What Are Typical Jumbo Loan Requirements

Jumbo loans have different requirements compared to conforming loans. These include:

- The minimum credit score required for a jumbo loan depends on the mortgage lender, but is usually at least 700. Conforming loan credit score minimums are typically 620 or 640.

- DTI ratio When it comes to DTI, the lower the better, especially for a jumbo loan. Many lenders look for no higher than 43 percent.

- Down payment The minimum down payment on a jumbo loan also varies by lender. This is because theres less of a secondary market for jumbo loans, and more of them are held in the lenders portfolio, explains Greg McBride, CFA, Bankrate chief financial analyst. This can mean a down payment higher than the traditional 20 percent and instead be at 25 percent or 30 percent, but some lenders offer programs that have lower down payment requirements, McBride says.

Purchasing Or Refinancing Investment Properties With A Jumbo Mortgage

Jumbo loans are not limited to primary residences, making them a viable financing option for investors who want to buy or refinance their high-end properties. However, not all lenders may offer jumbo loan options for secondary or investment properties, and the ones that do could have specific requirements and loan limits. Be sure to do your research beforehand.

The Jumbo Smart loan from Rocket Mortgage® is a great example of a loan option for primary households and rental properties alike. With the Jumbo Smart loan, you can borrow up to $2 million for an investment property. If you want to purchase or refinance a vacation home, the property must be a single-family dwelling. Otherwise, rental properties can be either a single or double unit.

Similar to primary home requirements, youll need at least a 680 FICO® Score and a DTI below 45% to qualify for the Jumbo Smart loan for your investment properties and secondary homes. Requirements may be higher depending on your loan purpose. Note that only the 30-year fixed jumbo loan is available for investment properties. 15-year fixed and ARM options are only available on primary and secondary homes.

Potentially Higher Interest Rates

Jumbo mortgage rates may be slightly higher than those on conforming loans, depending on the lender and your financial situation. However, many lenders can offer jumbo loan rates that are competitive with rates on conforming loans and some may even offer slightly lower rates depending on market conditions, so make sure to shop around.

Recommended Reading: Can You Refinance An Arm Mortgage

Va Jumbo Loan Credit Score Requirements

Depending on the lender, you may need enough cash reserves to cover a certain number of months worth of mortgage payments. Veterans United doesn’t currently have a cash reserve requirement for most VA jumbo loans.

Overall, VA jumbo loan guidelines vary depending on the lender, the size of the loan and other factors. But they’re often considerably more lenient than what veterans and military buyers will need for conventional jumbo loans.

Need help determining if you’re eligible for a VA jumbo loan? Speak with a trusted VA-lending specialist today

How Much Do You Need To Make To Afford A 500000 House

Need income for a 500k mortgage? A $500k mortgage with a 4.5% interest rate for 30 years and a $10k down payment requires an annual income of $121,582 to qualify for the loan.

What salary do you need to buy a 400k house? What income is required for a 400k mortgage? To pay off a $400,000 house, borrowers need $55,600 in cash to pay off 10 percent. With a 30-year mortgage, your monthly income must be at least $8,200 and your monthly payments on existing debt must not exceed $981.

Don’t Miss: How Much Will I Be Loaned For A Mortgage

What Exactly Is A Jumbo Mortgage

A mortgage is considered jumbo if the dollar amount falls above a certain limit. The limit is currently $548,250for most areas however, it can be greater in certain high-cost regions. Mortgages less than $548,250 typically are called conforming conventional mortgages. Many federal home ownership programs do not apply to jumbo mortgages, and lenders often charge higher rates for jumbo mortgages or have more restrictions on the loan.

Jumbo Loan Limits Vary By Property Type And Region

- It certain high-cost regions of the country there are expanded jumbo loan amount limits

- These loan limits are also higher for multi-unit properties like duplexes and triplexes

It should be noted that there are different jumbo loan limits depending on both the number of units on the property, along with where the property is located.

There are also high-cost conforming limits that arent jumbo or conforming, but somewhere in between, which Ill discuss below.

For properties located in the contiguous United States, including D.C and Puerto Rico, jumbo loan limits are as follows:

1-unit property: Greater than $548,250 2-unit property: Greater than $702,000 3-unit property: Greater than $848,500 4-unit property: Greater than $1,054,500

*In Alaska, Guam, Hawaii, and the U.S. Virgin Islands, jumbo loan limits are even higher.

For example, you can get a home mortgage as large as $1,581,750 for a four-unit property in Honolulu before it is considered jumbo.

As you can see, in some parts of the country, you can get a very large loan without entering into jumbo loan territory. The same goes for multi-unit properties in all 50 states.

Rather importantly, jumbo mortgages cannot be sold to Fannie Mae or Freddie Mac.

As a result, outside investors typically buy these nonconforming mortgages in securitized bundles on the secondary market, or lenders simply keep them on their own books .

Conversely, real estate priced closer to the national median is never short of buyers and sellers.

You May Like: How Much Mortgage Might I Qualify For

Why Are Jumbo Loan Limits Necessary

Conforming loan limits are set by the Federal Housing Finance Agency, which oversees Fannie Mae and Freddie Mac, the two government-sponsored enterprises that buy a large portion of mortgages made in the U.S. from lenders and resell them on the secondary market to investors. These limits help lenders make more loans available to borrowers, since the lender can now sell them to the GSEs, mitigating risk if the borrower cant repay. Loans outside of the conforming loan limits, including jumbo loans, are riskier for lenders.

Jumbo Refinance Rates In California

Mortgage industry guru, Rob Chrisman, reminded us recently that Freddie Mac 30-year fixed mortgage rates started 2020 at 3.72%, just 40 basis points above its all-time low, and plunged to 2.65% by the start of 2021. Now theyre back up to 3.125% 3.25%. Freddies volume in February was over 75 percent refi

With rates up so much now , many lenders are panicking and trying to shift to purchase money mortgages in a hurry.

While most of the easy pickin refis are long gone, there are still millions of borrowers who can benefit from a refi, particularly if they have PMI or debts to consolidate.

Recommended Reading: How To Calculate Interest Only Mortgage Payment

Minimum And Maximum Loan Amounts

If you are wondering whether youll need a jumbo loan, you need to consider the limits set for conforming loans and U.S. Federal Housing Administration loans. The agency-set maximum limits for these loans provide a baseline for jumbo loans.

Most parts of the country have one maximum loan amount for conforming loans. In some high-cost areas, such as Washington D.C. and certain California counties, the threshold for the maximum conforming loan is higher.

For 2022, the Federal Housing Finance Agency raised the maximum conforming loan limit for a single-family property from $548,250 to $647,200. In certain high-cost areas, the ceiling for conforming mortgage limits is 150% of that limit, or $970,800 for 2022.

Those limits apply to conforming loans that follow Fannie Mae or Freddie Mac guidelines. A different loan limit kicks in if youre buying a home in 2022 using an FHA loan, which is backed by the Federal Housing Administration. The maximum FHA loan limit for one-unit properties in low-cost areas in 2022 is $420,680, up from $356,362 in 2021. The maximum limit for one-unit properties in approximately 70 high-cost counties has been raised to $970,800, up from $822,375 in 2021.

Homebuyers’ In Expensive Real Estate Markets

Consider a jumbo loan if you’re looking to take out a loan to purchase an expensive property. You will likely have to meet some requirements to qualify, including having a high credit score and a large down payment.

Jumbo loans are ideal for people who are purchasing homes in expensive real estate markets or borrowing money to buy luxury vacation homes or investment properties.

Homeowners who want a large loan may consider a jumbo loan if you:

-

want to make a 20% or larger down payment on your home

-

are refinancing your mortgage

-

want to consolidate other debts, such as paying off a car loan or credit card debt

- are purchasing a second home and plan to use the first home as collateral

If you fall into one of these categories but don’t have perfect credit, you may still qualify for a jumbo loan with the help of a co-signer who does.

In addition, some lenders set different requirements according to how much you’re borrowing. For example, they could require borrowers who take out loans totaling $1 million or more to have higher credit scores than those applying for lower amounts. Finally, you might be able to qualify by having significant assets and cash savings and investments.

You May Like: Would I Be Eligible For A Mortgage

What Happens If You Default On Your Jumbo Mortgage Payment

You’ve seen that little flyer in the mail a few times, offering you a teaser rate of 3.99% on your mortgage payment. You’re unsure how to use it because it’s in tiny print and doesn’t make sense.

So, you put it in the recycling bin, but then you lose track of it. Then one day, nearly a month later, you open your mailbox, and there’s a letter from your bank saying that you’ve failed to make four payments.

Your credit score is already low. The bank will start sending notices if more payments are latebut does this mean that now that all of your payments are past due, the bank can legally foreclose? Is it possible for them to take your home away from you? Or worse: What happens if you default on the loan entirely?

Bad things happen when you default on your jumbo loan, but first, let’s look at some numbers. Later, we’ll show you how to avoid defaulting.

Statistics on loan defaults during COVID

-

By April 2020, the default rate for all loans was 2.8 %, up from 1.8% in December 2019.

- In June 2020, the overall loan default rate rose to 3%.

If you are concerned about missing a payment on your loan or mortgage, contact your lender as soon as possible to sort out a solution that works for you and your lender together.

How Do I Get A Jumbo Loan With 5% Down

Simply by shopping around. Check in with a few different mortgage lenders and ask about their minimum down payment for a jumbo loan.

Ask about credit score and income requirements, too, to see whether youre likely to qualify.

Youll likely have to look beyond your local bank, says Eric Jeanette, president of Dream Home Financing and FHA Lenders. There are many online lenders who have creative loan programs that local banks simply do not offer.

Another way to find a low down payment jumbo loan is to look to wholesale mortgage brokers.

Wholesale mortgage brokers have relationships with many lenders who can offer flexible terms and guidelines. They can also yield the most cost-effective mortgage solutions for the jumbo loan market, says David Yi, president at Providence Mortgage.

When you find a lender offering low-down-payment jumbo loans, you can fill out a pre-approval application to verify your eligibility.

Then, once you have a signed purchase agreement on the home, your lender will be able to issue a final loan approval confirming the interest rate, loan terms, and closing costs on your new jumbo loan.

One thing to note: most lenders are not very forthcoming with information about their jumbo loans online. So dont expect to find everything you need on a lenders website.

Instead, get in touch directly with a loan officer or mortgage broker who can fill you in on the details.

Read Also: How Do You Figure Out Mortgage Interest

The Difference Between Jumbo And Conforming Loans

For 2019, in most of the continental U.S., the conforming loan limit is $484,350. In Alaska, Hawaii, certain U.S. territories, and specific counties in the lower 48 states where home prices are exceptionally high, the limit can be as much as $726,525, or 150% of the national median. You can check the conforming loan limit for all U.S. counties at the FHFA website.

A mortgage for an amount greater than the local conforming limit is considered a jumbo loan.

Jumbo loans typically come with strict credit requirements and an even more rigorous review of applicant finances than conventional mortgages.

What Is A Jumbo Mortgage Anyway

Even as a mortgage professional, I am sometimes overwhelmed by the number of different loan types available. FHA, VA, Conventional, Fannie Mae, Freddie Mac All those words seem to run together and can become quite confusing. However, when you start browsing loans, one loan type is likely to jump out at youand probably not in a good way.

The term jumbo loan just does not sound good, does it? It brings to mind huge payments, bloated interest, and overall scariness. However, it is important that every homebuyer understand what a jumbo loan is and is notbecause this loan type may be more important to you than you think!

Recommended Reading: Can You Get A Mortgage With A 620 Credit Score

Jumbo Loans Vs Conforming Loans

The key difference between a jumbo mortgage and a conforming loan is the size of the loan. For a thorough look at the two, and the pros and cons of each, read about the differences between conforming and nonconforming loans.

Among the other factors that differentiate jumbo loans from conforming loans:

The Bottom Line On Jumbo Loans

A jumbo loan can be a useful option if you want to purchase a home thatâs on the pricier side or live in a costly area. Before you apply for one, you should evaluate your financial situation to determine whether a jumbo loan makes sense. Not only are they more expensive, but jumbo loans also usually have stricter requirements for borrowers. If you can meet those standards, however, then a jumbo loan may be right up your alley.

Don’t Miss: How To Determine Mortgage Pre Approval Amount

How To Qualify For A Jumbo Loan Mortgage

Not everyone that wants a jumbo loan can get one.

Jumbo mortgages are difficult to procure because not every lender offers them. The bigger the loan, the longer it takes to pay off, and the extended timeline presents more risk than most lenders allow. It is still possible to get a jumbo loan, but your interest rates will be higher than the traditional home mortgage, and it could be extremely difficult even to qualify.

Lynch gives us an exclusive inside look at PCMAs average client for a jumbo mortgage.

- Loan Amount: $1,004,302.89

- Co-Borrower Age: 59

- Years in Home: 16

Lenders look for a higher credit score for jumbo loans than they do for a conventional mortgage. Your debt-to-income ratio is also important, and lenders tend to prefer anywhere from 43% to as low as 36%.

The higher loan amount of a jumbo mortgage can make some banks uneasy, so to quell anxious nerves, they may ask for proof of reserve funds, such as savings or jewelry. This can go a long way in proving to a lender you are capable of repaying your loan.

The down payment is larger, too. Many lenders will accept as little as 3% for an average home loan, even though personal finance experts typically recommend aiming for 20%. On jumbo mortgages, lenders will look for anywhere from 15% to 30% down on loans. Additional appraisals may also be required.

Should You Avoid Jumbo Financing

This page updated and accurate as of November 25, 2021 Jumbo Mortgage Source

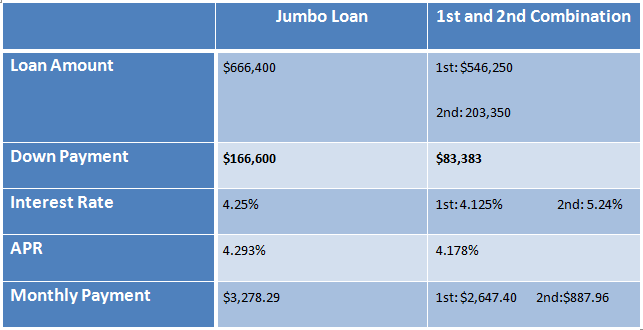

Jumbo loans are loan amounts above local conforming loan limits, in most locations this conventional loan limit is currently $548,250. Things have changed somewhat over recent years with Jumbo loans and these changes have made them more attractive, primarily as it relates to jumbo interest rates and structuring loans.

For some lenders not very experienced in the jumbo market, consumers might get the impression the lender doesnt want to issue a jumbo loan. Why? Because one of the first things some loan officers do is to find ways around a jumbo mortgage and get a bit more creative with your purchase. Yet that might very well be a mistake, especially so for those with higher credit scores and greater down payment.

In the past, say pre-2007, fixed jumbo interest rates could be more than 1.0% higher than for a conforming loan under the same circumstances. If a conforming rate was at 3.50% on a $400,000 loan a jumbo rate might be somewhere around 4.50% on a $600,000 mortgage. Using a 30 year fixed rate of 4.50%, the 1.0% difference can mean a lot, especially over the long term. Thats why some loan officers will run different scenarios in order to avoid the perceived pain of a jumbo rate.

Now, instead of a single jumbo loan, keep the first mortgage at $548,250 and follow up with a second lien of $91,750. Using the lower 3.5% conforming rate on $548,250 the principal and interest payment would be $2,461

Recommended Reading: How Much Would Mortgage Be On A 500 000 House