Does It Make Sense For You

To determine whether mortgage points are right for you, you need to find out how much you have available for the home buying process: down payment, closing costs, monthly mortgage payments, and mortgage points.

Use our mortgage calculators to help you work out how much cash you need to close.

Buying points to lower your interest rate makes the most sense if you select a fixed rate mortgage and you plan on owning your home after youve reached a break-even point of 36 months or less.

Under the right conditions, purchasing points when you purchase a home can save you quite a bit of money over the full length of your loan term. Remember, theres a lot to think about when considering paying/buying points to lower your rate. To be absolutely sure youre making the right decision, contact one of the mortgage experts at American Financing if youre considering buying a home and leveraging mortgage points.

How Much Does One Mortgage Point Reduce The Rate

When you buy one discount point, youll pay a fee of 1% of the mortgage amount. As a result, the lender typically cuts the interest rate by 0.25%.

But one point can reduce the rate more or less than that. Theres no set amount for how much a discount point will reduce the rate. The effect of a discount point varies by the lender, type of loan and prevailing rates, as mortgage rates fluctuate daily.

Buying points doesn’t always mean paying exactly 1% of the loan amount. For example, you might be able to pay half a point, or 0.5% of the loan amount. That typically would reduce the interest rate by 0.125%. Or you might be given the option of paying one-and-a-half points or two points to cut the interest rate more.

What Are Points In Real Estate

If you are purchasing or refinancing a home, chances are you have learned a lot of new terms. One of those may be points. But what exactly are points in a real estate deal?

Points are referred to as mortgage points or sometimes discount points. Points are a fee that a borrower pays to the lender to get a lower interest rate. One point costs one percent of your overall mortgage amount.

You will pay this fee up front, but secure a lower interest rate for the rest of your payoff period . This can result in savings over the long-term, even though you pay more initially.

You May Like: Who Is Rocket Mortgage Owned By

Will Applying For Different Mortgages Hurt My Credit

The generally consider credit checks from multiple mortgage lenders as one credit check because they assume you’re searching for the best deal. But you have to limit your applications to a short window of time. Some credit-scoring models consider multiple mortgage inquiries within 14 days as just one inquiry, while others treat several inquiries as a single one if you made them within 45 days. Because you probably won’t know what scoring model a particular lender will use now or if you apply for credit in the future, submit each of your mortgage applications within a 14-day period to be on the safe side.

What Are Negative Points On A Mortgage

Negative mortgage points, also known as rebates or yield spread premiums are portions of your mortgage fees that are paid by the lender, who in turn sets a higher interest rate on the loan. This is sometimes called a no-cost mortgage. One negative point is equal to one percent of the overall home loan.

Negative points are a way for borrowers who are severely tight on cash to finance a home. Since the fees are greatly reduced (depending on how many negative points are given, there is little requirement for cash upfront. The tradeoff is that borrowers will end up paying more for their mortgage in the long run due to the higher interest rate.

Recommended Reading: Reverse Mortgage For Mobile Homes

Are Mortgage Points Taxdeductible

Discount points can be taxdeductible, depending on which deductions you claim on your federal income taxes.

To write off discount points, or any other qualifying mortgage interest payments, youd need to itemize your deductions using Schedule A of Form 1040.

If you take the standard deduction, you will not be able to deduct mortgage interest or mortgage points.

Discount points paid on a home purchase mortgage loan can be 100% deductible in the year in which theyre paid. Discount points on a home refinance mortgage loan cannot.

The tax deduction for points paid on a refinance loan is spread over the life of the loan. A homeowner paying points on a 30year mortgage loan can claim 1/30 of the points paid as a deduction annually.

Always consult a professional before filing. This website doesnt give tax advice. Let your tax preparer know if youd like to write off mortgage interest payments and discount points.

What Are Mortgage Points Should You Pay Them

Men sign the house of the contract

When people want to find out how much their mortgages cost, lenders often give them quotes that include loan rates and points.

What Is a Mortgage Point?A mortgage point is a fee equal to 1 percent of the loan amount. A 30-year, $150,000 mortgage might have a rate of 7 percent but come with a charge of one mortgage point, or $1,500.

A lender can charge one, two or more mortgage points. There are two kinds of points:

Discount PointsThese are actually prepaid interest on the mortgage loan. The more points you pay, the lower the interest rate on the loan and vice versa. Borrowers typically can pay anywhere from zero to three or four points, depending on how much they want to lower their rates. This kind of point is tax-deductible.

Origination PointsThis is charged by the lender to cover the costs of making the loan. The origination fee is tax-deductible if it was used to obtain the mortgage and not to pay other closing costs. The IRS specifically states that if the fee is for items that would normally be itemized on a settlement statement, such as notary fees, preparation costs and inspection fees, it is not deductible.

How do you decide whether to pay mortgage points, and how many? That depends on a number of factors, such as:

- How much money you have available to put down at closing

- How long you plan on staying in your house

Distributed by Tribune Content Agency, LLC

Don’t Miss: Recasting Mortgage Chase

Is It Worth Refinancing To Save $200 A Month

Generally, a refinance is worthwhile if you‘ll be in the home long enough to reach the break-even point the date at which your savings outweigh the closing costs you paid to refinance your loan. For example, let’s say you’ll save $200 per month by refinancing, and your closing costs will come in around $4,000.

How Many Mortgage Points Can You Buy

Theres no one set limit on how many mortgage points you can buy. However, youll rarely find a lender who will let you buy more than around 4 mortgage points.

The reason for this is that there are both federal and state limits regarding how much anyone can pay in closing cost on a mortgage. Because limits can change from state to state, the number of points you can buy may vary slightly.

According to a survey of lenders conducted weekly by Freddie Mac, for about the last 5 years, the average number of points reported on a 30-year fixed conventional loan was between 0.5 0.6 points.

Its important to note you dont have to pay for a full point to get a lower rate. Points are sold in increments all the way down to 0.125%.

Recommended Reading: Bofa Home Loan Navigator

How Do I Calculate Points Paid On My Mortgage

Your lender will send you a Form 1098. Look in Box 2 to find the points paid for your loan. If you don’t get a Form 1098, look on the settlement disclosure you received at closing. The points will show up on that form in the sections detailing your costs or the sellers’ costs, depending on who paid the points.

How Much Does One Point Lower Your Interest Rate

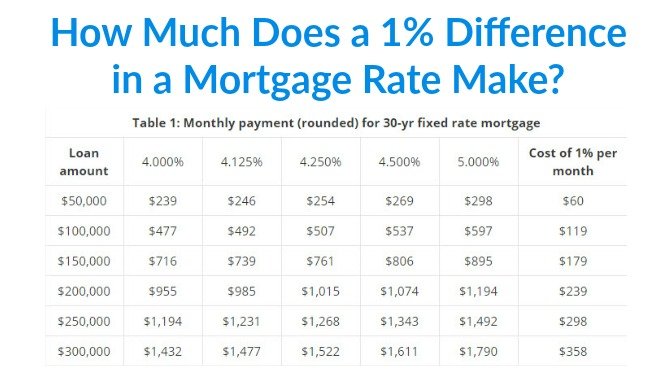

One discount point usually equals 1% of your total loan amount and lowers the interest rate of your mortgage around one-eighth to one-quarter of a percent. But heads up: the actual percentage change will depend on your mortgage lender.

Is your head spinning yet? Well hang on, were about to do some math.

To help this all make sense, lets break it down. Suppose youre buying a $300,000 house. You have a 20% down payment and are taking out a 30-year fixed-rate conventional loan of $240,000 at a 4.5% interest rate.

To lower the interest rate, you pay your lender for one mortgage point at closing, and assuming that point equals 1% of your loan amount, it will cost $2,400.

$240,000 loan amount x 1% = $2,400 mortgage point payment

After you buy the mortgage point, your lender reduces the interest rate of your mortgage by, say, a quarter of a percent. That takes your interest rate from 4.5% to 4.25%.

This slightly lowers your monthly payment from $1,562 to $1,526which is $36 less a month on a fixed-rate conventional mortgage.

You can use our mortgage calculator to figure the difference between the interest amount with the original rate and the interest amount with the reduced rate over the full lifespan of the loan.

Are you still with us? Okay, good.

Without any mortgage points, youll pay a total of $197,778 in interest. With one mortgage point, youll drop that amount to $185,035which saves you $12,743 in total interest.

| 30-year loan amount: $240,000 |

| $172,486 |

Read Also: Monthly Mortgage On 1 Million

What Do Points Mean In A Mortgage Calculation

Related Articles

Mortgage points or discount points are fees that you pay to the lender at closing in exchange for a reduced interest rate. Essentially, you are paying money up front to “buy down” the interest rate over the life of your loan. You might also come across the term “origination points” in your loan quotation. These are fees charged by the lender to cover the cost of the loan.

Where To Find Points And Credits On Your Loan Estimate** And How They Affect Your Loans True Cost

Points will be found under Section A on page 2 of your official Loan Estimate. Theyll be shown as a percentage of your loan amount and as the equivalent dollar amount youll pay upfront.

Lender credits are listed under Section J as a negative number. Thats the dollar amount thatll be taken off your upfront closing costs.

When calculating the true cost of your loan, its important to only factor in costs that are mortgage-related . The costs to include are listed in Section D , Section E, and Section J under lender credits.

Simply input information from your official Loan Estimate into the following formula to calculate your true loan cost:

Costs listed under section F and section G are non-mortgage related, and will occur whether you continue with the loan or not. For this reason, they should not be included in calculating the true loan cost.

Have more questions about points and credits, or need help deciding which is right for you and your loan? Were here to help.

*The rate table displayed above is for illustrative purposes only. It does not reflect any specific loan terms and is not a commitment to lend. Your loan terms will be different based on current market rates, property type, loan amount, loan-to-value, credit score, debt-to-income ratio and other variables.

**The Loan Estimated displayed in this article is for illustrative purposes only. It does not reflect any specific loan terms and is not a commitment to lend.

- More

Also Check: Rocket Mortgage Loan Types

What Are Mortgage Points

Mortgage points are the fees a borrower pays a mortgage lender to trim the interest rate on the loan. This is sometimes called buying down the rate. Each point the borrower buys costs 1 percent of the mortgage amount. So, one point on a $300,000 mortgage would cost $3,000.

Each point typically lowers the rate by 0.25 percent, so one point would lower a mortgage rate of 4 percent to 3.75 percent for the life of the loan. How much each point lowers the rate varies among lenders, however. The rate-reducing power of mortgage points also depends on the type of mortgage loan and the overall interest rate environment.

Borrowers can buy more than one point, and even fractions of a point. A half-point on a $300,000 mortgage, for example, would cost $1,500 and lower the mortgage rate by about 0.125 percent.

The points are paid at closing and listed on the loan estimate document, which borrowers receive after they apply for a mortgage, and the closing disclosure, which borrowers receive before the closing of the loan.

How Points And Credits Are Calculated

Points are calculated as a percentage of the total loan amount, with 1 point equal to 1%.

Every lender has a specific pricing structure, which is why different lenders offer the same rates at different prices.

At Better Mortgage, transparency is key to us, which is why points and credits are displayed in actual dollar values when you view your personalized rate options in your Better Mortgage account. Positive numbers in your points/credits column represent points , and negative numbers represent lender credits .

Also Check: Recast Mortgage Chase

Consider Making A Larger Down Payment Instead

Rather than purchasing points, some borrowers make a larger down payment to reduce their monthly payment amount. Also, if you make a down payment large enough, you can usually avoid paying for private mortgage insurance . The extra money you put towards the down payment might be money better spent than using your money on points.

In addition, putting more money down helps you build equity in the property faster. You could also decide to use the money to make extra payments on your loan and gain equity in your home quicker that way.

Donât Miss: How To Negotiate The Best Mortgage Rate

Why Do We Use Basis Points

Basis points are used to remove any uncertainty when talking about percentage change. To say my commission is usually 10%, but it increased by 10% last quarter is needlessly ambiguous is your commission now 20%, or 11%? This is why we use basic points, so that we know when someone says a 100 basis point increase they mean an increase of 1%.

Also Check: Requirements For Mortgage Approval

When Will You Break Even After Buying Mortgage Points

To determine if it’s a good idea to pay for points, compare your cost in points with the amount you’ll save with a lower interest rate and see how long it will take you to make your money back. If you can afford to pay for points, then the decision more or less boils down to whether you will keep the mortgage past the time when you break even. After you break even, you’ll start to save money. The break-even point varies, depending on your loan size, interest rate, and term.

Example. As in the example above, let’s say you get a 30-year loan of $300,000 with a 3% fixed interest rate. Your monthly payment will be $1,265. However, if you buy one point by paying $3,000, and your rate goes down to 2.75%, the monthly payment becomes $1,225. So, divide the cost of the point by the difference between the monthly payments. So, $3,000 divided by $40 is 75, which means the break-even point is about 75 monthsmeaning you’d have to stay in the home for 75 months to make it worth buying the point.

As you can see, the longer you live in the property and make payments on the mortgage, the better off you’ll be paying for points upfront to get a lower interest rate. But if you think you’ll want to sell or refinance your home within a couple of years , you’ll probably want to get a loan with few or no points. Check the numbers carefully before you pay points on a loan because you might not recoup the cost if you move or refinance within a few years.

How To Convert Basis Points To A Percentage Or A Decimal

If you’re trying to convert decimal points to a percentage, you move the decimal point two places to the left, so 50 basis points is 0.5%. To convert it back to basis points, you move the decimal point two places to the right.

To get to the decimal value of a basis point, you move the decimal point back four places to the left, so 100 basis points is .01. If you want to convert that into a percentage, you move the decimal back two places to the right from the decimal value. Going back to basis points would require moving the decimal four places to the right of the decimal value. Check out the table below for examples.

|

Basis Points |

You May Like: 10 Year Treasury Yield And Mortgage Rates

When Is It Worth It To Buy Points

Typically, most financial advisors would say that if you cant break even in 36 months or less then it wont make sense.

If you’re planning to move or refinance in a couple of years, paying points is probably not a good move.

Think of it as if youre putting money in a bank to make interest. The longer you have to wait to get the return is also a factor. Waiting longer than 36 months in most cases means that you may have been able to put those same funds in a different investment vehicle and make more money than what the cost wouldve saved you.