What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

The Annual Salary Rule

The ideal mortgage size should be no more than three times your annual salary, says Reyes.

So if you make $60,000 per year, you should think twice before taking out a mortgage that’s more than $180,000. However, if you have a partner, and your combined income is $120,000, you can comfortably increase your loan amount to $360,000.

That’s not to say you should always opt for the most expensive mortgage you can qualify for. If you settle on something below your max, you’ll have more wiggle room to put money into a savings account or pay for other costs like home renovations.

You May Like: Who Offers 20 Year Mortgages

When Do Consumers Choose An Arm

Adjustable-rate mortgages , on the other hand, have interest rates that change depending on market conditions. ARMs usually start with a low introductory rate or teaser period, after which the rate changes annually for the remaining term.

ARMs come in 30-year terms that can be taken as a straight adjustable-rate mortgage with rates that change annually right after the first year. However, borrowers usually take them as a hybrid ARM, which come in 3/1, 5/1, 7/1, and 10/1 terms. For example, if you get a 5/1 ARM, your rate remains fixed for the first 5 years of the loan. After the 5-year introductory period, your rate adjusts every year for the rest of the payment term.

When does taking an ARM make sense? ARMs are usually chosen by consumers who plan to sell their house in a few years or refinance their loan. If you need to move every couple of years because of your career, this type of loan might work for you. ARMs usually have a low introductory rate which allows you to make affordable monthly payments, at least during the teaser period. Before this period ends, you can sell your home, allowing you to avoid higher monthly payments once market rates start to increase.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

You May Like: What Is A Good Tip Mortgage

Understand The 28/36 Rule

Lenders may determine your ability to afford a new home by using the 28/36 rule. This rule states that:

- Housing expenses should be no more than 28% of your total pre-tax income. This includes your monthly principal and mortgage interest rate, home insurance, annual property taxes, and private mortgage insurance payments .

- Total debt should not exceed 36% of your total pre-tax income. This includes the housing expenses mentioned above as well as credit cards, car loans, personal loans, and student loans, so long as these monthly debt payments are expected to continue for 10 months or more. This does not include other monthly expenses such as groceries, gas or your current rent payments.

In concrete numbers, the 28/36 rule means that a borrower who makes $5,000 a month should not spend more than $1,400 on housing costs every month.

If youre a renter making $5,000 a month, its a good rule of thumb to spend a maximum of $1,400 on rent. However, for a homeowner making the same amount, $1,400 should cover your monthly mortgage payment, as well as homeowners insurance premiums and property taxes.

My Result Shows I Can Afford My New Home What Should I Do Next

First of all, congratulations! You are now one step closer to owning the home you desire. The next step is to reach out to our team of top-notch mortgage lenders and get started on securing yourself the perfect deal.

Click Get FREE Quote, and answer a few simple questions about yourself and the loan you are seeking to obtain personalized rate quotes from lenders doing business in your area. This service is totally FREE of charge and makes it easy to comparison shop for your best deal on a home loan. Take your next step today – it couldnât be simpler!

Recommended Reading: How Often Do Fico Mortgage Scores Update

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Where Do You Want To Live

}, }

! Your browser does not support geolocation. Consider using another browser.

How much mortgage can I afford?

The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Knowing your total household income, how much youâve saved for a down payment, and your monthly expenses , plus new expenses youâd take on , you can get a reasonable estimate. Learn more about factors that can affect your mortgage affordability.

How to estimate affordability

To estimate mortgage affordability, lenders will use two standard debt service ratios: Gross Debt Service and Total Debt Service . According to the Canadian Mortgage and Housing Corporation¹Note 1:

-

– GDS is the percentage of your monthly household income that covers your housing costs . It should be at or under 35% of your pre-tax household income.

-

– TDS is the percentage of your monthly household income that covers your housing costs and any other debts . It should be at or under 42% of your pre-tax income.

How your down payment affects affordability

The amount you have saved for a down payment is also another important piece of information to help determine affordability. Depending on the purchase price of a home, there are minimum amounts required for your down payment²Note 2:

Step 2 of 6

Read Also: What Does Mortgage Forbearance Mean

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Td Bank Mortgage Affordability

Before you get a mortgage from TD Bank, it is important to know how TD calculates your mortgage affordability. TD takes into account the following factors:

- The location of your future home

- Whether your future home is a detached home or condo

- Your household income

- Your down payment

- Your monthly bills and expenses including groceries, transportation, shopping, andinsurance.

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

Your location and property type are used to provide estimates for your potential property taxes, utilities, and condo fees.

TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of39% and a maximum total debt service ratio of44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to TD, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Also Check: What Are Mortgage Interest Rates At

What Percentage Of Income Do I Need For A Mortgage

A conservative approach is the 28% rule, which suggests you shouldn’t spend more than 28% of your gross monthly income on your monthly mortgage payment.

Be aware that lenders look at far more than the percentage of monthly income put towards a mortgage. Outside of credit score, lenders typically look at your debt-to-income ratio, which compares your monthly debts, including the prospective mortgage payment, to your expenses. With lenders looking at income and expenses, our mortgage calculator provides a great option when determining what you can potentially afford.

Getting Preapproved Can Tell You Your Home Buying Budget

One of the easiest ways to find your price range is to get a preapproval from a mortgage lender.

Preapproval is kind of like a dress rehearsal for your actual mortgage application. A lender will assess your financial situation as shown by your annual salary, existing debt load, credit score, and down payment size without making you go through the full loan application.

This can tell you whether youre qualified for a mortgage and how much home you might be able to afford.

You could also learn whether you can afford a 15year loan term or whether you should stick with a 30year mortgage. And, a preapproval can show whether youd be better off with an FHA loan or a conventional loan.

Finally, your preapproval shows you the added monthly costs of homeownership such as home insurance, real estate taxes, HOA fees, and mortgage insurance if necessary.

Also Check: How Do Mortgage Appraisals Work

How To Use The Maximum Mortgage Calculator

Not sure where to start? Let us help you:

How Lenders Decide

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back. Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

Read Also: When Do You Apply For A Mortgage Loan

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

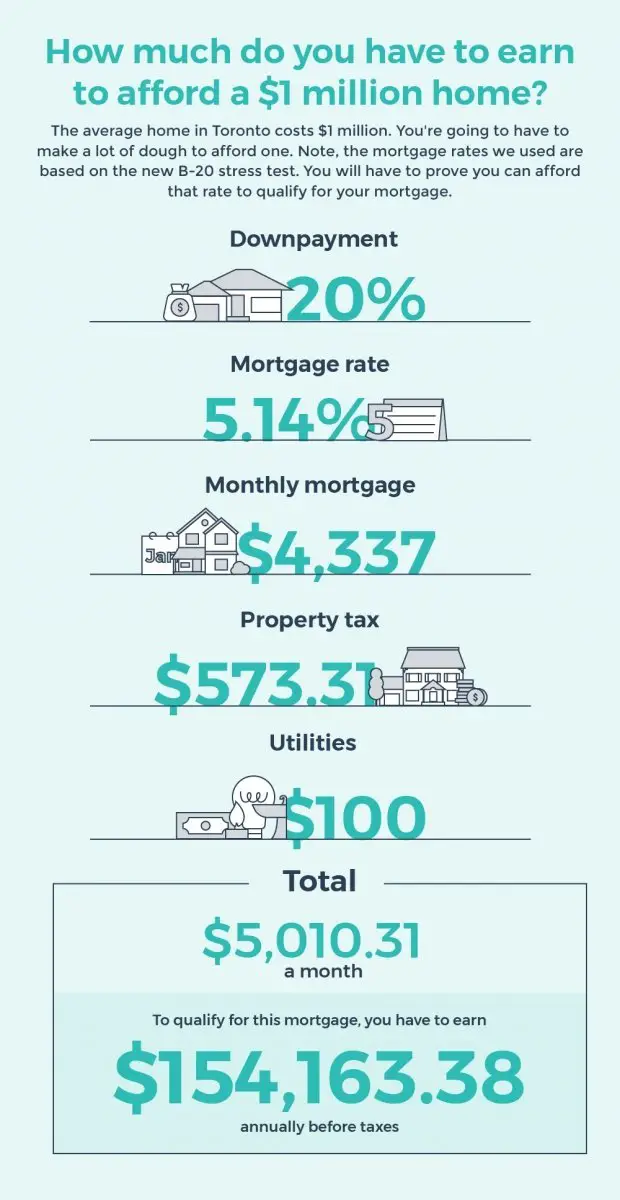

How Much Do You Have For A Down Payment

Your down payment affects the amount you can borrow to buy a home and the size of your payments. This will impact your monthly budget.

You must have at least 5% for a down payment if the home purchase price is less than $500,000.

If the home purchase price is between $500,000 and $999,999.99, you must have at least 5% for the first $500,000 and 10% for the remaining amount.

For home prices $1 million or over, the down payment must be 20%.

If you are a first-time home buyer, you can borrow up to $35,000 from your RSP towards your down payment.1

1. First time home buyers can withdraw up to $35,000, in a calendar year, from their RSPs for a home purchase . They then have 15 years to repay their RSP . Find out more about the RSP Home Buyers’ Plan.

Step 5 of 6

Also Check: How Much To Get A Mortgage

Start With A Better Homebuying Experience

At Better Mortgage, we know buying a home can be an overwhelming endeavor. Thats why were dedicated to making the entire homebuying and mortgage process faster, simpler, and less expensive.

Weve partnered with real estate agents across the country that can help make your homeownership dreams a reality.

Our Better Real Estate agents:

- Provide personalized guidance, not pushy sales tactics

- Help you secure affordable financing whether thats through Better or another lender

- Connect you with our trusted network of providers, such as home inspectors, appraisers, insurance agents, contractors, and more

When youre ready to look for homes, we can help you move fast by issuing you an official pre-approval letter online in minutes. Getting amortgage pre-approvalshows sellers youre a serious buyer. The pre-approval can also help solidify your homebuying budget and increase the likelihood that your offer will be accepted.

Our entire mortgage process from application through funding is 100% online, so updates are always just a few clicks away. Using a combination of effective technology and financial savvy, we can originate your loan for less money, and we pass those savings on to you. In fact, with Better Mortgage, youll never have to pay unnecessary lender fees or loan officer commissions, leaving you with more cash for your new place.

Are you ready to see how much you qualify for so you can find your dream home? Get pre-approved today.

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Recommended Reading: What Are The Best Mortgage Lenders