How Do You Shop For Mortgage Rates

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. Youll also want to compare lender fees, as some lenders charge more than others to process your loan.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

Each lender is required to give you a loan estimate. This three-page standardized document will show you the loans interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years.

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

How Do I Know If It Makes Sense To Refinance

So when does it make sense to refinance? The typical should-I-refinance-my-mortgage rule of thumb is that if you can reduce your current interest rate by 1% or more, it might make sense because of the money you’ll save. Refinancing to a lower interest rate also allows you to build equity in your home more quickly.

You May Like: What Is A Mortgage Modification Agreement

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

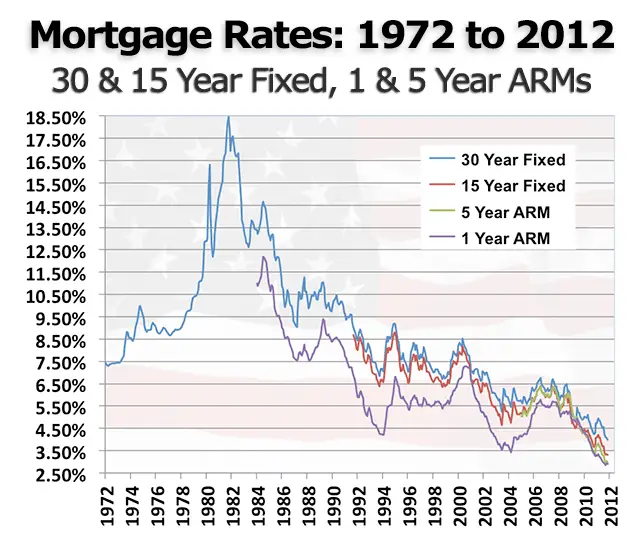

Mortgage Rates In The 1980s

The 1980s was the most expensive decade for mortgage borrowing largely due to consistently high inflation. By late 1981, mortgage rates averaged more than 18%, an astronomical price compared to todayâs standards.

Paul Volcker, the chairman of the Federal Reserve Board from 1979 to 1987, had the uphill task of rescuing the economy from âstagflation,â a term used to describe stagnant growth and high inflation.

Volckerâs monetary policy of focusing on bank reserves and limiting the money supply pushed the country toward a recession that lasted from 1980 until 1983. Inflation fell to 3.2% in 1983, from an all-time high of 13.5% in 1980, and the economy rebounded. Mortgage rates began falling in 1982, ultimately dropping to 9.78% by the end of the decade.

Read Also: How Much Interest You Pay On A Mortgage

What’s The Difference Between A Mortgage Interest Rate And Apr

When searching for rates, you’ll probably see two percentages pop up: interest rate percentage and annual percentage rate .

The interest rate is the rate the lender charges you for taking out a mortgage.

The APR shows you the full cost of borrowing, not just the interest rate. A mortgage’s APR takes into account things like points and fees paid to the lender in addition to your interest rate.

The APR gives you a better idea of how much you’ll actually pay to get a mortgage.

How Mortgage Rates Have Changed Over Time

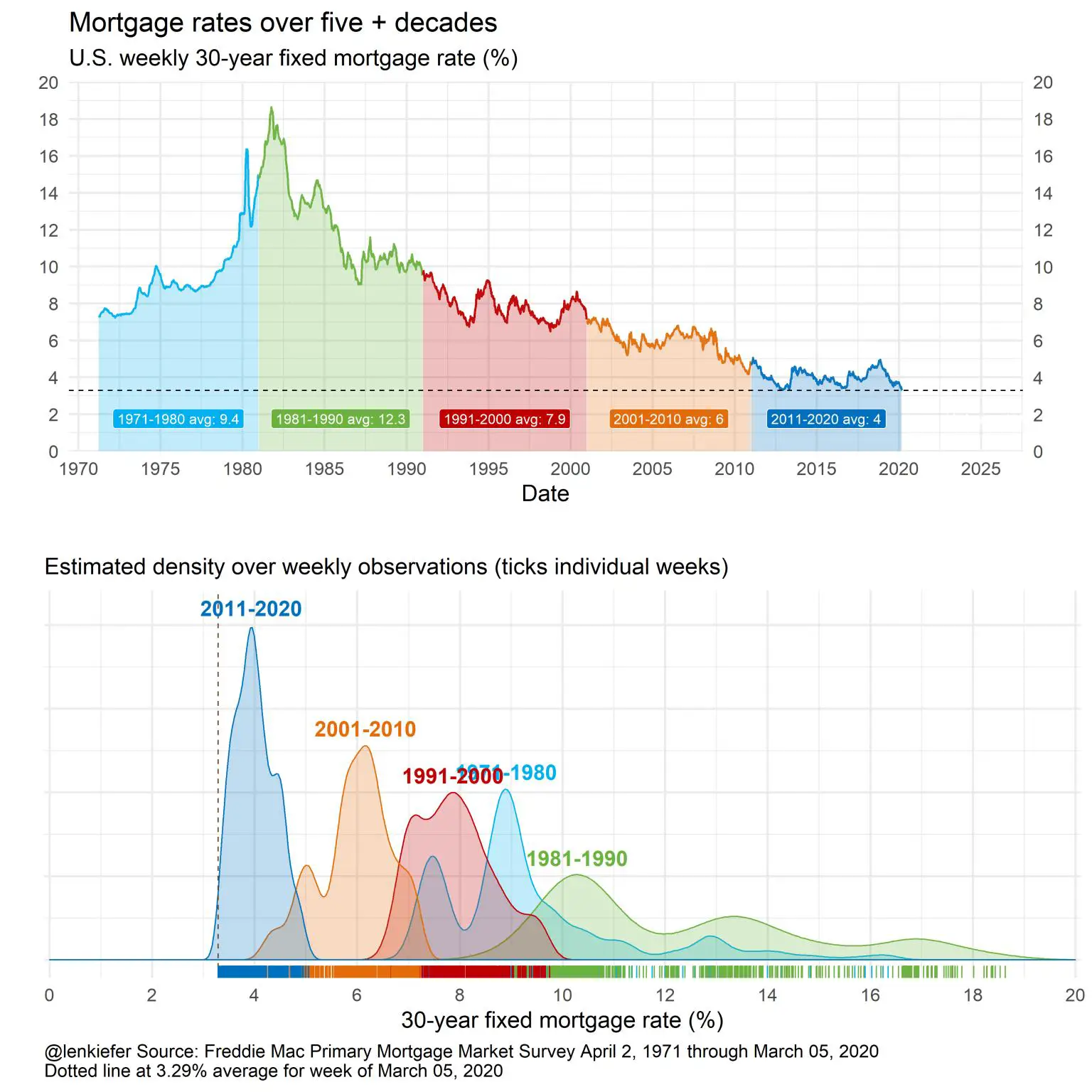

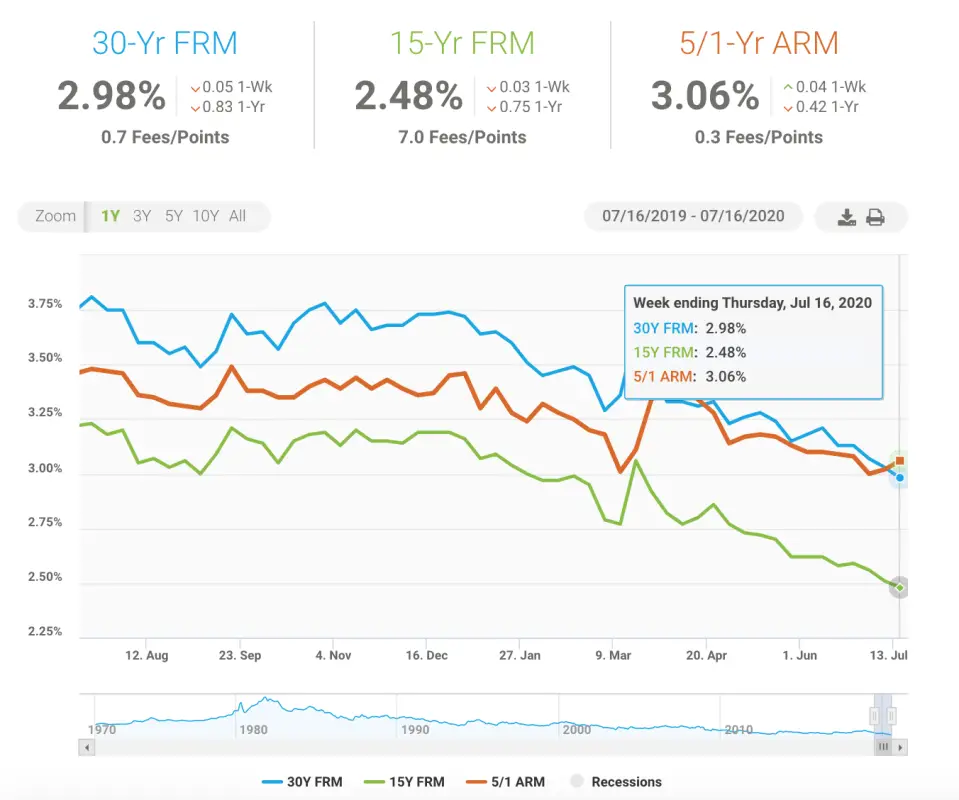

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 16.63% in 1981. A year before the COVID-19 pandemic upended economies across the world, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. The average rate for 2021 was 2.96%, the lowest annual average in 30 years.

The historic drop in interest rates means homeowners who have mortgages from 2019 and older could potentially realize significant interest savings by refinancing with one of todays lower interest rates. When considering a mortgage refinance or purchase, its important to take into account closing costs such as appraisal, application, origination and attorneys fees. These factors, in addition to the interest rate and loan amount, all contribute to the cost of a mortgage.

Are you looking to buy a home? Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Use Credibles online tools to compare rates and get prequalified today.

Thousands of Trustpilot reviewers rate Credible “excellent.”

Also Check: How To Figure Out What Mortgage You Qualify For

How To Get A Low 30

Getting the lowest possible mortgage rate for your 30-year fixed home loan is important if you want to keep your housing costs low. After all, as a homeowner youll be responsible for paying for property taxes, homeowners insurance, maintenance and repairs in addition to making a mortgage payment and paying interest.

To qualify for the lowest and best 30-year fixed mortgage rates, you need to have good credit. Most mortgage lenders look at FICO credit scores when assessing potential borrowers. Based on the FICO scoring model, a good credit score falls in the 670 to 739 range.

Different mortgage lenders have different standards regarding the credit scores that they expect borrowers to have. But in most cases, you wont be able to qualify for a conventional mortgage loan if your FICO credit score falls below 620. If your FICO score falls below that threshold, you do still have options. You can look into getting an FHA loan if you’re a first-time homebuyer or a USDA loan if youre planning on buying a home in a rural area.

Besides having a high credit score, you need to have a low debt-to-income ratio if you want to qualify for a low mortgage rate. Your DTI is the amount of debt youre paying off each month relative to your monthly gross income. Generally, you wont be eligible for a qualified mortgage if your debt-to-income ratio is higher than 43%.

Mortgage Rates In The 2020s

2020 saw new lows for mortgage rates, with the 30-year fixed rate diving to just under 3 percent, according to Bankrate data, and averaging 3.38 percent for the year. Amid the pandemic, fearful investors were attracted to safer products such as Treasury and mortgage bonds, pushing yields and rates lower.

Rates began to creep back up in 2021, but were ultimately tempered by COVID-19 variants. That has not been the case so far in 2022.

Mortgage rates have thus far staged the fastest and largest run-up in 28 years as inflation has soared to a 40-year high and the Federal Reserve is in the process of rapidly pivoting to a policy of tighter money and higher interest rates, McBride says of this year, adding that rates will keep rising so long as inflation accelerates.

You can view current 30-year mortgage rates on Bankrate.

Recommended Reading: How To Calculate Monthly Mortgage Payment

How Do I Compare Current 30

The more lenders you check out when shopping for mortgage rates, the more likely you are to get a lower interest rate. Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

With NerdWallets easy-to-use mortgage rate tool, you can compare current 30-year home loan interest rates whether youre a first-time home buyer looking at 30-year fixed mortgage rates or a longtime homeowner comparing refinance mortgage rates.

Historical Mortgage Rates And Refinancing

Mortgage refinancing is the process of swapping your old loan for a new loan. Homeowners can take advantage of lower rates to decrease their monthly payment. This extra money could go toward the principal, paying other debts or building up your savings.

A cash-out refinance is a refinancing option if you have enough equity in your home. With a cash-out refinance, you can tap into home equity youve built through repayment of your home loan as well as home value appreciation. You can use that money to pay off other debts or make home renovations.

Use our refinance calculator to see what your new monthly mortgage payment could be.

Also Check: Should I Refinance Home Mortgage

Whats The Difference Between Interest Rate And Apr

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

When To Consider A 30

A 30-year fixed mortgage is best for those looking for predictable, relatively low monthly payments. Youll wind up paying more in interest over the life of a 30-year mortgage than a 15- or 20-year one, but because of the longer repayment timeline, your monthly costs will be lower, so the more expensive loan may ultimately be easier on your budget.

Don’t Miss: How Long Can I Lock In A Mortgage Rate

What Is A Good 30

A 30-year fixed-rate mortgage is a home loan that maintains the same interest rate and monthly principal-and-interest payment over the 30-year loan period. With a rate that lasts the length of the loan, youll want the best rate you can get. Since your rate is most directly impacted by your credit score and down payment, youll want to make sure your credit file is accurate and make a down payment thats as much as you can easily afford.

Getting a good deal on a mortgage is like getting a good deal on a car. You do online research, you talk with friends and family, and then you comparison-shop. That last step, which involves applying with multiple lenders, is the most important step.

When you compare loan offers using the Loan Estimates, youll feel confident when you identify the offer that has the best combination of rate and fees.

A Freddie Mac report concluded that a typical borrower can expect to save $400 in interest in just the first year by comparison-shopping five lenders instead of applying with just one lender. Over several years, comparison-shopping for a mortgage can save thousands of dollars. Thatll give you something you can brag about.

The 30-year fixed isnt your only option. The 15-year fixed loan is common among refinancers. Adjustable-rate mortgages have low monthly payments during the first few years of the loan, making them popular for high-dollar loans.

How Big Of A 30

There are a few considerations to look into when determining how much of a mortgage you can afford. While lenders consider factors including your assets, liabilities, and income, your DTI will be the most significant factor in determining how much you can afford. The front-end DTI considers how much of your monthly income goes toward housing expenses. Lenders want to see this ratio at 28% or less.

Recommended Reading: Is It Hard To Get Approved For A Second Mortgage

How Do I Find Personalized 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. Specify the propertys ZIP code and indicate whether youre buying or refinancing. After clicking “Get Started”, youll be asked the homes price or value, the size of the down payment or current loan balance, and the range of your credit score. Youll be on your way to getting a personalized rate quote, without providing personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

Home Buyers With A Lot Of Monthly Income

If you have plenty of cash left over every month, you may be able to afford the higher payments that come with a shorter-term mortgage.

Opting for a shorter term could save you a bundle, because it means you pay less interest.

Instead of borrowing over 30 years, youd be borrowing for 20, 15, 10 or even fewer. And the less time you pay interest, the more you save.

The same benefits apply when refinancing to a 15-year term instead of a new 30-year term.

Intrigued? Run your figures through The Mortgage Reports mortgage calculator.

Youll notice the payments for a 15-year loan are much higher. But you may be shocked by how much interest youd save.

Also Check: What Is 10 Over 30 Mortgage

Historical Mortgage Rates In A Chart

This is a particularly fascinating time to be an interest-rate enthusiast. The Federal Reserve the U.S. central bank is raising rates in response to rising inflation.

The U.S. economy hasnt seen inflation like were currently experiencing since the 1970s. Many experts believe things could get worse because inflation has embedded itself so completely into the economys psyche.

These figures come from Freddie Mac, which began tracking 30-year fixed-rate mortgage rates in April 1971:

|

Mortgage Rates |

Where they were by the end of the decade |

|

1970s |

Thanks to Freddie Mac, theres solid data available for 30-year fixed-rate mortgage rates beginning in 1971.

Rates in 1971 were in the mid-7% range, and they moved up steadily until they were at 9.19% in 1974. They briefly dipped down into the mid- to high-8% range before climbing to 11.20% in 1979. This was during a period of high inflation that hit its peak early in the next decade.

Today’s National Mortgage Rate Averages

The 30-year average continues to bob up and down, after dropping notably last week from its highest peak since 2002. The flagship 30-year average added seven basis points Wednesday, rising back up to 7.25%. That’s still a third of a point below the 7.58% mark the average notched ten days ago.

Wednesday’s 15-year average also climbed seven basis points. Now at 6.70%, the 15-year average is similarly a third of a point below its recent peak, which at 7.03% was its highest level in 15 years.

Meanwhile, Jumbo 30-year rates remained flat Wednesday, again averaging 6.02%. The Jumbo 30-year average recently hit its highest point since 2010, a reading of 6.27%.

Refinancing rates moved similarly to new purchase rates Wednesday, with the 30-year refi average adding six basis points, the 15-year average tacking on four points, and Jumbo 30-year refi rates holding steady. The current cost to refinance with a fixed-rate loan is up to 43 basis points more expensive than new purchase rates.

After a historical rate plunge in August 2021, mortgage rates skyrocketed in the first half of this year. Indeed, the 30-year average’s mid-June peak of 6.38% was almost 3.5 percentage points above its summer 2021 trough of 2.89%. But the surge this fall is dramatically outdoing the summer peak, with the 30-year average having reached 1.2 percentage points above June’s high.

| National Averages of Lenders’ Best Rates – New Purchase |

|---|

| New Purchase |

Also Check: What Credit Score Is Needed To Get A Mortgage Loan

And The Coronavirus Pandemic

Today, as rates remain at near record lows of 2.65%, experts say homeowners can expect this to remain until the end of the year.

Theres a saturated dynamic at play in the mortgage market where so many Americans are in the mood to refinance and mortgage originators can only originate a certain number of mortgage pieces, Hart said. The industry is not lowering rates as expected because there is an imbalance of supply and demand.

Improvement in unemployment numbers will also not change rates much, Kushi said.

Positive economic data might give mortgage rates a small boost with more liquidity pouring into the market, Kushi said. We really should expect rates to remain at historical lows in the near term.

Dhara is a writer for Cashay and Yahoo Money. Follow her on Twitter @dsinghx.

Read more information and tips in our Mortgage section

Should You Refinance A 30

Refinancing is an option for people who have built up equity in their home by making consistent mortgage payments over the years. When you refinance your home loan, you’re taking out a new loan to replace your old mortgage at a better interest rate.

If you’ve only had your mortgage for a few years and have less than 20% equity in your home, the numbers may not work out in your favor. That’s because if your loan-to-value ratio is too high, you’ll only end up paying more interest over a longer period of time, defeating the purpose of refinancing to begin with.

Also Check: Where Do You Get A Mortgage