Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

Calculator: Start By Crunching The Numbers

Begin your budget by figuring out how much you earn each month. Include all revenue streams, from alimony and investment profits to rental earnings.

Next, list your estimated housing costs and your total down payment. Include annual property tax, homeowners insurance costs, estimated mortgage interest rate and the loan terms . The popular choice is 30 years, but some borrowers opt for shorter loan terms.

Lastly, tally up your expenses. This is all the money that goes out on a monthly basis. Be accurate about how much you spend because this is a big factor in how much you can reasonably afford to spend on a house.

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

How To Use Our Mortgage Payment Calculator

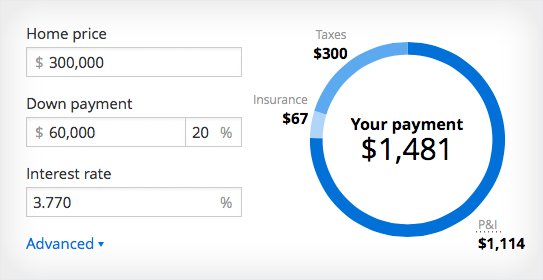

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Read Also: Rocket Mortgage Payment Options

How Can I Pay My 250k Mortgage In 5 Years

Regularly paying just a little extra will add up in the long term.

Here Are Mortgage Rates For May 31 202: Rates Cool Off

Today quite a few notable mortgage rates tailed off, though rates are expected to rise this year. Here’s what that means for you if you’re in the market for a mortgage.

A couple of closely followed mortgage rates trended lower today. 15-year fixed and 30-year fixed mortgage rates both decreased. The average rate of the most common type of variable-rate mortgage, the 5/1 adjustable-rate mortgage, also receded.

Mortgage rates have been slowly rising since the start of this year, and are expected to increase throughout 2022. Rates are now closer to 2018 levels than the historic lows seen during the height of the pandemic. Interest rates are dynamic — they rise and fall on a daily basis depending on economic factors. In general, now is a good time for prospective homebuyers to lock in a lower rate rather than later this year. Speaking with multiple lenders will help you find the best rate available for your financial situation.

Also Check: Chase Mortgage Recast

The Bottom Line: Shorter Or Longer You Have Many Choices

When it comes to mortgage terms, 15-year mortgages are perfect for those with the income to make the higher monthly payments. But just because youre not ready to commit to a 15-year mortgage now doesnt mean you cant enjoy the benefits that come with paying your mortgage off earlier.

Ready to apply? Get started with Rocket Mortgage today.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Pro: Youll Build Home Equity Faster

With a 15-year mortgage, you also build home equity in your home faster. Home equity is the portion of your property that you truly own. Its the difference between what your home is worth and whats left on the loan.

When you pay off your mortgage at double speed, you build up equity faster. That means youll be able to refinance your mortgage quicker if better rates become available, you need cash to undertake renovations or you want to buy an investment property.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

Tips For Buying An Affordable Home

- Set aside funds for home maintenance and emergencies. Unexpected expenses are par for the course for homeowners, so youll want to make sure you can cover them without taking on debt. Whether its a broken appliance or a pipe that springs a leak, home repairs always seem to happen at inconvenient times and wind up costing more than youd expect. State Farm recommends setting aside 1 percent to 4 percent of your homes value for emergency repairs each year.

- Plan for income changes. If you or your partner or co-borrower wants to switch up the employment situation after moving, youll want to make sure to factor that into your budget. You dont want to wind up taking out a mortgage that you can no longer afford.

- Shop around to save on homeowners insurance. Comparing mortgage offers isnt the only way to save. Youll also want to solicit quotes from multiple insurers to make sure youre getting the best deal.

- Stay within your means. A lender might be willing to offer you a larger mortgage than youre comfortable with or able to pay. Dont buy a house just because the bank tells you you can afford it only commit to monthly payments that actually fit into your overall budget.

| Loan Type |

|---|

How Much Extra Should You Pay To Payoff Your Mortgage Early

You dream of paying off your mortgage early.

You long for the day when you are debt free.

But how do you do it?

How much must you pay each month to be out of debt by a certain date?

What if you wanted to pay off your mortgage in 15 years instead of 30? How much would you save?

The good news is this mortgage payoff calculator makes figuring out your required extra payment easy.

You choose how quickly you’d like to pay off your mortgage, and the calculator will tell you the required extra monthly payment to get it done. It will also tell you how much interest you’ll save!

However, before you start making your extra payments, there are a few factors you’ll want to consider first . . . .

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

Make An Extra Mortgage Payment Every Year

Throw all or a portion of new-found money like a year-end bonus or inheritance at the mortgage. The earlier into the loan you do this, the more of an impact it will have. In a typical 30-year mortgage, about half the total interest you pay will accumulate in the first 10 years of your loan. That is because your interest rate is calculated against the very high principle amount you owe in the early years.

More Mortgage Tools And Resources

You can use CNET’s mortgage calculator to help determine how much you can afford for a house and work out how to manage financially. The tool takes into account your monthly income, expenses and debt payments. In addition to those factors, your mortgage rate will depend on your credit score and the zip code where you are looking to buy a house.

Find the Best Refinance Rates with the CNET Rate Alert

Don’t Miss: Chase Mortgage Recast Fee

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Apply For A Home Loan Online

Assurance Financial aims to help people achieve the American dream of homeownership. If youre ready to make the first step towards buying your home, were here to help. Abby, our online mortgage assistant, can walk you through the process of putting together your application.

You can get started with Abby today or set up an appointment to put together your application at a time that works for you. If youd rather talk to a representative right away, you can connect with a loan advisor in your state who can help you review your mortgage options and choose the one that works for you.

Recommended Reading: Rocket Mortgage Loan Requirements

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

Refinance With A Shorter

A shorter term on the mortgage means it goes away sooner, but at the cost of a much higher monthly payment and perhaps some out of pocket closing costs. Examine the loan closely.

The monthly payment on a 30-year, $200,000 mortgage at 2.5% would be $790 a month.

The monthly payment on a 15-year, $200,000 mortgage at 2.25 % would be $1,310.

Thats another $520 a month to finish paying off your mortgage 15 years sooner.

30 Years vs 15 Years of Payments| 30 Years of Payments |

|---|

| $235,830 |

| *For a $200k mortgage |

The bottom line on this decision is the bottom line: Can you afford the higher monthly payment of a 15-year loan, or are you better off contributing extra each month when you can to a 30-year payment?

You May Like: Rocket Mortgage Launchpad

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

Recommended Reading: Chase Recast

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

How Do I Pay Off A 30

There are a few ways to pay down a 30-year mortgage in 15 years. First, you could consider refinancing your current mortgage into a 15-year fixed mortgage. Another way is to make extra payments towards the principal amount or make biweekly payments equally one additional mortgage payment per year. This might not get you to the 15-year mark, but the amount of principal would most certainly go down.

Read Also: Rocket Mortgage Loan Types

Explanation Of Mortgage Terms

Mortgage terminology can be confusing and overly complicatedbut it doesnt have to be! Weve broken down some of the terms to help make them easier to understand.

Learn about

Home Price

Across the country, average home prices have been going up. Despite the rise in home prices, you can still find a perfect home thats within your budget! As you begin to house hunt, just make sure to consider the most important question: How much house can I afford? After all, you want your home to be a blessing, not a burden.

Learn about

Down Payment

The initial cash payment, usually represented as a percentage of the total purchase price, a home buyer makes when purchasing a home. For example, a 20% down payment on a $200,000 house is $40,000. A 20% down payment typically allows you to avoid private mortgage insurance . The higher your down payment, the less interest you pay over the life of your home loan. The best way to pay for a home is with a 100% down payment in cash! Not only does it set you up for building wealth, but it also streamlines the real estate process.

Learn about

Mortgage Types

15-Year Fixed-Rate Mortgage

30-Year Fixed-Rate Mortgage

5/1 Adjustable-Rate Mortgage

Learn about

Interest Rate

Learn about

Private Mortgage Insurance

Learn about

Homeowners Insurance

Learn about

Homeowners Association Fees

Learn about

Monthly Payment

Learn about

Property Taxes

Mortgage Calculator Uses

What Are The Differences Between 15

A 15-year mortgage’s monthly payments are higher than a 30-year mortgage, often significantly higher. A 30-year mortgage allows a borrower to stretch out payments over a long time and keep more of their monthly earnings. A 30-year mortgage has a higher interest rate than a 15-year mortgage, and you will pay more in interest rather than principal payments on a 30-year mortgage.

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

What Is The Difference Between A 15

Short term mortgages, like a 15-year loan, means a higher monthly mortgage payment that can be 40% to 50% higher than a 30-year mortgage. But youll be able to pay off the loan much sooner. The flip side, a 30-year mortgage means a lower mortgage payment but it will greatly increase the interest youll pay over the life of the loan.

| LOAN TERM |

Diy Extra Payment To Prepay Mortgage

Lets say you want to budget an extra amount each month to prepay your principal. One tactic is to make one extra mortgage principal and interest payment per year. You could simply make a double payment during the month of your choosing or add one-twelfth of a principal and interest payment to each months payment. A year later, you will have made 13 payments.

Make sure you earmark any additional principal payments to go specifically toward your mortgage principal. Lenders typically have this option online or have a process for earmarking checks for principal payments only. Ask your lender for instructions. If you dont specify that the extra payments should go toward the mortgage principal, the extra money will go toward your next monthly mortgage payment, which wont help you achieve your goal of prepaying your mortgage.

Once you have built sufficient equity in your home , ask your lender to remove private mortgage insurance, or PMI. Paying down your mortgage principal at a faster rate helps eliminate PMI payments more quickly, which also saves you money in the long run. You can also refinance your mortgage to eliminate PMI altogether.

You May Like: Does Rocket Mortgage Sell Their Loans