Does Getting A New Credit Card Hurt Your Credit

Getting a new credit card can hurt or help your credit, depending on your situation. It can help to increase your credit mix and improve your credit utilization percentage, but it will add a new hard inquiry to your account and make your average credit age youngerboth of which could lower your score. For those in the credit-building stage, adding a new credit card will most likely lower your score in the short term but also lead to a stronger credit score in the long term.

Helpful Mortgage Questions To Ask The Bank

Once you find a home you want to purchase, there are a host of questions you should ask your mortgage lender about when you’re preparing to make an offer.

Mortgage Questions

These include:

- Asking about the interest rate, amortization period and term.

- You’ll also want to ask about potential payments, prepayment options and how to save on interest. You can use a mortgage payment calculator to give you an idea of what your monthly mortgage payments come out to.

- Ask about the fees you’ll have to pay with your mortgage and mortgage insurance.

- Ask if there are penalties if you sell the home before the term ends or options if you pay it off early.

- If applicable, ask about transferring a mortgage balance if you buy a new property. And, how to register your mortgage with a collateral or standard charge.

Make The Most Of Credit Building Opportunities

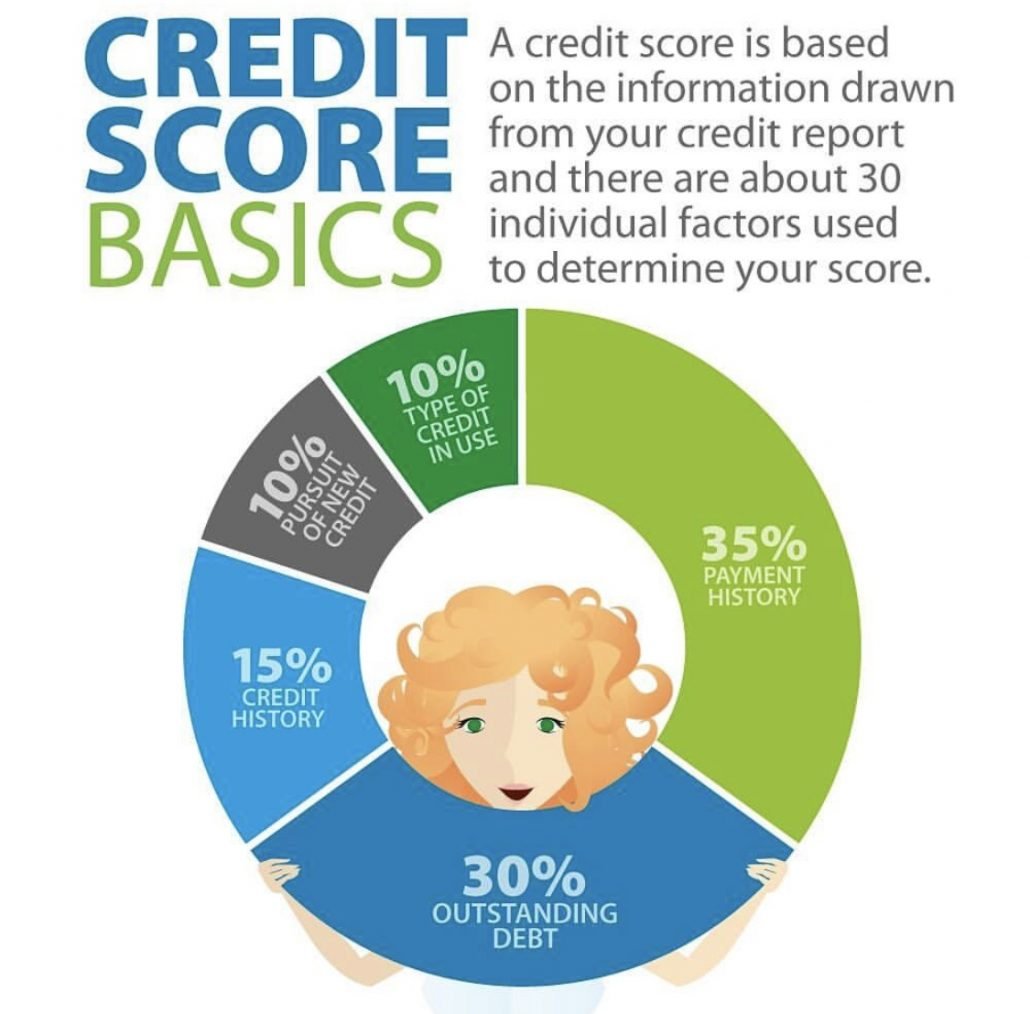

Solid credit references are built over time, so establishing a strong credit rating requires long-term commitment. In order to maintain a good credit score, it is essential to pay debts on time, without fail. Whether paying utility expenses, credit cards bills, or mobile phone premiums, staying current meeting financial obligations is the best thing you can do to build good credit.

Over time, responsible money management generates opportunities for various forms of financing, which adds diversity and longevity to your credit history. As you repay revolving and installment debt, reporting agencies document your success, which in turn reinforces the strength of your credit rating. Ultimately, lenders see you as a low risk investment, which translates to further financial privilege.

Without an outstanding credit rating, on the other hand, access to future funding is limited. Mortgages, car loans, credit cards, and other forms of financing are unavailable or very costly to those without top credit scores. To ensure personal financial success, take a proactive approach and make the most of each credit building opportunity.

You May Like: Chase Recast

Reduce Your Use Of Credit

If you use a lot of unsecured credit, in the form of credit cards or overdrafts, it can be considered a sign that you dont manage your money well or that youre living beyond your means. This will make you a much less appealing mortgage applicant.

Try to lower your use of unsecured credit to below 50% of the amount available as soon as possible, as this can have a positive impact on your credit score. Its important to reduce this debt as much as possible before you apply for a mortgage.

See our online mortgage finder and best buys to work out how much deposit you need to save

How Your Mortgage Affects Your Credit Score

A Tea Reader: Living Life One Cup at a Time

Financial gurus are constantly warning consumers to keep their in tip-top shape if theyre planning to purchase a home in the near future. The higher your credit score, the more likely you are to get the best mortgage rates. A mortgage calculator can show you the impact of different rates on your monthly payment. Once you have the mortgage, however, it can affect your credit score going forward.

Recommended Reading: Monthly Mortgage On 1 Million

How A Mortgage Affects Your Credit

Know the fundamentals. Your measures your ability to pay back debts. You only earn so much money so keeping your amount of debt in good proportion to your income is essential. This is called your debt-to-income ratio.

Keeping it no higher than 36% is considered optimum with no more than 28% going to your mortgage. If you know you will purchase a home in the near future, dont take on other debt obligations. Keep your debt-to-income ratio low.

However, do continue to build your . A little credit is better than no credit as far as your credit score is concerned. And of course, paying your mortgage on time is good for your credit history.

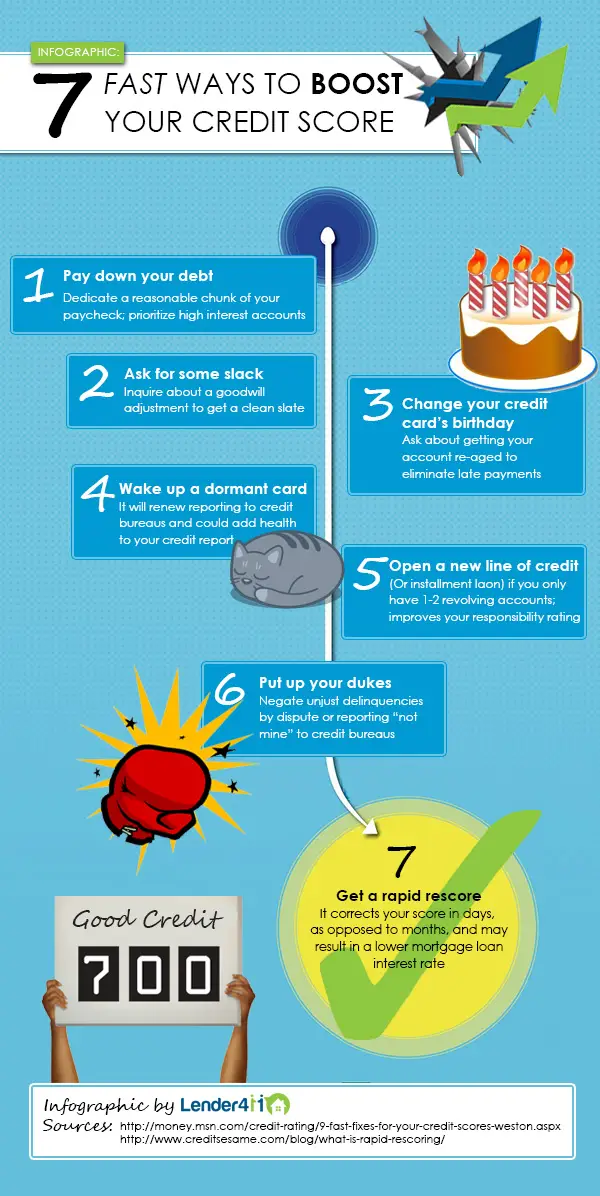

Correct Credit Score Errors Pronto

If your credit file info’s wrong, you have a right to do something about it either having the error corrected or, at the very least, having your say.

Your first step should be to check if the error is on your credit file held with other agencies, then talking to the lender. If this doesn’t work, the free Financial Ombudsman could step in and order corrections.

Here’s our step-by-step help:

Check your file with other agencies. See if your file with them has the same error. If you get it corrected with one agency the information should be sent to the others, but it’s better to contact them yourself to ensure your file with all three TransUnion, Equifax and Experian have the right details.

Contact the lender. Most will have a system in place to deal with customer disputes, and if you’ve proof, it should be resolved quickly. Write to it, say you think the error is unfair and ask it to wipe it from your file.

If it’s a default and you’re prepared to settle with your lender, either in part or in full, you could also try negotiating with it. As part of negotiations, you could make a condition of settlement that the default is wiped off your credit file. Companies can do this for disputed defaults.

You May Like: What Does Gmfs Mortgage Stand For

Use All Lines Of Credit

Most times, buyers favor one particular credit card. From rewards programs to down payments, there are many reasons to neglect your credit facilities. To improve your credit score, use all lines of credit no matter the purchase.

Closing unused accounts wont help your credit score, since your entire credit line accounts for almost 15% of your points. The longer your credit accounts remain open, the better your score. Maintaining a lean spending profile shouldnt affect your credit facilities. Instead, use the cards to make small purchases at the gas station or grocery store.

If youre worried about overspending, limit your spending on these cards to between $10 $30. After each purchase, transfer the fee to your card to clear out the debt immediately.

Similar Posts

Checking Savings And Other Banking

Checking accounts represent credit-building opportunities for young people, because it is relatively easy to qualify for basic accounts. They are powerful instruments, however, and should be handled deftly. On one hand, each check and deposit are credit entries account holders can use to build additional credit opportunities. Overdrafts and other mismanagement, on the other hand, have devastating impacts on young people’s emerging credit rankings. Savings accounts can be used for overdraft protection, to avoid insufficient funds. But maintaining reserve savings also supports a well-rounded financial approach that helps build credit.

Also Check: Can I Get A Reverse Mortgage On A Condo

Assumable Mortgages Fast Facts

LTK: Does the person who wants to assume the mortgage have to qualify?

MJ: Yes, they do. The seller would contact the servicing lender to notify them that they have a buyer who wants to assume the mortgage. The buyer would have to go through a credit standards check just like anyone who is applying for a mortgage and would have to meet the same credit criteria as someone getting a new mortgage. In essence, the lender who holds the mortgage has to approve the assumption.

LTK: Are most assumable mortgages fixed or adjustable rate mortgages?

MJ: There are some FHA loans with adjustable rates but most are fixed rates.

LTK: What types of fees or closing costs does the person who assumes the mortgage pay?

MJ: There is generally an assumption fee, updated title work, and the closing attorneys fee, which all totaled is usually less than $1000. Thats about one-fourth to one-third the cost of closing a new mortgage. Part of the assumption fee is so the servicing lender can put the buyer through a qualification process. If they qualify, the seller gets a release of liability.

LTK: Is it true that most assumable mortgages are FHA loans?

MJ: Yes, it is. Presently, the FHA will allow assumptions by a qualified buyer. This is referred to as a formal assumption, which means the buyer has to come in and actually apply with the current servicing lender.

Pay Off Existing Loans

Paying off existing loans is an essential step on how to improve mortgage credit score. Your payment history makes the bulk of your credit score. When saving up to buy your house, consider clearing your existing debt as well. Although essential, buying a house adds more debt to your credit history.

After buying your house, pay off existing loans from the biggest to the smallest. Make larger payments to the higher loans and spread the smaller ones.

Don’t Miss: How Does Rocket Mortgage Work

No : Pay Bills On Time

Late payments and collections leave major blemishes on your credit report, according to myFICO.com. And once you have a delinquent payment, there’s not much you can do about it.

Paying your bills on time and avoiding late payment is the only way to keep a positive payment history. And the only way to improve upon a payment history is by annually reviewing your report to keep a look out for, and correct, possible errors, says McNamara.

“Credit scores are slow to improve, but very quick to drop if late payments are recorded,” says Arzaga.

Johansson says that in addition to bankruptcy, foreclosure and judgments, collections and habitual late payments are the worst things to see on a credit report.

Improve Your Credit Score For Better Mortgage Rates

A consumers credit score directly influences their opportunities to be approved for loans or establish revolving credit accounts. It is also important to consider that credit scores have a profound impact on interest rates in terms of what a bank or lender might offer a consumer. They are a foundational aspect of how credit works. A consumer having a low credit score could be denied credit or be considered high risk, meaning if you are approved for credit, you will experience considerably higher interest rates than a person having an outstanding credit score. During the term of any loan, the amounting fees from interest can cost many thousands of dollars.

A person who currently has a good or outstanding credit score must do their best to properly maintain their score. It is also very important for a consumer having a poor or fair credit score resulting from past misuse of credit to attempt to rectify the poor credit score as soon as possible. There are many processes in which a person can rebuild their credit score, potentially enabling them to get better interest rates on revolving credit and loans.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

Keep Old Accounts Open And Deal With Delinquencies

The age-of-credit portion of your credit score looks at how long youve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts that youre not using, dont close them. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time. That wont erase the late payments but can improve your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the creditor a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsand bankruptcies for 10 years.

Keep Your Credit Utilization Rate Low

Weigh your balances relative to your credit limit to ensure youre not using too much available credit, a practice that can indicate risk.

Ulzheimer recommends trying to maintain a utilization rate of 10%. The higher that ratio, the fewer points youre going to earn in that category and your scores are absolutely going to suffer, he says. In fact, people who have the highest average FICO scores have a utilization of 7%.

The date your credit card provider reports to the credit bureaus may also impact your utilization rate.

Ulzheimer points out that FICOs scoring systems dont differentiate between those who pay in full each month and those who carry a balance. Your utilization rate at the time your issuer reports is what’s used for your score. VantageScore, though, does consider whether you pay in full or carry your balance month to month.

If you struggle with high balances and mounting interest payments on your cards, consider consolidating with a 0% introductory rate balance transfer credit card, but make sure you know when the rate will increase and by how much.

You May Like: Mortgage Recast Calculator Chase

How To Increase Your Mortgage Fico Score From Scratch

If youve only just begun your journey to build your credit score and have no credit history to fall back on yet, there are a few ways through which you may work on improving your FICO Score.

- Get a secured credit card. Qualifying for a secured credit card is typically easier than for a conventional credit card. This is because you need to pay a security deposit to get a secured card and the same usually functions as your credit limit. Your card provider reports your payments to credit bureaus, and this helps build your credit score.

- Become an authorized user. If youre unable to qualify for a credit card on your own, you may ask a family member or friend who has a credit card to add you as an authorized user. In this case, the primary users responsible use of his/her card will have a positive effect on your creditworthiness. However, the converse holds true as well.

- Apply with a cosigner. One way to get past the roadblock of not qualifying for a credit card is to apply with a cosigner who will qualify. In this case too, how well or poorly the other person uses his/her credit card will have a bearing on your credit score.

- Self-report. You might be able to improve your credit score by self-reporting the payments you make toward rent and utility bills. Experian Boost, a free service, helps you build your credit history by reporting payments you make toward utilities, phone, and popular online streaming services. UltraFICO works along similar lines too.

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Don’t Miss: Rocket Mortgage Payment Options

How To Quickly Improve Your Credit Score

Pay It Down And Keep It Down

This is especially important when your limits are not very large. Suppose you are a model citizen who uses her credit card frequently, and pays the balance in full every month after receiving the monthly statement, and before the due date.

That is the correct way to manage your credittaking advantage of the grace period you are given by all card issuers.

But these days, there is little benefit to trying to use up the entire grace period because current account interest rates are so low they are pretty much negligible. Its far better to pay your balance in full before your statements come out. You are even more of a model citizen, and now the balance being reported to the credit bureau will always be extremely small, if anything.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

Pay More Than Monthly Minimums

If youve maxed out your credit card in the past, now is the time to take control of the situation. Make more than the minimum payment due each month, says Lisa Torelli-Sauer, editor at Sensible Digs, a website specializing in budgeting home investments. Even if its only a few dollars more than the minimum payment, it will show the credit reporting agencies you are making a greater effort to pay down your debt and will improve your score.

Dont Miss: Can You Have A Credit Score Without A Social Security Number