still bound by the requirement to live in the house for 12 consecutive months. If selling your home becomes a challenge and you dont find a buyer within that 12-month window, the reverse mortgage can be called due, Micheletti says.

- You dont pay your property taxes or homeowners insurance. Even with a reverse mortgage, youre still responsible for paying property taxes, and failure to do so could violate the terms of your loan. In addition, you must maintain current homeowners insurance.

Also Check: What Does It Take To Become A Mortgage Broker