How We Determine Mortgage Interest Rates

We use Bankrates daily rate data for our mortgage rate trends. These overnight rates are based on a specific borrower profile, which only includes loans for single-family homes with a loan-to-value ratio of 80% or better. Bankrate is part of the same parent company as NextAdvisor.

This table has current average rates based on information provided to Bankrate by lenders nationwide:

Current average mortgage interest rates| Loan type |

|---|

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates â personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

The Surprise Mortgage Rate Drop

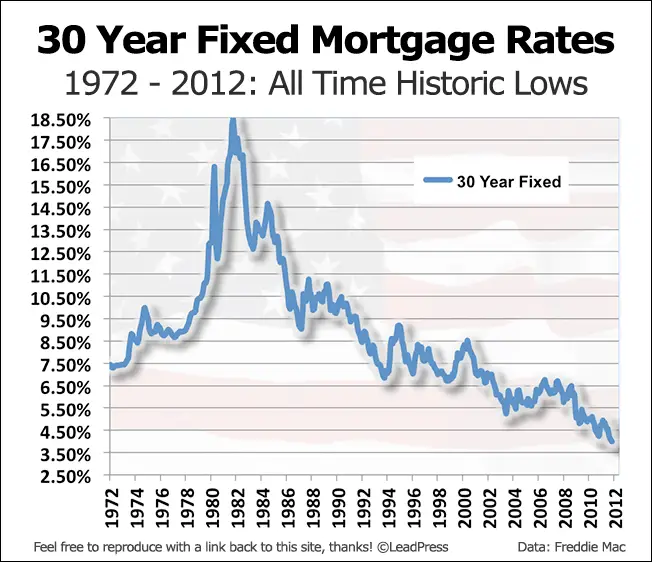

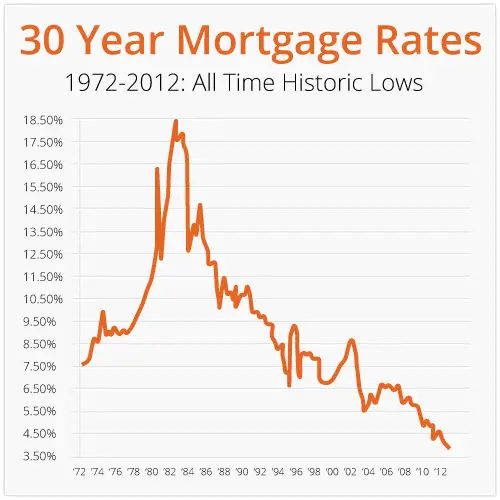

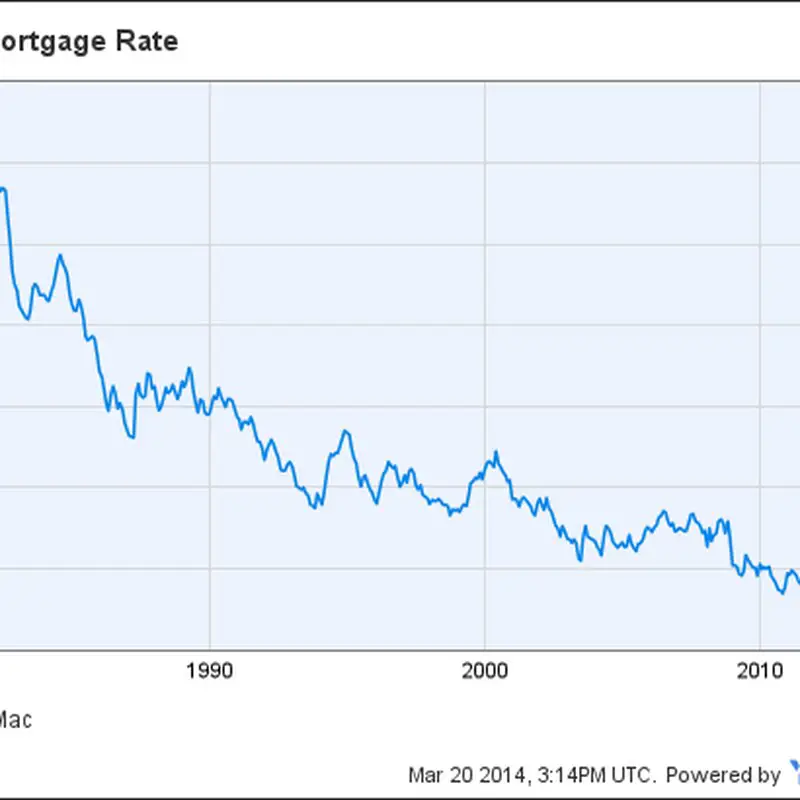

In 2018, many economists predicted that 2019 mortgage rates would top 5.5 percent. That turned out to be wrong. In fact, rates dropped in 2019. The average mortgage rate went from 4.54% in 2018 to 3.94% in 2019.

- At 3.94% the monthly cost for a $200,000 home loan was $948

- Thats a savings of $520 a month or $6,240 a year when compared with the 8% longterm average

In 2019, it was thought mortgage rates couldnt go much lower. But 2020 and 2021 proved that thinking wrong again.

Also Check: What Mortgage Companies Finance Mobile Homes

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Fha 30 Year Fixed Mortgage Rates

With an FHA 30 year fixed mortgage, you can purchase a home with a lower down payment and flexible lending guidelines or streamline refinance with less documentation than a traditional loan.

FHA loans are backed by the Federal Housing Administration, that is, the federal government insures them. Rather than issuing mortgages, the FHA offers insurance on mortgage payments so that more people can get the financing they need to buy a house or refinance. However, borrowers are required to pay Upfront Mortgage Insurance and monthly mortgage insurance when obtaining an FHA loan.

Do I qualify for an FHA loan?

For FHA 30 year fixed rate loans, there are low down payment options, gifts are allowed, Streamline Refinances are permitted and there are no penalties for repayment.

You May Like: What Credit Do I Need For A Mortgage

What Is The Difference Between Interest Rate And Apr

While interest rates show the percentage a lender may charge for a loan, it gives an incomplete look at total costs.

An annual percentage rate includes the interest rate as well as other fees, including origination fees, mortgage insurance, closing costs, mortgage points and more.

The APR gives borrowers greater insight into what theyre actually paying for their mortgage. For more on what you need to know, visit our Interest Rates vs Annual Percentage Rate page.

How To Apply For A 30

Before you apply for a mortgage, review your credit profile and make any necessary improvements. To qualify for the lowest interest rate, your credit should be as strong as possible.

Then, calculate how much home you can afford, including how much of a down payment you can make. Part of this initial process should include shopping around for lenders to get an idea of rates and products that best fit you.

Mortgages are available through banks, credit unions and many online lenders. Find out what rates each lender is offering as well as the annual percentage rate the total cost of a loan, including fees.

Related:Best Mortgage Lenders

When youre ready to apply for a mortgage, compile all necessary documentation like income verification, recent bank account statements and other proof of assets.

You can start the application process by seeking a preapproval letter from the mortgage lender. This letter will give you an estimate of your specific loan rate and terms, if you qualify. It also helps establish exactly how much home you can afford and gives you more negotiating power with sellers when you have a letter showing you are already approved for financing.

Recommended Reading: Is Now Good Time To Refinance Mortgage

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower rate and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

How Do You Choose A Mortgage Lender

Here are some considerations that may help:

- The personalized interest rates each lender offers

- Lender closing costs and fees

- Available loan terms AMR vs fixed-rate mortgage

- The amount you want to borrow versus the amount the lender is willing to lend

- How you plan to use the money, since some lenders may have restrictions

- You should also think about the lenders reputation for customer service. Our ranking has taken this into consideration.

Recommended Reading: Does Credit Score Affect Mortgage

What Are The Advantages Of A 30

The biggest advantage to a 30-year mortgage is the ability to spread loan payments out over the maximum amount of time. That keeps the monthly payment much more affordable and makes homeownership accessible to more people.

Another advantage is that paying more in interest can help you make a bigger tax deduction, if you itemize your deductions.

What You Should Know About Adjustable

Adjustable-rate mortgage loans are inherently riskier than fixed-rate mortgages. Although your introductory rate may be ultra-low, theres a good chance rates could rise at some point in your loan term.

A higher interest rate means a bigger monthly mortgage payment. And if rates rise enough, a homeowner could get priced out of their home which is a dangerous position to be in.

The risk of rising rates is the main reason most home buyers choose a fixed-rate mortgage over an ARM. However, if you know youll move or refinance before the introductory period ends, an ARM may offer a lower interest rate and savings on your mortgage payment.

If youre considering an ARM for its money-saving benefits, here are a few things you should know about this type of mortgage before opting in.

ARM rate caps make these loans less risky than you think

Today, most adjustable-rate mortgages come with rate caps. These reduce your exposure to risk by limiting the amount your rate can rise in any given year and over the life of the loan.

Rate caps are usually expressed like this: 2/2/5.

Following is the meaning for each, in order:

Still, caps are there to protect you.

You May Like: Can You Get A Mortgage With A 620 Credit Score

When To Consider A 30

A 30-year fixed mortgage is best for those looking for predictable, relatively low monthly payments. Youll wind up paying more in interest over the life of a 30-year mortgage than a 15- or 20-year one, but because of the longer repayment timeline, your monthly costs will be lower, so the more expensive loan may ultimately be easier on your budget.

Today’s Best Mortgage And Refinance Rates November 29 202: Most Rates Fall

Jeff Ostrowski covers mortgages and the housing market. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Recommended Reading: What Should My Credit Score Be For A Mortgage

Current Mortgage Rates Are Shooting Up Again

Leslie CookKristen Bahler19 min read

Mortgage rates continued trending higher this week. Freddie Mac’s average rate on a 30-year fixed-rate mortgage increased 0.23 percentage points to 5.89%, which is the highest that rate has reached since 2008.

This is the third straight week of increases, following a seesawing rate that carried through the better part of July and August.

For homebuyers, there is a bright side. Different lenders are now offering a variety of competing rates, and applicants can save anywhere between $1,500 and $3,000 per year on their mortgage payments by getting multiple quotes, noted Sam Khater Freddie Mac’s chief economist in a statement

As a result, “Borrowers can benefit from shopping around,” Khater said.

Both the 15-year fixed-rate loan and the 5/1 adjustable-rate mortgage also saw higher rates this week, according to Freddie Mac’s weekly survey. Rates for those loan categories are now averaging 5.16% and 4.64%, respectively.

If you are offered a rate that is higher than you expect, make sure to ask why, and compare offers from multiple lenders.

What Are Today’s Mortgage Rates

Although mortgage rates fluctuate daily, 2020 and 2021 were years of record lows for mortgage and refinance rates across the US.

While low average mortgage and refinance rates are a promising sign for a more affordable loan, remember that they’re never a guarantee of the rate a lender will offer you. Mortgage rates vary by borrower, based on factors like your credit, loan type, and down payment. To get the best rate for you, you’ll want to gather rates from multiple lenders.

| Mortgage type |

Don’t Miss: When To Refinance Your Mortgage Dave Ramsey

How Do 5/1 Arm Rates Compare

The initial interest rates on ARMs are generally lower than those for fixed-rate loans. Often, adjustable rates are about 0.5% lower.

For example, if you were in line for a 3.0% fixed-rate mortgage, you could likely get a 2.5% adjustable rate. That lower rate might mean you could afford a bigger mortgage and a better, more costly home.

But the relationship between fixed rates and adjustable rates is not an iron rule. Sometimes, the gap is a bit wider. And sometimes its a little narrower. There are also periods when ARM rates are actually higher than fixed rates.

So its up to you to check where ARM rates stand in comparison to FRMs at the time when you are deciding which to choose.

You also need to shop around between different lenders for your best possible rate.

The ARM rate lenders can offer you depends on your credit score, credit report, down payment, and home value, among other factors. And you wont know which mortgage lender can offer the lowest rate until youve compared personalized rates from a few of them.

Compare todays 5/1 ARM rates

| Program |

|---|

| Rates are provided by our partner network, and may not reflect the market. Your rate might be different. . See our rate assumptions . |

Current Mortgage Rates: Are Mortgage Rates Going Up Or Down

Since the start of 2022, mortgage rates have risen quickly. Unfortunately, as the year progresses, rates may increase even further, said Jacob Channel, chief economist for LendingTree. That may make buying a home even tougher as home prices continue their upward trajectory.

This has put many would-be buyers in a difficult situation where they can no longer rely on low rates to offset the high asking prices of homes on the market today, Channel said.

Don’t Miss: How To Get Approved For Mortgage With Low Income

Which Mortgage Term Is Best

If you choose a 30-year mortgage, you will have lower monthly payments. However, the loan will cost more in interest by the time you pay it off. A 15-year mortgage has higher monthly payments but less expensive interest over the life of the loan. The answer depends on your individual situation and financial goals.

How Does The Mortgage Loan Process Work

Once you submit all supporting paperwork, your loan will enter the underwriting process. The lender will check to make sure you have the credit and income to repay the loan and confirm other aspects of your application.

The lender will also verify your down payment and funds for closing. The underwriting agent will confirm the source of large deposits in your account and confirm that you have cash reserves. Many lenders require savings of at least two to three times your monthly mortgage amount in reserve to complete the underwriting process.

During the mortgage application process, the bank will order an appraisal of the home. They want to make sure its value exceeds the amount of the mortgage loan. You may also want to have a home inspector evaluate the property before you move forward with the purchase. Some mortgages, such as FHA loans, require the borrower to get a home inspection.

Three days before the scheduled closing date of your mortgage, the lender must provide the closing disclosure. This legal document provides the final terms of the loan as well as the total closing costs. If the disclosure meets your expectations, you make your down payment and closing costs at settlement, where you receive your keys and take ownership of your new home.

Don’t Miss: How To Transfer A Mortgage To Someone Else

About Our Mortgage Rates

The purpose of this page is to give you an at-a-glance view of a variety of mortgage products and a current snapshot of their respective rates. When shopping for a home loan, it can often be helpful to see todayâs rate quotes for a full range of mortgage products in one place for the purposes of a side-by-side comparison.

PennyMac Loan Services is committed to offering its customers a wide range of home loan options to suit a variety of mortgage needs. Whether youâre a first-time homebuyer, looking to consolidate high-interest debt or wish to invest in real estate, we offer competitive rates and term lengths that make purchasing or refinancing a home possible for thousands of customers.

If youâd like to see a more detailed quote for your specific financial profile, Pennymac also offers a Customized Quote tool that provides a no-obligation quote based on your exact needs. Once youâve found a current home loan rate that works for your needs, get pre-approved with Pennymacâs pre-approval or apply online using our Mortgage Access Center .

Enter your contact information below and a loan officer will reach out to you to assist you with the loan process and answer any questions.

Or call us now at

- Discount Points:

Conventional Mortgages:

- Discount Points:

Conventional Mortgages:

How Does It Work

Mortgage lenders generally determine the amount of equity they will allow you to take out based on your credit profile and your LTV .

Loan to value is the percentage of the loan you are taking out relative to the total value of your home. For example, if you have a $20k loan on a $100k home, your LTV is equal to 20%. Most lenders will lend to a borrower up to 80% of their LTV.

The higher your credit score, the easier it is to get approved and/or take out more cash, and the more competitive rates you can receive.

Don’t Miss: When Can I Drop My Mortgage Insurance

Take A Look At Our Mortgage Payment Calculator And Learn How Much Home You Can Afford

With a 30 year fixed mortgage, borrowers have the advantage of knowing the mortgage payments they make each month will never increase, allowing them to budget accordingly.

Each monthly payment goes towards paying off the interest and principal, to be paid in 30 years, thus these monthly mortgage payments are quite lower than a shorter-term loan. You will, however, end up paying considerably more in interest this way.