How To Get An Fha Loan

Not all mortgage lenders offer FHA loans, so the first step is to find one who does. Once youve done that, youll need to:

Tip:

Dont Miss:

The Buyers Employer Or Job Title Changed

Changing jobs even for higher pay can ruin your pre-approved mortgage.

If you plan to make any of the following changes in your job or career, ask your mortgage lender before making the change:

- Becoming a partner in a company

- Starting a new business

- Switching from a salaried position to a salary + bonus position

- Changing industries

- Accepting payment in cryptocurrency

Its okay to make changes in your career. Be sure to speak with your lender to avoid unintended consequences.

How Long Is A Home Loan Pre

The good-for period varies with the lender, but typically anywhere from a month to 90 daysand, in some cases, six months. Its good practice to keep track of the expiration date so that you dont run into a situation where you find a dream home that you can afford only to learn that your pre-approval has expired.

Also Check: What Do Lenders Look For When Applying For A Mortgage

Documents You Need For Fha Pre

An FHA loan pre-approval means the lender pulled your credit, evaluated your income and assets , and agrees that youre a good risk for the loan amount they approve.

So, how do you get the FHA loan pre-approval?

First, know that its possible whether youre looking for an FHA pre-approval for a first-time home buyer or youve done this before.

Start with an FHA loan pre-approval application. Then, the lender will ask for documents:

- Pay stubs from the last month

- W-2s and tax returns from the last 2 years

- Bank statements from the last 2 months

- Proof of employment

- Proof of identity

- Approval to pull your credit

Keep in mind it isnt a guaranteethat youll get the loan but its one step closer to being approved for the type of FHA loan to get the home of your dreams.

The Monthly Payment Is Higher Than Pre

Mortgage pre-approvals simulate the purchase of generic homes at specific purchase prices. But, when buyers make offers on real homes, those approvals use real numbers.

As part of the final approval, lenders replace pre-approval numbers with real numbers:

- The purchase price of the home

- The expected down payment

- The homes real estate tax bill

- The expected homeowners insurance premium

- The homes monthly assessment, if applicable

If the newly-calculated housing payment is higher than expected, the buyers pre-approval may be invalidated.

You May Like: How Much Income To Qualify For 300 000 Mortgage

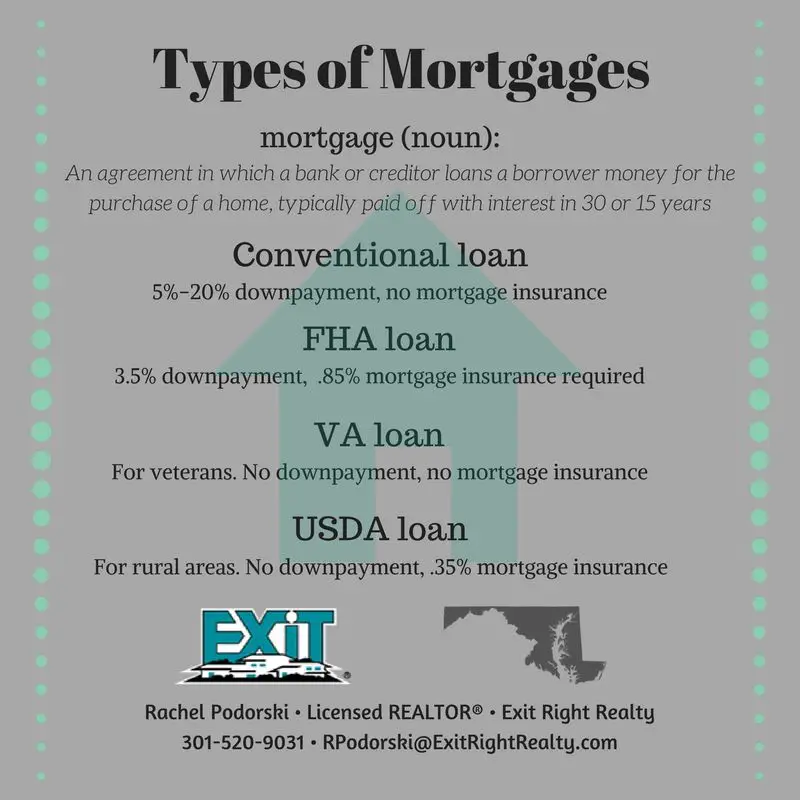

How Do Fha Loans Work

FHA loans essentially work the same as other home loan programs. Youll need to qualify based on your income, credit history, employment history and verify you have or can get a gift for the down payment and closing costs.

However, the flexibility of FHA loans may work best if:

- Your credit score is between 500 and 619.

- Your total debt-to-income ratio is higher than the 50% conventional DTI ratio maximum.

- You need a loan amount at or below the current FHA loan limit for the county in which youre buying.

- You want to buy and live in a two-to-four unit, multifamily home with a 3.5% down payment, and use rental income to help you qualify.

- You want to buy a fixer-upper home with a 3.5% down payment and roll the renovation costs into your loan amount.

- You need to qualify for a mortgage with the income of a co-borrower who wont live in the home.

- Youve had a bankruptcy in the past two or more years.

- Youve had a foreclosure in the past three or more years.

- You cant qualify for a conventional loan.

Bnc National Bank: Nmls#418467

Min. credit score

BNC National Bank offers conventional loans for as little as 3% down.

View details

View details

Why we like it

BNC National Bank offers a robust variety of loans, but you have to reach out to a loan officer to get customized interest rates.

Pros

-

Offers a wide variety of loan types and products.

-

Has robust online capabilities, and an app for iOS and Android.

-

Mortgage interest rates are lower than typical, according to the latest data.

Cons

-

Has a limited number of physical mortgage offices.

-

No rate information is available without starting an application or speaking with a loan officer.

-

Does not offer home equity loans or lines of credit.

|

Best for first-time homebuyers |

Don’t Miss: Does It Make Sense To Pay Points On A Mortgage

How Many Pre Approval Letters Should I Get

It is a good idea to get multiple mortgage pre-approval letters.

This will allow you to compare offers from different lenders and choose the best one for you. There is no commitment to take out a mortgage with the lender who has pre-approved you.

In fact, you should shop around for lenders before signing on the dotted line. Its best to compare offers, really taking into account the proposed interest rate and other fees.

When getting multiple mortgage pre-approval letters, be sure to let each lender know that you are shopping around so they can give you their best offer. This is especially important if you are trying to get a mortgage with bad credit.

Now that you know how to get a pre-approval letter for a mortgage, its time to start shopping around for lenders!

Popular posts

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what youre comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three months worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Recommended Reading: Average Apr For Motorcycle

Recommended Reading: Can You Roll Down Payment Into Mortgage

Find A Mortgage Company To Pre

Mortgage pre-approvals are available for free through most mortgage websites with no obligation to proceed. Many home buyers get their mortgage from a different mortgage company that pre-approved them. So, dont overthink this step.

The critical part of getting your pre-approval is that you get it. Without a pre-approval, you cannot buy a home.

Why Would The Fha Pre

FHA loans are easier to qualify for but not everyone who applies for an FHA loan will get approved. These are a few of the reasons we have encountered which resulted in pre-approvals getting denied:

- A bankruptcy within the past two years

- A foreclosure within the past three years

- No two-year work history

- Unable to document income or income that is documented is too low

- The proposed property to be financed is not the primary residence

- No down payment

These situations above occur but in some instances like the down payment issue, there are ways to still get the financing that you need. .

Read Also: What Is The Current National Mortgage Interest Rate

How Do I Get Rid Of My Fha Mortgage Insurance

FHA mortgage insurance lasts for the life of the loan or for 11 years, depending on the length of the loan.

The only way to get rid of that mortgage insurance is to refinance the mortgage with a non-FHA loan. Your FHA loan will then be paid off in full. Assuming you own at least 20% equity in the home, you should no longer be required to have mortgage insurance.

How To Qualify For An Fha Loan

FHA loans can be great for first-time homebuyers as they may qualify for a down payment as low 3.5% of the purchase price. And people with lower incomes and credit scores may also qualify for FHA loans. This loan type makes homeownership possible for many.

Taking out a loan to buy a home is exciting, but its also a big decision that takes significant time and consideration. We want to provide you with the right information to help you make the best choices for you and your family, and this guide will help you understand what an FHA loan is and how to apply for one.

You May Like: Does Applying For Mortgage Hurt Credit

Overtime And Bonus Income

If you derive income from bonuses or commissions, youll need a two-year history of receiving that income for the lender to count it on your application. The lender will determine an average of overtime or bonus income over this period to come up with an amount that contributes to your qualifying income. The lender will verify with your employer that overtime and bonus income will continue.

What Credit Score Do You Need For An Fha Loan Approval

In order for you to be approved for an FHA, most lenders require a min 640 credit score.

FHA loans are forgiving in terms of down payment and even income, but they do have min standards in terms of credit. If you do have a previous negative credit history, you may still qualify as long as:

- Defaults and bankruptcies are more than 3 years old, and

- Foreclosures are more than five years old, and

- You do not owe the government any past-due money, including late taxes, OR

- Your score suffered from a one-time, negative problem that has since been resolved.

FHA Mortgage Source is Floridas leading FHA loan resource, serving you 7 days a week. Please call us today to learn more.

Don’t Miss: What Is Needed To Refinance A Mortgage

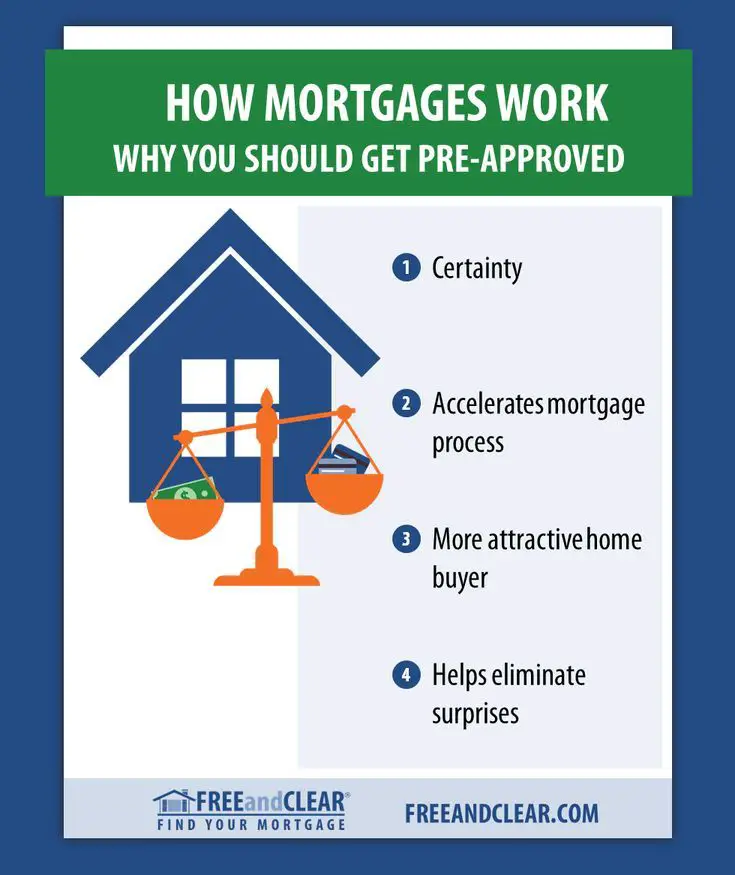

What Is Mortgage Preapproval

Preapproval is as close as you can get to confirming your creditworthiness without having a purchase contract in place. You will complete a mortgage application and the lender will verify the information you provide. Theyll also perform a credit check. If youre preapproved, youll receive a preapproval letter, which is an offer to lend you a specific amount, good for 90 days.

History Of Honoring Debts

A lender will look at your work history for the past two years as well as your payment history for bills such as utility and rent payments.

People who fall behind on federal student loan payments or income tax payments will be rejected unless they agree to a satisfactory repayment plan. A history of bankruptcy or foreclosure may prove problematic, too.

Typically, to qualify for an FHA loanâor any type of mortgageâat least two or three years must have passed since the borrower experienced bankruptcy or foreclosure. However, exceptions can be made if the borrower demonstrates having worked to re-establish good credit and get their financial affairs in order.

Recommended Reading: Can Low Credit Score Get Mortgage

Receive Your Mortgage Preapproval Letter

When you get preapproved, you usually get a preapproval letter. There are a few reasons the preapproval letter is important. First, real estate agents typically want to see your preapproval letter before they show you houses. This ensures they dont waste time showing you homes outside your budget.

Second, the preapproval letter is something you can share with the homes seller when you make an offer. It shows you wont have problems getting financed for the amount youre offering.

Our Advice Its Never Too Soon To Pre

The best time to get pre-approved is when you start thinking about homes. Pre-approved home buyers get better rates and better homes.

Getting pre-approved establishes your home purchase price range and minimum down payment and gives you time to edit and correct your credit.

Most importantly, though, pre-approvals indicate seriousness about buying a home.

Get pre-approved today in under 3 minutes.

Get pre-approved for a mortgage today.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

You May Like: How To File A Complaint Against A Mortgage Lender

What Is The Max Amount You Can Get From An Fha Loan

That depends on where you live as well as on your ability to repay the loan. The maximum amount you will be able to borrow will be based on your financial circumstances.

The maximum amount anyone can borrow from the FHA varies by region.

In 2022, loan limits range from $420,680 for a one-unit property in a lower-cost area to $2,800,900 for a four-unit home in the country’s most expensive cities.

What Happens When You Get Preapproved

When you apply for preapproval, the lender verifies the information you provide. If your information checks out, the lender gives you a preapproval letter. The letter lists the amount the lender is willing to lend you and the interest rate youre approved for.

It doesnt guarantee that youll get a loan, but its a good starting point that shows sellers youre a serious home buyer and a mortgage lender is taking your application seriously.

Don’t Miss: How To Shorten A 15 Year Mortgage

Why Is My Credit Score Important

Your is not only important for qualifying for a mortgage, but its also the key to getting a lower interest rate. The better your credit score, the lower your interest rate will be, which can save you quite a lot of money.

Consider that a borrower with a $300,000, 30-year mortgage with a 3% interest rate will pay $29,635.90 less over the life of the loan than a borrower who has a 3.5% rate. On a monthly basis that equals $82 in savings.

Who Can Apply For An Fha Loan

People who do not have perfect credit, have filed for bankruptcy in the past, or new homebuyers who are still working on their finances should consider an FHA loan. In cases where you may not qualify for a traditional loan, FHA financing may be right for you.

First-Time Homebuyers

FHA loans may be a good match for new homebuyers who may still be working on their financial picture. Those who have been renting and dreaming of buying a home sometimes hesitate because their credit is not perfect or because its hard to save up 20% of the down payment of a home.

Fortunately, the more relaxed requirements of an FHA loan mean that more people can enjoy the American dream of buying their own property. FHA loans are available for properties with one to four units.

If youre not sure whether this type of home loan is a match for your plans, speak to FHA loan lenders at Assurance Financial. We can explore your options together.

Read Also: How To Get A Mortgage With Bad Credit

How Far In Advance Should I Get Pre

The best time to get pre-approved for a mortgage is at least one year before you decide to purchase.

As a home buyer, pre-approvals are for your benefit, so its never too early to get one.

Getting pre-approved early is an advantage because one-third of mortgage applications contain an error. These errors can negatively affect your interest rate and ability to buy a home. Pre-approvals uncover those mistakes and give you time to fix them.

Getting pre-approved also sets your price range. Pre-approved buyers are less likely to overspend or underspend! on their residence as compared to buyers who use online mortgage calculators.

Learn more about getting pre-approved before looking for a home.

Best Lenders For Fha Loans In October 2022

FHA loans offer several benefits including lower down payments and more lenient requirements. Compare some of the top FHA lenders to find the right fit for your needs.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You might think all Federal Housing Administration lenders are the same. But when youre looking for an FHA loan, its always smart to shop at least three lenders. Their mortgage rates and fees can differ substantially, plus lenders’ requirements for approval for an FHA loan vary.

NerdWallet has picked some of the best FHA lenders in a variety of categories so you can quickly determine which one is right for you.

» MORE:Compare FHA mortgage rates

You might think all Federal Housing Administration lenders are the same. But when youre looking for an FHA loan, its always smart to shop at least three lenders. Their mortgage rates and fees can differ substantially, plus lenders’ requirements for approval for an FHA loan vary.

NerdWallet has picked some of the best FHA lenders in a variety of categories so you can quickly determine which one is right for you.

Recommended Reading: What Are 15 Year Mortgage Interest Rates