Final Steps To Paying Off Your Mortgage Early

Once you’ve made your final mortgage payment, you’ll have to finalize everything so you can put the loan behind you and enjoy your fully paid-off home.

- Request your mortgage payoff statement: Your job isn’t done after you make your final mortgage payment, as you’ll have to request your mortgage payoff statement from your lender. This document shows that you no longer owe anything on your mortgage.

- Inform your city of ownership status: Either you or your lender will have to inform the city or municipality where your home is located that you are the official owner of the property. In many cases, you can do this online or request your lender do it for you. Remember, most mortgages pay your property taxes on your behalf from your escrow balance — once your mortgage is paid off, that becomes your job.

- Inform your insurance company: Now that your home is in your name, you’ll also be responsible for paying your insurance provider directly. Inform your insurance provider that you own the home and will be making payments going forward.

- Inquire about escrow funds: When you’re paying off your mortgage, your lender may keep funds for homeowners insurance and property taxes in an escrow account for you. Once you’ve paid off your mortgage, you can ask your lender to transfer any remaining escrow balance back to you.

Get the CNET Personal Finance newsletter

- More From CNET

What Is A Prepayment Privilege

A prepayment privilege is the amount you can put toward your mortgage on top of your regular payments, without having to pay a prepayment penalty.

Your prepayment privileges allow you to:

- increase your regular payments by a certain percentage

- make lump-sum payments up to a certain amount or percentage of the original mortgage amount

Prepayment privileges vary from lender to lender.

Check the terms and conditions of your mortgage contract to find out:

- if your lender allows you to make prepayments

- when your lender allows you to make prepayments

- if there’s a minimum or a maximum amount that youre allowed to prepay

- what fees or penalties apply

- if there are other conditions

Most lenders limit the allowed prepayment amount per year. Typically, you cant carry a prepayment amount from one year to the next. This means you usually cant add the amount you didnt use in previous years to the current year.

The Pros Of Paying Off Your Mortgage Early

- Save money on interest. Each month that you make a mortgage payment, some money is going toward interest so the fewer payments you have, the less you will pay in interest. Paying off your mortgage early could save you tens of thousands of dollars.

- No more monthly payments. By eliminating monthly mortgage payments, you free up that cashflow to put toward other things. For example, you could invest the extra money or pay for your child’s college tuition.

- You own the home outright. If you hit a financial rough patch, there’s the possibility that you won’t be able to afford monthly mortgage payments. Your house could be foreclosed upon if you default on payments. When you completely own the home, there’s no chance of losing the house.

- Peace of mind. You may simply like the idea of not having a mortgage hanging over your head. The freedom that no mortgage payments gives you is a powerful motivator.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

Understanding Mortgage Prepayment Charges

With interest rates at historical lows, you may be thinking about renegotiating your mortgage rate to take advantage of lower rates. However, if you break your closed term mortgage, you will be assessed a prepayment charge.

Understand your options and find answers to frequently asked questions such as:

Why is there a prepayment charge for a closed-term mortgage? How is the prepayment charge for a closed variable rate or RateCapper mortgage calculated? How is the prepayment charge for a closed fixed rate mortgage calculated? Why can the prepayment charge change?

Make Payments Towards Your Principal

Making payments directly to the principal of the loan will save you money.

When you send your payment in each month, part of it goes to the principal and part to the interest. Early on, most of your mortgage payment goes towards interest. Towards the end, most of your payment will be going towards the principal.

If you pay down the principal early, you can reduce the amount you spend on interest. This is because interest is calculated as a percentage of the principal amount. A smaller principal amount means less interest will accrue.

Paying down large amounts earlier than later is advised because of the nature of amortization. If you wait to start making extra payments, you already will have lost a good deal to interest. Whereas, by making extra payments from the beginning, you can lop off a good deal of the principal and minimize the amount of interest you pay,

Recommended Reading: Can You Refinance Your Mortgage With Bad Credit

How To Calculate The Blended Interest Rate

This method of calculating a blended interest rate is simplified for illustration purposes. It does not include prepayment penalties. Your lender can combine the prepayment penalty with the new interest rate or ask you to pay it when you renegotiate your mortgage.

Example : Calculate the blended interest rate

Suppose interest rates have gone down since you signed your mortgage contract. To take advantage of these lower rates, you’re considering terminating your mortgage and renegotiating a new mortgage with your current lender.

Suppose you have:

- months until end of the term: 24

- current interest rate for a 5-year term offered by the current lender: 4.0%

- current term: 5 years or 60 months

- payment frequency: monthly

| Steps to calculate a blended interest rate | Example | Enter your information |

|---|---|---|

| Step 1: multiply your current interest rate by the number of months remaining on your current term | 5.5% x 24 months = 132 | |

| Step 2: subtract the number of months of the new term from the number of months remaining on your current term | 60 months 24 months = 36 months | |

| Step 3: multiply todays interest rate by the difference between the number of months of the new term and the number of months remaining on your current term | 4% x 36 months = 144 | |

| Step 4: add the results of Step 1 and Step 3 | 132 + 144 = 276 | |

| Step 5: divide the results of Step 4 by the number of months in the new term | 276 / 60 = 4.6 |

Calculation Of The Ird

To calculate the IRD, your lender typically uses 2 interest rates. They calculate the entire interest fees left to pay on your current term for both rates. The difference between these amounts is the IRD.

To do so, they can first use one of the following interest rates:

- the posted rate at the time you signed your mortgage contract

- your current rate or discounted rate as described in your contract

Your lender can calculate a second interest rate based on the following:

- the current posted rate for a term with a similar length

- the current posted rate for a term with a similar length minus the discount you were originally offered

Don’t Miss: Where Can I Find My Mortgage Loan Number

Mortgage Penalty Calculator 2022

What is the remaining balance on your mortgage?

What is the term-length and type of your current mortgage?

What is your current mortgage interest rate?

If applicable, what was the rate discount you received when you signed your current mortgage agreement?

If you are unaware of any discount, you can skip this step.

When did your current mortgage start?

Who is your current mortgage lender?

What is TD’s current interest rate for a3-year fixed rate mortgage?

Fixed Rate Mortgage Penalty Interest Rate

For fixed-rate mortgages, lenders usually use the greater of three months of interest or an interest rate differential . Each lender has their own IRD calculation. The interest rate that they use for their IRD is usually based on either their current advertised mortgage rates or their posted rates, which can often be much higher.

| Advertised Rate IRD |

|---|

| SimpliiLaurentian |

You May Like: Which Company Has The Lowest Mortgage Rates

Who Is Mortgage Payoff Best For

Paying off a mortgage early is often a consideration for homeowners looking to retire early or stay in their homes for an extended period of time.

Ultimately, the decision comes down to personal preference and whether the benefits outweigh the costs. Consider any prepayment penalty and the potential tax consequences. Also, conduct an inventory of your finances to determine if its more sensible to use the funds elsewhere, like to eliminate high-interest debt.

What If I Make Two Extra Mortgage Payments A Year

If making an additional payment on top of what youd already be paying extra through a biweekly schedule or committing to one annual extra payment is a feasible financial option for you, doing so can be a great way to gain full ownership of your home even faster.

However, you should only consider this option if it wont put your ability to pay for your other financial responsibilities at risk.

Don’t Miss: What Are Club Seats At Rocket Mortgage Fieldhouse

Will You Feel More At Peace Paying Off Your Mortgage

Some people hate debts hanging over their heads. If you lose sleep at night thinking about the interest you pay on your mortgage, you might feel better paying it off.

On the flip side, having your money tied up in your home might bug you more rather than paying it off slowly.

Think about what you value the most and handle your mortgage that way. If paying it off in one lump sum worries you, consider other options, such as bi-weekly payments.

The Cons Of Paying Off Your Mortgage Early

- Earn more by investing. The average mortgage interest rate right now is around 3%. The average stock market return over 10 years is about 9%. So if you pay your mortgage off 10 years early vs. invest in the stock market for 10 years, you’ll most likely come out on top by investing the money instead.

- Mortgage prepayment penalties. A mortgage prepayment penalty is a fee you pay the lender if you sell, refinance, or pay off your mortgage within a certain amount of time of closing on your initial mortgage usually three to five years. Not all lenders charge this fee, and you probably don’t need to worry about it if you’re waiting more than five years to pay off your mortgage. But you should always ask your lender first.

- Lose the mortgage interest tax deduction. As a homeowner, you can claim the amount you pay in mortgage interest on your taxes to lower your taxable income. You’ll lose this perk by paying off your mortgage early.

- Hurt your credit score.Several factors make up your credit score, and one is your mix of credit types. For example, maybe you have a credit card, car loan, and mortgage. By taking away one type of credit, your credit score will decrease. This should be a fairly small drop, but it’s something to consider.

Don’t Miss: What Were Mortgage Interest Rates In 2006

How Much Do You Value Peace Of Mind

Sometimes its less about the bottom line and more about peace of mind. If you own your home free and clear, that can provide benefits that cant be measured in strictly financial terms. For many, eliminating a monthly mortgage payment ahead of retirement can provide mental relief when considering living on a fixed income.

Personally, Im paying down my mortgage, says Thomas of Mission Wealth. It feels good to have it paid off before retirement. It might not always make financial sense, but it offers peace of mind and it might allow for better budgeting.

Another potential advantage is the ability to borrow against the equity in your home. Having a considerable amount of equity can allow you to establish a home equity line of credit , providing a source of emergency income, as well as allowing you to make home improvements or make progress toward other financial goals.

When To Pay Off Your Mortgage Early

It may seem like a good idea to pay off your mortgage early as soon as you have the right amount of money to do so, but there is more to consider. If you have a strong financial reason to pay off your mortgage earlier than expected then it makes a lot of sense. For example, if you want to retire earlier than expected then you dont want a mortgage in your retirement years.

However, paying off your mortgage early, no matter how you choose to do it, ties up a significant amount of liquidity that you could use to invest and build more wealth, or save for unexpected hard times. You also wont be eligible for some tax deductions any longer that youre able to take when you are actively paying on your mortgage.

Ultimately, the right time to pay off your mortgage early really comes down to your personal financial situation. It needs to be a time that wont hurt you financially and that benefits you over the long haul. We recommend working with your financial advisor to determine when that time is for your situation.

Don’t Miss: How Much Is Mortgage On 150k House

Should I Pay Off My Mortgage Early

If youre like most Americans, your mortgage is one of your biggest monthly expenses. Can you imagine what it would be like to not have to pay your mortgage every month?

If you were to eliminate your mortgage payment, you would be able to do more with your monthly income. Perhaps, you would have a surplus of cash you could invest or use to check items off your bucket list. However, while for some, paying off their mortgage might seem like a dream, its not always the best solution for homeowners. To identify if paying off your mortgage is the right financial move for you, here are a few things to consider.

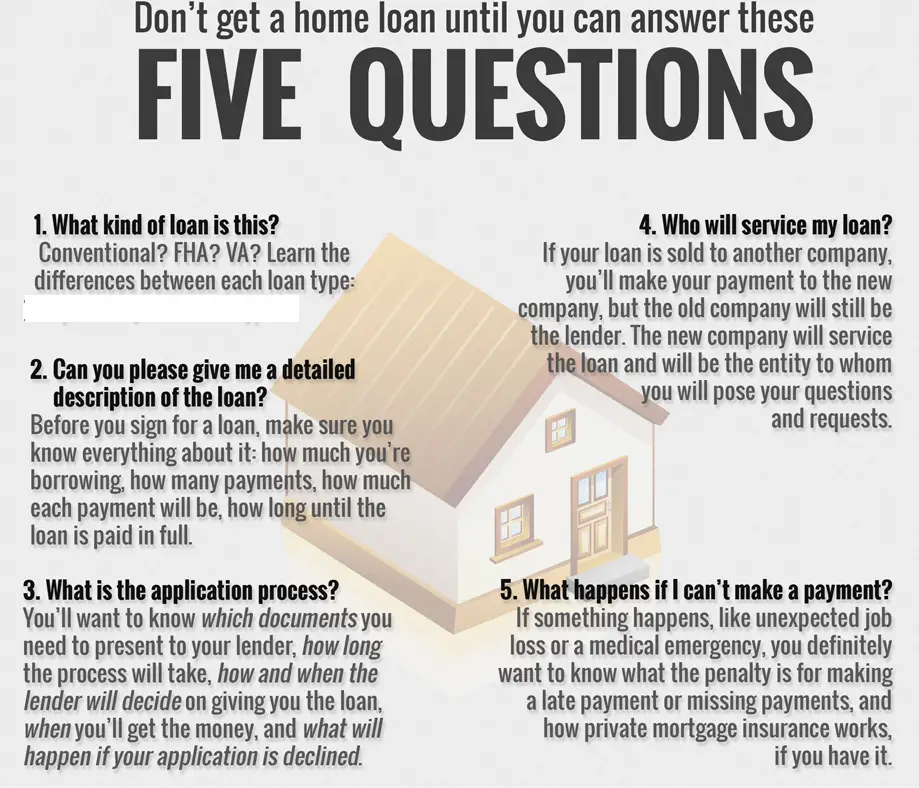

What Your Lender Needs To Tell You

If your lender is a federally regulated financial institution, such as a bank, they have to provide certain information.

The following details must appear in an information box at the beginning of your mortgage agreement:

- prepayment privileges

- prepayment penalties

- other key details

Your lender must tell you how they calculate your prepayment penalty. Your lender must also tell you what factors they use to determine the penalty. These details must be clear, simple and not misleading.

Read your mortgage contract carefully. Make sure you understand the details about penalties before you sign your contract. Ask questions about anything you dont understand.

Also Check: How Do Banks Make Money On Reverse Mortgages

Related Topics & Resources

Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Subject to underwriting guidelines, review and approval. Products and discounts not available to all persons in all states. Nationwide Investment Services Corporation, member FINRA. Home Office: One Nationwide Plaza, Columbus, OH. Nationwide, the Nationwide N and Eagle and other marks displayed on this page are service marks of Nationwide Mutual Insurance Company, unless otherwise disclosed. ©. Nationwide Mutual Insurance Company.

How To Find Out If Your Loan Has A Prepayment Penalty Clause

Speak with your mortgage counselor to learn more about your mortgage loan and if any prepayment penalties are included in the loan agreement. Your mortgage counselor can help determine if your loan agreement has prepayment penalty fees and how to avoid paying them. Ultimately, if early repayment fees are added to your mortgage loan, legally, there must be a clause that clearly states the fees and how charges are calculated.

Don’t Miss: What Does Conforming Mean In A Mortgage

What Are The Reasons For Breaking A Mortgage

Some scenarios:

- The current interest rate on your mortgage is 4.2% and you have 2-years left on your 5-year fixed rate before you have to renew. You do some research and your bank is currently offering 3.1% on a 5-year fixed rate. Because of current events, you suspect that you won’t be able to get this low rate a few years from now. You do the math and it looks like you’ll save more money in the long run if you switch now.

- You have a variable rate mortgage and you notice the rates are as low as you have ever seen them. So to lock in this new low rate you decide to switch to a fixed rate mortgage.

- You have come into a large sum of money and want to use it to pay off $200,000 of your mortgage principal but can’t because this amount is much higher than what is allowed in your mortgage contract. Thus, you must break your mortgage agreement to proceed.

- You cannot afford your current mortgage monthly payments. The solution would be to get a new mortgage with a longer amortization period so the monthly payments are reduced. Anamortization calculatorcan let you find out how much you can lower your mortgage payments by stretching out your amortization period.

- You have a accumulated a significant amount of credit card debt that is accruing interest at a rate of 19.99%. Your financial advisor strongly suggests consolidating your high interest credit card debt into your mortgage by taking equity out your home and refinancing.