Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

Mortgage Rate Forecast For July 2021

Rates have remained enticingly low throughout the first half of 2021 lower than many experts predicted six months ago. And the outlook for July doesnt call for a radical rate leap, either.But several factors are in play that can easily result in you paying at least slightly more for a purchase or refinance home loan in the coming weeks or months. Thats the consensus opinion among the group of industry pros Bankrate recently polled, who envision mortgage rates edging marginally higher at worst or standing pat over the next month.

Over the next month, rates may rise a bit but will likely be pretty close to where they are today around 3 percent for the 30-year fixed-rate mortgage, says Leonard Kiefer, deputy chief economist for Freddie Mac in McLean, Virginia. While inflation has ticked higher in recent months, many analysts consider much of the increase in consumer prices to be transitory. Thus, even with higher inflation rates, mortgage rates have held pretty steady. Id expect these near historically low mortgage rates to stay through at least early summer.

Learn more about specific loan type rates| Loan Type |

|---|

Recommended Reading: Can You Get A 30 Year Mortgage On Land

Can You Buy A House Making 35k A Year

It’s possible to qualify with a score in the 500s, though you’d need to make a 10% down payment if your score falls below 580. FHA loans also have a higher DTI threshold than most other loans which can help a lot when you earn $35,000 a year. You can qualify with a DTI of 50% or even higher in some cases.

Also Check: Rocket Mortgage Payment Options

How To Get A 250k Mortgage

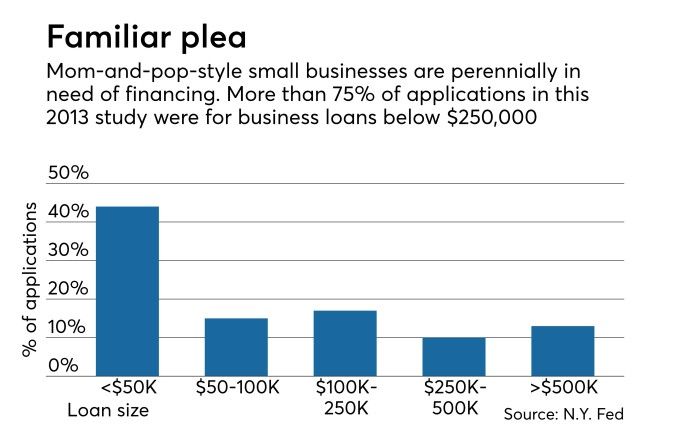

The homeownership rate ticked up more than 2 percentage points in the last year, to 67.4 percent. And there are many renters eager to join the club, especially since mortgage interest rates dropped to all-time lows during the coronavirus pandemic.

For first-time homebuyers, the process of becoming a homeowner can be intimidating. Its a big purchase that comes with a host of responsibilities and costs. But, its also a long-term investment that can help secure your financial future.

For some, it might take longer to achieve the American dream especially if you have existing debt, live in an expensive area or are just starting your career whereas others may have all the pieces in place to buy a home already. Regardless of how much you earn or what you have in the bank, its always a good time to start thinking about buying a home.

Becoming a homeowner is one of the most important decisions people make in their lifetime. Its not easy, but it can be done with some hard work and dedication. Next, we will discuss how to become a homeowner from finding an affordable home to finally signing on the dotted line.

Here we break down what you need to do to become a homeowner in 2022 and get approved for that $250,000 mortgage loan.

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

You May Like: Chase Recast

What Percentage Of Your Income Should Go Towards Your Mortgage

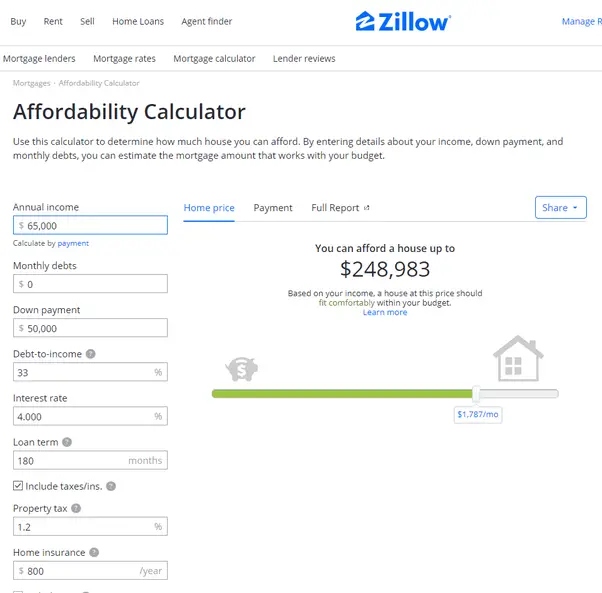

Your salary makes up a big part in determining how much house you can afford. On one hand, you may want to see how much you could afford with your current salary. Or, you may want to figure out how much income you need to afford the house you really want. Either way, this guide will help you determine how much of your income you should put toward your mortgage payments every month.

Down Payment For A Mortgage

One of the first considerations is the down payment. The larger the down payment you make, the higher likelihood you will receive a lower interest rate.

There are many different types of loans that have different requirements for how much money needs to be put down initially.

Some have requirements of as little as 0% down, some require 3.5%, and some require 20% or greater.

Also Check: 10 Year Treasury Yield Mortgage Rates

How Long Do You Want The Mortgage Term To Be

Most mortgages are fully repaid over 25 years, but you can opt for a longer or a shorter mortgage term. Your mortgage term could be as long as 35 years, or as short as five years .

Longer mortgage terms generally mean lower monthly repayments, as you have longer to pay off the loan. Against that, the total amount you repay will be greater for the same reason.

Heres an example:

A £250,000 25-year mortgage with a 2 per cent fixed-rate deal would mean an initial monthly payment of £1,060. However, the same mortgage on a 15-year term would mean an initial monthly payment of £1,609.

However, assuming you could keep 2 per cent interest , with the 25-year mortgage you would repay £318,000 in total but with the 15-year mortgage you would repay only £289,620 in total.

Check Your Eligibility Today

It can be tempting to apply to multiple lenders in hope of getting approved but this can negatively impact your credit score which is something you want to avoid. After all, lenders look at recent credit applications to determine your risk level as a borrower and recent credit rejections dont help to build your case.

To find out if youd get approved for a £250,000 mortgage ask a broker to compare your options and then check on your behalf.

Its quick, free and wont damage your credit report.

Alternatively, if you have questions about how you can get a mortgage for 250k or any other amount, speak to one of our advisors and they can help you find the answers youre looking for.

Read Also: 10 Year Treasury Yield And Mortgage Rates

Typical Home Price In Pennsylvania: $234684

- Typical single-family home value in 2021: $235,808

- Average mortgage rate, July 2021: 3.033%

- Average mortgage payment to median income: 24.4%

Pennsylvania residents can purchase homes with reasonable mortgage payments for their incomes . A typical home price 20% less than the typical U.S. price keeps mortgages budget friendly.

Average Property Tax In Texas Counties

Taking U.S. Census data, NerdWallet has crunched the numbers to help you understand what property tax rate you can expect to pay on your future home in Texas. Because assessed values arent frequently updated, you may pay a higher rate at first but eventually youll pay a similar rate.

| County |

|---|

| $39,900 |

Under “Home price,” enter the price or the current value . NerdWallet also has a .

Under “Down payment,” enter the amount of your down payment or the amount of equity you have . A is the cash you pay upfront for a home, and is the value of the home, minus what you owe.

On desktop, under “Interest rate” , enter the rate. Under “Loan term,” click the plus and minus signs to adjust the length of the mortgage in years.

On mobile devices, tap “Refine Results” to find the field to enter the rate and use the plus and minus signs to select the “Loan term.”

You may enter your own figures for , and , if you dont wish to use NerdWallets estimates. Edit these figures by clicking on the amount currently displayed.

The mortgage calculator lets you click “Compare common loan types” to view a comparison of different loan terms. Click “Amortization” to see how the principal balance, principal paid and total interest paid change year by year. On mobile devices, scroll down to see “Amortization.”

» MORE:

The mortgage payment calculation looks like this: M = P /

The variables are as follows:

» MORE:

The mortgage calculator lets you test scenarios to see how you can reduce the monthly payments:

You May Like: Monthly Mortgage On 1 Million

How Much Does It Cost To Buy A Home

On top of the home sale price, it can cost the average American over $20,000 to buy a home.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as Credible.

If youre wondering how much it cost to buy a house, youre not alone. This guide can help you get started on preparing your savings account and your monthly budget for buying a new home.

Heres a breakdown of both the upfront costs of buying a house and the recurring costs of homeownership:

Recommended Reading: How Much Mortgage Do You Pay A Month

How Much Do I Need To Earn To Get A Mortgage Of 250000

So, how do you roughly calculate how much income is needed get a £250k mortgage, taking into consideration the standard lender caps?

Supposing you earn an annual salary of £85,000 just over 3x your combined earnings equals £255,000, which should theoretically open you up to a wide choice of mortgage lenders because your income falls within the bracket the majority of lenders will consider.

If on the other hand, you earn £45,000 per year, you would need to find a provider that is willing to loan you nearly 6x your income, which is more difficult to come by.

This table will give you an idea as to how much you may be eligible to borrow based on typical income lender caps:

| Income | |

|---|---|

| £425,000 | £510,000 |

The above table is for demonstrative purposes only and we recommend you contact your lender or broker for the most up-to-date information.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

Speak To A Mortgage Affordability Expert Today

If you like anything in this article or youd like to know more, call Online Mortgage Advisor today on 0808 189 2301 or make an enquiry.

Then sit back and let us do all the hard work in finding the broker with the right expertise for your circumstances. We dont charge a fee, and theres no obligation or marks on your credit rating.

Got a question?

We can help!We know everyone’s circumstances are different, that’s why we work with expert brokers who specialise in finding the best deals.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

Maximise your chances of approval, whatever your situation. Find your perfect mortgage broker

If You Have A Low Credit Score How To Improve

First of all, start by checking for errors on your credit report before applying for loans or mortgages. You can get one free copy from each of the three bureaus once every 12 months so you can face any looming obstacles head on.

But there are also steps you can take to establish credit history and improve your credit score, like how long it takes for lenders to report payment or how much of their balance is available on short-term loans. You may want to review the list of common myths about mortgages, too.

You May Like: Reverse Mortgage On Condo

Will Uk House Prices Fall In 2022

There are a number of things that could cause house prices to fall:

- The end of the furlough scheme on 30 September 2021 as more people lose their jobs and cant afford their mortgages. If people sell their homes, housing supply will increase which could cause prices to fall.

- After the stamp duty holiday fewer people will be rushing to buy. The number of property transactions plunged 63% in July from June, according to figures from HMRC.

- If interest rates rise from their current record lows, it would also make mortgages rates more expensive. This could slow demand.

But generally speaking, house prices have risen faster than salaries over the years, making the housing market increasingly unaffordable.

What Is Cmhc Insurance

CMHC insurance protects lenders from mortgages that default. CMHC insurance is mandatory for all mortgages in Canada with down payments of less than 20% . This is an additional cost to you, and is calculated as a percentage of your total mortgage amount. For more information on mortgage default insurance rates, please read our guide to mortgage default insurance .

You May Like: Can You Refinance Mortgage Without A Job

Dont Overextend Your Budget

When you buy a more costly home like a 300k mortgage or 400k mortgage, banks and real estate agents make more money.

Most of the time, banks pre-approve you for the maximum amount that you can afford. Your budget will be stretched to its limits right out of the gate.

Its critical to ensure that youre happy with your monthly payment and the amount of money youll have after purchasing a house.

Every major purchase should begin with a carefully-constructed budget, which should include your debt, income and assets. You should include how much you need to bring to the table in order for this purchase to make sense.

First-time homebuyers often have more debt than they do income, which makes it necessary to start with a bare bones plan of how the money will be spent on housing and other expenses before jumping into homeownership. Having a plan to get out of debt is often necessary.

Youll also want to realistically assess costs associated with homeownership. For example, how much will it cost to maintain your home?

Make sure you have enough available monthly income so that your mortgage payments, property insurance, taxes and homeowners association fees are manageable.

To get a clear picture of what you can afford and how much you have available for a downpayment, view SmartAssets downpayment calculator in minutes to determine your monthly payment using a mortgage calculator.

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

You May Like: Who Is Rocket Mortgage Owned By

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

You May Like: Does Rocket Mortgage Sell Their Loans