Does It Cost Money To Lock In Your Rate

Sometimes rate locks cost money and sometimes they dont. The rate lock fee may be a flat fee, a percentage of the total mortgage amount or added into the interest rate you lock in. The fees may be refundable or non-refundable. Typically, short-term rate locks are free or cost roughly up to about 0.25 0.50 percent of the total loan, or a few hundred dollars. Lenders typically charge more for longer-term rate locks.

Are Mortgage Rate Locks Worth It

Given where mortgage rates are today, getting a rate lock can pay off.

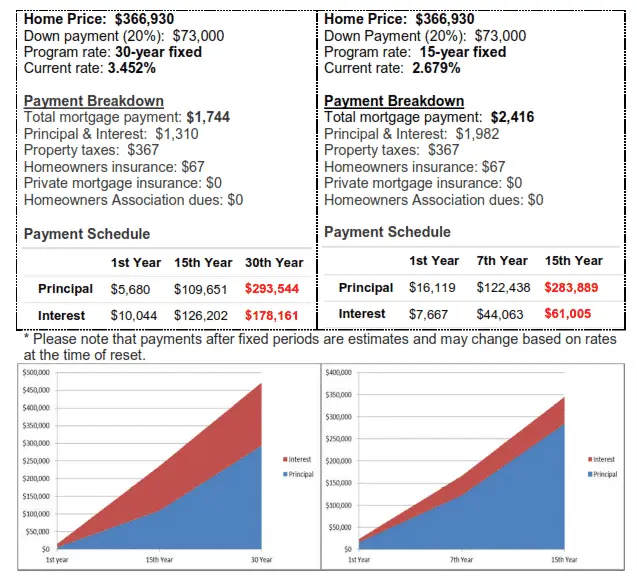

Consider if you lock in a 3.2 percent rate on a 30-year loan for $240,000. At this rate, the total interest youd pay over the next 30 years would be just over $133,650.

Now, lets say you dont lock your rate and rates rise to 3.4 percent by the time you close. For the same mortgage, youd pay more than $143,167 in interest a difference of about $10,000.

You can use Bankrates mortgage calculators to get a sense of what youd pay based on your rate lock.

What Happens If I Never Lock My Mortgage Rate

You eventually will have to lock your mortgage rate or you wont be able to close on your loan. Your lender is required to give you closing disclosures within certain timelines that detail your rate and closing costs. Your lender cant prepare an accurate closing disclosure if you dont lock your interest rate. If you delay locking your rate, you may end up with a much higher interest rate if rates rise. If youre close to the limit of your budget, then a higher interest rate may actually make you ineligible for your loan.

You May Like: How Do You Figure Out Mortgage Interest

Do I Lock A Rate When I Get Preapproved

No. When you get a preapproval letter, the mortgage rate youre quoted will be a floating rate. In other words, it will rise and fall in line with the overall market.

Your first chance to lock a mortgage rate is typically after you sign a purchase agreement to buy a home and have your loan application finalized. And, while you might decide to float your rate in the hopes that rates go down, you generally have to lock your rate at least five days before you close no matter what.

You can track whats happening to mortgage rates and where we think theyll head in the future on our daily rates report.

Should I Lock My Rate Today

If youve compared rates with at least three to five lenders and reviewed all the closing costs on the loan estimate, its best to get a rate lock as soon as possible. The speed at which rates are moving is something we havent seen in awhile, Kan said. If you find the right combination of rate and costs, locking in will protect you from volatility.

In addition, there are different factors to consider if youre buying versus refinancing a home.

Recommended Reading: Will Mortgage Rates Continue To Drop

When Can You Lock In A Mortgage Rate

When locking your mortgage loans interest rate, you can choose to secure it from the moment you receive initial loan approval to 5 days before the closing. Some lenders may even lock your rate at the same time they send you the loan estimate. However, your rate lock will have an expiration date, after which your interest rate will start to increase or decrease even if you havent completed your refinance or home purchase.

Thats why its essential to time your mortgage rate lock correctly to ensure you have a lower interest rate and APR for your new mortgage.

Unlike most rate lock options, RateShield® allows you to lock your rate for up to 90 days while you shop for a home with a one-time option to lower your rate if they fall during that period.

To know whether you should lock your rate right away, you may want to do some research to find out how rates have been acting. If rates have been rising, it might be best to lock your rate as soon as your mortgage or refinance is approved. If rates are on the decline, floating your rate could pay off.

Just keep in mind that no one can predict what rates will do. Floating your rate can be risky even a small increase in interest rates can cost you thousands of dollars over the life of your loan.

Lock your low rate today!

Get approved before interest rates continue to rise.

Decide Why Youre Refinancing

Refinancing is when you take out a new home loan to replace your old one. You might want to do that for a few reasons. If mortgage rates have dropped or your financial situation has improved significantly, you might be able to get a lower interest rate, meaning lower monthly mortgage payments. If your first loan was an FHA loan, you may have to refinance to a conventional mortgage to get rid of mortgage insurance. You may also want a cash-out refinance, in which you take out a loan for more money than you owe on the old loan to turn some of your equity into cash, maybe for home improvements or debt consolidation.

Recommended Reading: Does Rocket Mortgage Require Appraisal

Exactly What Are The Financial Rate Fashion Having 2022

Pricing features fluctuated but overall they truly are reduced than the price record. However,, of numerous masters believe prices will upsurge in 2022 .

Just like the cost savings recovers together with Government Reserve established their bundle to lessen their lower-speed formula the newest probably lead would be ascending financial rates. not, new presumption among benefits isnt really to own skyrocketing prices straight away, but instead a steady go up throughout the years.

Has just, even if, costs had been unpredictable. News of your Omicron COVID-19 variation has established fresh financial suspicion and that is putting upward tension toward pricing. At the same time, prices are getting downwards tension as a result of the high rising prices within the 40 years.

Long-term, masters nonetheless expect prices so youre able to reduced boost once the economy recovers. This new recent volatility could remain through the end of the year and you will towards the 2022.

Risks Of Taking On A Mortgage Rate Lock

A downside, for the borrower, is a mortgage rate lock would prevent them from taking advantage of lower rates that may occur during the lock period. Conversely the lender cannot take advantage of rises in interest rates.

Some borrowers walk away from the agreement if interest rates fall, and unscrupulous lenders have been known to let lock periods expire if interest rates rise under the guise that the borrower could not process the necessary paperwork in time.

A lock deposit requirement indicates that both the borrower and the lender intend to keep the agreement. A rate lock may be issued in conjunction with a loan estimate.

A mortgage rate lock period could be an interval of 10, 30, 45, or 60 days. The longer the period is could mean a higher interest rate is agreed upon. Essentially the rate lock would be lower on shorter intervals till the close because there is less risk of fluctuation in the market. If the lock period expires and the mortgage has not closed, it may be possible to request an extension to the rate lock. If an extension is not granted, then they mortgage will be subject to the going market rates.

Also Check: How To Get A Cheap Mortgage Rate

Basic Rate Locks Explained

When an interest rate is locked there is an expiration date associated with it. When the lock expires, the rate is no longer valid.

Rate locks are measured is calendar days and are typically done in 15-day increments going out as far as 90 days. Normal rate locks are typically 30 to 60 days. The rates shown on advertisements are typically 30-day locks.

Rates can be locked for 15, 30, 45, 60, 75, or 90 days. After 90 days the rate locks no longer operate in 15 day intervals. Moreover, rate locks beyond 90 days require up-front money to lock in the rate.

Dont Let The Lock Expire

Every mortgage rate lock has an expiration date based on the duration of the lock. The interest rate is lost and becomes void once it has expired. All costs and credits associated with the rate are also null and void.

Do not let the rate lock expire. All deposits are lost and will not be refunded if the rate lock expires.

Read Also: What Does It Mean Points On A Mortgage

How Long Should You Lock

The purpose of a rate lock is to allow enough time to close on your refi. Typical rate locks run from 7 to 90 days, longer in some cases. Some lenders will allow you to extend your rate lock if it expires however, some will not meaning youd be losing the refinance mortgage rates you initially locked.

You have several choices when it comes to when to lock your refinance rates. You can lock when submitting your application for mortgage refinancing, known as a pre-lock. This ensures your refinance mortgage rates are locked before your home loan is underwritten. Some homeowners choose to float their mortgage rates and lock at the last minute, gambling that rates wont go up while their application is being processed.

Its up to you to choose when to lock in your mortgage rates however, once you do if you dont get the rate lock in writing it never happened. Dont assume the lender or broker will lock your interest rate.

Also Check: Rocket Mortgage Conventional Loan

When Can I Lock My Interest Rate

Your first opportunity to lock a rate is usually when your final loan application has been approved. And that can only happen after youve signed a purchase agreement for your chosen home.

Be aware that no rate lock is open-ended. You have to close within a set time frame in order for the rate to be guaranteed.

Rate lock periods often last between 15 and 60 days, depending on your lenders policies. If your lock period expires before youre ready to close, you may be able to renew it for a fee. Or your rate may revert to the market rate .

Ask your lender about its locking policies. In particular, ask:

One last thing, try to lock your rate for a period that ends after your anticipated closing date. Delayed closings are common enough that theres a real risk you could be caught out. But keep the time frame reasonable because a longer rate lock can cost more.

Read Also: How Are Mortgage Interest Rates Determined

Timing Your New Construction Rate Lock

There have been times in recent history when locking in a 360-day rate would have paid off. For example, a home builder in August of 2021 could have locked in a 30-year fixed rate of 3 percent. Eleven months later, in July of 2022, that same home builder may pay 6% over a 30-year loan term.

Even if that extended rate lock cost $5,000, the extra cost would have paid off many times over the life of the loan.

That said, its very difficult to predict what will happen with mortgage rates in the future.

Theres always a possibility that rates will rise. So if you can afford the home you want now and have a chance to lock a rate, it may be wise to do so. But your lenders policies and rate lock fees will play into the decision.

You should work closely with your loan officer to analyze current interest rates, how the market is moving, and your own home buying budget. Together, the two of you will decide when it makes sense to lock a new construction mortgage rate.

What Happens If My Rate Lock Expires Before Closing

Your rate will begin to float with daily interest rate movements. The best idea is to talk to your lender well before your lock expires to see if they will extend it. If youve been responding promptly to each information request from the lender, the delays may not be your fault and you might get a little extra time.

Don’t Miss: Can You Buy A New Home With A Reverse Mortgage

Why Does Home Financing Works

A mortgage is a kind of secured mortgage where the possessions often your house is the security. So youll never be able to take out a mortgage as opposed to with a world real estate attached to they. Mortgages was issued by financial institutions, credit unions, or any other different varieties of lenders.

Except that paying the financing right back, you only pay to have home financing in 2 suggests: charge and notice. Attention is actually repaid on your loan equilibrium on lifetime of the mortgage that will be built-into your own monthly payment. Financial charge usually are reduced upfront and are also an element of the loans settlement costs . Particular costs can be charged per year or monthly, for example private financial insurance rates.

Mortgage loans is repaid more than what exactly is referred to as mortgage title. The preferred loan identity was thirty years. In addition there are a mortgage that have a shorter name, such as 15 years. Short-label finance features highest monthly installments however, down interest levels. Mortgages with lengthened terms and conditions provides lower monthly installments, but you will normally spend a high rate of interest.

What Are Todays Mortgage Rates

After setting record lows during the pandemic, average mortgage rates are once again near historic norms. Wider market forces set the context for rates today, but your rate will be unique to you.

To estimate your rate and loan costs, apply for a mortgage pre-approval.

Not only will a pre-approval show the rate you could likely lock in, itll also show home sellers youre a serious buyer.

Also Check: Why Are Mortgage Closing Costs So High

What Are The Risks If The Loan Is Not Locked

Let’s say you decide to wait. You’ve narrowed down where you will get a mortgage and looked at all your loan choices. Maybe you’ve even decided on the loan product you want. But the housing market is falling. The Federal Reserve has cut interest rates twice, and you expect them to drop further. So you decide not to lock.

This is no different from gambling. Rates may go down, and your gamble could pay off. In that case, you would have been a little worse off if you had locked your loan. But if rates go up, you have no protection. You will pay a higher rate if you remain with that lendera lock would have prevented the increase.

Factors That Could Change Or Void The Terms Of Your Mortgage Rate Lock

A mortgage rate lock is a guarantee for both the buyer and lender that an agreed-upon mortgage rate won’t change for a specific amount of time. There are certain stipulations that make this agreement work. Changes to your application details or agreed-upon exclusions could change the terms of your mortgage rate lock. Those changes include:

Recommended Reading: Am I Approved For A Mortgage

Can You Change Lenders After Locking A Rate

Yes, you can change lenders even after locking a rate. Its legal and doesnt carry a specific fee or penalty.

Sometimes borrowers choose to switch lenders in the middle of the transaction. While this isnt ideal for you, it may be necessary if your mortgage adviser is unresponsive or slow and if they lose paperwork or cant close on time.

What If I Lock My Interest Rate And Rates Go Down

When you lock your interest rate, you’re protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take advantage of a lower rate, you may be able to pay a fee and relock at the lower interest rate. This is called “repricing” your loan.

Note: If you’re using a Bond program, contact your home mortgage consultant to see if the bond program you’ve chosen allows you to modify your rate.

Don’t Miss: How Do You Abbreviate Mortgage

How To Calculate The Blended Interest Rate

This method of calculating a blended interest rate is simplified for illustration purposes. It does not include prepayment penalties. Your lender can combine the prepayment penalty with the new interest rate or ask you to pay it when you renegotiate your mortgage.

Example : Calculate the blended interest rate

Suppose interest rates have gone down since you signed your mortgage contract. To take advantage of these lower rates, youre considering terminating your mortgage and renegotiating a new mortgage with your current lender.

Suppose you have:

- months until end of the term: 24

- current interest rate for a 5-year term offered by the current lender: 4.0%

- current term: 5 years or 60 months

- payment frequency: monthly

| Steps to calculate a blended interest rate | Example | Enter your information |

|---|---|---|

| Step 1: multiply your current interest rate by the number of months remaining on your current term | 5.5% x 24 months = 132 | |

| Step 2: subtract the number of months of the new term from the number of months remaining on your current term | 60 months 24 months = 36 months | |

| Step 3: multiply todays interest rate by the difference between the number of months of the new term and the number of months remaining on your current term | 4% x 36 months = 144 | |

| Step 4: add the results of Step 1 and Step 3 | 132 + 144 = 276 | |

| Step 5: divide the results of Step 4 by the number of months in the new term | 276 / 60 = 4.6 |