The Property Being Refinanced Was On A Company Title

Simply put, a company title gives you a share in the company who owns the block of flats or units you live in. For example, if you own shares 1001 to 2000 then you own unit 2, so it is by who owns what shares as to who owns which unit.

The problem is that the majority of lenders see a company title property as an unacceptable form of security for a home loan.

Only a few lenders do and they tend to limit the amount theyre willing to lend, i.e. the maximum is 60%-80% .

More Seniors Are Taking Out New Home Loans

Many retirees no longer see paying off their home as part of their financial goals.

More and more Americans are taking advantage of the low interest rates and tax breaks that come with having a mortgage.

If youre sizing down, you might get a mortgage instead of buying the new place with cash. Or you might refinance for lower payments rather than paying off a chunk of your balance.

Luckily, there are plenty of home loan options for seniors today, even if youre on Social Security income. Heres what to know.

In this article

Buying A House At 65 Years Old: Major Pros And Cons

Is 65 too old to buy a house? | Buy vs rent | Financing a home in retirement| FAQs about buying a house at 65 years old

Buying a house is a large investment, no matter how old you are.

If you’re considering buying a house at 65 years old, you should first look at your financial portfolio and perhaps even speak with a financial advisor to determine whether an investment of this size makes sense for you.

Next, you should find an experienced realtor who knows the local market and can help you negotiate a winning offer on the perfect house for your retirement goals.

With an expert buyerâs agent at your side, thereâs nothing stopping you from finding the house of your dreams at any age.

Ready to find a great realtor? Clever offers a free, no-obligation service that matches you with top-rated agents from trusted brokerages like Berkshire Hathaway and Century 21. And, on eligible purchases, you could also get a cash-back refund of 0.5%that keeps more money in your pocket!

Also Check: Is Phh A Good Mortgage Company

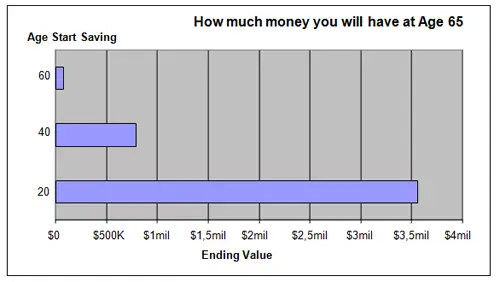

What Age Should You Buy A Retirement Home

The earlier you purchase a home for your retirement, the more you can take advantage of home equity. This is especially true if you need to take out a mortgage to finance your purchase. We recommend consulting with your financial advisor and a top buyer’s agent to decide if purchasing a home is the right fit for your retirement goals. Learn more about buying a house at 65 years old and beyond.

Apply With Your Lender Of Choice

The refinance process begins with an application. You dont need to refinance with your current lender. You can submit an application with any lender you choose. Your lender will usually ask you for documentation that proves your income. This can include statements detailing your Social Security benefits, tax returns and any statements from your retirement accounts or pension plans.

Don’t Miss: What Is Buying Points On A Mortgage

What Types Of Mortgages Can Older Borrowers Get

As long as you meet the lenders eligibility requirements, you should be able to get a traditional repayment mortgage. This could be a fixed-rate mortgage or a variable-rate mortgage such as a tracker. You borrow a set amount of money and have to pay it back over a pre-agreed term with interest. This could be a new mortgage because youve moved house or bought your first home, or it could be a remortgage to get a better deal. As described above, if youre under 60, you should be able to access the same rates and deals that a younger borrower can.

However, there are also special kinds of mortgages that are designed specifically for older borrowers.

Find The Best Mortgage For You

Most mortgage lenders have loan programs that make it possible for seniors to buy a home or refinance their current home.

However, not all lenders are experienced in issuing mortgages to retirees.

Prior to choosing a lender, make sure to ask a few screening questions. In addition to getting the lowest mortgage rates, youll want to know how the lender qualifies retirement income, as well as how they calculate qualifying income from assets.

A few questions asked upfront can help you find an experienced lender to process your application and get you the best deal.

You May Like: How Long Do You Have To Pay Private Mortgage Insurance

When To Continue Making Mortgage Payments

Monthly mortgage payments make sense for retirees who can do it comfortably without sacrificing their standard of living. It’s often a good choice for retirees or those just about to retire who are in a high-income bracket, have a low-interest mortgage , and benefit from tax-deductible interest. This is particularly true if paying off a mortgage would mean not having a savings cushion for unexpected costs or emergencies such as medical expenses.

Continuing to make monthly mortgage payments makes sense for retirees who can do it comfortably and benefit from the tax deduction.

If you’re retiring within the next few years and have the funds to pay off your mortgage, it may make sense for you to do so, particularly if those funds are in a low-interest savings account. Again, this works best for those who have a well-funded retirement account and are still left with substantial savings for unexpected expenses and emergencies.

Paying off a mortgage ahead of retirement also makes sense if monthly payments will be too high to afford on a reduced fixed income. Entering retirement years without monthly mortgage payments also means you wont have to withdraw funds from your retirement account to pay for them.

Should Retirees Pay Off Their Mortgage?

Secure A Mortgage In Spain

If you are considering retiring in Spain and are over age 60, you can get a mortgage if you are receiving a pension. You can appoint a guarantor when applying for a Spanish retiree mortgage, which may also give you some tax advantages if you list the guarantor as part-owner of the property.

More and moreforeigners are buying homes in Spain. Centro de Información Estadìstica del Notariado reports that for the second half of 2021, real estate sales to foreign buyers in Spain increased by 41.9%. According to the data provided by theProperty Registry in Spain, 7% of theproperty mortgages issued in Spainwere signed by foreign citizens.

If you have made the decision to buy a house in Spain at age 60 or over, consider that if you already own a private home, you can sell it, which will increase your savings for the purchase of the new Spanish property. Remember that those over 65 years will pay the income tax on the capital gains arising from the sale. You could also rent your existing property and use the rental income toward your total income.

Don’t Miss: What Is The Mortgage On A 900 000 Home

Start With Your Current Lender

You may have an increased chance of getting approved for a refinance with your current lender since they will already know the details of your loan. Your lender may be able to suggest different refinance programs for seniors that youll easily qualify for and may even be able to loosen the requirements to refinance .

What Do I Need To Do To Take Out A Mortgage If Im Over 60

Youll need to be able to prove your ability to repay the loan. Your lender will check for:

- Proof of income. If youre retired, youll still need to prove that youre receiving a steady income and will be able to make consistent loan payments. This can include a combination of pension and retirement plan payments.

- Debts. This includes any outstanding debts, such as credit cards, loans and current mortgages.

- Debt to income ratio. Mortgage providers will look at your income in comparison to all your debts to determine if you are qualified to take on a mortgage.

- A good credit score will make a big difference when it comes to lenders. If your score is less than ideal, consider using a credit repair service before applying for a mortgage.

Promoted for

About our promoted products

Recommended Reading: How To Report Mortgage Payments To Credit Bureau

Mortgages For The Over 70s

Getting a mortgage in your 70s is certainly possible, but you will find your options are more limited. You will have fewer lenders and fewer deals to choose from, and you may only be eligible for terms of 5-15 years. Interest rates are also likely to be less competitive.

However, some lenders are more flexible than others, particularly if you look at building societies and niche lenders, where you may be able to borrow up to the age of 95. It may also be possible to apply for a guarantor mortgage if you can provide a guarantor who would be willing to meet the repayments should you be unable to.

Freddie Mac Senior Home Buying Program

Similarly, Freddie Mac changed its lending guidelines to make it easier for borrowers to qualify for a mortgage when they have limited incomes but substantial assets.

The rule allows lenders to consider IRAs, 401s, lump sum retirement account distributions, and proceeds from the sale of a business to qualify for a mortgage.

Any IRA and 401 assets must be fully vested, and must be entirely accessible to the borrower, not subject to a withdrawal penalty, and not be currently used as a source of income.

Recommended Reading: What Is The Mortgage On A 280 000 Home

Have You Ever Heard Of A 60

Q: Have you ever heard of anyone financing a 60 year mortgage?

A: For a time during the great real estate boom, when home prices were skyrocketing and mortgage products designed to “improve affordability” were all the rage, we did see some unusually long terms for mortgages. However, the longest such offers were usually 40 years.

Can You Get A Mortgage As A Senior

When it comes to getting a home loan in retirement, mortgage lenders look at a lot of numbers to decide whether a borrower is qualified but age isnt one of them. The Equal Credit Opportunity Act makes it unlawful to discriminate against a credit applicant because of age.

I once did a 30-year mortgage for a 97-year-old woman, recalls Michael Becker, sales manager and loan originator at Sierra Pacific Mortgage in Lutherville, Maryland. She was lucid, understood what she was doing and just wanted to help out a family member some cash out of her home, and had the income to qualify and the equity in the home she owned it free and clear so she was approved.

When seniors apply for a mortgage, lenders look at the same criteria as they do for any other borrower, including:

- Debt-to-income ratio

- Income and other assets

The minimum credit score to get a conventional loan backed by Fannie Mae or Freddie Mac is 620, although that score wont qualify you for the best rates. A DTI ratio as high as 50 percent might be allowed, but lenders prefer to see you spending less than 45 percent of your monthly income on debt payments, including your mortgage.

The same underwriting guidelines apply to retirees and seniors as does to everyone else, Becker says. They must have the capacity to repay the loan that is, have the income and assets to qualify.

You May Like: Can You Sell House Before Paying Off Mortgage

Why Is It Harder To Get A Mortgage When You Are Older

If youre aged 50, you shouldnt have any difficulty getting a mortgage. After all, life expectancy continues to rise, and more people are working later in life, which means youre likely to have a regular salary for longer.

However, as you get older and get closer to retirement, it can become harder to get accepted for a mortgage and mortgage terms can be shorter. If, for example, youre only planning to work for the next 18 years, you might find it harder to get accepted for a 25-year deal.

Lenders become more concerned about your ability to repay your debt the closer you are to retiring. Even if youre due to have income from your pension, lenders cant easily assess how much youll be receiving.

As you get older, theres also an increased risk of ill health which means you may not live to the end of your mortgage term.

If Youre Looking For A Mortgage Adviser Who Takes The Time To Get To Know You And Where You Are In Life Youve Come To The Right Place

Choosing the right mortgage for you can be really challenging. At Private Wealth Mortgages, our expert advisers guide you through the entire process and will find the best deal for your circumstances.

How much deposit is required for a buy to let retirement mortgage?

For a buy to let retirement mortgage, you will need a minimum deposit of at least 20% of the value of the property, but this will be dependent on your current and future income levels and expected rental income. It can vary between 20-40% depending on the terms.

Is there an age limit on buying a house?

There is no upper age limit on buying a house, but should you need to borrow, the terms of your mortgage will need to consider your personal and financial circumstances and are subject to differing criteria. There is however a lower age limit on buying a house you do need to be 18 years old or above.

Can I get a mortgage at 58?

Yes, you can, and whats more, there are several options that we can look at that would best suit you based on your current situation, whether you are 58 or 78. There are a variety of interest only retirement mortgages and lifetime mortgages available to you that are based on your property value or your retirement income and can run for a fixed number of years, or your lifetime.

Am I too old to apply for a mortgage?

Can over 60s get a mortgage?

Can a senior citizen get a mortgage?

Contact us today for more information on , visit our Retirement section on our website, or email:

You May Like: What Is A Cd In A Mortgage Process

Seniors Taking Out Mortgages Is It Ever A Good Idea

This article was published more than 5 years ago. Some information may no longer be current.

Mortgage expert Jake Abramowicz says he sees seniors taking equity out of their homes. If theres a good business case to be made in taking out a mortgage at this age, then lets do it.Jennifer Roberts/The Globe and Mail

When Lenore K., a former corporate communications manager in Toronto, retired recently at 66, she and her husband considered how they might further optimize their money.

In addition to Ms. K.’s private pension, the couple also have government pensions, retirement savings plans, a tax-free savings account and investments in mutual funds. They own their house, having paid off any mortgages a decade ago, but they are considering taking out a low-interest, fixed-term, 30-year mortgage and investing the money in other ways, such as in the mutual funds that currently give them up to a 6-per-cent annual return.

When they next meet with their financial adviser, they’re planning to work out their risk tolerance and get his advice on whether to go ahead and use the equity in their house to get a bigger return.

Before taking on mortgage debt, Ms. K., who asked that her full name not be used, believes she and her husband need to consider all the risks involved, such as whether mutual funds or stocks will become less stable because of world events including Brexit in Britain and Donald Trump’s election in the United States.

Renting A Home In Retirement

On the other hand, renting a home in retirement provides flexibility for older adults who anticipate traveling or moving again in the future, or who simply want to save their nest egg for other expenses rather than buying a house.

Financially, renting is much simpler and requires less forethought than buying a home. Finding a home or apartment to rent takes a fraction of the time it would take to purchase and leaves you free to spend your money on other things that matter to you like traveling to visit friends and family or starting a new hobby.

You May Like: Can You Refinance Your Mortgage

How To Get A Mortgage If You Are An Older Borrower

The maximum age to get a mortgage varies depending on the lender and with some retirement mortgages there is no maximum age at all instead the primary consideration is your unique financial circumstances in terms of earned income, pension income and credit history. Age is not always the ultimate factor with certain types of mortgages too some lenders of buy to let products, for example, dont have a maximum upper age limit. Our team of expert retirement mortgage advisors have access to the whole market and can discuss, for free and with no obligation, the best options for you. Weve been helping people prepare for retirement by providing impartial, expert guidance for over 20 years so you can trust our team to assess your own personal situation and give you honest advice. Here are some answers to our most frequently asked questions:

Can a retired person qualify for a mortgage?

We have many customers asking us, Can you get a mortgage when retired? The answer is yes, you can. There are several options that we can look at that may best suit you based on your current situation, from interest only retirement mortgages that are dependent on your retirement income to lifetime mortgages that are largely based on your property value.

What is the maximum age to get a buy to let mortgage?

Is there an age limit to get a mortgage?

Can you get a mortgage beyond retirement age?

Can I get a mortgage at 60?

Can a 60-year old get a 30-year mortgage?