How Do I Get A Mortgage

Getting a mortgage is the most important part of the homebuying process. Its likely the largest loan youll ever take out. So finding the right lender and getting the best deal can save you thousands of dollars over the life of the loan.

Heres what you need to do.

There are lots of different types of lenders. Looking at the loans and programs that banks, credit unions, and brokers offer will help you understand all of your options.

If youre looking for a specific type of loan, like a VA loan or a USDA loan, then make sure that the lender offers these mortgages.

2. Apply for preapproval

Before you start shopping for a home, youll need a preapproval letter. A mortgage preapproval is different from a formal loan application in that it doesnt affect your credit and doesnt guarantee youre approved. But it does give you an idea of your likelihood of approval.

3. Submit an application

Once youre ready to start comparing loan offers, submit an application. Until you apply, the lender wont be able to give you an official estimate of the fees and interest rate you qualify for.

To find the lowest rate and fees, you should submit applications with two or three lenders. Once you have each Loan Estimate in hand, its easier to compare and determine which offer is best for you.

4. Underwriting and closing

What Happens At The End Of A Term

At the end of each term, you have the option to renew or refinance your mortgage.

- Renewing your mortgageinvolves signing for another term with your existing lender. Your monthly payment and mortgage interest rate may change.

- Refinancing your mortgageinvolves signing a new term agreement, possibly with a different rate or lender. Refinancing allows you to take advantage of lower mortgage rates or better options not offered by your current lender. You can also borrow more money by using your home equity and receiving it in cash.

Your mortgage lender might not reassess your credit score or debt service ratios if youre renewing at the same lender. If youre switching to a new lender, youll need to be reassessed and you may need to pass the mortgage stress test.

When Should You Refinance A 30

If you want to pay off a 30-year fixed-rate mortgage faster or lower your interest rate, you may consider refinancing to a shorter term loan or a new 30-year mortgage with a lower rate. Thebest time to refinancewill vary based on your circumstances. Keep in mind that closing costs when refinancing can range from 2% to 6% of the loans principal amount, so you want to make sure that you qualify for a low enough interest rate to cover your closing costs. Learn more abouthow to refinance and compare todays refinance rates to your current mortgage rate to see if refinancing is financially worthwhile.

The rate and monthly payments displayed in this section are for informational purposes only. Payment information does not include applicable taxes and insurance. Zillow Group Marketplace, Inc. does not make loans and this is not a commitment to lend.

Read Also: Rocket Mortgage Payment Options

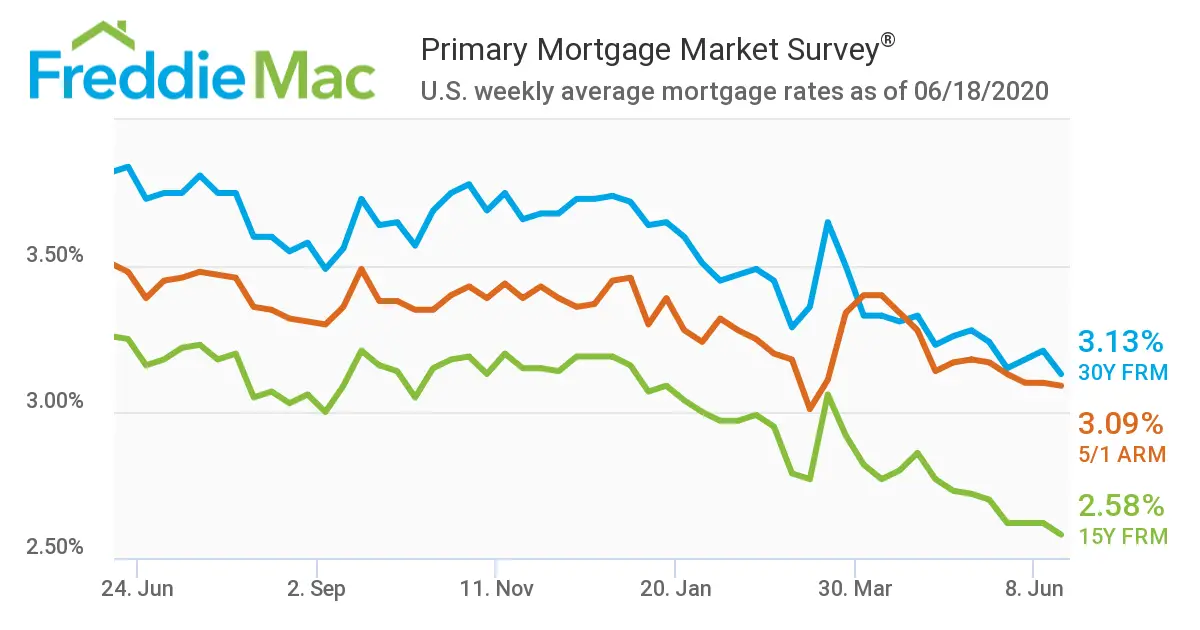

Mortgage Rate Predictions For 2021

At the time of this writing , the U.S. economy was in a strong growth period coming out of the pandemic. And the Fed had just announced plans to start withdrawing its mortgage stimulus, pushing interest rates higher.

Inflation was also at a 30year high. And rising inflation tends to drag rates up with it.

In short, all signs point toward higher rates in 2022 as the economy continues to expand.

So dont wait on lower 30year interest rates. They could fall for short periods of time, but were likely to see an overall upward trend in the coming months.

How To Calculate Mortgage Payments

Mortgages and mortgage lenders are often a necessary part of purchasing a home, but it can be difficult to understand what youre paying forand what you can actually afford.

To estimate your monthly mortgage payment, you can use a mortgage calculator. It will provide you with an estimate of your monthly principal and interest payment based on your interest rate, down payment, purchase price and other factors.

Heres what youll need in order to calculate your monthly mortgage payment:

- Interest rate

Recommended Reading: Chase Recast

How Do I Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youre paying for.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

To calculate your monthly mortgage payment, heres what youll need:

- The home price

Refinancing To Shorten The Loan’s Term

When interest rates fall, homeowners sometimes have the opportunity to refinance an existing loan for another loan that, without much change in the monthly payment, has a significantly shorter term.

For a 30-year fixed-rate mortgage on a $100,000 home, refinancing from 9% to 5.5% can cut the term in half to 15 years with only a slight change in the monthly payment from $805 to $817. However, if you’re already at 5.5% for 30 years , getting, a 3.5% mortgage for 15 years would raise your payment to $715. So do the math and see what works.

Read Also: Reverse Mortgage On Condo

Typical Ontario Mortgage Amounts

Finding the right mortgage has a lot to do with determining what you can afford. And that depends on where you live.

Below are typical mortgage amounts for someone putting down 20% in select Ontario cities. Theyre based on a 30-year amortization and average purchase prices as tracked by the Canadian Real Estate Association :

- Barrie and District: $570,800

| 2,130 | 0.10% |

Thanks to Ontarios stable economy and housing market, it tends to have lower arrears rates than other provinces.

How Do I Compare Current 30

The more lenders you check out when shopping for mortgage rates, the more likely you are to get a lower interest rate. Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

With NerdWallets easy-to-use mortgage rate tool, you can compare current 30-year home loan interest rates whether youre a first-time home buyer looking at 30-year fixed mortgage rates or a longtime homeowner comparing refinance mortgage rates.

You May Like: Chase Mortgage Recast Fee

What Factors Determine My Mortgage Rate

The factors that most often determine a mortgage rate are your credit score, the property’s location, the size of the down payment, the terms of the loan and the type of loan.

“A lot of mortgages are over 30 years. Shorter-term loans, like 10, 15 or 20 years have lower interest rates,” says Clint Lotz, president and founder of the predictive credit tech company TrackStar. “A larger down payment means a lower interest rate if a homebuyer can make the 20% down payment, that’s great, but if not, lenders will usually require the buyer to purchase PMI: private mortgage insurance.”

In addition to the loan term, the loan type will impact your interest rate. Some loans have a fixed interest rate for the entire life of the loan, while others have an adjustable rate — which could result in significantly higher payments down the road.

Who Sets Va Mortgage Rates

Even though the U.S. Government guarantees that a portion of the loan is insured, VA mortgage rates are not set by the Department of Veterans Affairs.

Your lender will always make the final decision on whether to approve a loan and what interest rate is appropriate for your case. The interest rate is set after your lender conducts a thorough review of your and debt management history, along with an analysis of current market trends within the real estate economy.

Once your lender can gauge the level of risk associated with your application, theyll attach an interest rate to their initial financing offer.

As a popular lending option, VA mortgages come with several unique advantages that continue to help military members become homeowners. Lets take a closer look at how you can benefit from a VA home loan:

- Zero down payment

- 100% LTV on VA cash-out refinances

Recommended Reading: How Does Rocket Mortgage Work

What Is A High

A mortgage with a down payment below 20% is known as ahigh-ratio mortgage. The term ratio refers to the size of your mortgage loan amount as a percentage of your total purchase price.

All high-ratio mortgages require the purchase of CMHC insurance, since they generally carry a higher risk of default.

What Is The Difference Between A Fixed And A Variable Interest Rate At Td

A fixed interest rate means your interest rate, along with your principal and interest payments, will stay exactly the same during your mortgage term.

With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the amounts from each payment that go toward the principal and interest can vary.

Also Check: Can You Refinance A Mortgage Without A Job

Managing Your Mortgage Payments

Purchasing a 30-year fixed loan means making consistent payments for three decades. Thats a long time, so you must stay on top of your payments. This is why its important to secure a stable career and build savings. You must keep paying your loan even during emergencies. The same goes even when youre retired and not yet fully paid on your loan.

Before you agree to any real estate deal, you should understand how mortgage payments work. One important document you should use is the amortization schedule. This breaks down your monthly payments so you know how much goes toward your interest charges and principal loan.

- Principal This is the amount you borrowed from your lender. It also indicated the outstanding balance you still owe after making several payments.

- Interest This is the payment lenders charge to service your loan. Interest costs are higher when your principal is large. Likewise, interest increases the longer it takes to pay down a loan.

Calculate Your PITI Costs

Mortgage payments are not just comprised of interest and principal payments. You must also pay for real estate taxes and homeowners insurance. When taken together, this is called PITI costs or Principal, Interest, Taxes, and Insurance. If you check your PITI expense, you can calculate the total cost of your monthly payments. Finally, while principal and interest payments remain the same, your insurance and property taxes may change over the years.

Whats The Difference Between Fixed Rate And Adjustable Rate Mortgages

Unlike a 30-year fixed rate mortgage, adjustable rate mortgages come with a fluctuating interest rate that rises or lowers along with market conditions.

Minimum monthly payments on these loans depend on external factors, and opting for this mortgage type is usually seen as a greater risk. When mortgage interest rates go up, so do the monthly payments on an ARM.

Homeowners cant control the economy or shift the real estate market. If you apply for an ARM and these factors turn against your favor, you could end up paying thousands more in added interest after the ARM expires.

This also makes it difficult to predict how much money youll have for other expenses down the line. If the amount of interest suddenly spikes after your 5-year or 7-year ARM adjusts, youll have to adjust your finances. This makes ARMs a much more volatile lending option than 30-year fixed rate mortgages.

The major advantage of an adjustable rate mortgage is that you could end up saving money over time. The initial interest rates on these loans are typically lower than their fixed rate counterparts. If the mortgage rates continue to dip after the fixed rate period on your ARM expires and your rate adjusts, your rate could decrease even further, lowering your monthly mortgage payments.

Again, this depends entirely on the state of the economy and market trends. In addition to paying a steady rate of interest, 30-year fixed rate mortgages offer a number of financial advantages.

Don’t Miss: Rocket Mortgage Conventional Loan

Choose The Right Mortgage

Once you have your credit and savings in place and a good idea of what you can afford, its time to start searching for a lender, comparing interest rates and terms and finding the right kind of mortgage for your situation.

The main types of mortgages include:

- Conventional loans These are best for homebuyers with solid credit and a decent down payment saved up. Theyre available at most banks and through many independent mortgage lenders.

- Government-insured loans These can be great options for qualified borrowers who may otherwise struggle to buy a home. Government-insured loans are widely available through many institutions, but are targeted at borrowers with less-than-stellar credit. USDA loans have some geographical restrictions, and VA loans can only go to members of the military, veterans or their spouses.

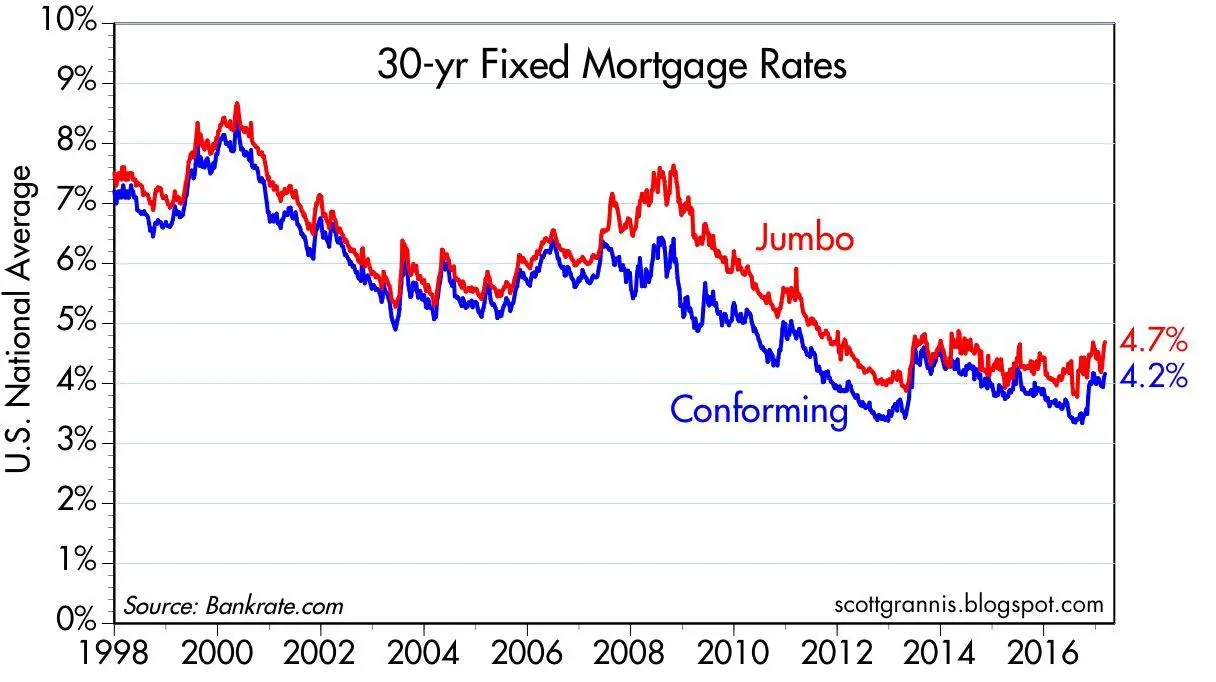

- Jumbo loans These are for the big spenders out there. Conventional loans have a maximum allowable value, and if you need to finance more than that , youll need to get a jumbo loan.

A first-time homebuyer, for instance, might consider an FHA loan, which requires a minimum credit score of 500 with a 10 percent down payment or a minimum score of 580 with as little as 3.5 percent down.

to determine the right time to strike on your mortgage with our daily rate trends.

Canadian Bank Closed Mortgage Prepayment Amounts

RBC has one of the lowest prepayment amounts you can pay at only 10% of your original mortgage amount. For some buyers, this may get in the way of you paying your mortgage off very aggressively, however getting anopen mortgagewhere you can pay the loan off at any time in full may be a better option if this is the case.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

How Does Credible Calculate Refinance Rates

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage refinance rates. Credible average mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage refinance rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Know What You Can Afford

Its fun to fantasize about a dream home with every imaginable bell and whistle, but you should really only purchase what you can reasonably afford.

Most analysts believe you should not spend more than 30 percent of your gross monthly income on home-related costs, says Katsiaryna Bardos, associate professor of finance at Fairfield University in Fairfield, Connecticut.

Bardos says one way to determine how much you can afford is to calculate your debt-to-income ratio . This is determined by summing up all of your monthly debt payments and dividing that by your gross monthly income.

Fannie Mae and Freddie Mac loans accept a maximum DTI ratio of 45 percent. If your ratio is higher than that, you might want to wait to buy a house until you reduce your debt, Bardos suggests.

Andrea Woroch, a Bakersfield, California-based finance expert, says its essential to take into account all your monthly expenses including food, healthcare and medical costs, childcare, transportation, vacation and entertainment expenses and other savings goals.

The last thing you want to do is get locked into a mortgage payment that limits your lifestyle flexibility and keeps you from accomplishing your goals, Woroch says.

You can determine what you can afford by using Bankrates calculator, which factors in your income, monthly obligations, estimated down payment, the details of your mortgage like the interest rate, and homeowners insurance and property taxes.

Don’t Miss: Rocket Mortgage Vs Bank

How Do I Choose The Best Mortgage Lender

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees vary, but the quality of service as well. Regardless of what lender you end up working with, its important to find someone that can help your individual challenges. For example, if youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

To find a trusted lender, you can look at online reviews, or even better, ask around. Your real estate agent and friends who recently purchased a home are great sources for mortgage lender recommendations. Try comparing a variety of different mortgage lenders. The best mortgage lender for you may be a bank, credit union, mortgage broker, or an online mortgage lender, depending on your situation.

How Are Mortgage Rates Set

Mortgage rates fluctuate for the same reasons home prices change supply, demand, inflation, and even the U.S. employment rate can all impact mortgage rates. The demand for homes isnt necessarily a sign of where mortgage rates are headed. The best indicator of whether rates will go up or down is the 10-year Treasury bond rate.

When a lender issues a mortgage, it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans. Mortgage bonds and 10-year Treasury bonds are similar investments and compete for the same buyers, which is why the rates for both move up or down in tandem.

Thats why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record.

Recommended Reading: Rocket Mortgage Qualifications