Check Your Credit Report For Errors Or Evidence Of Paid Off Accounts

There’s always a small chance your credit report might contain errors, so it’s a good idea to check it every so often. Roughly 25% of Americans have noticed some sort of error on their credit reports, typically in the form of fraudulent or duplicated accounts should you come across anything questionable, contact the credit bureau you’re viewing it through to correct the issue as soon as possible. If you happen to have any accounts that have gone to collections and have since been paid off, such as medical debt, you can also ask for those accounts to be removed from your credit report.

You can monitor your credit with a free , like Experian or Chase Credit Journey, which will help you understand your credit score and figure out how to raise it as needed.

Learn more about eligible payments and how Experian Boost works.

Can I Remortgage To Pay Off Debt

Yes. You can remortgage to raise capital to pay off debts as long as you have enough equity in your property and qualify for a bigger mortgage either with your current lender or an alternative one. … Moreover, releasing equity from your property isn’t the only way a remortgage can help with your debts.

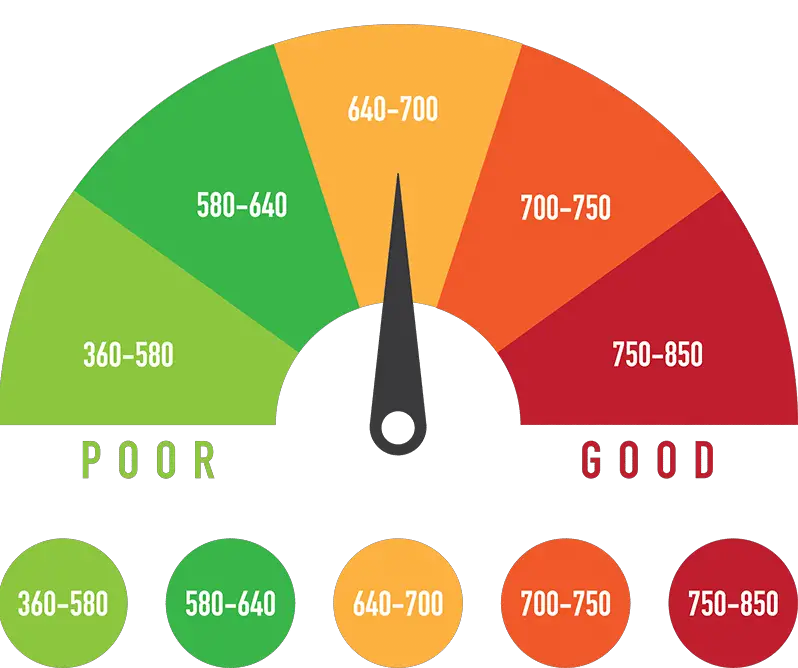

What Is The Range Of Credit Scores

If youre wondering what a good credit score is, it can help to review standard ranges to see where your number fits. FICO scores fall between 300 and 850 and are categorized as follows:

- Exceptional: 800

- Poor: below 580

How does your score measure up? If you dont see yourself in the top ranges, that doesnt mean its time to stop looking for your first home!

Read Also: Why Does My Mortgage Loan Keep Getting Transferred

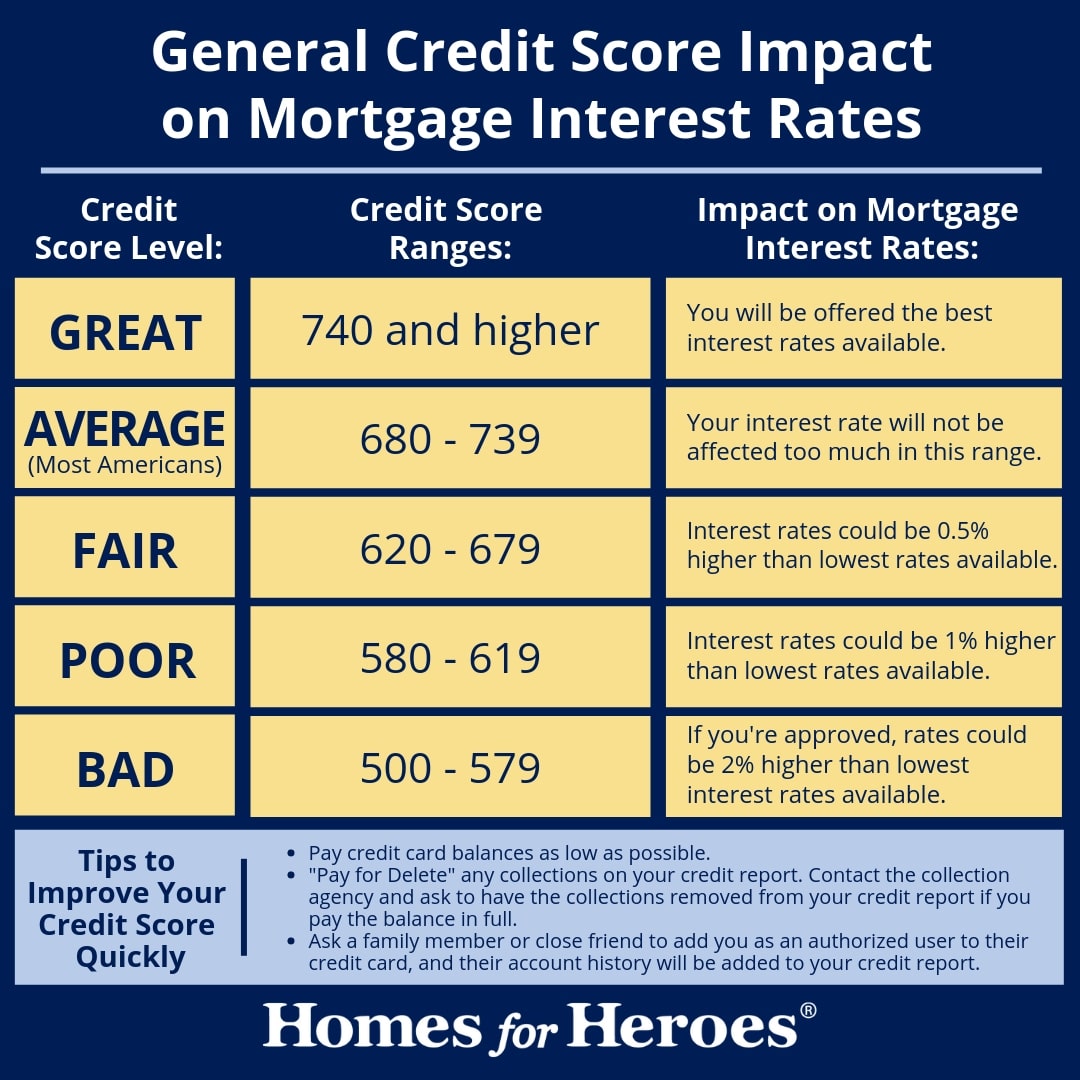

How Lenders Use Credit Scores

A higher score increases a lenders confidence that you will make payments on time and may help you qualify for lower mortgage interest rates and fees. Also, some lenders may reduce their down payment requirements if you have a high credit score.

On the other hand, a credit score under 620 could make it harder to get a loan, and your interest rates may be higher. Lenders differ, but they generally consider 670 or above to be a good credit score.

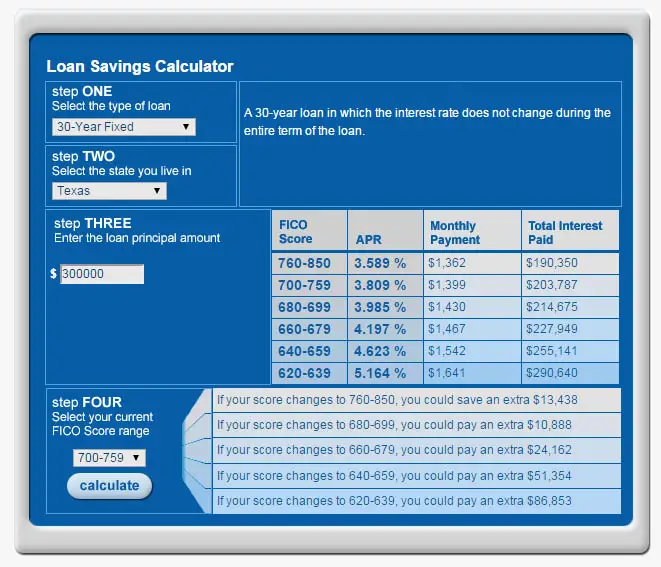

If you plan to get a $300,000, 30-year fixed-rate mortgage, improving your credit score in this example could save you more than $93,000 in interest payments over time.

This example is provided for comparison purposes only and does not constitute a commitment to lend nor is intended to guarantee that you currently qualify for the example APRs above.

Dont Miss: Syncb/ppc Account

Ways To Boost Your Credit Score

Your credit score can change every month, and even a small increase can help when applying for a mortgage. Here are some steps you can take to improve your score:

Make sure you pay all of your bills on time.

Pay off as much credit card debt as possible. Lenders prefer that balances be less than 30 percent of your available credit.

Check your credit reports and promptly correct any errors. Visit AnnualCreditReport.com to get a free copy of your report.

Avoid closing old credit card accounts or open new ones.

You May Like: What Is A Conforming Fixed Mortgage

How Does Your Credit History Affect Getting A Mortgage

Lenders use your credit report to get information on how reliable you have been at paying back debts in the past. When you apply for a mortgage you will have to supply payslips, P60s and bank statements to show how much you earn and what your monthly budget might look like. This shows lenders your current financial situation, but to predict how you might behave in the future they will also look at your credit report.

Your credit history might also affect your mortgage interest rate, in the sense that the types of mortgage you are offered will be affected by how responsibly youâve borrowed in the past. Special introductory rates or other attractive mortgage offers might only be available to people whose credit history meets certain criteria.

Can I Get A Mortgage Without 2 Years Tax Returns

Generally, lenders request W-2 forms going back at least two years when approving home loans. Lenders use your tax returns to verify your income as part of the application process. They need proof that you have consistently earned enough in recent years to fulfill your monthly mortgage payments for a particular home.

Don’t Miss: What Is The Current Interest Rate For 15 Year Mortgage

Make Sure It’s A Fico Score

One final thing – the variances in rates described above are based on FICO credit scores – the ones lenders typically ask for when evaluating a borrower for a mortgage. However, if you order your credit score from one of the three credit rating agencies, there’s a good chance it will be based on a proprietary rating system and not a FICO score.

These proprietary systems can produce scores that vary significantly from a FICO score and may give a consumer the impression their credit is better than it is. You can obtain your Equifax or Transunion FICO score for free through MyFico.com or for a fee from either company just make sure the score you’re obtaining is specifically identified as your FICO score. You cannot obtain your FICO score from Experian, as it no longer provides customers with FICO scores but will only provide them with scores produced by alternative credit scoring systems.

Questions To Ask Your Lender Or Broker When Getting Preapproved

When getting preapproved, ask your broker or lender the following:

- how long they guarantee the preapproved rate

- if you will automatically get the lowest rate if interest rates go down while youre preapproved

- if the pre-approval can be extended

Ask your lender or broker about anything you dont understand.

Donât Miss: How Much Is The Average House Mortgage

Recommended Reading: When To Refinance Home Mortgage

Do Some Mortgages Focus Less On Credit Scores

So, what are the best mortgage options if you have bad credit? Conventional mortgages focus greatly on credit score and creditworthiness in their credit assessments. However, other mortgage sources offer more relaxed lending guidelines, including:

- The minimum score for FHA Loan is 580 for a 3.5% down payment.

- The with a 10% down payment can fall below 580.

- The minimum credit score required for conventional loans is 620 for fixed-rate mortgage loans and 640 for adjustable-rate mortgages.

If youre not sure how to decipher the best lending options based on your credit score, working with a company that offers bad credit home loans in Houston can help!

Why Your Credit Score Impacts Your Mortgage Rate

Your credit score is a numerical representation of the items on your credit report. Lenders report your loans and payments to credit bureaus and those are listed on your report.

Then an algorithm crawls over your report, assigning numerical values to each item. So you get negative points for late payments and other bad behavior. And you get positive points for on-time payments and other good behavior.

The goal of your credit score is to determine how responsible or irresponsible you are as a borrower. This can help lenders decide how risky your loan is and what interest rate to charge you.

You May Like: How To Reduce My Mortgage Quickly

How To Improve Your Credit Score

To boost your credit score for your upcoming mortgage approval, first, check your credit report to learn whats comprising your score. All consumers get access to a free annual credit report at AnnualCreditReport.com.

You can also check your credit score by getting pre-approved.

If youve never reviewed a credit report, it can feel overwhelming. There are public resources that can help you, or you can ask for help in our chat. Well consider the factors that impact your credit score and discuss ways to make improvements, like opening a secured credit card account or shifting balances between charge cards.

Here are the best habits to improve your credit score:

- Pay your bills on time Payment history accounts for 35% of your FICO credit score

- Lower your credit utilization Increase your debt payments temporarily or request a credit limit increase

- Avoid new credit lines Hard credit inquiries are performed for a new line of credit and can affect your credit score for the next six months

- Dont close old accounts Keep old credit lines open and catch up on old payments or delinquencies

- Be patient It can take up to 6 months to make big changes in your credit score, so do the work and wait it out

Learn more about how to fix your credit to buy a home.

Rocket Mortgage By Quicken Loans

This online lender gives you two options for preapproval: a Prequalified Approval and a Verified Approval. The prequalified approval lets you apply online and sync your bank account to verify income and assets for your down payment and closing costs. The verified approval is billed as even stronger and connects you with a lending specialist who performs a full analysis of your assets, income and credit. That option includes a guarantee that Rocket will pay you $1,000 if you dont close on your financing based on its review. For more details, read our Rocket Mortgage review.

You May Like: What Are Prepaid Items On A Mortgage

Recommended Reading: How Much Is A 300 000 Dollar Mortgage

How Rate Shopping Affects Your Credit Score

The FICO score ignores all mortgage and auto inquiries made in the 30 days before scoring. If you find a loan within 30 days, the inquiries wont affect your score while youre rate shopping.

The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home, and that their searching may cause multiple lenders to request their credit report. To compensate for this, multiple auto or mortgage inquiries in any 14-day period are counted as just one inquiry.

In the newest formula used to calculate FICO scores, that 14-day period has been expanded to any 45-day period, Watt said.

This means consumers can shop around for an auto loan for up to 45 days without affecting their scores.

If youre wondering how to get the most bang for your buck while rate shopping, a nonprofit credit counselor can help walk you through the process. The advice is free and can save you from committing a costly error while perusing over various rates.

To sum things up, soft inquiries have no effect on your credit score. They happen all the time without your knowledge, so dont worry about them. A single hard inquiry will go mostly unnoticed by the credit bureaus. Any damage done will mend itself in a couple months.

However, if you make too many hard inquiries in a short enough period of time, your credit score will plummet.

5 MINUTE READ

Order Copies Of Your Credit Report

Get started by ordering copies of your credit report. This way, you can get an idea of everything a lender would see when reviewing your loan application.

First, check to make sure that all the information is 100% accurate. From there, look at where there are weaknesses on your report. Is the amount of debt you owe really high?

Read Also: How To Invest In Second Mortgages

How To Improve Your Credit Score To Get A Better Interest Rate

If youre concerned about how your credit score will affect your mortgage approval, you can take steps to improve your credit score now. Your score wont go up overnight, but slow and steady improvements can make a big difference in the interest rate youre offered once youre ready to apply for a home loan.

Several factors affect your credit score, including your amount of debt, payment history, and the length of your credit history. You can take actions to improve several of these factors.

Recommended Reading: Does Making Biweekly Mortgage Payments Help

How Can You Boost Your Credit Score

There are one-off actions that can improve your credit score, such as registering yourself on the electoral roll and clearing errors on your credit report. However, careful, long-term credit use is the most effective way to improve your credit score.

Its easy to think that never taking out a credit card would show youre good with money, but it can actually lower your credit score. Thats because lenders dont know how reliable youre going to be with repayments, as theres no record of you ever borrowing. If youre looking to improve your credit score, try:

- Spending and paying off a small amount each month on a credit card to show lenders you can responsibly manage your credit.

- Prioritising paying off debt to improve your debt/income balance.

- Making sure you know when payments are coming out and always having enough money in your account to cover them.

- Closing any old credit card accounts youre no longer using having too many open will make it look like youre relying on credit too much.

- Encouraging your partner or spouse to work on their credit score too, particularly if theyre an associated financial partner .

Don’t Miss: How Do You Get A 2nd Mortgage

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Make Sure Its A Fico Score

One final thing the variances in rates described above are based on FICO credit scores the ones lenders typically ask for when evaluating a borrower for a mortgage. However, if you order your credit score from one of the three credit rating agencies, theres a good chance it will be based on a proprietary rating system and not a FICO score.

These proprietary systems can produce scores that vary significantly from a FICO score and may give a consumer the impression their credit is better than it is. You can obtain your Equifax or Transunion FICO score for free through MyFico.com or for a fee from either company just make sure the score youre obtaining is specifically identified as your FICO score. You cannot obtain your FICO score from Experian, as it no longer provides customers with FICO scores but will only provide them with scores produced by alternative credit scoring systems.

Recommended Reading: Can You Have 2 Mortgages On The Same Property

How Your Mortgage Affects Your Credit Score

A Tea Reader: Living Life One Cup at a Time

Financial gurus are constantly warning consumers to keep their in tip-top shape if theyre planning to purchase a home in the near future. The higher your credit score, the more likely you are to get the best mortgage rates. A mortgage calculator can show you the impact of different rates on your monthly payment. Once you have the mortgage, however, it can affect your credit score going forward.

What Is A Hard Inquiry

A hard inquiry is when a lender checks your credit report and has your permission to check it.

This is part of the application for a credit card, car loan, student loan or mortgage. These are the kinds of inquiries that consumers fret over, since they stay on your credit report for two years for all the world of lenders and creditors to see.

If your soon-to-be landlord checks your credit as part of the application process for renting an apartment, thats a hard inquiry, too.

Basically, any time you tell someone its OK to check your credit report, FICO counts it as a hard inquiry.

Recommended Reading: How Long Does Bad Debt Stay On Your Credit Report

Also Check: What Is The Mortgage On 1.4 Million

Hard Vs Soft Credit Inquiries: Do They Affect Your Credit Score

Youre ready to apply for a mortgage loan. When your mortgage lender checks your credit reports will this hurt your three-digit FICO credit score?

The short answer? Probably. Because when a lender pulls your credit after youve applied for a car, mortgage or personal loan, thats known as a hard inquiry. According to FICO, the company behind the FICO credit score, a single hard inquiry could cause your credit score to fall temporarily, usually by less than five points.

But heres the complicated part: Not all inquiries will do this. And depending on how old your credit is and how many open credit accounts you already have, even a hard inquiry might not cause your score to dip.

As with most matters regarding credit scores, the impact of credit checks can be a bit confusing.

Dont Miss: Does Carvana Report To The Credit Bureaus

How To Improve Your Credit Score To Buy A House

Before you look at houses, its smart to check your credit score and pull your credit reports from the three major credit agencies. Addressing credit issues early on can help you raise your score before you apply for a mortgage.

If your credit score isnt great, there are still options. Instead of settling for the mortgage rates you currently qualify for, consider postponing homeownership and working to boost your credit score and improve your options. Here are some quick tips to help:

Don’t Miss: Does Refinancing Your Mortgage Hurt Your Credit Score