The Best Insurance Companies To Protect Your Mortgage

The life insurance companys financial rating and the coverage cost are the two most essential elements to consider when selecting the best term life insurance plan. Because all term life insurance plans operate similarly, its about ratings and price. The best life insurance companies to protect your mortgage are:

Why Homeowners Need Some Type Of Life Insurance Protection

Until its paid off, theres plenty of financial risk built into your mortgage. If you cant make the monthly payments, for example, your bank could sell your property to cover its losses. Thats why many homeowners enter a mortgage with someone else like a spouse, partner or even a co-signing parent. Often, this person is helping limit the financial risk of buying a home.

But, what happens if you were to pass away unexpectedly? Your co-signer could end up facing that financial responsibility of a mortgage alone. If that happened, it could undermine the stability you have worked so hard to provide. Thats why having some type of insurance coverage in place is so important it helps provide a financial cushion to your beneficiaries if you were to die.

Dont Put Your Home At Risk

- Choose your Mortgage Protection accidental death insurance coverage from $50,000 to $350,000.

- Acceptance is guaranteed, regardless of health if you are between the ages of 18 and 69.

- No health questions or medical exams.

- The affordable monthly premiums will never increase for any reason.

- Rates as low as $5.50 per month.

Recommended Reading: Does Pre Approval Mean You Get The Mortgage

Who Should Consider Mortgage Protection Insurance

- All new homeowners

- Any homeowner that has life insurance only through their workplace

- Any homeowner that has individual life insurance but did not consider the amount of their mortgage when they calculated their life insurance needs.

- Any homeowner wanting to make certain that their mortgage is paid if the pass away or who is concerned about their ability to make their mortgage payment if they become disabled.

Is Mortgage Protection The Same Thing As Life Insurance

Yes and no. Like life insurance, mortgage protection policies pay out a benefit when the policyholder dies, but the beneficiary is always the mortgage lender â not your family or some other beneficiary who you designate. It’s helpful to consider mortgage protection as a limited type of life insurance with more specific rules about who and how much is paid by the policy.

You May Like: How Much Debt Is Too Much For Mortgage

Mpi Vs Homeowners Mortgage And Life Insurance

| MPI | |||

|

|

|

|

Neither homeowners insurance nor mortgage insurance either private mortgage insurance or mortgage insurance premium are required by state law, but you may need both if youre purchasing a home and financing it with a mortgage.

If you have a mortgage, your lender will require homeowners insurance to protect your home and belongings and to protect you from liability if an injury happens on your property. If the mailman slips and falls on your sidewalk, the dog bites a guest, a tree falls on your roof, or a kid is injured using your swimming pool, homeowners insurance can protect you.

If you have a mortgage and your down payment is less than the average 20%, your lender will require mortgage insurance to protect them in case you default on your mortgage payments.

Is It Worth Getting Mortgage Protection Insurance

If you have frequent health issues or you are a senior citizen, it can be difficult to get a good life insurance policy at affordable rates. Thats when mortgage protection insurance can be your best and even only option. To find the right policy that matches your needs, you should research the best mortgage protection insurance companies.

However, before you do that, you must look at traditional term life insurance policies first. A term life policy can provide you more bang for your buck than MPI. It can offer you more flexibility by allowing you to choose your policy length and the coverage amount. It may also be cheaper than mortgage protection insurance. Therefore, it is worth comparing term life insurance and mortgage protection insurance quotes to see which of them is the best value for your money.

Recommended Reading: How Long For Mortgage Pre Approval

Mpi Pmi And Mip: Differences Explained

Although these acronyms all have the same three letters, they have marked differences between them.

MPI

MPI is mortgage protection insurance designed to help loved ones continue making mortgage payments even after the policyholder dies. The premium costs vary and depend on multiple factors like the amount of mortgage, your health, and your age. MPI covers only the principal amount and the interest part of the mortgage payment. Usually, additional fees like property taxes, homeowners insurance, and other HOA fees would still need to be paid separately. However, some mortgage protection insurance providers also offer rider packages to cover these miscellaneous expenses.

PMI

MPI is often confused with another type of insurance, the PMI private mortgage insurance. This type of mortgage insurance is taken out by homeowners to protect the lender who provided the loan for your mortgage. It is usually required if the borrower is unable to pay a down payment of 20%. If the borrower passes away unexpectedly, PMI will give the payout to the lender. However, it will not pay off the mortgage on your home.

MIP

Aside from these two types of insurance, there is also MIP mortgage insurance premium. This premium is paid by homeowners who have applied for Federal Housing Administration loans. However, if the borrower is unable to make a down payment of at least 10%, they will have to pay MIP for the life of the loan.

Best Mortgage Protection Life Insurance Companies

The market for mortgage protection is crowded. Multiple companies offer their own version of the product. Some, unfortunately, are overpriced, and others have very thin policies which dont provide many features.

We represent over 30 of the best life companies. Because we specialize in life products, we have been able to sift through the options and understand exactly what is being offered and at what price. Beware of solicitations that dont provide options. If the agent you are working with only represents one company, the offer is probably better for the agent than it is for you.

The most significant factor when choosing the best mortgage protection company is determining which company will offer you the best rate class. If you do not know what a rate class is you should. You can learn what a rate class is on this page.

The best mortgage protection life insurance companies are:

The worst mortgage protection life insurance companies are:

- Mutual of Omaha

State Farm, USAA, Americo or Mutual of Omaha, Even though these companies say they have a particular mortgage protection series product, they are all still just term policies, and they are expensive term policies compared to the competition.

Also Check: What Credit Do I Need For A Mortgage

Who Might Pass On Mortgage Protection Insurance

- People who have a paid-for home

- People who are renting and not buying a home

- Anyone who has enough life insurance to meet the financial needs of their surviving loved ones and pay for their outstanding mortgage.

- Single people without children and no surviving loved ones who would need to continue living in their home.

How Do I Purchase Mpi

Now that youve learned more about MPI, talk to a real estate agent or lender to purchase MPI. Make sure to take the time to call around for quotes and find features that will benefit your situation. If youre interested in MPI, check in with A.M. Best, a company that rates the financial health of insurance providers before making a purchase.

Also Check: Can Seniors Get A Mortgage

When Is Mortgage Life Insurance A Good Idea

Mortgage life insurance makes sense if you have any health conditions that could make term life insurance overly expensive. While the benefits will go entirely to your mortgage lender rather than your surviving family, mortgage life insurance is ideal if your main goal is to make sure your home loan is paid off no matter what happens to you.

What Is Mortgage Insurance Premium

Mortgage insurance premiums are paid by homeowners who take out mortgages backed by the Federal Housing Administration. Up until 2017, mortgage insurance premiums were also tax-deductible. However, in 2020, the Further Consolidated Appropriations Act of 2020 allows tax deductions for MIP and private mortgage insurance for 2020 and 2018 and 2019.

You May Like: What Are Mr Cooper Mortgage Rates

In Summary: Term Life Insurance Offers Better More Flexible Protection Than Mortgage Insurance

If you have a mortgage and a young family, having some sort of coverage for your mortgage only makes sense. Itâs easy to see from the cost comparisons that term life insurance is usually cheaper than mortgage life insurance. And sometimes, it’s cheaper by a lot.

In short, if you’re looking for broad coverage that’s flexible and affordable, pass on mortgage life insurance and buy a term life insurance policy instead.

Ready to see how affordable term life insurance can be?

COO & Co-Founder

Laura McKay is the co-founder and COO of PolicyMe, Canada’s fastest-growing digital life insurance company. In 2021, she was named one of the Women of the Year by Bay Street Bull. Laura has a Bachelor of Mathematics from the University of Waterloo. Her degree focused on Actuarial Science. After her degree, she was employed by Manulife and Munich Re in Actuarial Science. Laura then worked at famed management consulting company Oliver Wyman where she worked with many Fortune 500 life insurance companies and helped them develop growth strategies and solve operational problems and regulatory issues.

Best For Young Families: Banner Life

Banner Life

For young familieswith financial concerns that include new home loans, small kids, and even future babiesterm coverage through Banner Life can provide up to 40 years of reliable mortgage protection, earning our nod for this category.

-

Term policies last as long as 40 years

-

Available in almost every state

-

Up to $10 million in coverage offered

-

Supplemental terms up to 20 years

-

Preferred underwriting available even with medical or tobacco history

-

Must buy coverage through an agent

-

Annual policy fee added

The needs of younger families are different than those of older families which could include households that are still growing and new home purchases. Both of these can affect the level of mortgage protection you and your loved ones need.

For young families, Banner Life is our top pick for protecting not only your partner and children but also the mortgage on your family home for the duration of the loan even if you refinance or upgrade properties. The carrier offers as much as $10 million in life insurance coverage for up to a 40-year term, with the option to add a supplemental 20-year term that can further protect your family until the kids are grown or the house is paid off. This allows you to account for both shorter- and longer-term financial concerns with one policy.

-

Term, whole, and universal life coverage

-

Retiring veterans can replace SGLI and lock in premiums

-

Many terms and riders to choose from

-

Available in all 50 states

-

Add or convert coverage as needed

Recommended Reading: How To Find Out If A Mortgage Is In Default

What Is Mortgage Protection Insurance And How Does It Work

Mortgage protection insurance is life insurance that can help protect your family if you die before the loan is paid off and you cant make your monthly mortgage payments. This policy will pay off your mortgage, which can help keep your family from losing their home if something unexpected happens.

Mortgage protection insurance can also be known as Mortgage Redemption Insurance.

Will My Job Affect How Much I Pay

Your job or the type of employment contract you have may affect the policy you can get. Most insurers will categorise jobs in different risk categories. Below is an example of how insurers may classify your jobs risk level, with Class 4 being the highest risk.

- Class 1: Professionals managers administrative staff staff with limited business mileage admin clerks computer programmers secretaries.

- Class 2: Some workers with high business mileage skilled manual workers engineers florists shop assistants

- Class 3: Skilled manual workers and some semi-skilled workers care workers plumbers teachers

- Class 4: Heavy manual workers and some unskilled workers bartenders construction workers mechanics

Most providers will now cater for self-employed people but read the small print carefully to check you’re not exempt – for example, if you’re on a casual or fixed-term contract.

Recommended Reading: Why Does My Mortgage Payment Keep Going Up

Does Mortgage Protection Insurance Cover Job Loss

When obtaining a mortgage loan, borrowers have the option to purchase unemployment protection insurance. This coverage often is included with mortgage protection policies. If laid off by an employer, MPI can prevent falling behind on mortgage payments for a limited time. Not all insurers will offer job loss and disability protection, so if interested, confirm its inclusion with the policy.

What Is Mortgage Insurance And How Does It Work

Mortgage insurance, also known as homeowners insurance or private mortgage insurance , protects the lender if you cant repay your loan. This makes it possible for the lender to give you a loan that you might not have been able to get otherwise. However, mortgage insurance increases the cost of your loan. If you must pay for mortgage insurance, it will be included in your total monthly mortgage payment to your lender or may be paid at closing in a down payment.

Different kinds of loans are available to people who want to buy a home but dont have saved money. Depending on your loan, you might have to pay for mortgage insurance differently.

Don’t Miss: What Is A Good Tip Mortgage

How Mortgage Protection Insurance Works

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The promise of mortgage life insurance is simple and appealing when you die, your family can keep the house with its mortgage paid off. The reality is more complex. For many people, a normal policy is a better option than mortgage life insurance.

As the name implies, mortgage protection insurance is a policy that pays off the balance of your mortgage should you die. It often is sold through banks and mortgage lenders.

The reason lenders like mortgage life insurance is simple theyre the ones who get paid when you die. The death benefit of a normal life insurance policy goes to . But with a mortgage life insurance policy, the beneficiary is the lender, which will be paid the remaining balance of your mortgage.

That means your family only benefits indirectly. If you owe $150,000 on your mortgage, the mortgage protection policy will pay it off, and the property will be mortgage-free, but your family will have no say in how that money is spent.

Since your mortgage decreases over time as you make payments, that means the death benefit of your mortgage life insurance decreases, as well.

» MORE:

What Is Mortgage Life Insurance

Mortgage life insurance is insurance that covers your outstanding mortgage balance.

In other words, your insurer will pay whateverâs left on your mortgage to your mortgage provider if you pass away before your mortgage is paid off.

Mortgage life insurance is sometimes called âmortgage insuranceâ or âmortgage protection insurance.â

Itâs not the same as mortgage default insurance, which is required when you pay less than 20% on a down payment on a home. Itâs administered by the Canada Mortgage and Housing Corporation .

This crystal-clear explainer video will tell you everything you need to know.

To learn about different types of mortgages, read our comprehensive guide on Fixed vs Variable Mortgages and Life Insurance vs. Mortgage Insurance.

Recommended Reading: How To Qualify For Mortgage Refinance

Best Mortgage Protection Insurance Companies

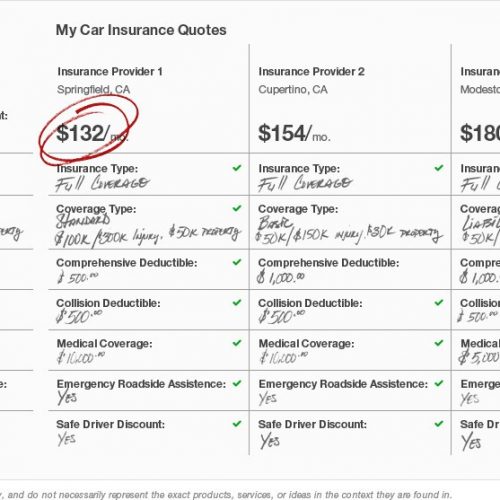

Mortgage protection insurance offers limited coverage and is more expensive than term life insurance, which is affordable and provides a more comprehensive financial safety net for your family.

If you want to make sure the rest of your mortgage is paid off if you die, we recommend purchasing a 15-, 20-, or 30-year term life insurance policy instead of MPI. These are our top picks.

How Mortgage Life Insurance Works

Mortgage life insurance is simply life insurance that pays off your outstanding mortgage balance if you die. The mortgage insurance policy is usually purchased when you buy your home, or soon after that, and lasts for the same number of years as your mortgage. Mortgage life insurance is a type of term life insurance. Its usually sold by insurance agencies affiliated with mortgage lenders and by independent insurance companies that obtain information about your mortgage from public records, which is why you receive so many offers when you buy a home.

Terms and conditions vary for mortgage life insurance, but in most cases, if you were to die during the policy term, the lender would receive the payout, and the death benefit is exactly the amount you owe. As you make each monthly payment, your outstanding mortgage balance goes down, the death benefit amount on the mortgage life insurance policy goes down with it. Some insurance companies do offer a level death benefit, meaning the life insurance payout is the same whenever the insured person dies. Youll want to find out whether the death benefit of a mortgage life insurance policy decreases as the mortgage is paid off, as most policies do, before you consider buying one.

Dont confuse mortgage life insurance with private mortgage insurance , which you may need to pay for along with your mortgage if you put down less than 20 percent on your home. Here are the advantages and disadvantages of mortgage life insurance:

You May Like: What Percent Down Payment To Avoid Mortgage Insurance