Will My Monthly Payments Change Constantly

Your monthly payments will depend on the type of mortgage you take out. For fixed-rate mortgages, your monthly payments will remain the same throughout the lifetime of the loan . For adjustable-rate mortgages, or ARMs, your monthly payments will be affected by fluctuating rates.

An ARM has a fixed interest rate for an initial period of time, which varies depending on your loan terms. After that, your rate could go up or down depending on the current benchmark or index rate, plus whatever your lender adds on by way of an ARM margin.

Compare this to interest-only mortgages where you start off with a fixed or adjustable low introductory payment period during which youre only paying off interest from your loan. After this period is over, youll need to make larger payments that incorporate the principal balance.

Not all interest-only mortgages work this way. Some have a balloon payment at the end, so make sure you know what youre getting into. Rocket Mortgage® doesnt offer interest-only mortgages at this time.

When Not To Buy Mortgage Points

Mortgage points dont make sense for every homeowner. Here are some reasons not to buy them:

- You dont plan to stay in your home for long. If youre a wandering soul who loves to move from place to place every few years, you wont get much benefit out of discount Points are a long-term strategy to pay less interest over time. It takes a few years for the money you save on interest to override the amount you spend to buy the points. If you know youll want to move at any point in the near future, points arent worth the cost.

- You plan to pay extra on your mortgage payments. Mortgage points will only benefit you if you pay on your home loan for a long time. If you have the means to pay off your loan quickly, you might not end up saving much money.

- You dont have the money to buy points. Its not worth emptying your savings account to save on interest down the line. Instead, you could save on interest in the long run by putting extra money toward your principal when you have the cash.

- Your down payment would suffer. Its usually better to apply extra cash to your down payment than to points. A larger down payment could mean a lower interest rate, cheaper home mortgage insurance or lower payments. Mortgage discount points dont come with all of these benefits.

Changes To The Cibc Prime Rate

Changes to the CIBC Prime Rate are sometimes described in terms of increases or decreases in basis points. A basis point is a unit of measure that represents 1/100th of one percent . For example, if interest rates are increased by 50 basis points, it means they were increased by 0.5%. The term basis point value simply denotes the change in the interest rate in relation to a basis point change.

Recommended Reading: Rocket Mortgage Vs Bank

How Many Mortgage Points Can You Buy

Theres no one set limit on how many mortgage points you can buy. However, youll rarely find a lender who will let you buy more than around 4 mortgage points.

The reason for this is that there are both federal and state limits regarding how much anyone can pay in closing cost on a mortgage. Because limits can change from state to state, the number of points you can buy may vary slightly.

According to a survey of lenders conducted weekly by Freddie Mac, for about the last 5 years, the average number of points reported on a 30-year fixed conventional loan was between 0.5 0.6 points.

Its important to note you dont have to pay for a full point to get a lower rate. Points are sold in increments all the way down to 0.125%.

But What Do These Lower Mortgage Rates Mean For You And What Should You Know Before You Start Comparing Them

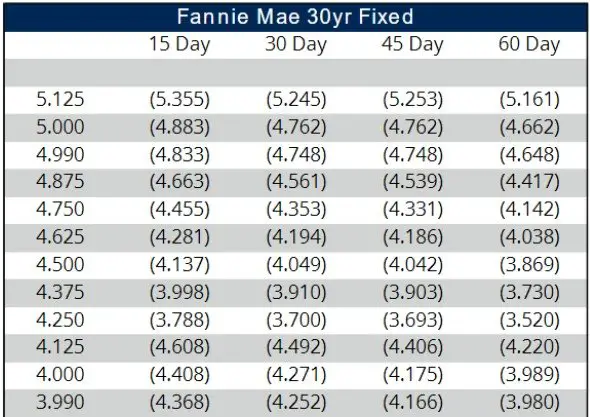

Now that were looking in the 3 percent range, were seeing even more competition to get the lowest interest rates while paying the fewest possible points.

Heres the bottom line. Even a fraction of a percentage of difference in interest rate is enough to make someone choose one lender over another. But what does that really equate to? Money Under 30 has created a

Heres an example:

- On a 30-year fixed-rate loan of $150,000 at 3.5 percent APR, your monthly payment is $674.

- Drop the rate to 3 percent, your payment drops to $632.

That saves you $41 a month on your monthly payment not bad, but not earth-shattering. But over 30 years, youll save $14,817 in interest.

So half of a percentage can make a huge difference in how much money you spend or save over time. But if you have to buy down the interest rate by paying up front points , then it may or may not be worth it. For example, on a loan of $150,000 again, one point would be $1,500 that you would need to pay up front. The amount that a point reduces your interest rate depends but typically for every point you pay, you lower your interest rate by one quarter of a percent. So for this example, if you want to get from 3.5 to 3 percent, youd need to pay $3,000.

Recommended Reading: Rocket Mortgage Launchpad

What Are Mortgage Points And How Do They Work

1-min read

A mortgage point equals 1 percent of your total loan amount for example, on a $100,000 loan, one point would be $1,000.

Mortgage points are essentially a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payments .

In some cases, a lender will offer you the option to pay points along with your closing costs. In exchange for each point you pay at closing, your mortgage APR will be reduced and your monthly payments will shrink accordingly.

Typically, you would buy points to lower your interest rate on a fixed-rate mortgage. Buying points for adjustable rate mortgages only provides a discount on the initial fixed period of the loan and isn’t generally done.

How Discount Points Work

When you apply for a loan and get approved, your lender will give you a loan offer. In your offer, the lender will typically offer you multiple rates, including a base rate, as well as lower rates that you can get if you purchase discount points.

Those discount points represent interest that youre repaying on your loan. If you decide to purchase points, you pay the lender a percentage of your loan amount at closing and, in exchange, you get a lower interest rate for the loan term. Typically, for every point you purchase, you get to lower your interest rate by 0.25%.

Like normal mortgage interest that you pay over the life of your loan, mortgage points are typically tax-deductible. However, points are usually only used for fixed-rate loans. Theyre available for adjustable-rate mortgages , but when you buy them, they only lower your rate for your intro periodseveral years or longeruntil the rate adjusts.

Recommended Reading: Recasting Mortgage Chase

When Are Mortgage Points Worth It

If you are buying a home and have some extra cash to add to your down payment, you can consider buying down the rate. This would lower your payments going forward. This is a particularly good strategy if the seller is willing to pay some closing costs. Often, the process counts points under the seller-paid costs. And if you pay them yourself, mortgage points usually end up tax deductible.

In many refinance cases, closing costs are rolled into the new loan. If you have enough home equity to absorb higher costs, you can pay mortgage points. Then you can finance them into the loan and lower your monthly payment without paying out of pocket.

In addition, if you plan to keep your home for a while, it would be smart to pay points to lower your rate. Paying $2,000 may seem like a steep charge to lower your rate and payment by a small amount. But, if you save $20 on your monthly payment, you will recoup the cost in a little more than eight years.

The lower the rate you can secure upfront, the less likely you are to want to refinance in the future. Even if you pay no points, every time you refinance, you will incur charges. In a low-rate environment, paying points to get the absolute best rate makes sense. You will never want to refinance that loan again.

But when rates are higher, it would actually be better not to buy down the rate. If rates drop in the future, you may have a chance to refinance before you would have fully taken advantage of the points you paid originally.

What Determines The Prime Rate

Variable rates are linked to CIBC’s Prime Rate, which is based directly on the Bank of Canada rate. The Bank of Canada is not a commercial bank and doesn’t provide services to the public, instead their principal role, as defined in the Bank of Canada Act, is “to promote the economic and financial welfare of Canada.”

You May Like: Reverse Mortgage For Mobile Homes

Should You Pay Mortgage Refinancing Points Or Not

Many people struggle with the decision to pay refinancing points. Most of the time, its only beneficial to pay those points when you plan on staying in your home for quite a while. This is particularly true if youre paying points to buy down your interest rate. The short-term incentive can blind long term reality.

One thing to notice is how much youll save over the long term. How many points to refinance is usually up to you obviously, though, the more points you pay, the more you will save over the span of a 30-year mortgage loan.

Another factor to consider is how expensive the upfront cost will be. Calculate your break-even point, or how long it will take you to pay off the upfront cost of the points.

For example, if you bought one point for $2,000 lower your interest rate 0.25 percent, you could expect a monthly savings of $30.55. To find your break-even point, youd divide your upfront cost, $2,000 by your monthly savings, $30.55. The result of this equation will show you, in months, how long it would take to break even from buying this point. In this case, 65.4 months, or about 1/5 of a 30-year mortgage.

Also, consider tax breaks you might earn. By pre-paying the interest for the life of your loan, and at a discounted rate, you can likely deduct them from your taxes.

How Much Is A Mortgage Point

- Its just another way of saying 1% of the loan amount

- So for a $100,000 loan one point equals $1,000

- And for a $200,000 loan one point equals $2,000

- The higher the loan amount, the more expensive a point becomes

Wondering how mortgage points are calculated? Dont worry, its actually really easy. You dont even need a mortgage calculator! Or a so-called mortgage points calculator, whatever that is

When it comes down to it, a mortgage point is just a fancy way of saying a percentage point of the loan amount.

Essentially, when a mortgage broker or mortgage lender says theyre charging you one point, they simply mean 1% of your loan amount, whatever that might be.

Also Check: 10 Year Treasury Yield And Mortgage Rates

Disadvantages Of Buying Mortgage Points

As with anything, there are drawbacks to buying points, too. The biggest is that it takes a big chunk of upfront money — money you could use toward higher-ROI investments, your emergency fund, your closing costs, or your down payment.

If you have to take cash away from your down payment to buy points, it could result in a few unwanted effects:

Another disadvantage is that it takes a while to pay off that upfront cost. If you only plan to be in the home a short while or just aren’t sure how long you’ll own that piece of real estate, you run the risk of paying more for the points than they save you. They’re really best-suited for long-term property owners.

How Much Does It Cost To Buy Down An Interest Rate

The cost for each discount point depends entirely on the amount you, as the borrower, take out on the loan. Each point that a borrower pays is equivalent to 1% of the loan amount.

For example, a mortgage lender may offer a borrower the ability to reduce their interest rate by .25% in exchange for a point. So, if the borrower is obtaining a mortgage for $400,000 and is offered an interest rate of 4%, paying $4,000 would lower their interest rate to 3.75%.

Don’t Miss: Reverse Mortgage For Condominiums

Lower A Key Monthly Payment

Youve likely heard of buying down the interest rate on a mortgage or paying up front for points. They are one and the same. You can use mortgage points to your advantage and lower the overall cost of buying a home. If you can pay more than the minimum down payment on a home, then look to purchase as many points as you can and still meet your savings goals. A point is a fee equal to one percent of your mortgage loan amount. The point is typically included in your closing costsit pays a portion of the future in advance. This is then reflected in the lower interest rate youll pay each month for the length term of the loan.

Are you still asking yourself, How do mortgage points work? Take a closer look through the infographic below and then find out how much you can save with mortgage points.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Chase Recast Mortgage

Advantages Of Buying Mortgage Points

The biggest perk of buying mortgage points is obvious: You get a lower interest rate — high credit score or not. And if you have the loan for a while, a lower rate can save you big money over time, as well as mean a lower monthly payment.

Here’s an example: Say you’re taking out a 30-year loan for $200,000. You originally qualified for a 3.75% rate, but you purchased two points , bringing your rate down to 3.25%. In this scenario, you’d break even on that $4,000 in just over four years. More importantly? You’d save about $20,000 in interest over the long haul.

Another advantage of buying mortgage points is that it’s tax-deductible. If you itemize your returns, you can write off those points — as well as any other mortgage interest you pay during the year. If you spend a good amount on points at closing, it can mean quite a significant write-off come tax time.

Finally, points can mean a lower monthly payment over the loan term. These monthly savings might even allow you to buy a higher-priced home than you originally planned for. In the $200,000 scenario above, here’s how points would impact your mortgage payment:

| MORTGAGE RATE |

|---|

| $843.21 |

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

For many borrowers, however, paying for discount points on top of the other costs of buying a home is too big of a financial stretch, and buying points might not always the best strategy for lowering interest costs.

It may make financial sense to apply these funds to a larger down payment, says Boies.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Overall, borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

Recommended Reading: Monthly Mortgage On 1 Million