Is It Worth Refinancing For 05 Percent

There are two common scenarios when refinancing for 0.5 percent could be worth it:

- If youll keep the new loan long enough to recoup closing costs

- OR, ifyou can get the lender to cover your closing costs

First, lets look at a break-evenscenario.

Remember, the less your ratedrops, the less you save each month. So it takes longer to recoup your closingcosts and start seeing real benefits.

For example, dropping your rate 0.5 percent from 3.75% to 3.25% could save you about $150 per month on a $300,000 mortgage loan.

Thats a decent monthly savings, but it will likely take you over three years to break even with closing costs. So you want to be sure youll keep the refinanced loan for at least that long.

Refinancing for 0.5 percent: break-even method

| Loan Balance | |

| Worth It? | Yes, if you keep the loan ~4 years or longer |

Now lets look at how the numbers compare if you can drop your mortgage interest rate by 0.5 percent using a no-closing-cost refinance.

Say your current mortgage rate is 3.75%. Your refinance lenderoffers you a new rate of 2.5%.

Instead of accepting the ultra-low rate, you ask the lender to pay your closing costs. The lender agrees, and in exchange, you accept a higher rate than the initial offer: 3.25%.

This arrangement only lowers your interest rate by 0.5 percent. But theres no break-even point because you paid no upfront closing costs. So you start seeing real savings from your lower monthly payment right away.

How To Calculate Mortgage Interest For Each Year

Mortgage interest can be calculated using algebra, but the formulas involved are extremely complex. The simplest way to determine how much interest will be paid over the course of a year is to use a spreadsheet, which can be on a computer or by hand.

1

Write down the initial balance of the mortgage at the beginning of the year on the top of the first column. If this is for the first year, this will be the full principal of the mortgage. In later years, this will change based on previous interest accrued and total payments made to date. For example, in the first year of a $600,000 mortgage, write 600,000.

2

Calculate the rate of interest you are paying for each payment period. For example, if you are paying 5 percent per year with monthly payments, that is 0.05/12, or 0.00417. Enter this in the top of the second column.

3

Multiply the first number by the second, and enter this in the third column. In a spreadsheet, use a formula such as “=A1*B1.” In the example, this will display 2,500. This is your interest accrued for this month.

4

Enter your monthly payment at the top of the fourth column. For example, the monthly payment on a loan of $600,000 at 5 percent would be $3,220.93.

5

Add the initial balance to the interest , then subtract the payment . In a spreadsheet, this would be “=A1+C1-D1.” Enter this at the top of the fifth column. This is your balance at the end of the first month.

6

7

8

9

References

How Much Does A 1% Difference In Your Mortgage Rate Matter

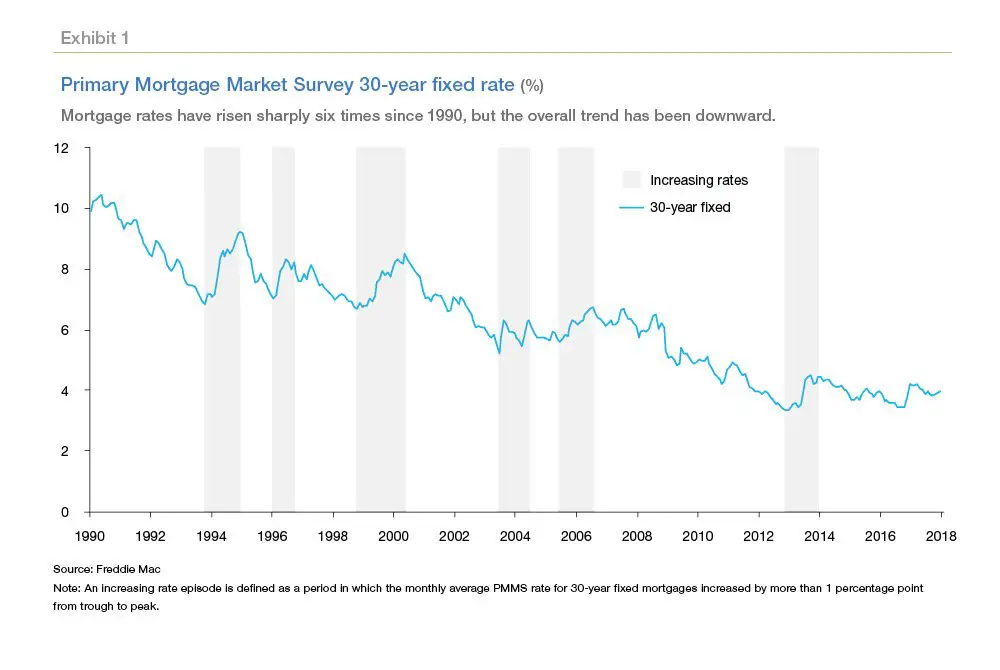

The interest rate on your mortgage tells you how much youre paying each year to your lender for just having the loan.

If you want numbers specific to your home purchase, you can use an online mortgage calculator to customize your costs.You can also insert what you’re looking for below and find the perfect loan type for you.

Basically, a lower interest rate means a lower overall cost of your investment.

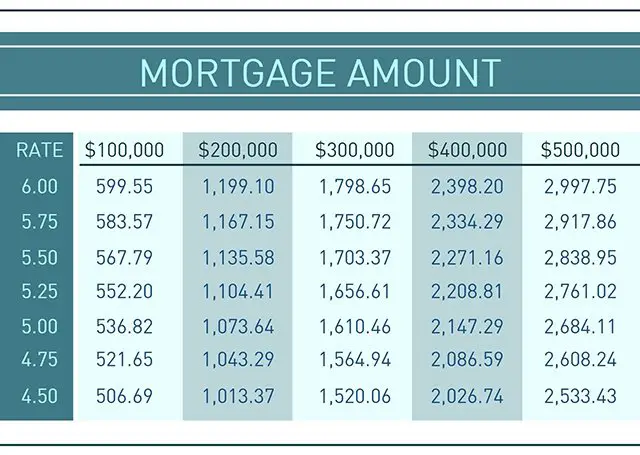

For example, consider a mortgage loan for $300,000 with a fixed interest rate of 4.5 percent and 30-year terms. Over the life of your loan, youll pay a total of $547,220 . Monthly payments on this loan would be about $1,520.

If you get the same loan at 3.5 percent, the cost of your investment over 30 years will be $484,968 . Monthly payments on this loan would be about $1,347.

In this example, a 1 percent difference in interest rate could save you $173 per month or $62,252 over the life of your loan.

When youre shopping for a home loan, mortgage lenders that offer lower mortgage interest rates can lead to lower monthly mortgage payments and save you over the life of your investment.

If you own a home, it may be a good time to look at refinancing your home loan. Refinancing your loan now is especially valuable if you have an adjustable-rate mortgage and your introductory rates will expire.

Read Also: How To Apply For A Home Mortgage

How To Calculate How Much Interest You’ll Pay On A Mortgage

You can figure out how much interest you’ll pay each month by looking at an amortization table for your loan. You can ask your lender for one or use an online mortgage calculator that has an option to break down your amortized payments by month or year.

When you close on your mortgage, you can also look at the fifth page of your Closing Disclosure form to see the total amount of your finance charges and the total interest percentagethe amount you pay in interest relative to the loan amount over the loan’s term.

However, how much you actually pay in interest will depend on whether you repay the mortgage over the full term, refinance your mortgage or pay off the mortgage early when you sell the home.

What Factors Determine Your Mortgage Interest Rate

When a lender determines the mortgage rate, they look at various factors including:

- Your down payment

- Loan type

- Price of the home

There are a few things you can do to help obtain a better interest rate, including saving up for a larger down payment, increasing your credit score, and being selective about the area where you purchase your home. Other items, like lender fees and market trends, are out of your control. You can talk to several lenders to save as much money as possible.

Read Also: How To Become A Reverse Mortgage Specialist

How To Calculate The Total Cost Of Your Mortgage

Once you have your monthly payment amount, calculating the total cost of your loan is easy. You will need the following inputs, all of which we used in the monthly payment calculation above:

- N = Number of periods

- M = Monthly payment amount, calculated from last segment

- P = Principal amount

To find the total amount of interest you’ll pay during your mortgage, multiply your monthly payment amount by the total number of monthly payments you expect to make. This will give you the total amount of principal and interest that you’ll pay over the life of the loan, designated as “C” below:

- C = N * M

- C = 360 payments * $1,073.64

- C = $368,510.40

You can expect to pay a total of $368,510.40 over 30 years to pay off your whole mortgage, assuming you don’t make any extra payments or sell before then. To calculate just the total interest paid, simply subtract your principal amount P from the total amount paid C.

- C P = Total Interest Paid

- C P = $368,510.40 – $200,000

- Total Interest Paid = $168,510.40

At an interest rate of 5%, it would cost $168,510.40 in interest to borrow $200,000 for 30 years. As with our previous example, keep in mind that your actual answer might be slightly different depending on how you round the numbers.

What Is A Prepayment Privilege

A prepayment privilege is the amount you can put toward your mortgage on top of your regular payments, without having to pay a prepayment penalty.

Your prepayment privileges allow you to:

- increase your regular payments by a certain percentage

- make lump-sum payments up to a certain amount or percentage of the original mortgage amount

Prepayment privileges vary from lender to lender.

Check the terms and conditions of your mortgage contract to find out:

- if your lender allows you to make prepayments

- when your lender allows you to make prepayments

- if there’s a minimum or a maximum amount that youre allowed to prepay

- what fees or penalties apply

- if there are other conditions

Most lenders limit the allowed prepayment amount per year. Typically, you cant carry a prepayment amount from one year to the next. This means you usually cant add the amount you didnt use in previous years to the current year.

Read Also: How Many Years Left On Mortgage

Getting A Second Mortgage

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.

If you cant make your payments and your loan goes into default, you may lose your home. If thats the case, your home will be sold to pay off both your first and second mortgages. Your first mortgage lender would be paid first.

Should I Try To Make My Mortgage Interest Tax Deductible

So, in conclusion, mortgage interest payments are not tax deductible, except under specific circumstances, such as renting out your property to earn an income. Once again, home based businesses that do not involve renting of any kind, will not benefit from mortgage interest tax deductions. So, if you are thinking about turning your home into a small business or rental property, thereby saving yourself a bit of money in taxes, just remember to consider all the factors, and know what youll be getting yourself into.

Whats the difference between a tax credit and a tax deduction in Canada? Find out here.

Like any kind of investment, trying to make your mortgage interest tax deductible by turning your primary residence into an investment property comes with its own share of risks. You have to be certain that youll get back whatever youve invested in the property in the first place. It could be months, if not years until you see a return, and later, if you decide to sell your home, you need to be prepared to pay taxes on whatever profit you made. So, if youre thinking about doing this, discuss it with a financial advisor first. They will be able to tell you if your business venture will likely be profitable.

Rating of 4/5 based on 43 votes.

You May Like: Can A Locked Mortgage Rate Be Changed

Mortgage Interest Rates Explained

A mortgage interest rate a percentage of your total loan balance. It’s paid on a monthly basis, along with your principal payment, until your loan is paid off. It’s a component in determining the annual cost to borrow money from a lender to purchase a home or other property.

Investors require higher interest rates to make back money when the economy, stock market, and foreign markets are strong. This causes lenders to raise their rates. Bond investment activity can also impact mortgage rates, as well as your personal financial situation. Nonetheless, you might have some options to reduce your lender’s quoted interest rate when you’re looking to buy a home.

How Home Loan Interest Works

In most cases the interest on your home loan is calculated daily and charged monthly on your specified due date. Therefore, at the end of each day your lender will multiply your home loan interest rate by the outstanding amount and divide that by 365 days to find the daily interest amount. On your interest due date the sum of all the daily interest calculations for the period will be charged to your loan account.

You May Like: Is An All In One Mortgage A Good Idea

How Much Of Your Home Loan Repayments Are Interest

Have you ever stopped to consider what proportion of your home loan repayments cover your principal loan amount, interest rate and fees? In this article we break down what your repayments cover and what you can do to pay less interest over time.

Your home loan is made up of a principal loan amount and the interest you must pay within the loan term. In addition, you may also incur a number of fees over the life of the loan such as: one-off establishment or application fees ongoing fees such as redraw facility or offset account keeping fees break costs should you break your fixed rate mortgage or discharge fees for paying out your mortgage in full.

Most lenders offer several types of home loans including:

How To Account For Taxes And Recurring Expenses

Accounting for recurring charges like PMI and HOA fees requires a little more work, but even these aren’t very difficult to calculate. You can find the total cost of recurring expenses by adding them together and multiplying them by the number of monthly payments . This will give you the lifetime cost of monthly charges that exclude the cost of your loan.

The reverse is true for annual charges like taxes or insurance, which are usually charged in a lump sum, paid once per year. If you want to know how much these expenses cost per month, you can divide them by 12 and add the result to your mortgage payment. Most mortgage lenders use this method to determine your monthly mortgage escrow costs. Lenders collect these additional payments in an escrow account, typically on a monthly basis, in order to make sure you don’t fall short of your annual tax and insurance obligations.

You May Like: A& m Mortgage Merrillville Indiana

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

How You Can Reduce The Interest You Pay

One way you can reduce the interest you pay over the life of your loan is through an offset account attached to your mortgage. The money held in this account is used to offset the interest charged on your home loan each month. You may pay for the privilege of an offset account, so ensure youre getting the most out of it by keeping money in the account.

Consider depositing your savings, lump sum payments, bonuses and your salary into the account every month to reduce the amount of interest you pay on your loan. Essentially, the more you keep in your offset, the less interest youll pay.

You May Like: How To Lower My Mortgage

What Can You Do If Your Mortgage Interest Rate Goes Up

Firstly, a rise in the Bank of England rate will only affect you if you have a variable or tracker mortgage.

The best way to deal with an interest rate rise is to be prepared in the first place, by understanding how an interest rate rise will affect you before you choose your mortgage. To give you an idea: with a rate rise from 0.25% to 0.5%, a person on a tracker mortgage who’s paying 2% interest on a 25-year, £250,000 mortgage would see their monthly £1,060 repayment rise by around £30.

If you already have a mortgage, there are other options. You could consider overpaying while the lower interest rate lasts, so you have less to pay off after the rate goes up. Most lenders allow you to overpay by a certain amount each year without charge. If you exceed the limit you may get stung with an early repayment charge. Alternatively, you could try and lock in a good deal by remortgaging to a fixed rate â although if a rate rise is imminent, lenders will take this into account when making an offer. Just remember, you may be charged an early repayment fee if you remortgage during your fixed term. Calculate how much you could save with our overpayment calculator:

Looking For A Mortgage

Mojo Mortgages has been voted the UK’s best mortgage broker. Let’s get you the best rate you can… for free, all from the comfort of your sofa.

Put simply, an interest rateâs how much it costs to borrow the cash. Most mortgage interest rates are annual rates, however interest is calculated monthly, but itâs quite simple to work out how much youâll pay in interest:

Letâs look at a 3% rate on a £150,000 loan:

- Convert the rate into a decimal = 0.03

- Divide it by 12 because we are looking for the monthly interest = 0.0025

- Multiply .0025 by the loan £150,000 = £375

And thatâs what youâll pay in interest each month. Sort of…

Also Check: Can You Refinance Mortgage With Poor Credit

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.