Mortgage Payments By Income

Just like the average mortgage payment in Utah is different from payments elsewhere, this segment varies by income, as well. According to the data provided by the US Census Bureau, Americans making the most money have the highest average house payments per month. People from this income group, interestingly, dont have the highest median interest rate.

The highest mortgage interest rates are reserved for Americans making between $10,000 and $39,999. Those from the $10,000-19,999 income group are among the consumers paying the highest interest rate. Yet, they boast the lowest typical mortgage payment per month.

As you can see in the table above, households making $120,000 or more pay the highest median mortgage of about $1,600. Those making $10,000-19,999 meanwhile pay the lowest median mortgage payment per month of $607.

The difference between the highest and lowest median payments is an impressive $993. The first group gets better median rates of 4%, while the latters median mortgage rate is 5%.

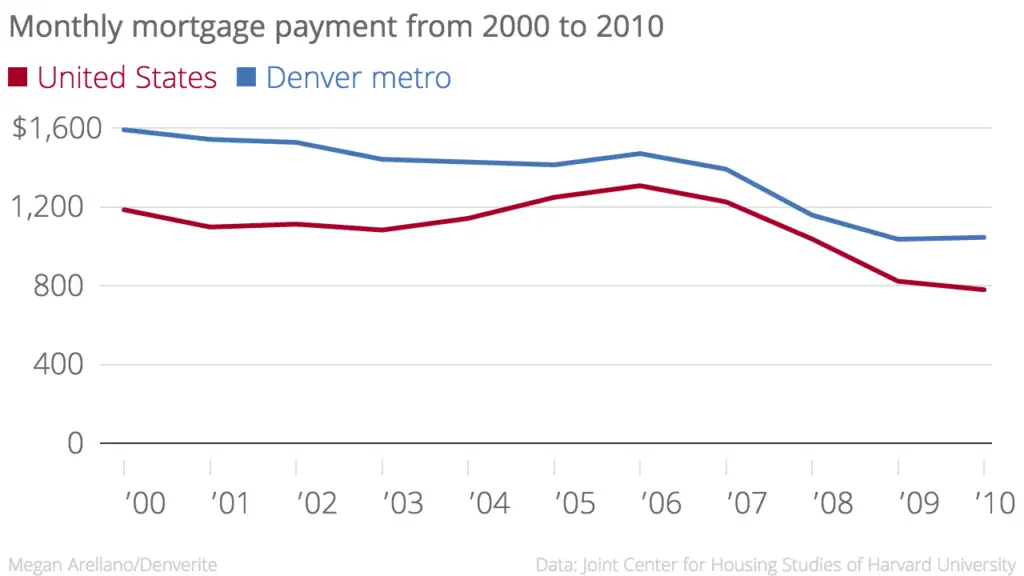

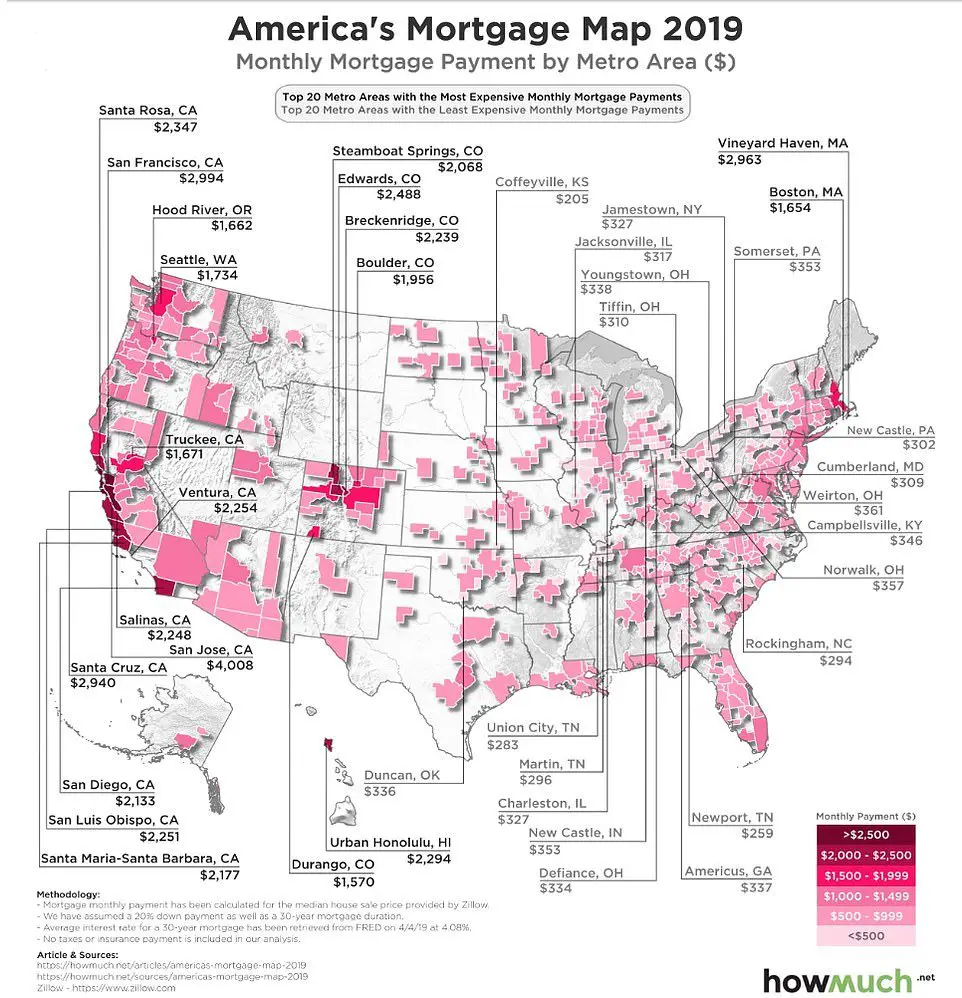

Average Monthly Mortgage Payment For Cities In Colorado

Here are some figures that can give you an idea of monthly mortgage payments in Colorado:

- The average cost of a house in Pueblo is $280,723.00, and the monthly mortgage payment is around $1,053.00.

- The average cost of a house in Grand Junction is $278,809.00, and the monthly mortgage payment is around $1,048.00.

- The average price of a home in Colorado Springs is $388,907.00, and the monthly mortgage payment is around $1,350.00.

- The average price of a house in Denver is around $568,178.00 while the monthly mortgage payment is approximately $2,376.00.

Realize That Other Expenses May Come Up

Even if your mortgage doesnt stretch your budget, an unexpected job loss or other event could cause you to struggle to make your mortgage payments. The more affordable a home is in the first place, the better chance youll have of recovering.

Building up an emergency fund is easier if you limit your mortgage payment to 25 percent of your take-home pay. The more cash you have on hand, and the lower your monthly obligations, the better chance youll have of staying afloat if difficult times strike.

Recommended Reading: Reverse Mortgage For Condominiums

Also Check: How Much Is Mortgage On A 1 Million Dollar House

The Cost Of Living In Colorado

U.S. Census Bureau data shows Colorados population grew by 1.4% from 2017 to 2018, which is the seventh highest rate in the nation. That growth probably isnt surprising to anyone whos visited or seen pictures of Colorado: Its a beautiful state thats perfect for nature-lovers. But is Colorado affordable? The answer depends on where in the state you live. It also depends on how sound your financial plan is if you need help figuring out whats within your means, try speaking with a financial advisor.

No Central Air Conditioning

One thing that might surprise you by moving to Colorado is that many homes DO NOT have central air conditioning.

As a girl from Texas, I found this quite shocking. But after living in the state for my first year, I quickly realized that air conditioning is usually not needed.

In fact, our home in Colorado Springs does not have central A/C . And weve honestly never needed it.

In addition, many small businesses and shops do not have central A/C in their buildings.

Colorado is a state that likes to keep its doors open to nature and to reduce the amount of noise created by central air conditioning units.

Recommended Reading: Rocket Mortgage Vs Bank

Prices For Homes In Cities Across Colorado

Here are just some of the different median home prices in various cities in Colorado:

- Boulder $973,606

- Fort Collins $519,264

- Grand Junction $346,449

As you can see, the prices vary widely. You could be buying a home for as little as $346,449 in Grand Junction or as much as $973,606 in Boulder. As such, your down payment amount will also vary.

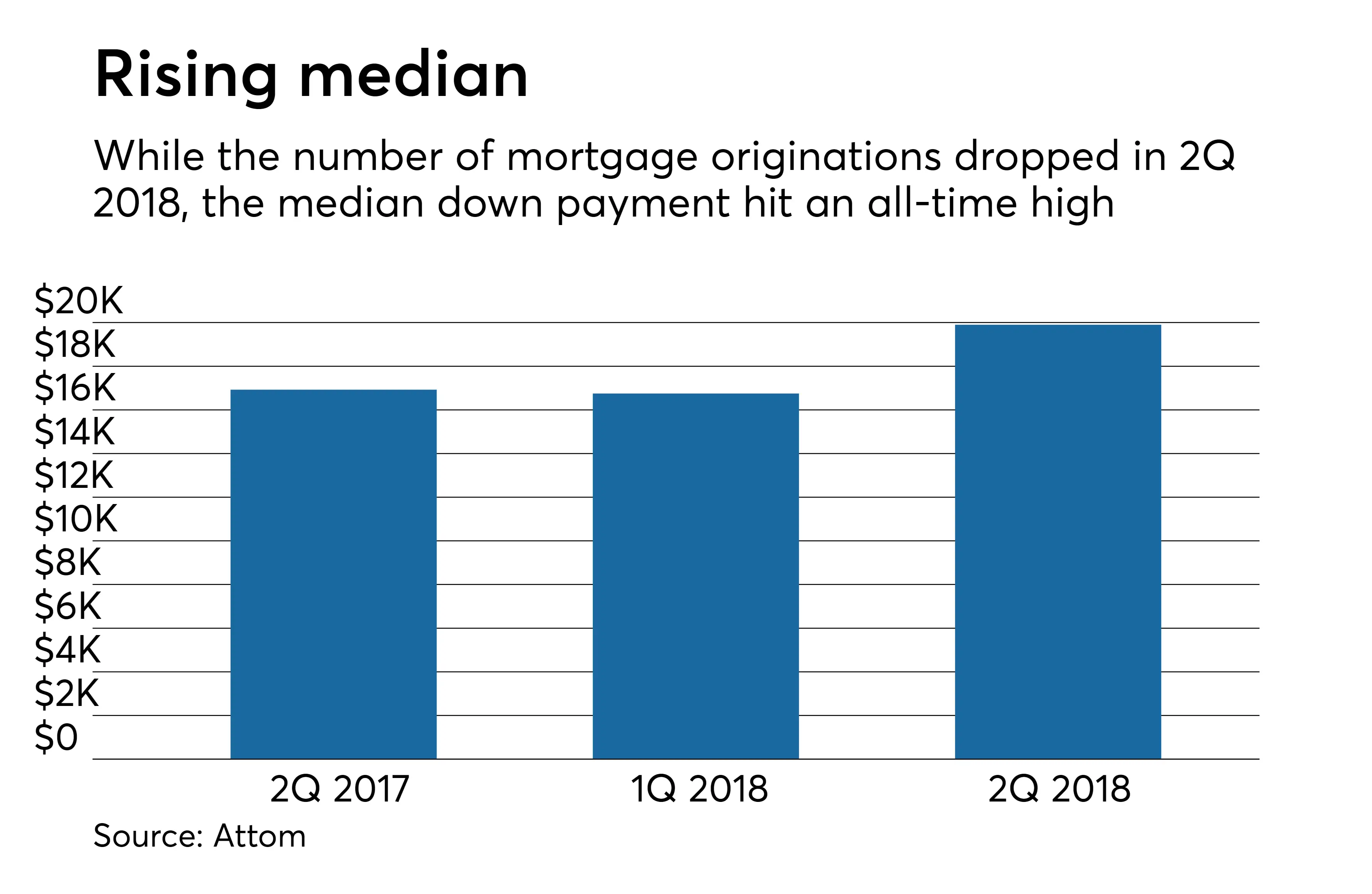

When it comes down to it, the price of the home, your credit score, and the amount of money youre able to come up with will dictate how much you will be putting down towards the purchase of a home.

Related: Why You Should Get Pre-Approved for a Mortgage Before You Start Shopping

The down payment is a crucial piece of the puzzle when it comes to getting a mortgage in Colorado. Obviously, the more money you can put down, the better in terms of how much you have to borrow and how much you end up having to repay when all is said and done.

Regardless of how much you can come up with, a down payment is required. Do your best to start saving early in order to have enough to secure a mortgage.

Low Cost Of Natural Gas

Colorado is the 6th largest natural gas-producing state, and is among the top 5 natural gas-producing states in the country.

This makes it easy for Colorado residents to use the natural gas they produce, reducing the high cost of transportation and delivery required from out-of-state.

However, with the economy still reeling from 2020 and potentially having a shortage soon, prices for natural gas have skyrocketed.

Instead of traditional electric stoves and central heat, many homes have gas cooktops and a furnace to keep the home warm in the winter.

In fact, 7 out of 10 households in the state use natural gas as their primary home heating source.

You May Like: 10 Year Treasury Yield Mortgage Rates

Average Monthly Mortgage Payment In Colorado By City

According to the U.S. Census Bureaus latest American Housing Survey, the average monthly mortgage payment in the U.S. is $1,487.00. In Colorado, that number is slightly higher, coming in at an average monthly mortgage payment of $1,681.00.

However, in some cities of Colorado, homeowners pay more for their mortgage due to higher home prices. In other areas, the average monthly payment is less.

If youre considering buying a home in Colorado, you may be wondering what to expect for your monthly payment. Below, weve provided some information about average mortgage payments in different cities of Colorado including Denver, Grand Junction, Colorado Springs, and Pueblo.

How Do I Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youre paying for.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

To calculate your monthly mortgage payment, heres what youll need:

- The home price

Read Also: Can I Get A Reverse Mortgage On A Condo

Other Expenses Not Calculated

Other factors not included in these calculations are travel and entertainment costs, we all know how Coloradans love to ski and snowboard, and contributions for retirement.

In addition, this does not take into consideration any payments for car loans or other debts aside from owning a home.

This is obviously not a complete list of what it costs to live in Colorado but this covers the basics.

It gives you an educated idea of what you can expect to pay on average, when living in this beautiful state.

Mortgage Legal Issues In New York

New York has a long history of being a buyer beware state, but some of those concerns have been remedied throughout the years. Currently, sellers must fill out a property condition disclosure statement that contains several pages of questions ranging from whether the property is located in a floodplain to the last date of sewage pumping. The seller only has to disclose what she knows to the best of her knowledge and isnt required to verify statements with an inspection. That due diligence falls on the seller, who is warned at the top of the document that the disclosure is not a substitute for any inspections or tests. Youll still have to research the property using your own means. The disclosure is just one of the pieces of information available to you.

If youre curious how foreclosure works in this state, you might be relieved to know that its favorable for homeowners. New Yorks foreclosure process is judicial, which means the lender has to sue the borrower in order to enforce their rights. This is generally considered more favorable for the homeowner than a non-judicial foreclosure, which means no court involvement and has a quicker timeline from initiation to home auction. With a judicial foreclosure, the lender has to win the lawsuit in order to sell the property at auction. The moment a lawsuit is filed is when the homeowner is considered in foreclosure.

Also Check: Can You Get A Reverse Mortgage On A Condo

Read Also: Chase Recast Mortgage

What Do These Look Like Altogether

Lets say you buy a gorgeous $200,000 house on a 20% down payment . In this scenario, youd have to borrow $160,000. On a 15-year mortgage with a fixed interest rate of 4%, youd pay around $1,184 a monththats principal and interest.

But wait. Theres still tax and insurance. So lets say one of our ELP insurance agents hooked you up with a sweet deal and got you homeowners insurance for $75 a month. Then lets say your local government charges you $1,400 a year for property taxes or $117 per month. Add all these numbers together, and you have your monthly mortgage.

How Much Do I Need To Make To Afford A 450000 Home

Even if you had the best-case scenario you have no debt, an excellent credit score and $90,000 to put down, and youre successful in getting an interest rate as low as 3.12 percent your monthly payment on a $450,000 property would be $1,903. That implies your yearly salary would have to be $70,000 before taxes in order to meet this requirement.

Recommended Reading: Reverse Mortgage On Condo

Average Monthly Mortgage Payment In Boulder Colorado

Summary: Based on the current median home sold price of $954,800 from Realtor.com, along with average mortgage rates for a 30-year fixed jumbo loan at 3.375% and 20-percent down, the average mortgage payment in Boulder is approximately $3,377 as of October 2021.

Just a year ago, the average payment was $2,722 based on a median sold price of $769,500 from October 2020.

Having said that, your monthly payments may be affected by a few parameters such as current interest rates, your credit scores, and the down payment or the equity you have in your home if youre looking to refinance.

For the typical homeowner, mortgage payments in Boulder, Colorado have gradually gone up over the past two years, as a result of home values rising quickly across the region.

As we get into late 2021 & 2022, mortgage rates are expected to rise. The average rate for a 30-year fixed home loan has decreased over the past few months, based on Freddie Macs weekly survey. For Boulder area homeowners, this benefits them if they refinance to reduce their monthly mortgage payment.

One can always pay discount points to buy the rate down to a certain point to secure a lower monthly payment.

Another parameter is the fact that some borrowers, such as those who are self-employed, may not qualify if they provide tax returns because they have large deductions. However, their income is still strong according to what is deposited. We can certainly help with that type of low doc loan.

Housing Costs In Colorado: $1494

Housing costs are the biggest main factor on why the cost of living in Colorado is so high.

How much do homes cost in Colorado? According to Zillow, the median price for a home in Colorado at the beginning of 2022 is $569,952 . And prices are expected to continue rising in the next few years.

Here is how the home prices and values stack up in the top 3 most popular cities in Colorado.

Read Also: Mortgage Rates Based On 10 Year Treasury

Local Economic Factors In Colorado

The Centennial State holds the top spot on a number of lists that detail the states with the best economies. Colorado ranks highest for private aerospace employment, and along with strong offerings in high-tech performance, startup activity and STEM-based economy, according to the U.S. Chamber of Commerce and Choose Colorado. Key industries include bioscience, defense and homeland security, energy and natural resources and tourism.

Earnings in Colorado are also strong. In 2020, the per capita personal income was $63,776, according to the U.S. Bureau of Economic Analysis. The national average was $59,510. Looking at unemployment, Colorados December 2021 unemployment rate was 4.8% while the national rate was 3.9%.

Tax rates for Colorado residents arent bad, either. The state levies a 4.50% income tax. Local and municipal governments cant levy additional income taxes, either. However, local governments can set sales taxes on top of the 2.90% state rate, so actual sales taxes will vary across counties and municipalities. Colorado has one of the most decentralized revenue-raising structures in the country, with local governments setting property tax rates and sales tax. Residents are also protected from sharp increases by the 1992 Tabor Act which sets limits on state taxation power.

What Is The Average Mortgage Payment

From down payments to mortgage payments, private mortgage insurance and homeowners insurance, theres a lot to consider when youre buying a home. Upfront costs are easy enough to calculate, but one important factor to consider is whether youll realistically be able to afford your mortgage payment and if youre even ready to buy a house given your monthly income.

Of course, the specific amount of your mortgage payment will depend on many things, including the size of your down payment, your mortgage rate and the size and duration of the loan. But examining the averages in these areas can help prospective home buyers examine their budget to avoid financial headaches down the road.

Also Check: Does Pre Approval For Mortgage Affect Credit

Average Down Payment On A House In Colorado In 2022

Buying a home typically requires a mortgage. But part of securing a mortgage involves coming up with a down payment. So, whats the average down payment on a house in 2022 in Colorado?

It takes a lot of planning when it comes to buying a home in Colorado. But one of the first things that need to be done long before a mortgage is applied for and the house-hunting search starts is saving for a down payment.

What If You Cant Come Up With 20%

If you cant come up with a 20% down payment towards the purchase price of a home in Colorado, youre not alone! With the median price for a home in the state currently sitting at $522,970, a 20% down payment would equate to $104,594. Thats a hefty sum of money that a lot of borrowers would have a tough time coming up with on their own.

Thats why there are other down payment options that borrowers may consider, such as high-ratio mortgages that allow a minimum down payment of 3%.

In this case, a 3% down payment on an average-priced home in Colorado would work out to be $15,689. While still a lot of money, its a lot less than the previous figure and is a lot more doable for many homebuyers.

Read Also: Chase Recast Calculator

Mortgage Rates In Colorado

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

If you’re hoping to buy a home in Colorado, it helps to know what the best mortgage rates look like statewide. Applying for a home loan with several mortgage lenders will increase your chances of locking in a great deal, so don’t hesitate to shop around. Do so within a relatively short time span, though, to minimize potential damage to your credit score via too many hard inquiries on your record. Here are todays mortgage rates in Colorado.

For today, June 2nd, 2022, the current average mortgage rate in Colorado for a 30-year fixed-rate mortgage is 5.296%, the average rate for a 15-year fixed-rate mortgage is 4.478%, and the average rate for a 5/1 adjustable-rate mortgage is 4.050%. Rates are quoted as annual percentage rate .

Our Advice: Stick To Your Budget

Knowing the average mortgage cost for different cities can be helpful because it allows you to narrow down your options. It can also prevent you from getting your heart set on a particular home or area that you cant afford.

Remember, Colorado has become a popular place to live and home prices have gone up in the last few years. While places like Denver and Boulder used to be relatively affordable, these areas are now very desirable and much more expensive than they used to be.

So, while you may once have dreamed of being able to walk out your back door and hike to the Flatirons, ask yourself if thats truly a realistic scenario. Instead of buying a home you cant afford in Boulder and winding up with a huge mortgage payment, consider a more affordable suburb thats only a short drive away like Loveland or Greeley.

Sure, youll have to drive a little bit to get to the best trails. But youll save a lot of money and stress by sticking to your budget.

Also Check: Reverse Mortgage For Mobile Homes

Answer Your Financial And Mortgage Questions

Understanding all of the factors that impact your monthly payment is important before applying for a mortgage. While this mortgage calculator can give you a useful starting point, it cannot replace an in-depth conversation with your agent or lender.

Your real estate agent can help you understand different home loan options available based on your financial situation. And when you’re ready for the next step, your agent can connect you with a qualified local lender.