Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or youre looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowners insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

What To Do Before You Buy

Whatever you can afford, you want to get the best mortgage ratesand you want to be in the best position to make an offer on your house. Make these steps part of your preparation:

- Check your credit score. Your can have a direct affect on the interest rate youll pay. Check your score, and do what you can to improve it. You can get a free credit report at AnnualCreditReport.com.

- Get pre-approved. Go to a lender and get pre-approved for a loan before you make an offer on a house. It will put you in a much stronger bargaining position.

How To Interpret The Results

The calculator shows two sets of results:

Most lenders require borrowers to keep housing costs to 28% or less of their pretax income. Your total debt payments cant usually be more than 36% of your pretax income.

Some mortgage programs – FHA, for example – qualify borrowers with housing costs up to 31% of their pretax income, and allow total debts up to 43% of pretax income.

Use our Debt-to-income Calculator to find your DTI ratio and learn more about debts role in your home purchase.

You May Like: Chase Recast

How Much Can I Borrow On A Mortgage

Before you start looking for your dream home, you need to know how much youre able to borrow in order to fund it. Generally, how much you can borrow will depend on four things. The amount you want to borrow in relation to the propertys value , your , your income and your outgoings.

You should be able to comfortably afford the mortgage when you take it out so that unforeseen events dont put your home in jeopardy later on. Remember, although the lender or mortgage broker is responsible for checking whether you can afford a particular mortgage, making sure you can easily manage the repayments youre taking on will give you valuable peace of mind before you apply.

Dont Miss: Can You Wrap Closing Costs Into Mortgage

Do Mortgage Calculators Require A Credit Check

No, you wont need to undergo a when using mortgage calculators, as the only information youre inputting is your basic salary no other personal details are required. This means therell be no searches appearing on your credit report and no impact on your score, but if youre concerned that your current score may be holding you back from getting the best deals, nows the time to work on improving it. Find a free credit check service.

Recommended Reading: Mortgage Recast Calculator Chase

Home Buying Examples: See You Much You Can Afford On $100k Per Year

The amount you can borrow for a mortgage depends on many variables and income is just one of them.

That means two people who each make $100,000 per year, but have different credit scores, debt levels, and savings, could have vastly different home buying budgets.

Here are a few examples of how much home someone might afford on a $100K salary when those other requirements are factored in.

Buying a house with a $100K salary and low credit

First, lets look at an example of a homebuyer who makes $100,000 per year, but has a lower credit score and relatively high debts.

This could be someone who recently graduated with student loans and hasnt had a chance to build up their credit yet. Or, someone who has existing debt from a few different lines of credit like credit cards and an auto loan.

Whatever the case, a lower credit score and higher debts mean your home buying budget will be on the lower end of the spectrum.

$100K salary and low credit buys a home below $300K

- Income: $100,000/year

*Interest rates shown are for sample purposes only. Your own rate will be different

This borrower makes a $100k salary and has a 650 credit score.

They are looking for an FHA mortgage with a low down payment. And, they owe about $1,000 in nonmortgage debts each month.

Assuming that the lender offers a 4.5% interest rate which is higher than current averages because of their credit score and debts this borrower may be able to buy a $288,500 home.

- Income: $100,000/year

%/36% Rule Of Affordability

Heres a rule of thumb you should follow to determine the kind of house you can comfortably afford to buy:

- Your housing expenses such as monthly principal, interest payments, property taxes, and insurance should not be more than 28 percent of your pre-tax household income.

- Your total debt payments such as mortgage, credit card debt, auto loan, or home loan debt should not be more than 36 percent of your pre-tax gross monthly income.

Read Also: 10 Year Treasury Yield Mortgage Rates

How We Calculate How Much House You Can Afford

Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for a down payment, and what your monthly debts or spending looks like. This estimate will give you a brief overview of what you can afford when considering buying a house.Go one step further by applying some of the advanced filters for a more precise picture of what you can afford for a future residence by including the costs associated with homeownership. The advanced options include things like monthly homeowners insurance, mortgage interest rate, private mortgage insurance , loan type, and the property tax rate. The more variables you enter into the home affordability calculator will result in a closer approximation of how much house you can afford.

How Much Do You Need To Qualify For The Biggest Mortgage

However, in order to qualify for the lowest mortgage rates and, thus, the largest loan amount you must also have a high credit score, few debts, and a substantial down payment. Most mortgage doors will be open to you if you have all of these variables in place and a yearly income of $100,000 or more.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

How Much Income Do You Need To Buy A $500000 House

The good rule of thumb is that the maximum cost of your home should not exceed 2.5 to 3 times your total annual income. This means that if you want to buy a $ 500K home or qualify for a $ 500K loan, your minimum wage must fall between $ 165K and $ 200K.

How much do I need to own a 500k home? How Much Income Do I Need for a 500k Loan? You need to make $ 153,812 a year to get a 500k mortgage loan. We base your income on a 500k mortgage by paying 24% of your monthly income. In your case, your monthly income must be about $ 12,818.

I Make $120000 A Year How Much Home Can I Afford

The home affordability calculator will give you a rough estimation of how much home can I afford if I make $120,000 a year. As a general rule, to find out how much house you can afford, multiply your annual gross income by a factor of 2.5 – 4. If you make $120,000 per year, you can afford a house anywhere from $300,000 to $480,000.

Recommended Reading: How Much Is Mortgage On 1 Million

How Much Money Do I Need To Afford A 500 000 House

How Much Money Do I Need to Make a $ 500,000 Home? Typically, home loan repayment should not exceed one-third of your monthly income. So with a 20% 30-year discount and a 4% interest rate, you will need to make at least $ 90,000 a year before tax.

How much should I make to afford a 400k house?

What is the income required for a 400k loan? To be able to afford a $ 400,000 home, lenders need $ 55,600 in cash to make a 10 percent reduction. When you have a 30-year loan, your monthly income must be at least $ 8200 and your monthly repayment of existing debt should not exceed $ 981.

How much do I need to make to buy a $300 K House?

What is the required income for a 300k loan? $ 300k loans with 4.5% interest rate over 30 years and $ 10k downward will require an annual income of $ 74,581 to qualify for the loan. You can even calculate further variations on these dimensions using the Loan Required Income Accountant.

How Much Is The Average Monthly Mortgage Payment Uk

What is the average mortgage repayment rate in the UK? The average mortgage repayment rate in the UK is £ 723, with an interest rate of 2.48%. This is based on the latest survey conducted by Santander in 2018.

How much is the average monthly mortgage payment?

Read our editorial standards. The average mortgage payment is $ 1,159 for a 30-year fixed mortgage, and $ 1,747 for a 15-year loan. However, an accurate estimate of what the average U.S. would spend on their debt each month would be averaging: $ 1,609 in 2019, according to the U.S. Bureau of Statistics.

How much per month is a 200k mortgage UK?

| £ 200,000 Loans Various Terms |

|---|

Recommended Reading: Reverse Mortgage Mobile Home

A Higher Credit Score Could Increase What You Can Borrow

Your has a big part to play in how much you can borrow. In the most extreme cases a low credit score could prevent a mortgage lender from even considering you or, more likely, a low score could mean that the lender uses a lower multiple of your income to decide how much you can borrow.

Thats why youll want to make sure your credit score is up to scratch before you even consider applying for anything. Our guide on improving your credit rating will be able to help you with this.

Calculate Your Max Budget For Rent

Once you know how much money you make and how much your fixed expenses are including how much you want to save you can figure out what your max budget for rent is.

Keep in mind that the 30% rule can vary according to your financial circumstances. Thats why its important to come up with a list of your expenses and understand how they fit into your budget. You also have to consider how expensive your area is. You might end up having to spend more than 30%, but even if you do, youll be prepared to adjust other parts of your budget.

Read Also: Does Rocket Mortgage Sell Their Loans

Is 120k Combined Income Good

Previously answered: Is $ 120,000 total household income a good income? That is 15% of the highest family income in the United States.

Is 120K a year middle class?

Most Americans would like to make $ 150k a year. Almost everyone in the United States is considered some kind of â dhexe middle class.â That income is middle class.

What is a good combined salary for a couple?

While ZipRecruiter sees annual wages as high as $ 186,500 and as low as $ 115,000, most Home Couples wages now range from $ 125,500 to $ 156,000 with the highest earners making $ 175 a year. . .

How Much Should You Put Down On A $12000 Car

A typical down payment is usually between 10% and 20% of the total price. On a $12,000 car loan, that would be between $1,200 and $2,400. When it comes to the down payment, the more you put down, the better off you will be in the long run because this reduces the amount you will pay for the car in the end.

Read Also: Requirements For Mortgage Approval

How Much Of A Down Payment Do You Need For A House

A 20% down payment is standard, if you can afford it. Though some mortgage loans may only require as little as 3.5 percent down, or none at all, a larger down payment will have a greater impact on your monthly mortgage payment.Your down payment effectively reduces the total amount of your home loan, which increases your home affordability estimate, and at the same time, decreases your mortgage payment each month. For example, below is a chart showing how a certain level of down payments, based on a percentage of the sale price, directly impacts your monthly mortgage payment :

| Percentage |

|---|

List out your expenses and then add them together to get your total monthly spending.

How Much Do I Need To Make To Buy A $300k House

Assuming that you are going to make the average percentage that a regular American household will make for their down payment, which is 6%, and that you will choose a 30-year term, then you will need to have a monthly income that ranges from $72,000 to $82,000. For shorter-term repayment, you should expect that the monthly income you are earning should be at least 10 to 20 thousand more per year for every 5 years that you deduct from your term. To get more exact estimates based on your down payment and the interest rate you can use a mortgage calculator to determine the exact income you will need to earn annually.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

How To Calculate Your Required Income

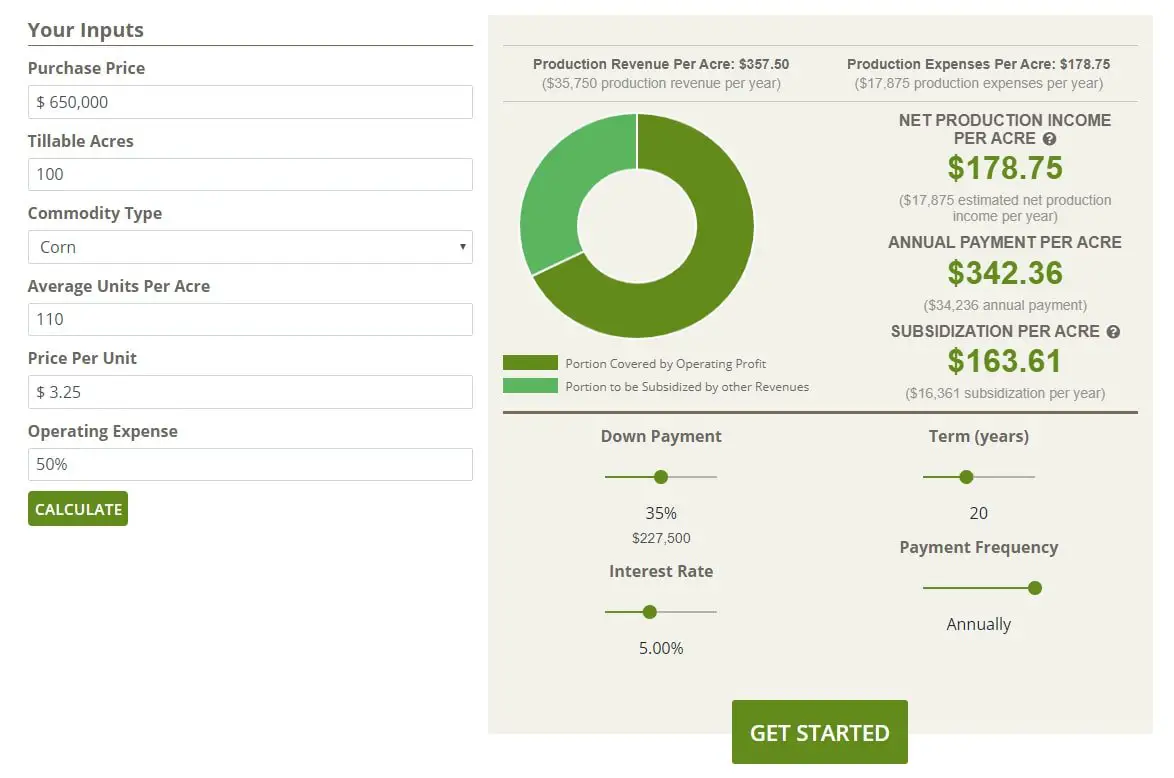

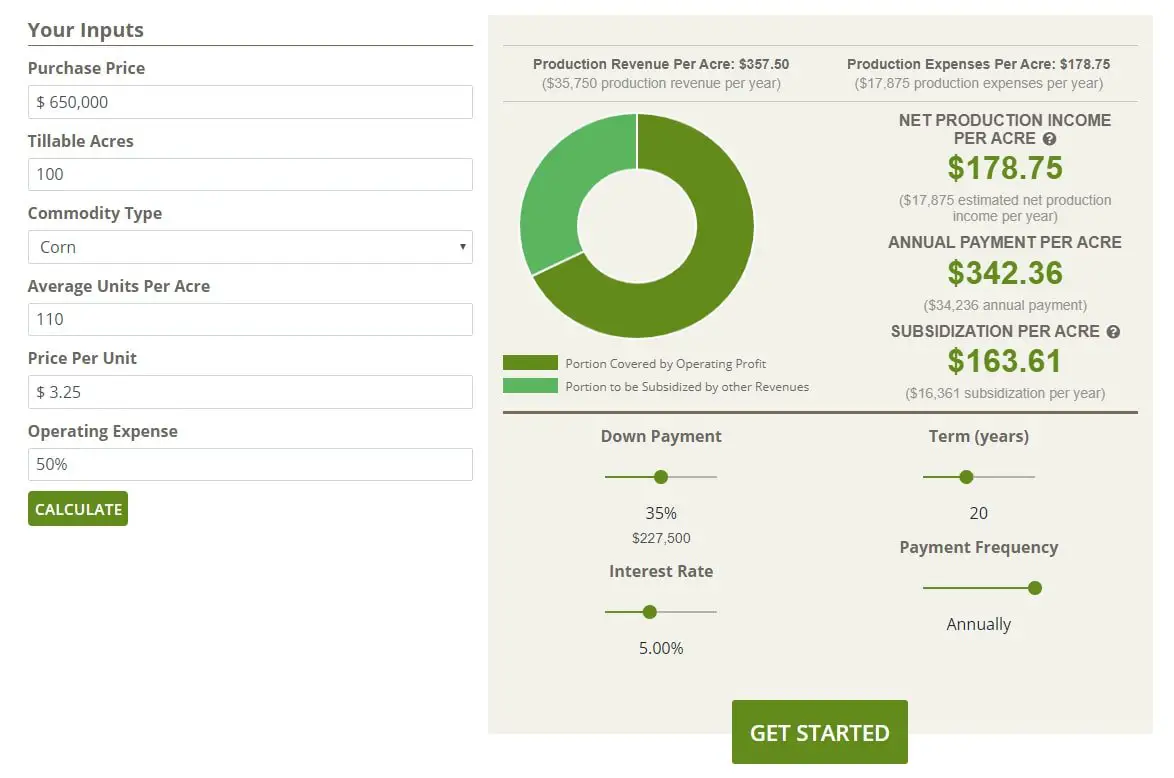

To use the Mortgage Income Calculator, fill in these fields:

-

Homes price

-

Loan term

-

Mortgage interest rate

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease

-

Minimum credit card payment

-

Personal loan, child support and other regular payments

Monthly property tax

Monthly homeowners insurance

Monthly homeowners association fee

What Salary Do I Need For A 500k Mortgage

A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

Can I buy a house making 25k a year? HUD, nonprofit organizations, and private lenders can provide additional paths to homeownership for people who make less than $25,000 per year with down payment assistance, rent-to-own options, and proprietary loan options.

What house can I afford on 40k a year?

However, how much you can afford depends on your credit, down payment and other costs like taxes and insurance.

Read Also: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Can I Buy A House With A $100k Salary

With a $100,000 annual salary, you have a good chance of putting together a good homebuying budget.However, in order to qualify for the lowest mortgage rates and, thus, the largest loan amount you must also have a high credit score, few debts, and a substantial down payment.Most mortgage doors will be open to you if you have all of these variables in place and a yearly income of $100,000 or more.

Key Factors Determining How Much House Can I Afford On 120k Salary

Here are the game-changers that will finally determine your affordability.

- Income This includes a regular, stable salary as well as any income from financial investments.

- Cash reserves or savings Buying a house means that youll have to make a down payment and cover closing costs. Your hard-earned savings will come to the rescue here. A good rule of thumb regarding how much money to save is to have three months of payments and other monthly debts, in reserve. That way, you can cover your mortgage payment in case of an unexpected expenditure.

- Debt and home expenses These include your financial obligations such as credit card payments, car loan payments, student loan payments, groceries, utilities, home maintenance, homeowners insurance, mortgage insurance premiums, etc.

- Credit score and financial profile Your loan repaying credibility depends hugely on your and the amount of debt you owe. A loan lender will look at these before considering you qualified for a mortgage. They will then determine how much money to lend you and at what mortgage interest rate.

See your home’s investment dashboard

Your equity and how to grow it, plus help with managing maintenance and visibility to neighborhood projects

You May Like: What Does Gmfs Mortgage Stand For