Retiring Debt Early First Requires A Financial Review

But just because paying off your mortgage loan early won’t substantially increase your credit score doesn’t mean that you shouldn’t do it. Paying off your mortgage early can save you thousands of dollars in interest over the life of your loan.

“No one likes to be in debt,” says Ulzheimer. “And you do pay interest on that loan. Someone else is profiting off your money instead of you. If you have the ability to comfortably pay off a bill, I suggest that you do so.”

What you shouldn’t do, though, is take money out of your retirement to pay off your mortgage early, says TJ Freeborn, a mortgage expert with Discover Home Loans in Chicago.

Freeborn says that homeowners should first examine their finances before deciding whether or not to pay off their mortgage loan early. It might make more sense, for instance, for you to eliminate your credit card debt before prepaying your mortgage loan. Credit card debt, after all, comes at much higher interest rates.

There can be a surprising range of things to consider before you prepay your mortgage. HSH’s comprehensive Mortgage Prepayment Guide covers all the nuances, including the effects of different methods of making prepayments.

Your Score Could Drop But Will Rebound With Timely Payments

Becoming a homeowner is a huge milestone. It often takes years to build up your credit and finances enough to get approved for a mortgage. But how does a mortgage affect your credit score during and after the homebuying process? While you may see your score drop, dont panicits usually temporary. Heres what you should know.

Alert: Highest Cash Back Card We’ve Seen Now Has 0% Intro Apr Until 2023

If you’re using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until 2023, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

You May Like: Reverse Mortgage On Condo

How Does Getting A Mortgage Affect Your Credit Score: Faqs To Consider

If youve applied for a mortgage, youve probably been advised not to make any financial moves until your mortgage has been approved, including taking on more credit card obligations, quitting your job, buying a car, etc. The good news is that once you have signed the papers to close on the mortgage, its far easier to maintain it than it was to get it in the first place. The most important rule of thumb to remember is to make your mortgage payments on time, every time.

Here are a few questions that can put you on the right path:

The Average Age Of Your Accounts Has Now Decreased

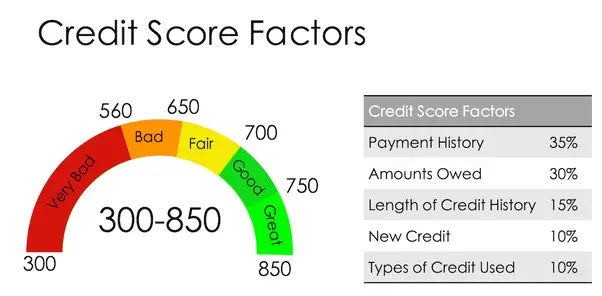

The length of your credit history makes up 15% of your FICO score. It is calculated by looking at the age of each of your open credit accounts and finding the average among them. Typically, the longer your credit history, the higher your credit score tends to be.

If your personal loan is one of your oldest standing accounts, once you pay it off it becomes closed and will no longer be accounted for when determining your average account age. Because of this, your length of credit history may appear to drop. However, over time your average account age and your length of credit history can increase since you will have been a credit consumer with other forms of open credit for even longer.

Don’t Miss: Chase Recast Mortgage

How Paying Off Your Mortgage Affects Your Credit Score

Congratulations! You’ve just finished paying off your mortgage probably the largest debt you’ll ever have in your life. Should you expect your credit score to increase as a result? Not necessarily.

Your credit score is calculated from your , a history of all of your borrowing and payment activity. While your mortgage was probably a huge part of that history, it’s just one part. Credit reports also consider other installment loans, your credit card payments, and any payments for non-borrowing related charges that have gone into collections. Every account matters and contributes to your credit score.

Consider the factors that go into calculating a credit score, starting with payment history the most influential factor. Mortgages require regular payments for a long time. With those payments removed, that’s one less regular payment that proves you’re handling credit responsibly. Your credit score may dip slightly as a result. If you’ve been less responsible with other payment paths, your score could drop further.

Paying your mortgage off early will save on interest charges, while making payments on your regular schedule could keep your credit score up. However, your credit score shouldn’t play much of a role in deciding whether to pay a mortgage off early. Calculate the economic tradeoff between interest savings versus other uses of your money .

How Big Events Affect Your Credit

Its extremely important to know these four events and what they can do to your credit score:

- Foreclosure

- Deed In Lieu

- Bankruptcy

Any of these four events can remain on your credit report and affect your credit score. If you have a mortgage and the rest of your credit history is not so great, its important to remember that making consistent and on time payments can help offset other poor credit factors.

Don’t Miss: 70000 Mortgage Over 30 Years

Your Credit Score Could Decrease

As crazy as it seems, paying off what is likely your largest installment debt might not, in fact, send your FICO score through the roof.

Philpot explains that if you dont have a balanced mix of revolving to installment debt and a good length of time that credit has been establishedand is still openyour score may dip slightly.

While minor, there could be a negative impact if your mortgage was the only loan in the installment category, as the overall credit mix of your credit picture accounts for 10% of your score, says David Bakke at MoneyCrashers.

And isnt the only category that could negatively affect your score.

Your score may also see a modest drop when the loan is paid off, because it takes the mortgage off of the length of credit portion of your score, which accounts for 15% of your score, Bakke says.

Paying Off Student Loans Early

Paying off a student loan early shouldnt have any negative impact on your credit score. Student loans dont come with prepayment penalties, so youre free to pay them off as fast as youd like. At the same time, though, making consistent payments over the life of the loan can improve your payment history, which is the biggest factor in your FICO score.

Also Check: Can I Get A Reverse Mortgage On A Condo

How Do Mortgages Affect Your Credit Score

Getting a mortgage can improve your credit score — but it takes time.

Your credit score is your ticket to a low interest rate on loans and special perks on credit cards. Getting a mortgage will usually have a negative impact right after you take out the loan, but it doesn’t have to ruin a good score. As long as you pay it on time each month, your mortgage can actually help your score over time.

Should I Pay Off My Mortgage Early

For generations, making a final mortgage payment has been cause for celebration. But despite the undeniable appeal of paying off your mortgage early, whether you should do so depends on your financial situation. If you’re in a position to pay off your mortgage ahead of schedule, there are a few things you’d do well to think about first.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

How Can I Improve My Credit Score Once I Have Paid Off My Debts

Once you have paid off your debts, you will probably want to know how to improve your score. First and foremost, paying off your debts is almost always a good decision. Credit cards and other types of consumer debt frequently come with high interest rates, so paying them off helps your financial well-being.

After your debt is paid, the best approach to take is to keep making other bill payments on time and keep your overall credit utilization under 30%. Payment history and credit utilization are the largest factors that impact your credit score by far, so if you focus on these two factors, youâll see your credit score recover from a temporary credit score drop in a short amount of time.

If youâre concerned about your credit score dropping after paying off debt, donât sweat it. This credit score impact is usually temporary, and as long as you keep exhibiting good credit and financial behaviour, your credit score will go back up to its normal level over time.

Alternate Ways To Pay Off Credit Card Debt

Cash-out refinancing is not your only option for paying down credit card debt. For example, you could explore a home equity line of credit or a home equity loan. You could also negotiate with your credit card companies to secure lower interest rates or consolidate your debt with a balance transfer. Read more about balance transfers in our article on the subject.

Read Also: Rocket Mortgage Loan Requirements

Mortgage Questions: Should I Pay Off My Collections

A customer’s story

Here’s a story relayed to us by one of our mortgage consultants. A hopeful home buyer calls him up and says, “I want to buy a house so I need a mortgage. My bank told me I need to improve my credit score, and I should pay off my collections on my credit report. I did, but my score didn’t go up. Did I do something wrong?”

Read our free Guide to Mortgage Ready Credit and start planning your future today.

Sound familiar? Maybe you have a collection on your credit report and you’re thinking that if you just pay it off, your score will go up and you’ll be able to buy that dream home you found last month.

Not so fast. Before you go making any changes to your credit history – like paying off collections, closing credit lines or refinancing a car loan to get a lower payment – you should talk to a mortgage professional about how these actions might affect your credit and your chances of getting a mortgage.

Did you know that lowering your 2-year old car payment by refinancing actually gives you a new line of credit? New lines of credit aren’t considered “seasoned,” which is bad news for someone looking for a mortgage. The older your credit lines are, the better. A new car loan is bad, but a 3-year old car loan shows you make regular, on-time payments. That’s a good thing.

Q& A with mortgage consultant Steve Cartwright

A: Here are a couple reasons why you haven’t seen any results:

Consider Your Future Credit Report

Once you pay off your mortgage, it doesn’t just disappear from your credit report. Equifax® states that the loan information could remain on your credit report for as long as 10 years from the date you made your final payment. During that time, it can be used as a factor in creating your current credit score.

Also Check: 10 Year Treasury Vs 30 Year Mortgage

How Do Mortgage Payoffs Work

A mortgage comprises of the principal amount and the interest incurred. Every mortgage typically has a minimum repayment threshold which applies first towards the interest and then towards the principal. For most mortgages, the law mandates that the minimum payment must be high enough so that it does pay off some of the principal balance. Banks do this to minimise their risk, to ensure that the debt is eventually paid off in a reasonable time frame.

Will Paying Off A Loan Improve Your Credit

One of the largest factors when it comes to determining your credit score is whether you pay off your debts on time. If you have a history of paying off debts in full and on time, youll likely have a better credit score than someone who frequently makes late payments. Thus, you would think that paying off a loan would automatically improve your credit scorehowever, the reality is more complicated than that.

Paying off a loan can indeed improve your credit score. But, at the same time, paying off a loan may not immediately improve your credit score. In some cases, paying off a loan can even hurt your credit score in the short-term. Whether paying off a loan helps or hurts your credit score depends on a variety of factors.

This may sound confusing, but dont worrywell unpack it all and explain the reasons why your credit score may increase or decrease when you pay off a loan. Read on to learn more about how much a loan affects your credit score or use the links below to navigate to any section in the article.

Recommended Reading: Reverse Mortgage For Condominiums

How Long Should You Wait After Closing To Make Another Big Purchase

As noted above, taking out a mortgage can negatively affect your credit score temporarily. Thats why youll want to wait to make another purchase until your score has risen again, in order to ensure youre receiving the best terms and interest rate for your new purchase or loan. When youve taken on a responsibility as big as a mortgage, your future lenders want to make sure you have the ability to stay the financial course and maintain your financial wellness.

But aside from the potential impact on your credit score, its just fiscally sound to wait to make another purchase after you buy a home. New homeowners often find they are beset with a multitude of unexpected expenses from homeowners dues to maintenance. So, its wise to be in your home for some time to make sure that you can capably pay the bills before assuming more debt.

Length Of Credit History

The average age of your credit accounts is another important factor in determining your credit score. Having many older accounts has a positive impact on your credit score, and having several new accounts is a negative contributing factor. If you pay off debt on an older account and subsequently close it, your credit score may drop.

Don’t Miss: Chase Mortgage Recast Fee

How To Raise Your Credit Score By 100 Points In 45 Days

Insurance carriers use credit scores as part of their calculations to determine the level of risk you would pose to them as an insured. They have found a direct correlation between credit scores and claim activity. Knowing that, it’s important to keep your credit scores in good shape so that your insurance premiums stay in line.

Your Credit Report Is Your Rsum

Think of your credit report like a personal résumé. Yeah, I used the accents. Instead of employment history, its your credit history.

You want it to be good, right? You want to show possible creditors youve got some serious experience, not just an entry-level job.

Heck, anyone can manage a few credit cards over the years, but those who can handle a high-dollar mortgage display a lot more responsibility.

Why? Because the monthly payments are often much higher than any other line of credit. And homeownership alone is a signal of dependability.

If you can muster the payment each month for year after year, it shows youve graduated beyond managing a measly credit card or two.

As noted, the loan term of 30 years means you increase the length of your credit history over time.

And if youre also paying down other debts and credit cards each month, youre essentially a credit superstar.

For these reasons, a mortgage could actually improve your credit score, though theres no hard and fast number.

Recommended Reading: Chase Recast

How Can I Improve My Credit Score

Qualifying for a mortgage was the first sign youre on the right path. But as you continue to strive to build your credit score, you might be wondering what factors impact it the most. Here is a breakdown FICO® shares of the model it uses to determine your credit score:

- Payment history : Never miss a payment to receive the full effect of this hefty percentage.

- Keep your revolving credit under 30% for the best results. Remember that this number doesnt take into account your installment credit, like your mortgage or a personal loan, as those will have set repayment terms.

- Length of credit history : Keep those older accounts open, even if youre not using them regularly.

- This refers to the different types of revolving and installment credit you have, including credit cards, vehicle loans, student loans, and now, your mortgage. Lenders like to see that you can manage different types of credit responsibly.

- New credit : Lenders will take into account if youre applying for new cards, which could signal that youre planning a spending spree.

Other Ways To Improve Your Credit

You have plenty of other options if improving credit is your biggest goal. Continue to make timely payments on all of your accounts and keep credit card balances to a minimum, ideally charging no more than 30% of your credit limit on each credit card at any point. This will ensure your doesn’t negatively impact your credit score, but to see credit improvement, the lower your utilization is, the better.

It’s also important to maintain a healthy average account age, which means you should avoid closing your oldest credit card accounts unless they carry a fee that makes it a financial burden to keep it open. That doesn’t mean you have to use them very frequently. One small purchase per month that you pay off immediately will signal to lenders and the credit bureaus that you have a handle on responsible credit usage over time.

Read Also: Recasting Mortgage Chase