My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

This table shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

Whether The Home Is Too Expensive

Another thing a mortgage calculator is very good for is determining how much house you can afford. This is based on factors like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering emergency funds and any other financial goals. You dont want to put yourself in a position where youre house poor and unable to afford retiring or going on vacation.

Take Homeowners Insurance Into Consideration

Even if you think you can avoid it, homeowners insurance should be taken into consideration. Most people have to pay for this item, and the lender will automatically add the cost to the payment you make each month.

There are many different types of insurance in the world. For homeowners, there are eight options to choose from for your place. Its critical to consult a professional to determine which will help you the most in case of a disaster.

Varying price points depend on the type of insurance you get, and a high deductible means you owe a lower monthly premium than other choices.

Also Check: Which Banks Offer Lowest Mortgage Rates

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

What To Expect When Visiting Our Dealership

There are many reasons to visit Permian Ford Lincoln, from the vehicles we sell to the online car shopping tools we provide. Youllfind all sorts of trucks and SUVs in our new inventory, and we love to talk about what makes our new Ford models so great. You may prefer the value of one of our used vehicles. Of course, its more than just our vehicles that draw drivers to us as we have a Ford service center near Andrews, TX that is where to come for everything from oil changes to Ford accessories!

Recommended Reading: Recast Mortgage Chase

You May Like: Should I Have A Mortgage

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that play a role in determining your mortgage rate and, therefore, your payments over time.

Understand Your Mortgage Payment

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest.

Keep in mind that you may pay for other costs in your monthly payment, such as homeowners insurance, property taxes, and private mortgage insurance . For a breakdown of your mortgage payment costs, try our free mortgage calculator.

Also Check: Can You Get Extra Money On Your Mortgage For Furniture

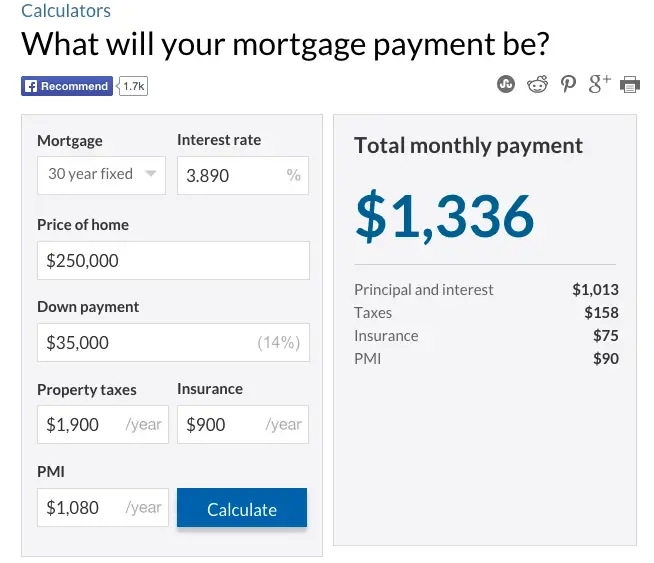

How To Use Our Mortgage Payment Calculator

We have included a mortgage payment calculator on the above page for your use and to help determine approximate payments. Once inputting the basic data that is applicable to your particular situation, the calculator will give the payment based on the information submitted. Always change the data so that you have numbers from multiple scenarios in case the rate or mortgage amount is different. This will give you a mortgage payment range so that you are prepared for differences between your numbers and the actual number.

Mortgage calculators can be used to answer questions like: What will the monthly payment be if one borrows $250,000 at a 7% annual interest rate and repays the loan over thirty years, with $3,000 in annual property taxes, $1,500 in annual property insurance, and 0.5% in annual private mortgage insurance? $2,142.89 is the correct answer.

Calculate Your Monthly Payment

Its finally time to calculate your mortgage payment. You can use an online mortgage calculator with extra payments, a traditional mortgage payment calculator, or the formula listed above if you want to calculate the number by hand.

Calculate the payment a few times to ensure you did it correctly. The closer you can get, the better your financial future.

Once you have your monthly payment, you can determine if the mortgage is affordable. Its helpful to calculate this estimate ahead of time to steer clear of sticky situations.

Recommended Reading: How To Refinance Your Mortgage Without Closing Costs

Considerations For Extra Payments

Pay Off Higher Interest Debts First

Paying off your mortgage early isn’t always a no-brainer. Though it can help many people save thousands of dollars, it’s not always the best way for most people to improve their finances.

Compare your potential savings to your other debts. For example, if you have , it makes more sense to pay it off before putting any extra money toward your mortgage that has only a 5 percent interest rate.

Further, unlike many other debts, mortgage debt can be deducted from income taxes for those who itemize their taxes.

Also consider what other investments you can make with the money that might give you a higher return. If you can make significantly more with an investment and have an emergency savings fund set aside, you can make a bigger financial impact investing than paying off your mortgage. It is worth noting volatilility is the price of admission for higher earning asset classes like equities & profits on equites can be taxed with either short-term or long-term capital gains taxes, so the hurdle rate for investments would be the interest rate on your mortgage plus the rate the investments are taxed at.

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Also Check: How Much Is A 260 000 Mortgage

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

What Are The Most Common Reasons To Refinance A Mortgage

You May Like: Can I Get A Mortgage And Rent The Property

What Is A Monthly Mortgage Payment Calculator

Contents

A Monthly Mortgage Payment Calculator will help you figure out how much your monthly mortgage payment will be based on the applicable data, such as loan amount, rate, number of years of mortgage, etc. When entering the data that is relevant to your situation, the mortgage calculator will give you the payment based on that data.

Estimated monthly payments typically include principal, interest, property taxes, and homeowners insurance. By showing additional options like credit score, ZIP code, and HOA fees, you will get a more precise payment estimate. This will enable you to enter the homebuying process with a more accurate understanding of how to calculate mortgage payments and make a confident purchase.

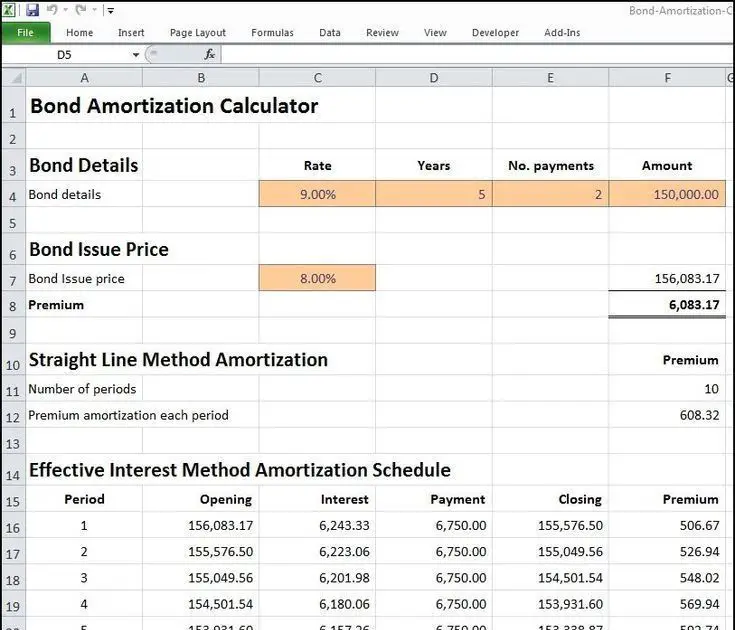

Creating An Amortization Schedule

Don’t Miss: How To Refinance A Seller Financed Mortgage

Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

Read Also: How Much Does An Average Mortgage Cost

Exercising Additional Payment Options

When you sign on for a 30-year mortgage, you know you’re in it for the long haul. You might not even think about trying to pay off your mortgage early. After all, what’s the point? Unless you’re doubling up on your payments every month, you aren’t going to make a significant impact on your bottom line right? You’ll still be paying off your loan for decades right?

Not necessarily. Even making small extra payments over time can shave years off your loan and save you thousands of dollars in interest, depending on the terms of your loan.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

You May Like: How Much Does A 150k Mortgage Cost

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.