Your Credit Report Should Reflect A Good Diversity Of Credit Products

When youre successfully managing a credit card, a line of credit and a loan, potential mortgage lenders are going to see someone who will be capable of handling one more payment every month. If all you have is one credit card, even if youve managed it well and kept it in good standing, your credit report is not going to look as good as it could. Lenders may still wonder what sort of risk you pose as a borrower – will you be able to handle multiple credit products or is one your limit? There is no way of them knowing. If you have poor credit, there are still ways to go about diversifying your credit products. Look into secured cards, secured lines of credit and credit building programs. for more info on those.

What Mortgage Lenders Look For When Approving A Home Loan

When you apply to get pre-approved, your lenders will review your credit history and consider your current credit outlook. This includes looking at:

- How on-time have you been with your payments and obligations?

- What does your current debt load look like, and how is it spread out?

- How much experience do you have managing credit?

- Have you been recently trying to acquire access to new sources of credit?

- Do you let items go into collections?

- Have you previously filed for bankruptcy?

Lenders ask these questions to get comfortable with you. Your financial health isnt the only consideration lenders make, but how you manage your bills tells a large part of your story.

Lenders also look for specific credit events known as derogatory items, like bankruptcy or delinquent accounts.

Derogatory items dont disqualify a mortgage approval. Generally, its only required that theyre historical events and not current ones. For example, you can get approved for a mortgage if youve declared bankruptcy in the past, or if youve lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. Whats important is whats happened in the time since the derogatory event occurred.

Can I Get A 658 Credit Score Mortgage

Yes, you can get a mortgage with a credit score of 658. If your credit score is 658 and you checked your score with Experian, it means your score is categorised as Poor, which means youll have less mortgage lenders willing to lend to you than if you had an Excellent score, but you still have options.

A Poor credit rating often means youll need a specialist lender because theyll be willing to consider your application on a case-by-case basis. Often, specialist lenders are only available through a specialist mortgage broker. Thats where we can help. We have a network of specialist mortgage brokers who can help get you a mortgage even if you have a Poor credit rating. Get in touch now and get matched to the perfect broker.

If your credit score is 658 and you checked with TransUnion or Equifax, it means you have an Excellent credit score and you should have lots of mortgage options available to you.

You May Like: Can You Take Out A Third Mortgage

Checking Your Credit Score

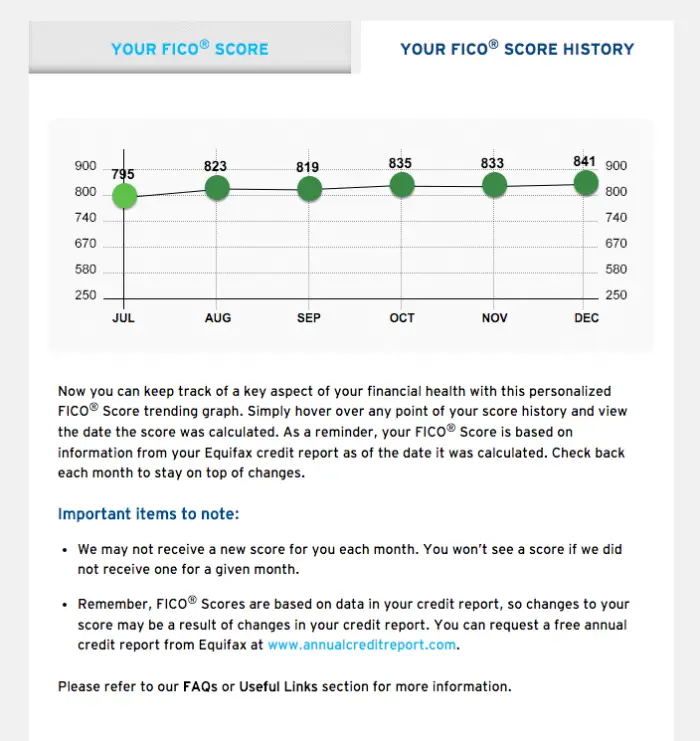

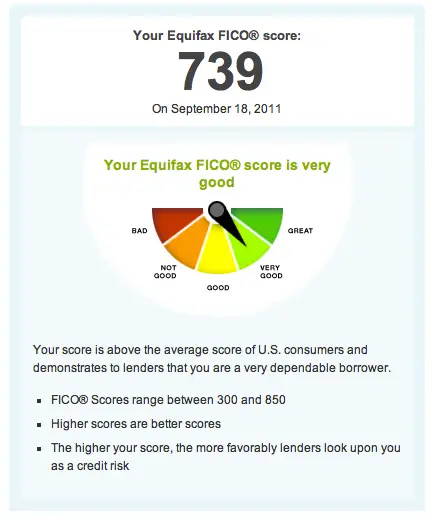

You should check your credit score well before you begin the mortgage process so you will know where you stand and the mortgage rate you could qualify for. You can check your credit score for free through several online services. Many banks, credit unions, and credit card providers offer credit scores as a regular feature. Since most major mortgage lenders use your credit score in their decision, it’s worthwhile to obtain all three of your reports to make sure the information on your record is accurate.

It’s a good idea to research your credit score and your credit reports well in advance of making a major purchase so you have time to address any errors or other issues you might discover.

Tips To Boost Your Credit Score

And, of course, you can boost your credit score through your own efforts. Read How to raise your credit score fast for helpful tips.

A few of the most impactful steps you can take to raise your credit prior to applying for a mortgage include:

You should also order a copy of your credit report from AnnualCreditReport.com. That site is owned by the Big 3 credit bureaus. And youre legally entitled to a free copy of your report each year.

Many reports contain errors. And it can take months to get them corrected. So start the process early.

Don’t Miss: What Is The Average Mortgage Interest Rate In Massachusetts

The Minimum Fico Credit Score For A Conventional Mortgage

A conventional or conforming mortgage is the most common type of home loan. This term refers to mortgages that meet the underwriting standards of Fannie Mae or Freddie Mac.

The minimum FICO® Score required for a conventional mortgage is 620. However, 620 is the bare minimum credit score for a home loan. The borrower’s down payment, reserves, and other debts also play a part. According to Fannie Mae’s latest underwriting standards, the minimum score can be as high as 700. And it’s worth noting that the 620 score is the minimum threshold set by Fannie and Freddie — individual lenders might have their own stricter requirements.

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage will depend on the type of mortgage youre trying to obtain.

|

Type Of Loan |

|

|

FHA Loan Requiring 10% Down Payment |

500 – 579 |

Most lenders consider FICO ® Scores of 740 or higher to be excellent ones with credit scores above 740, youll usually be able to qualify for a conventional loan with a low down payment requirement and low interest rate.

For a standard FHA loan, a minimum of one credit score is required to qualify. If your lender obtains all three of your credit scores, it will use the middle score for consideration. If you apply for a mortgage with your spouse, lenders will use the lower of the two middle credit scores.

Don’t Miss: How Much Do Mortgage Loan Originators Make

Lets Start With Your Fico Credit Scores

In the old days, banks and other lenders developed their own score cards to assess the risk of lending to a particular person. But the scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various credit card, mortgage and auto lending decisions.

How Can I Improve My Credit Score For A Mortgage

You can take certain steps to improve your credit score, such as:

- Ensure youre on the electoral roll

- Check your credit reports for inaccuracies or fraudulent activity

- Pay your bills on time, preferably on a monthly direct debit

- Check that your address history is correct, especially if youve moved recently

- If you have CCJs, make sure theyre satisfied

- Try not to depend on loans and overdrafts

- Dont apply with multiple mortgage lenders

Don’t Miss: What’s A 5 1 Arm Mortgage

How Much Deposit Do I Need To Get A Mortgage With A Poor Credit Score

It may be the case that to access your chosen lenders rates and meet their terms, you have to deposit a higher percentage of the properties market value. That being said, the amount of deposit you need to get a mortgage will vary depending on a whole host of factors including your age and the type of property you want to buy.

There isnt a typical deposit size, but some lenders ask applicants to deposit as much as 30% for a mortgage if they have a poor credit score or low affordability.

For a home valued at £200,000 that would equate to a £60,000 deposit. Large deposits arent a viable option for a lot of borrowers and thankfully there are a handful of lenders that appreciate this and may be more willing to lend under more flexible terms.

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

How To Solve Common Credit Issues When Buying A House

If your credit score or credit history is standing in the way of your home buying plans, youll need to take steps to improve them.

Some issues like errors on your credit report can be a relatively quick fix and have an immediate impact on your score. Other issues can take much longer to resolve.

You should start checking your credit early on, ideally six to 12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Recommended Reading: Can I Buy Another House If I Have A Mortgage

How Credit Scoring Models Affect Your Score

In the old days, banks and other lenders developed their own scorecards to assess the risk of lending to a particular person. But these scores could vary drastically from one lender to the next, based on an individual loan officers ability to judge risk.

To solve this issue, the Fair Isaac Corporation introduced the first general-purpose credit score in 1989. Known as the FICO Score, it filters through information in your credit reports to calculate your score.

Since then, the company has expanded to offer 28 unique scores that are optimized for various types of credit card, mortgage, and auto lending decisions.

But FICO is no longer the only player in the game. The other main credit scoring model youre likely to run into is the VantageScore.

Jeff Richardson, vice president for VantageScore Solutions, says the VantageScore system aimed to expand the number of people who receive credit scores, including college students and recent immigrants, and others who might not have used credit or use it sparingly.

What Scores And Models Are Used When Applying For A Mortgage

FICO® created different scoring models for each credit bureauExperian, TransUnion and Equifax. The commonly used FICO® Scores for mortgage lending are:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO® Risk Score 04

Mortgage lenders will often get a single report that contains your credit reports from each of the three credit bureaus and the associated FICO® Scores. It may base the lending decision on your middle credit score or, if youre applying jointly with a partner, the lower middle score.

Keep this in mind when youre trying to figure out what . If youre looking for a mortgage that requires a minimum credit score of 580, you may need your middle score to be at least 580 based one these specific FICO® Score models.

There are exceptions, though. Mortgage lenders could use different credit scoring models for loans that arent secured or bought by Fannie Mae or Freddie Mac. You might even be able to get a mortgage if you dont have a credit history or score at all.

Additionally, theres a review underway that could open up the use of different credit scoring models for mortgages, even if theyre secured or bought by Fannie Mae or Freddie Mac. However, until theres a change, many mortgage lenders will continue to use these three classic FICO® Scores.

Recommended Reading: What Documents Are Needed For A Mortgage Refinance

Other Factors Lenders Consider

Mortgage lenders don’t just look at your credit score when determining your rate, though. They’ll also consider your debt-to-income ratio how much of your gross monthly income goes toward debt paymentsas well as your down payment and available savings and investments.

So while it’s important to work on your credit score before you apply for a mortgage, avoid neglecting these other important areas of your financial situation.

What Does My Credit Score Need To Be For A Mortgage

The minimum credit score required to get a mortgage varies by loan type:

| Type of Loan | |

| 700-740 | 10-20% |

1With a credit score between 500-579 you may still qualify for an FHA loan if you can put at least 10% down.

2No minimum credit score established by either the USDA or VA, but lenders are allowed to set their own requirements.

If youre a first-time home buyer, you may be surprised you could get approved for a mortgage loan with a credit score below 600.

But the score you see in a credit monitoring app, or in your credit card statement, wont necessarily be the score your lender sees when it pulls your credit.

The score your lender sees will likely be lower. So if your credit is borderline, youll want to understand how lenders evaluate your credit score and credit history before moving forward with a loan application.

Recommended Reading: What Do You Need To Refinance Your Mortgage

Reduce Credit Card Debt

If avoiding new debt helps burnish your credit, it’s probably no surprise to learn that lowering existing debt can also help your credit standing. Paying down credit card balances is a great way to address this. Paying them off altogether is an ideal goal, but that isn’t always feasible within the span of a year or less. In that case, it’s wise to be strategic about which balances to tackle when paying off your credit cards.

One of the biggest influences on your credit scores is the percentage of your credit card borrowing limits represented by your outstanding balances. Understanding how credit utilization affects your credit scores can help you determine the smartest approach to paying down your current balances.

Your overall credit utilization ratio is calculated by adding all your credit card balances and dividing the sum by your total credit limit. For example, if you have a $2,000 balance on Credit Card A, which has a $5,000 borrowing limit, and balances of $1,000 each on cards B and C, with respective borrowing limits of of $7,500 and $10,000, your total your utilization ratio is:

Most credit scoring models start to ding your scores once utilization ratios near or exceed 30%. Total utilization is the most important factorand paying down any portion of a card’s balance reduces thatbut the guideline also applies to utilization ratios on individual cards.

Why Do My Fico Credit Scores Differ

Like we mentioned before, FICO periodically updates its credit scoring models so there are multiple FICO Score versions. They feature unique formulas that cater to, say, credit card issuers, mortgage lenders or car salesmen, each placing importance on different factors.

If youve had a car repossessed or missed a payment on an auto loan, for example, your FICO Auto Score may put extra weight on those factors. Note that your base FICO Score will likely also account for a missed car payment, but it may be weighted differently.

Though your scores may vary, theyre all based on the information provided by the credit-reporting agencies. So, focusing on whats in your credit reports could help you build your credit across the board.

You May Like: Rocket Mortgage Payment Options

Don’t Miss: How Much Does A 150k Mortgage Cost

How To Check Your Credit Score Before You Buy A Home

One way to check your credit score is to buy it from one of the three major credit reporting agencies. By law, credit reporting agencies are required to provide you with a free copy of your credit report once every 12 months, but those free reports do not include credit scores.

When we prequalify you for a mortgage to buy a house we will do a soft credit pull, which generally does not have an impact on your credit score. When you give us permission to pull your credit for prequalification, we can often tell you your current credit scores.

Prequalification can also give you an estimate of home prices you can afford, based on an estimate of the amount of a mortgage for which you might get approved.

Why Are Credit Scores Lower For Fha Loans

If you have a low credit score, your loan officer or online preapproval process may direct you to an FHA loan.

FHA loans are so named because the Federal Housing Administration, or FHA, insures them. With government insurance protecting these loans, lenders can offer competitive interest rates even if your score wouldnt qualify you for a conventional mortgage.

FHA insurance helps borrowers with lower credit scores get loans with lower mortgage rates and low down payment requirements. But this flexibility costs money. Your loan would require an upfront mortgage insurance premium of 1.75% of the loan amount. Thats $4,375 if youre getting a $250,000 home loan.

Youll also pay an annual MIP which typically costs 0.85% of the loan balance each year. Later, once youve paid down the balance enough, you could refinance into a conventional mortgage to eliminate these extra premiums.

Conventional or conforming mortgages loans that follow rules set by Fannie Mae and Freddie Mac will need private mortgage insurance unless youre making a down payment of 20% or more.

But with conventional loans you can stop paying PMI once youve paid off 20% of the loan amount.

Also Check: How Much Can I Borrow Mortgage Australia

How To Improve Your Score Before Applying For Credit

A tried-and-true way to establish excellent credit is to pay all your bills on time, across each of your credit accounts. This isnt a fast way to improve a credit score, but done consistently, it will strengthen your scores no matter the model or version you look at. Paying off debt balances, if possible, will also lower your credit utilization, similarly improving your score.

If youre applying for credit very soon, avoid other hard inquiries in the weeks leading up to the application, as these could cause a temporary drop in your score. Also avoid closing old credit accountsas long as theyre not expensive or unwieldy to maintainso your scores benefit from the accounts credit limit and long credit history. Lenders will be glad to see that youve been able to responsibly manage an account over an extended period of time.