Best Mortgage Rates September 2022

With financial markets betting The Bank of England will more than double interest rates by next May to 4%, its more important than ever to check you’re on the best mortgage deal. Read on for the best rates, including fees, best remortgaging deals, best 5 year fixed rate, Help to Buy mortgage deals, green mortgage deals and more this month.

Finding the best mortgage rates in a sea of mortgage deals is hard work. So every month well be showcasing the best deals for you, with input from the mortgage experts at L& C.

Year Fixed Mortgage Rates

In a 30 year fixed mortgage, your interest rate stays the same over the 30 year period while you repay the loan, assuming you continue to own the home during this period. Such mortgages tend to be some of the most popular type of home loan thanks to the stability and lower monthly payments they offer borrowers compared to 15 year fixed mortgages.

What The Forecast Means For You

Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

Higher interest rates mean higher monthly payments for borrowers. For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172. This doesnt include insurance, taxes or other loan costs. If the rate rises to 6%, the monthly payment jumps to $2,398.

This means time is running out for homeowners who hope to lock in a lower interest rate by refinancing.

Also Check: Are Mortgages Cheaper Than Rent

How Long Can You Lock In A Mortgage Rate

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesnt process the loan before the rate lock expires, youll need to negotiate a lock extension or accept the current market rate at the time.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- A new down payment amount

- The home appraisal came in different from the estimated value in your application

- There was a sudden decrease in your credit score because you are delinquent on payments or took out an unrelated loan after you applied for a mortgage

- Theres income on your application that cant be verified

Talk with your lender about what timelines they offer to lock in a rate as some will have varying deadlines. An interest rate lock agreement will include: the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but its wise to get it in writing as well.

S To Get The Lowest Refinance Rate

The main goal of most mortgage refinances is to lower your interest rate and maximize your savings. Naturally, the lower the rate the bigger the savings.

But just because lenders offer a certain rate doesnt mean youll necessarily qualify for it. Often lenders will publish their lowest rate available, but those rates are reserved for borrowers who tick several boxes, like holding a high credit score and a low loan-to-value ratio.

Borrowers can put themselves in the best position to get the lowest rate by doing these three basic things:

Don’t Miss: How Big A Mortgage Can I Get

What Determines Mortgage Rates

Mortgage rates fluctuate for the same reasons home prices change supply, demand, inflation, and even the U.S. employment rate can all impact mortgage rates. The demand for homes isnt necessarily a sign of where mortgage rates are headed. The best indicator of whether rates will go up or down is the 10-year Treasury bond rate.

When a lender issues a mortgage, it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans. Mortgage bonds and 10-year Treasury bonds are similar investments and compete for the same buyers, which is why the rates for both move up or down in tandem.

Thats why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record.

Real Estate Deal Volume & Appreciation

- Fannie Mae anticipates home sales which were at 6 million units in both 2018 and 2019 will end 2020 with 6.2 million transactions and will see 6.1 million transactions in 2021.

- Real estate appreciation in the United States during 2018 and 2019 ran at 5.1% and 4.2%. In 2020 Fannie Mae anticipates home prices to increase 5.5% and increase a further 2.6% in 2022.

Recommended Reading: How To Find Out Who My Mortgage Was With

What Impact Do Rising Fixed Rates Have On The Stress Test

As mortgage rates continue to rise, the mortgage stress test will continue to go up as well.

Mortgages are currently stress tested based on the higher of:

- the qualifying rate , or

- your contract rate + 2%

As of September 8, 2022 the lowest available high ratio 5-year fixed rates are at 4.29%, while the lowest variable rate available is 4.25%. Therefore, whether you have a fixed or variable mortgage, the stress test used is the contract rate + 2% .

Figure Out How Long It Will Take You To Break Even

One of the most important factors in refinancing is figuring out your break-even timeline. A refi usually comes with upfront costs at the closing, just like an initial mortgage, and those can be thousands of dollars or more. If you’re not planning to stay in your current home for more than a few years, the savings you get from a lower rate might not outweigh those costs before you move. Bankrate’s refinance calculator can help you figure out this timeline.

Don’t Miss: How Difficult Is It To Refinance A Mortgage

Best Variable Rate Mortgages

The lowest rate on a variable mortgage this month is from Furness Building Societys 4.03% discount for 2 years which has an initial rate of 2.06%. Youll need a 20% deposit and it has an arrangement fee of £999. Last month the lowest rate on a variable rate mortgage was from Beverley Building Societys 3.47% discount for 2 years which had an initial rate of 1.77%.

How Much Have Fixed Rates Increased In 2022

On January 1, 2022 the best high-ratio, 5-year fixed rate in Canada was 2.34%. As of September 8, 2022, the best high-ratio, 5-year fixed rate in Canada was 4.29%.

Since the beginning of 2022, fixed mortgage rates in Canada have gone up a total of almost 2%, which represents an increase of just over 83%.

Also Check: What Is The Veterans Mortgage Relief Program

How To Find The Best Mortgage Rate For You

Different lenders will look at your financial circumstances in different ways.

For example, a lender that specializes in FHA loans will rarely raise an eyebrow if your credit score is in the 580 to 620 range. But one that caters to super-prime borrowers likely wont give you the time of day.

Ideally, you want a mortgage lender that is used to dealing with people who are financially similar to you. And the best way to find your ideal lender is by comparing loan offers. Heres how to do that.

Mortgage Rate Forecast: What Drives Changes In Mortgage Rates

Inflation has been high this year, with the consumer price index at 7.7% year-over-year in October. That was lower than expected, offering hope that the Federal Reserves efforts to raise rates to slow down consumer demand are starting to work. The Fed has raised its key interest rate several times this year, with the latest by 0.75 percentage points in November, but Chairman Jerome Powell indicated the central bank may start to slow down the pace of those increases.

Those factors have both pushed mortgage rates higher this year, from around 3.3% in January to more than 7% at the end of October.

Inflation is absolutely in the drivers seat, particularly as it pertains to mortgage rates. Until we get some sustained evidence that inflation is beginning to recede, the upward pressure on mortgage rates will remain, says Odeta Kushi, deputy chief economist at First American Financial Corporation.

Read Also: How To Calculate My Mortgage Payment

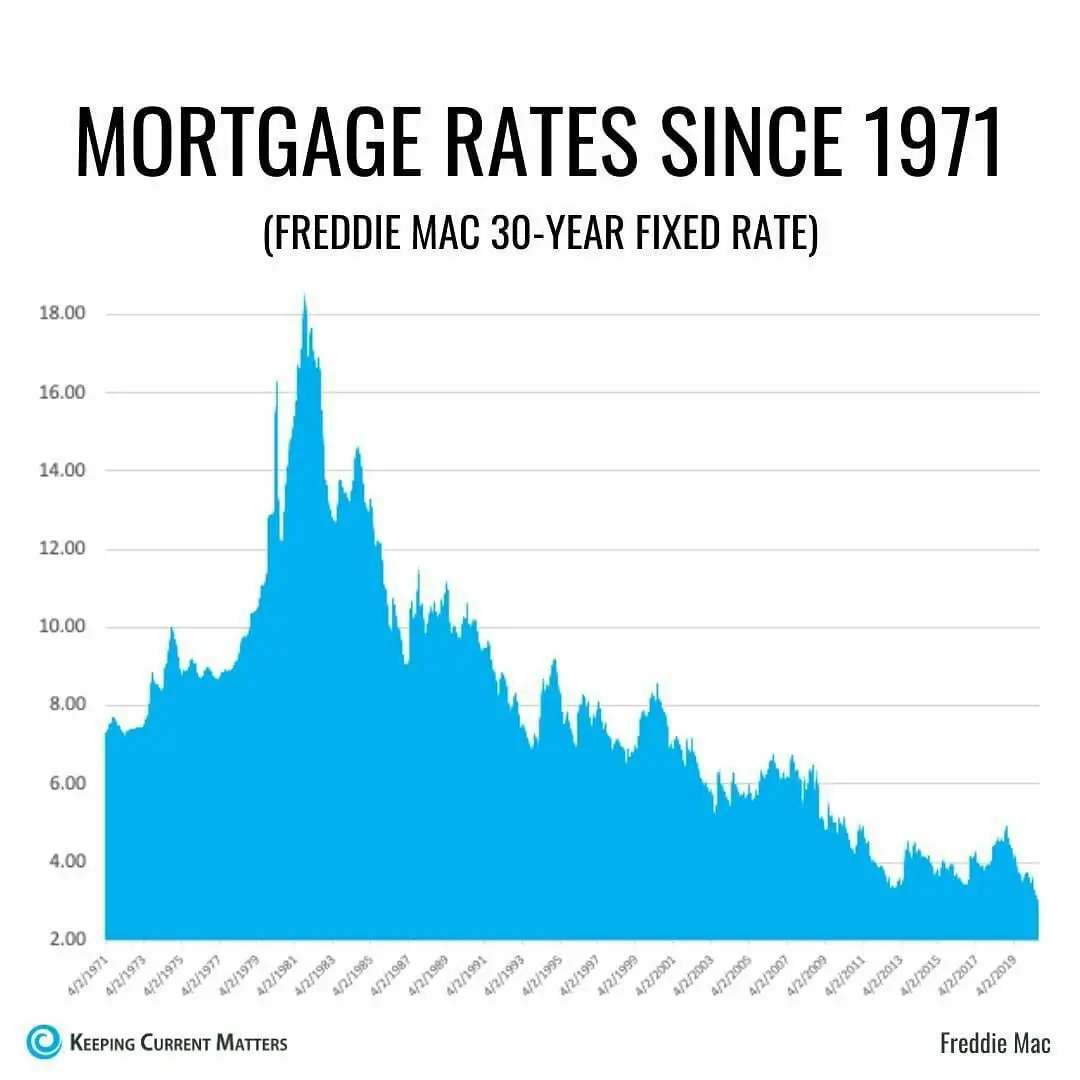

How Mortgage Rates Have Changed Over Time

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of todays lower interest rates. When considering a mortgage or refinance, its important to take into account closing costs such as appraisal, application, origination and attorneys fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

Are you looking to buy a home? Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Use Credibles online tools to compare rates and get prequalified today.

Thousands of Trustpilot reviewers rate Credible excellent.

How Big Of A Down Payment Do I Need

Nowadays, mortgage programs dont require the conventional 20 percent down.

In fact, first-time home buyers put only 6 percent down on average.

Down payment minimums vary depending on the loan program. For example:

- Conventional home loans require a down payment between 3% and 5%

- FHA loans require 3.5% down

- VA and USDA loans allow zero down payment

- Jumbo loans typically require at least 5% to 10% down

Keep in mind, a higher down payment reduces your risk as a borrower and helps you negotiate a better mortgage rate.

If you are able to make a 20 percent down payment, you can avoid paying for mortgage insurance.

This is an added cost paid by the borrower, which protects their lender in case of default or foreclosure.

But a big down payment is not required.

For many people, it makes sense to make a smaller down payment in order to buy a house sooner and start building home equity.

Read Also: Is Mr Cooper A Legitimate Mortgage Company

What Are The Advantages Of A 30

The biggest advantage to a 30-year mortgage is the ability to spread loan payments out over the maximum amount of time. That keeps the monthly payment much more affordable and makes homeownership accessible to more people.

Another advantage is that paying more in interest can help you make a bigger tax deduction, if you itemize your deductions.

How To Get The Best Mortgage Rate

Mortgage rates change daily and can vary widely depending on a variety of factors, including the borrower’s personal situation. The difference in mortgage rates can mean spending tens of thousands of dollars more in interest over the life of the loan. Here are some tactics to help you find the best mortgage rate for your new home loan:

You May Like: What To Watch For When Refinancing Mortgage

What Are Closing Costs

Youll likely owe more when you close on the house than just the down payment on the mortgage. There are other expenses that have to be paid to make this big transaction go through. Closing costs often entail taxes and fees associated with the purchase that arent included in the sale price.

Expect closing costs to total around 3% to 6% of the purchase price, so youre looking at between $8,250 and $16,500. They might include fees charged by the lender like loan origination fees, points paid to get a lower mortgage rate, fees associated with the property such as an appraisal or inspection, or prepaid costs such as property taxes or homeowners association dues.

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

Read Also: How Much Mortgage Can You Get With 100k Salary

/1 Arm Interest Rates

A 5/1 ARM has an average rate of 5.49%, a decrease of 5 basis points compared to a week ago.

An ARM is ideal for individuals who will sell or refinance before the rate changes. If thats not the case, their interest rates could end up being remarkably higher after a rate adjusts.

For the first five years, a 5/1 ARM will typically have a lower interest rate compared to a 30-year fixed mortgage. Keep in mind that depending on how much your loans rate adjusts, your payment has the potential to increase by a large amount.

Current Mortgage Rate Trends

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-central-new-jersey.jpeg)

The mortgage or refinance rate you get depends a lot on your personal finances. But the overall mortgage rate market provides context for your personal rate.

Average mortgage rates were low over the past two years. This climate allowed the most qualified borrowers to access historically low rates. But rates have risen in 2022 and could potentially go even higher by the end of the year.

To see where 30-year mortgage rates may be going, lets check where theyve been.

Don’t Miss: Can I Apply For Mortgage With Multiple Lenders

Mortgage Rates Maintain Their Ascent

Mortgage rates rose again as markets continue to manage the prospect of more aggressive monetary policy due to elevated inflation. Not only are mortgage rates rising but the dispersion of rates has increased, suggesting that borrowers can meaningfully benefit from shopping around for a better rate. Our research indicates that borrowers could save an average of $1,500 over the life of a loan by getting one additional rate quote and an average of about $3,000 if they get five quotes.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

How Do You Qualify For The Best Mortgage Rates

Getting the best mortgage rates requires five main things:

You May Like: What Mortgage Lenders Use Equifax

Shop Around To Find Your Best Interest Rate

Mortgage lenders personalize your interest rates based on your credit history and other details about your financial life. So you wont know for sure what your rate options look like until you apply and get pre-approved.

The first rate youre quoted may not be your best interest rate. Be sure to apply with several lenders so you can compare Loan Estimates and find your best deal.

How Do I Choose The Right Mortgage Interest Rate For Me

Buying a property is usually the most expensive purchase a person will make in their life.

Given the price of a Kiwi property these days, its likely you dont have $1 million sitting in the bank gathering dust.

So, in order to buy your first home, or your next investment property, youll need to ask the bank to lend you the money. You need to get a mortgage.

All mortgages come with an interest rate, the price you pay for the bank to lend you the money.

Once you get a mortgage youll develop a keen obsession with interest rates. What are they? How are they behaving? Can I predict what rates will be in 3 years time? What bank offers the best interest rates?

In this article well take you through 8 essential things to consider when you are deciding on your interest rate.

Do you have a question or comment about the the current interest rates? Feel free to leave your thoughts in the comment section at the end of the page.

Please remember: Heres the thing with interest rates they change all the time. So, the interest rates mentioned today may be out of date in 6 months.

Well do our best with current figures and market trends in this article. But, to check out the latest interest rates, look at the table above .

Fixed Or Floating Rate?

Also Check: Does A Bigger Down Payment Lower Mortgage

You May Like: Is Nationwide A Good Mortgage Lender