How Much Will Your Future Mortgage Payment Be Let Us Help You With This Guide

Pittsburghers have often cited their city as the greatest: in its sports, in its people, and in its overall uniqueness. It’s no surprise to those of us who call Pittsburgh home that it’s been voted one of the most livable cities by The Economist Intelligence Unit. No wonder why people want to move here!

As many know, the journey of buying a new home can be exciting, but also long and stressful. From mortgage applications to move-in day, theres a lot of planning and time that goes into the process. Before you start searching for homes, you should understand how to calculate a mortgage payment in order to get an idea of what your monthly payment could be. When you can estimate what that expense will look like each month, you’ll be better prepared to focus on homes within your price range.

How Interest Affects The Cost Of A 150000 Mortgage

The interest rate is crucial for any mortgage or loan because it will directly affect how much you pay each month. Mortgage lenders in the UK can offer interest rates from 1% to 5% for a £150,000 mortgage.

The rates lenders are willing to offer are usually based on your credit history or profile and the size of your deposit. The interest plus a portion of the capital or amount borrowed is paid back each month for the duration of the loan until the total amount is cleared.

For example, heres an estimate of how much you would pay each month for a £150,000 mortgage with a 30-year term based on different interest rates.

| Interest Rate |

| £805 |

Get Matched With The Right Mortgage Broker For Your 150000 Mortgage

Finding a mortgage broker with the exact experience youre looking for is not always simple, but our broker matching service does the hard work for you. No matter whether youre concerned about self-employment, age, adverse credit, or youre looking to buy a less traditional property, such as a timber-framed building, well be able to pair you with a broker who has the most knowledge in the area you need.

Every broker we work with provides an initial consultation completely free of charge, and youll only pay beyond that if theyre able to secure you a mortgage. Call now on 0808 189 2301 or make an enquiry, to take advantage of our free 5-star matching service.

Read Also: What Credit Card Can I Pay My Mortgage With

How Much Is A 100k Mortgage Per Month Uk

With a monthly repayment of £ 100,000 for a 4% fixed interest rate, your monthly 30-year loan repayment could be £ 477.42 per month, while a 15-year loan can cost £ 739.69 per month. Note that the repayment of the monthly loan will vary depending on your interest rate, taxes and PMI, which are related fees.

How much will it cost 100,000 loans a month? With a fixed interest rate of 4%, a 30-year monthly loan repayment could be as high as $ 477.42 per month, while a 15-year high could cost $ 739.69 per month.

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

Read Also: How To Get Someone Off A Mortgage

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

Dont Miss: Rocket Mortgage Payment Options

What Is A Fixed Rate Mortgage

Fixed rate mortgages allow you to benefit from a set interest rate for an extended period of time. You can find fixed rate mortgages with high street banks for 2,3,5 or 10 years.

Securing an interest rate could help you know exactly how much you have to pay each month for the first few years of your mortgage. However, it is impossible to predict how interest rates will behave, and it is possible that the best interest rate today may not continue to be as competitive throughout your fixed rate period.

Recommended Reading: What Is A Good Mortgage Interest Rate

Cut Your Water Bills And Save Up To 100 Every Year With Little

Lifting interest rates is meant to encourage people to save, rather than spend, which in theory should help bring rampant inflation under control.

The Bank of England now expects inflation to peak at 11 per cent this October, compared to its earlier forecast of 13.3 per cent in August.

This would would mark the highest inflation the UK has witnessed since January 1982.

The central bank has already hiked the base rate six times this year.

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

Don’t Miss: What Is A Future Advance Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Rated Excellent By Our Customers

This fee is typically between a few hundred and a few thousand pounds, depending on the property type and searches required

Most lenders will insist that buildings insurance is in place prior to mortgage approval

Theres no stipulation from lenders to have mortgage protection, however, its advisable to protect yourselves

Recommended Reading: How To Report A Private Mortgage To Credit Bureau

How Do I Use The Mortgage Calculator

Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or well estimate the costs based on the state the home is located in. Then, click Calculate to see what your monthly payment will look like based on the numbers you provided.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options.

Costs Of Property Tax

Property taxes are collected by the lender and then paid into a specific account, usually known as an escrow or impound account, at the end of each year and are often included in a monthly mortgage payment. On behalf of the homeowners, the taxes are paid to the government at the end of the year.

The amount you owe in property taxes is determined by local tax rates and the homes value. Therefore, the lenders estimate of how much a homeowner will have to pay may be greater or less than the actual amount owed, resulting in a credit or a bill at tax time.

Also Check: What Is The Current Interest Rate For Second Mortgages

Where You Want To Buy

When it comes to real estate, its all about location, location, location especially when it comes to what you can afford. Every market and even every neighborhood within a market is different, and you can probably find a variety of price ranges where youre looking.

Its also good to keep in mind the property taxes youll be needing to pay depending on the state or city youre looking in and whether theres any additional home insurance youll need .

How Much Is The Average Monthly Mortgage Payment Uk

What is the average mortgage repayment rate in the UK? The average mortgage repayment rate in the UK is £ 723, with an interest rate of 2.48%. This is based on the latest survey conducted by Santander in 2018.

How much is the average monthly mortgage payment?

Read our editorial standards. The average mortgage payment is $ 1,159 for a 30-year fixed mortgage, and $ 1,747 for a 15-year loan. However, an accurate estimate of what the average U.S. would spend on their debt each month would be averaging: $ 1,609 in 2019, according to the U.S. Bureau of Statistics.

How much per month is a 200k mortgage UK?

| £ 200,000 Loans Various Terms |

|---|

Don’t Miss: How To Figure Out Mortgage Interest

Why Does It Take So Long For Federal Money To Arrive In Storm

Buildings and homes are damaged in the aftermath of Hurricane Laura Thursday, Aug. 27, 2020, near Lake Charles, La.

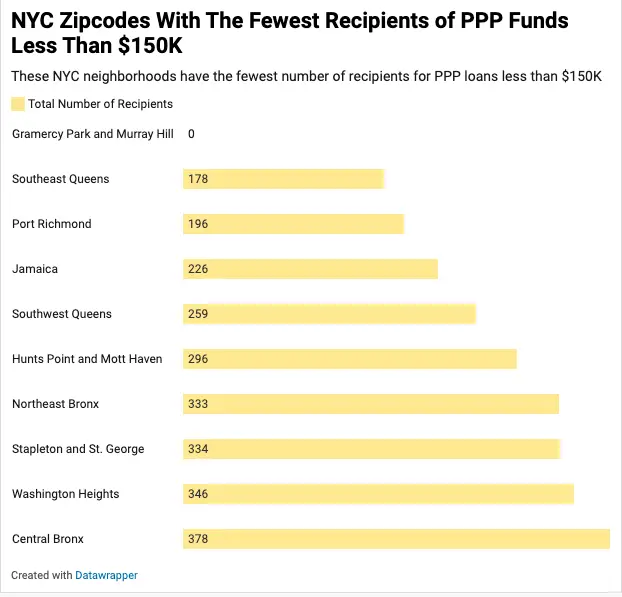

ProPublica and The Times-Picayune just published an investigation into why it has taken so long for federal assistance to arrive in parts of Louisiana that were damaged by a hurricane two years ago. We all watched on TV as Hurricane Laura struck Lake Charles, Louisiana, and politicians promised the response would be better than the debacle that failed Puerto Rico three years earlier. But the journalists found:

It took more than a year and a half after Laura for the federal government to approve what local officials deemed adequate long-term recovery assistance for the region. And more than two years after the storm, the first federal check from the Department of Housing and Urban Development has still not arrived.

The money has been entangled in the governments byzantine process of doling out such long-term recovery funds, a process that can drag on for many months and get buffeted by the political priorities of congressional leadership and the White House.

In addition to the wait, it also means that communities in the wake of disaster do not know how much Congress will eventually provide, making recovery planning difficult. Appropriations can vary widely from disaster to disaster.

Can I Get A 150000 Buy

Yes, of course, but the rules can be different for buy-to-let mortgages, so its important to know a few things before you start.

Some mortgage providers will expect you to put down a higher deposit of around 25%, although others will accept 15% subject to other criteria. You may also find that certain providers insist on minimum income requirements around £25k is standard although affordability come down to whether the forecast rental income will cover the mortgage repayments by 125-130%.

There are also lenders who will only offer you a buy to let deal if you have owned and lived in your own home from at least six months, but specialist providers may consider first-time buyers subject to other criteria being met.

The majority of buy to let mortgages are set up on an interest-only basis, so see the section below for examples of what the monthly payments on a £150,000 mortgage might be.

Read Also: Rocket Mortgage Launchpad

You May Like: Which Credit Union Is Best For Mortgage

How Do Lenders Determine How Much Mortgage I Qualify For

Before you figure out how much house you can afford, its useful to know how lenders calculate whether you qualify for a mortgage. Mortgage lenders determine your qualification based on your credit score and debt-to-income ratio .

Your DTI enables lenders to evaluate your qualifications by weighing your income against your recurring debts. Based on this number, lenders will decide how much additional debt youll be able to manage when it comes to your mortgage.

To see if youll qualify for a mortgage, you can begin by calculating your DTI:

Once you have calculated your DTI, you can evaluate whether its low enough to get approved for a mortgage. The lower your DTI, the more likely youll get approval.

If your total monthly debt is $650 , and your monthly income is $4,500 before taxes, your DTI would be 14%. A DTI of 14% is quite low, so youd be likely to obtain a mortgage.

Very rarely will mortgage lenders give a loan to an individual whose DTI is above 43%. After calculating your DTI ratio, if you find that its over 43%, youll need to work on lowering it.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Recommended Reading: Can You Do A Quit Claim Deed With A Mortgage

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

Can You Afford A 15000000 Mortgage

Is the big question, can your finances cover the cost of a £150,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering yes then its worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £150,000.00

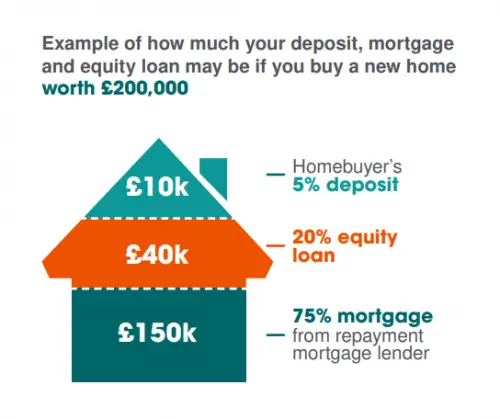

Do you need to calculate how much deposit you will need for a £150,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UKs leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesnt charge you fees, so you get the best mortgage deals without the hassle.

Also Check: How Interest Is Calculated On Mortgage