How Your Credit Rating Affects Your Interest Rate

Lenders look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a mortgage. If you have good credit history, you may be able to get a lower interest rate on your mortgage. This can save you a lot of money over time.

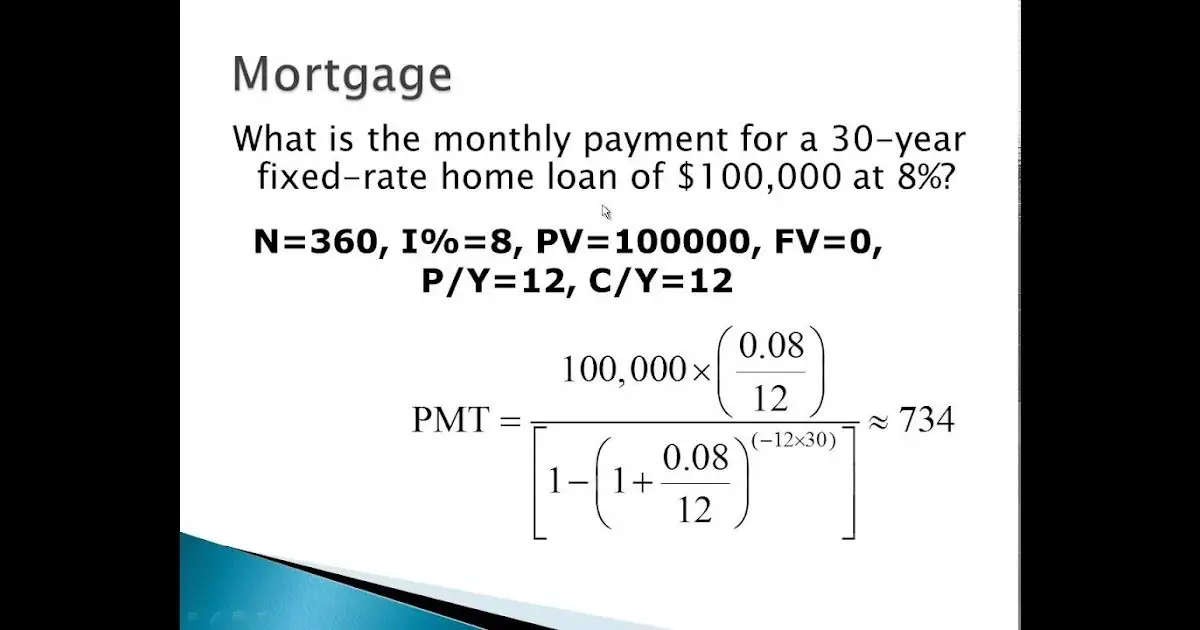

How Do You Calculate A Mortgage Payment

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much youll pay over time.

Whats The Difference Between Interest Rate And Apr

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

Don’t Miss: How Much Is A Mortgage On A 250k House

How To Use Our Mortgage Rate Tool

You need six pieces of information to start comparing rates:

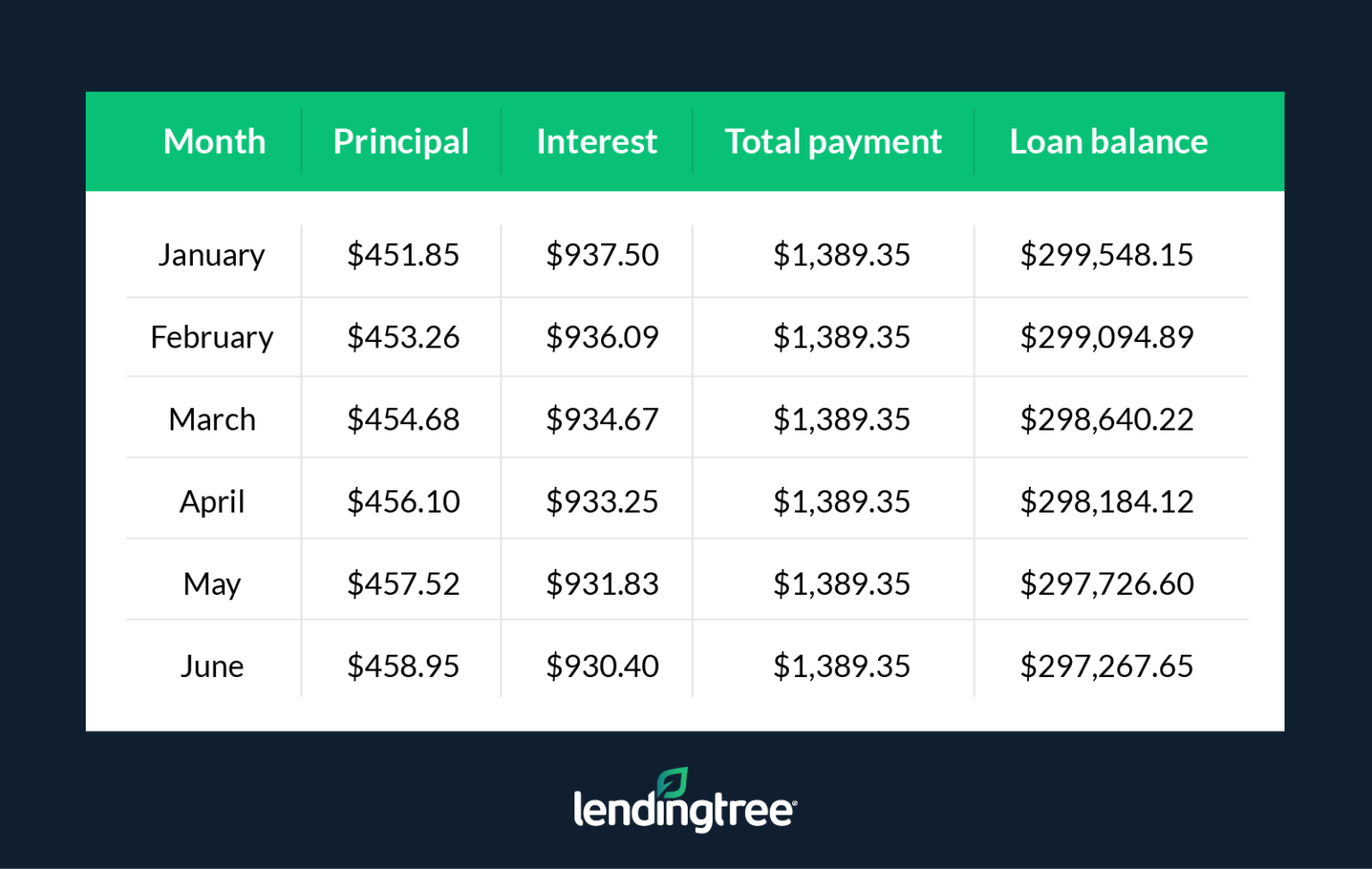

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates â personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

You May Like: What Is The Current Prime Mortgage Interest Rate

Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their forever home have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thats why its so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

How Is My Mortgage Penalty Calculated

Are you looking topay off your mortgage early? Or refinance the terms of your mortgage at a lower interest rate? Maybe you sold your home and purchasing a new home, in which a mortgage transfer will apply. Whatever the case, you most likely will have to pay a mortgage break penalty set by your lender. Whatever the situation, our calculator will help you determine the cost to break your mortgage so you can be confident about your mortgage decisions.

Also Check: Where Can I Get Mortgage Life Insurance

How Much Can I Save Comparing 1

Your mortgage is likely to be the largest financial commitment youâll ever make, and getting a better rate can save you thousands, even over just a 1-year term. Even a slightly lower mortgage rate can result in big savings, especially early on in your mortgage.

For example, on a $500,000 mortgage with a 25 year amortization period, a rate of 3.00% would see you pay $14,721 interest over 1 year. With a 2.75% rate, youâd pay $13,496 interest over the term. So, a difference of just 0.25% can save you $1,225⬠over your 1-year term.

How Are Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market. You cant do anything about that, but its worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

» MORE: Get your credit score for free

Don’t Miss: How To Take Out 2nd Mortgage

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

How Do I Find Current Fha Interest Rates

NerdWallets mortgage rate tool can help you find competitive FHA mortgage rates tailored to meet your needs. In the Refine results section, enter a few details about the type of loan youre looking for and youll get a customized interest rate quote in moments, without providing any personal information. From there, you can start the process of getting your FHA loan and be on your way to making offers. Its that easy.

Recommended Reading: What Is Union Home Mortgage

How To Calculate How Much Interest You’ll Pay On A Mortgage

Mortgage interest is calculated in arrears – meaning for the month before your payment date. When applying for a mortgage loan, your lender should give you an amortization schedule, which breaks down just how much you’ll pay in principal and interest for each month of your loan term.

At the start of your loan, more of your payment will go toward interest. You’ll pay more toward your principal balance as you get further into your term.

How Much Interest Can Cost

Your interest rate and how its calculated affects your regular mortgage payments. A mortgage is usually a large amount of money. Therefore, small differences in the interest rate can have a significant impact on your costs.

Figure 1: Example of monthly mortgage payment for a mortgage of $300,000.00 with an amortization of 25 years at various interest rates

| Interest cost over 5 years | Interest cost over 25 years |

|---|---|

| 2.50% | |

| $73,097.91 | $233,738.23 |

Make sure your home is within your budget. Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, you may be overextending yourself.

Don’t Miss: How Much Is A Mortgage A Month

How Do I Find Personalized 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. Specify the propertys ZIP code and indicate whether youre buying or refinancing. After clicking “Get Started”, youll be asked the homes price or value, the size of the down payment or current loan balance, and the range of your credit score. Youll be on your way to getting a personalized rate quote, without providing personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

Do Fha Interest Rates Vary By Lender

Yes, FHA loan rates vary by lender, so it can pay to comparison shop. Once youve found a few lenders that seem right for you, compare each one.

If youre approved, each lender will provide you with a Loan Estimate form. This will let you compare not only FHA mortgage rates, but also origination fees, closing costs and everything else youll pay over the life of the loan. Comparing loan estimates from more than one lender will give you confidence that youre getting a good rate and that youre getting the right loan for your situation.

Also Check: How To Increase Your Mortgage Credit Score

How Do Lenders Calculate My Dti

At a minimum, lenders will total up all the monthly debt payments youll be making for at least the next 10 months Sometimes they will even include debts youre only paying for a few more months if those payments significantly affect how much monthly mortgage payment you can afford.

Lenders primarily look at your DTI ratio. There are two types of DTI: front-end and back-end.

Front end only includes your housing payment. Lenders usually dont want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance. For example, if your total monthly income is $7,000, then your housing payment shouldnt be more than $2,170 to $2,520.

Back-end DTI adds your existing debts to your proposed mortgage payment. Lenders want this DTI to be no higher than 41% to 50%. Lets say your car payment, credit card payment and student loan payment add up to $1,050 per month. Thats 15% of your income. Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450.

What Other Things Should I Consider When Choosing A Mortgage Product

Fixed or variable arent the only decisions youll have to make when it comes to your mortgage, and there are some features you might want to look for that could make your mortgage and payments more flexible, such as:

- Prepayment privileges that allow for payment increases, or lump sum payments that go directly to your principal

- Underpayment options in case you need some financial assistance and cant make your full payment

- Portability that could let you take your mortgage with you if you move before the term is up

- Reborrowing capabilities such as a readvanceable mortgage that give you access to some of the money youve already put into the house

- Payment holidays that allow you to defer payments under some circumstances

Don’t Miss: How Often Are Mortgage Rates Updated

Will Mortgage Rates Follow The Fed

Mortgage rates have been on an upward track so far this year, but that path might change as the Federal Reserve continues to battle inflation, increasing the federal funds rate again in July.

The Fed has raised interest rates as much in little more than four months as what took three years the last time they moved rates up, says Greg McBride, chief financial analyst for Bankrate. The cumulative effect of this sharp rise in rates has cooled the housing market and caused the economy to start slowing, but hasnt done much to lower inflation.

Fed policy doesnt influence rates on fixed mortgages they follow the 10-year Treasury yield. However, the central banks moves could drive those yields down and pile on the recession woes.

If that happens, fixed mortgage rates might pull back from the near-6 percent range weve seen as of late.

Though the Fed doesnt set fixed mortgage rates, its actions do affect adjustable-rate mortgages and home equity products. Each time the central bank raises its key rate, variable home loan rates move in-step.

The swift uptrend in mortgage rates has been weighing on home sales during what would historically be an active spring and summer homebuying season. As of June, sales have come in lower five months in a row, the National Association of Realtors reports.

Still, for buyers, a slowdown would bring much-needed relief after the pandemic home-shopping frenzy.

Which Loan Is Right For You

When choosing a mortgage, you need to consider a wide range of personal factors and balance them with the economic realities of an ever-changing marketplace. Individuals personal finances often experience periods of advance and decline, interest rates rise and fall, and the strength of the economy waxes and wanes. To put your loan selection into the context of these factors, consider the following questions:

- How large a mortgage payment can you afford today?

- Could you still afford an ARM if interest rates rise?

- How long do you intend to live on the property?

- In what direction are interest rates heading, and do you anticipate that trend to continue?

If you are considering an ARM, you should run the numbers to determine the worst-case scenario. If you can still afford it if the mortgage resets to the maximum cap in the future, an ARM will save you money every month. Ideally, you should use the savings compared to a fixed-rate mortgage to make extra principal payments each month, so that the total loan is smaller when the reset occurs, further lowering costs.

If interest rates are high and expected to fall, an ARM will ensure that you get to take advantage of the drop, as youre not locked into a particular rate. If interest rates are climbing or a steady, predictable payment is important to you, a fixed-rate mortgage may be the way to go.

Also Check: What Is The Downside Of Refinancing Your Mortgage

When Is A Variable Rate Better Than A Fixed Rate

In general, the gap between the current fixed and variable rate is a good measure of how attractive one is verus the other. As the gap between them increases , variable rates become more attractive. This is because it would take 2 Bank of Canada interest rate increases by 0.25% each time in order to close the gap between the two and a third to make the variable rate more expensive.

When interest rates are low, as they are right now, it often makes sense to take advantage of those low rates and lock in with a fixed mortgage. This is especially true if those rates arent expected to continue falling, or its predicted that theyll go up.

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Read Also: What Percentage Of Mortgage Is Interest