Which Term Is Better Right Now

What do you need, fixed-rate or variable-rate mortgage? When taking out a mortgage, you are confronted with all kinds of questions to which you may not know the answer. To pick the right mortgage, its important to remember these differences.

We dont want you to get the wrong deal. Weve spelled out the difference between a fixed-rate and a variable-rate mortgage so you can be confident in your decision.

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

Why Are Mortgage Interest Rates Important

Your mortgage interest rate determines how much the balance of your loan will grow each month. The higher the interest rate, the higher your monthly repayments.

Interest rates are always calculated as a percentage of your mortgage’s balance.

If you have a repayment mortgage – which most people do – you’ll pay a set amount of your balance back each month plus interest on top of that. Those with interest-only mortgages pay interest but none of the -capital.

You May Like: What Can You Include In A Mortgage

How Do Mortgage Rates Work

The mortgage rate a lender offers you is determined by a mix of factors that are specific to you and larger forces that are beyond your control.

Lenders will have a base rate that takes the big stuff into account and gives them some profit. They adjust that base rate up or down for individual borrowers depending on perceived risk. If you seem like a safe bet to a lender, you’re more likely to be offered a lower interest rate.

Factors you can change:

-

Your . Mortgage lenders use credit scores to evaluate risk. Higher scores are seen as safer. In other words, the lender is more confident that you’ll successfully make your mortgage payments.

-

Your down payment. Paying a larger percentage of the home’s price upfront reduces the amount you’re borrowing and makes you seem less risky to lenders. You can calculate your loan-to-value ratio to check this out. A LTV of 80% or more is considered high.

-

Your loan type. The kind of loan you’re applying for can influence the mortgage rate you’re offered. For example, jumbo loans tend to have higher interest rates.

-

How you’re using the home. Mortgages for primary residences a place you’re actually going to live generally get lower interest rates than home loans for vacation properties, second homes or investment properties.

Forces you can’t control:

» MORE: What determines mortgage rates?

The Basics Of Mortgage Interest Rates

Buying a mortgage can be intimidating. There are different mortgage types, interest rates, and mortgage insurance. The process, for many, has proved to be a frustrating one.

The interest rate you pay will significantly affect the total cost of your mortgage. Mortgages can typically last up to 30 years. The choices you make can affect your finances for up to that length of time, so it’s vital to understand how interest rates work. To get this right as you start, we’ve provided the scoop on exactly how interest rates work.

Using a mortgage calculator is a good resource to budget these costs.

You May Like: How To Get A Physician Mortgage

Current Mortgage Rates Take Another Tumble

Leslie CookKristen Bahler19 min read

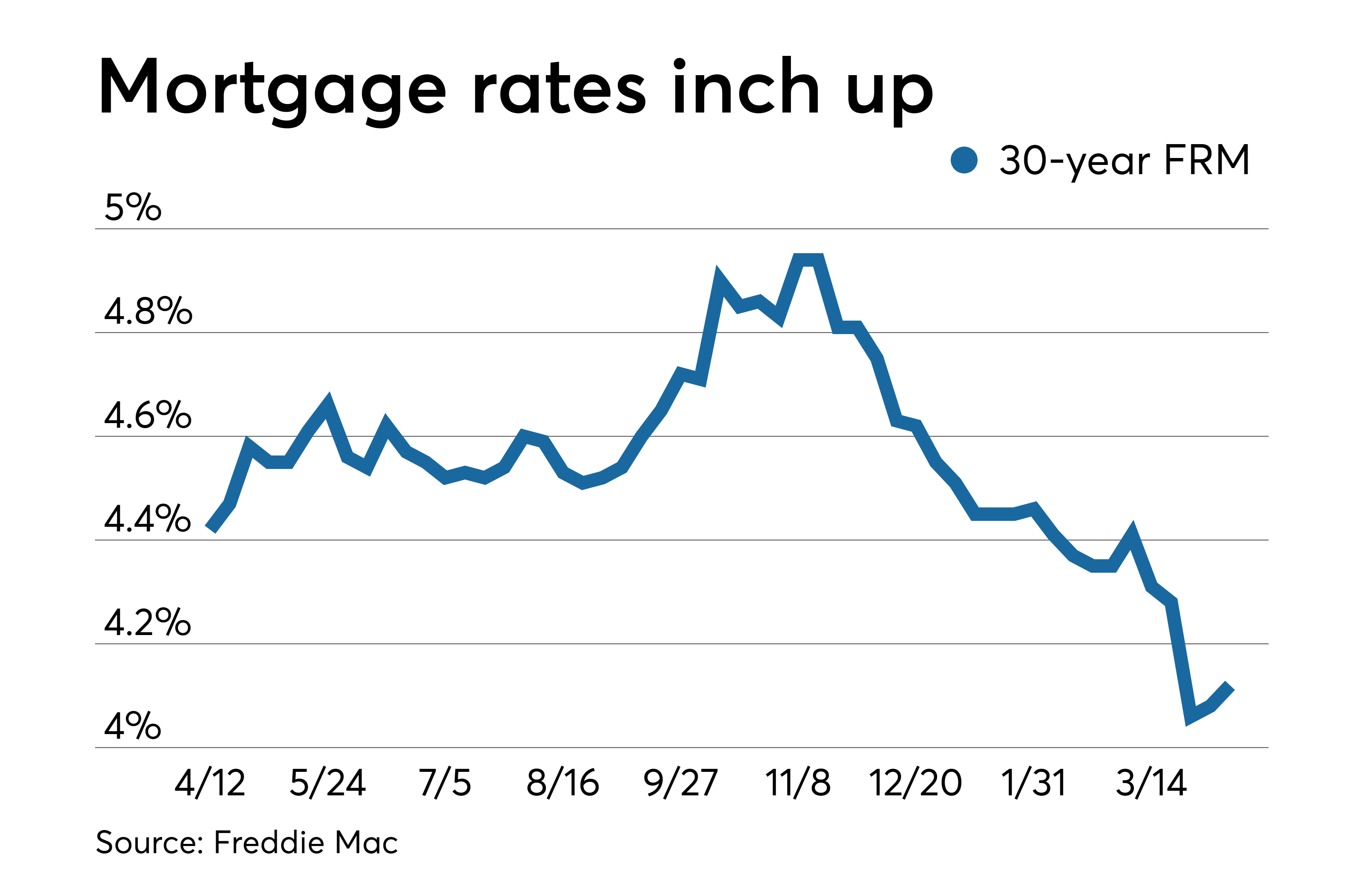

The average rate on a 30-year fixed-rate loan dropped 0.31 percentage points, decreasing to 4.99%, according to Freddie Mac’s weekly survey.

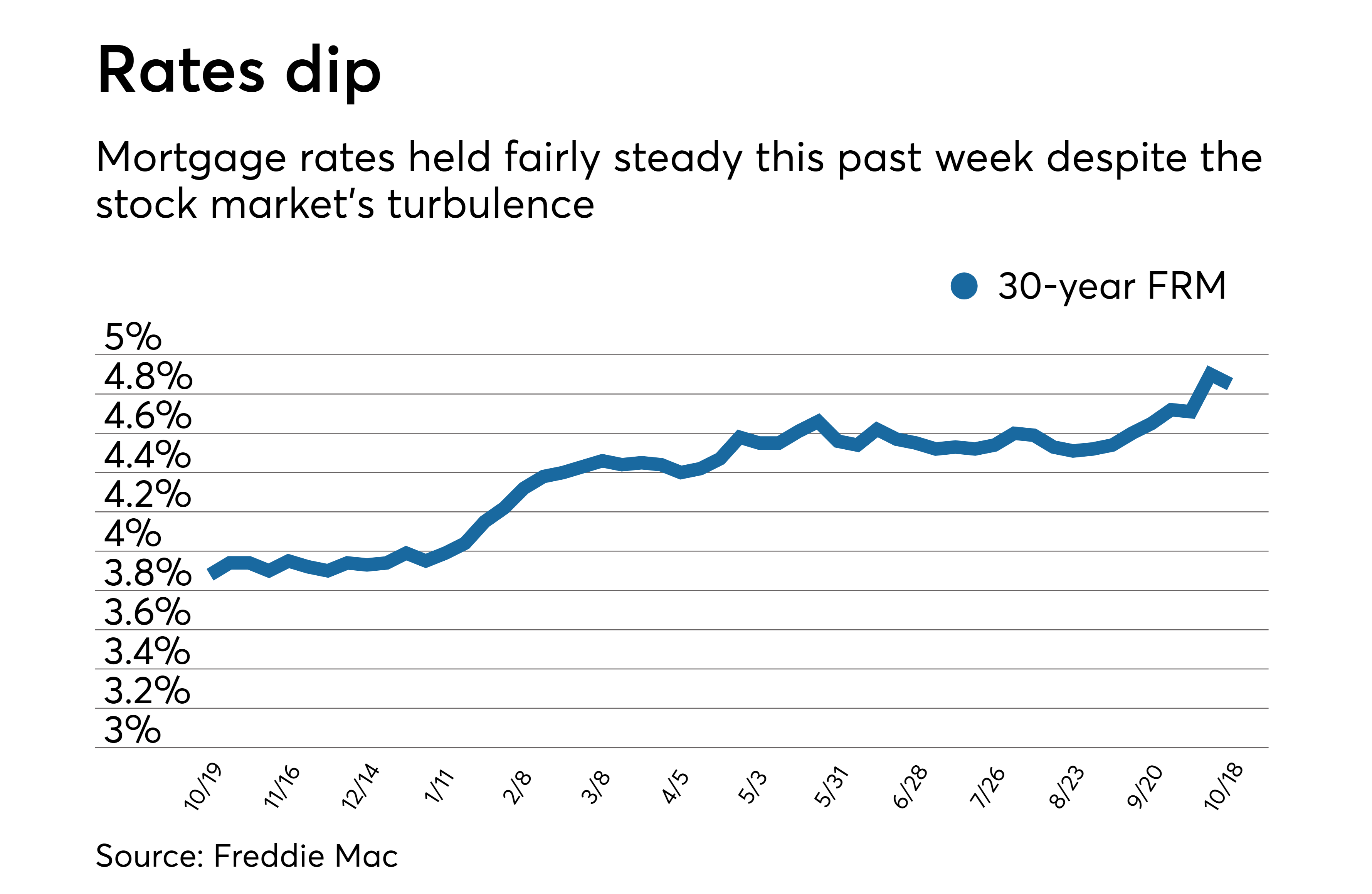

This is the second week in a row that the 30-year rate has decreased. Mortgage rates soared by more than 2 percentage points during the first 6 months of the year, ending a two-year run of historically low mortgage rates caused by the economic disruption of the pandemic. The last time the rate averaged less than 5% was the first week of April.

“The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment,” Sam Khater, Freddie Mac’s chief economist, said in a press release.

Average rates for other loan categories are lower as well. The 15-year fixed-rate mortgage is averaging 4.26% while the 5/1 adjustable-rate mortgage is averaging 4.25%.

If you are offered a rate that is higher than you expect, make sure to ask why, and compare offers from multiple lenders.

How Do I Refinance A 30

Refinancing is when you replace your existing mortgage with a new home loan. When 30-year refinance rates are significantly lower than your existing mortgage rate, you may be able to save money with a refinance. Keep in mind that the potential savings will need to outweigh the upfront closing costs youll pay to refinance, which are typically 3% to 6% of the loan balance.

Another factor to consider when you refinance is, how many years have you been paying off your current mortgage? If youre 10 years into a 30-year loan, taking out a new 30-year mortgage adds those 10 years back onto your repayment term. Even though you may be lowering your monthly payment and rate in that scenario, you could end up paying more interest over the long term even if you have a lower rate.

For more information on how to refinance a mortgage, see NextAdvisors refinance page.

Also Check: How Much Money Does It Cost To Refinance A Mortgage

How Do I Find Current Va Mortgage Rates

NerdWallets mortgage rate tool can help you find competitive, customized VA mortgage rates. In the Refine results section, enter a few details, and in moments youll get a rate quote tailored to meet your needs, without having to provide any personal information. From there, you can start the process of getting approved for your VA home loan. Its that easy.

What Is A Mortgage Interest Rate

A mortgage interest rate a percentage of your total loan balance. It’s paid on a monthly basis, along with your principal payment, until your loan is paid off. It’s a component in determining the annual cost to borrow money from a lender to purchase a home or other property.

You May Like: How Long Can I Lock In A Mortgage Rate

Variable Interest Rate Mortgage

A variable interest rate can increase and decrease during your term. If you choose a variable interest rate, your rate may be lower than if you selected a fixed rate.

The rise and fall of interest rates are difficult to predict. Consider how much of an increase in mortgage payments youd be able to afford if interest rates rise. Note that between 2005 and 2015, interest rates varied from 0.5% to 4.75%.

Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, a fixed interest rate mortgage may be better for you. You may also consider fixed payments with a variable interest rate.

A variable interest rate mortgage may be better for you if youre comfortable with:

- your interest rate changing

- your mortgage payments potentially changing

- the need to follow interest rates closely if your mortgage has a convertibility option

Get information on current interest rates from the Bank of Canada or your lenders website.

What Is The Standard Interest Rate On A Mortgage In Canada

Its not uncommon for mortgage interest rates to fluctuate, and a variety of factors might affect your final interest rate. While some of these are personal characteristics that are under your control and some are not, you should be aware of what your rate of interest may look like as you begin the house loan application process.

To get the best deal on their mortgage, Canadians have a choice between two different types of interest rates: fixed and variable. Your interest rate will fluctuate over time depending on which of these mortgage rate alternatives you choose. The interest rate you pay on your mortgage can be determined by various factors, including those considered by your mortgage lender.

Mortgage Maestro provides customers with a simple mortgage process and the best insurance rates, all from the comfort of their own homes. For more details, check this site.

Also Check: What Does Arm Mean In Mortgages

Why Has My Variable Mortgage Interest Rate Changedpress To Expand/collapse

We have changed some or all of our variable mortgage interest rates because there has been a change to our cost of lending or we know that our cost of lending is about to change. There are a number of reasons why our cost of lending can change and they include a change in Bank of England base lending rate or a change to laws and regulations that impact our costs.

If you have a tracker rate, the change will be because the rate automatically follows the Bank of England base lending rate.

Current Mortgage Rates From Super Brokers

Below you will see each of the terms available: 6-month, 1-year to 5-year, 7-year, 10-year and variable. Not only will the change from the previous rate be listed, so too will the date that the change took place. These will arm you with the rate knowledge that you need to get the best mortgage rates going forward.

| Type |

|---|

| 4.99% | 4.59% |

Please Note: Some conditions may apply. Rates may vary from Province to Province. Rates are subject to change without notice. Posted rates may be high ratio and/or quick close, which differs from conventional rates. *O.A.C. & E.OThe mortgage rates are provided as guidance only, and the accuracy of these rates is not guaranteed. The rate provided by any financial institution listed, or any approval or decline you receive, will be based solely on your personal situation. You are strongly encouraged to speak with a licensed mortgage professional for the most accurate information and determine your eligibility.

You May Like: How To Get A Lower Interest Rate On Mortgage

Standard Variable Rate Vs Fixed

While some lenders offer mortgages at the SVR, the most common reason youll pay the SVR is because it is the default rate when a fixed-rate mortgage deal ends.

As the name suggests, a fixed-rate mortgage means that the interest rate on your mortgage, and therefore your monthly payments, will be fixed for a set amount of time. This is normally two, three or five years.

On a fixed-rate mortgage, your payments wont be affected by any changes to the Bank of England base rate. This can help with budgeting as youll know exactly what your monthly payments will be for the duration of the fix.

However, you wont benefit from any decrease in the base rate or your lenders SVR.

At the end of the agreed fixed-rate period, your mortgage will usually automatically be moved to your lenders SVR. In most cases, the SVR will be more than you were paying on the fixed-rate and your payments will increase. They could also change month to month if your lender changes its SVR. This can make budgeting more difficult. As a result, many people remortgage for a better deal at the end of their fixed term.

One of the biggest advantages of opting for a fixed-rate mortgage is the security it offers. This is ideal for those who want to know exactly how much they will be paying each month, allowing for easier budgeting.

Compare Local Conveyancers

Read More Real Estate Coverage

“Increased economic uncertainty and prevalent affordability challenges are dissuading households from entering the market, leading to declining purchase activity that is close to lows last seen at the onset of the pandemic,” said Joel Kan, an economist at the Mortgage Bankers Association.

There could be “a potential silver lining” for the market, he added, as stabilizing mortgage rates and rising inventory “may bring some buyers back to the market during the second half of the year.”

Applications to refinance a home loan fell another 4% for the week and were 83% lower than the same week one year ago. The average rate on the 30-year fixed mortgage was 3.01% a year ago. Most borrowers have already refinanced to far lower rates than exist today. The refinance share of mortgage activity decreased to 30.7% of total applications from 31.4% the previous week.

All eyes and ears are now on the Federal Reserve, which is widely expected to increase its benchmark lending rate Wednesday at its latest meeting of the Federal Open Market Committee.

While mortgage rates do not follow the federal funds rate, they will respond to any commentary from Fed Chairman Jerome Powell after the meeting.

Don’t Miss: Can You Sell House Before Paying Off Mortgage

Where Can I Compare Mortgage Interest Rates

There are many price comparison sites that allow you to compare mortgage interest rates, based on your own personal criteria.

It’s important, however, to not focus solely on the rate that a lender offers, but the total cost of the mortgage across the term of the deal. This way, you’ll factor in any fees and cashback associated with the deal as well as the interest being charged.

This is where the APRC can help.

How To Get A Good Mortgage Interest Rate

Rates vary by lender, so its always important to shop around for the mortgage lender that’s offering the best terms. Each lender has its own overhead and operating costs. It has to charge differently in order to make a profit based on these factors.

The rate youre offered depends largely on your own financial situation as well. A lender will consider:

- Your repayment history and any collections, bankruptcies, or other financial events

- Your income and employment history

- Your level of existing debt

- Your cash reserves and assets

- The size of your down payment

- Property location

- Loan type, term, and amount

The riskier you are as a borrower, and the more money you borrow, the higher your rate will be.

You can apply for a mortgage to several lenders at once, or you can go to a mortgage broker who will do the shopping for you and help you make sure that you’re getting the best rate. Brokers can often find lower rates, thanks to their industry connections and access to wholesale pricing.

Make sure youre comparing the full loan estimate, closing costs included, regardless of which option you choose. You want to be able to accurately see whose pricing is more affordable.

Don’t Miss: How Much Mortgage Can I Afford With 120k Salary

Understanding Different Mortgage Rates

If you’re going to buy a home, you’ll likely need a mortgage. It will probably be the biggest loan you’ve ever taken outand getting it wrong can be a mistake that will cost you for years. So getting it right means educating yourself. Start by checking our mortgage rates tables, which are updated on a daily basis. Then, read below to learn more about how the mortgage market works, which type of mortgage to choose, how to find and lock in the best rate, and more.

How Does A Standard Variable Rate Mortgage Work

A standard variable rate is a type of variable-rate mortgage, meaning the total amount that you pay could change each month.

When you repay your mortgage, part of the money goes towards the interest charged by your lender, and the other part towards repaying the money you’ve borrowed .

If your lender raises its SVR, your monthly payments will increase. But the extra money you pay will go towards the higher interest rather than the capital, so you wouldnt be paying off your mortgage more quickly.

If youre on your lenders SVR, you need to be comfortable with the risk of your monthly mortgage payments going up if the rate changes.

You would also need to be able to cover the higher payments – our mortgage interest calculator can help you work this out. If youre unable to keep up repayments on your mortgage, your home could be repossessed by your lender.

Recommended Reading: Is A 4.5 Mortgage Rate Good

What Does It Mean For Mortgages

The typical cost of a mortgage has been pushed up by successive base rate rises.

During the pandemic house buying boom in 2020 and 2021, interest rates reached record lows with some deals priced at below 1 per cent – but now the cheapest fixed deals are charging more than 3 per cent.

According to fresh analysis by the financial information service Moneyfacts, the average two-year fixed mortgage rate is now 3.95 per cent. In August 2020, it was just 2.08 per cent.

Similarly, the typical five-year fix has now surpassed the 4 per cent mark to reach 4.08 per cent – up from 2.34 per cent in August 2020.

With the base rate having risen, these averages are set to increase further.

Cecilia Mourain, managing director for homebuying at the finance app Moneybox said: ‘Lenders will hike mortgage rates straight after a Bank of England rate rise, but we’ve seen that typically they will come down again, ever so slightly, in the following weeks as lenders continue to compete for business.’

However, how this rise affects borrowers depends on the type of mortgage they have.

For those not on fixed rates the Bank of England decision brings another increase, the third this year, and even those on fixed rates will face increased interest rates when their term ends.

Simon Gammon, managing partner of estate agent Knight Frank’s finance arm, said: ‘Mortgage rates are now changing on a daily basis and lenders are giving borrowers and brokers little notice about repricing.

Variable rates

Fixed rates