Calculating A Credit Score

Each time you pay your bills, you are building credit. Companies that bill you for goods and services report your payment history and credit use to credit bureaus. Your credit score is primarily calculated by tracking your payment history, use of different types of credit, and the length of time that you have utilized your credit.

You may not know that there are different types of credit, and using more than one type of credit helps you build a better credit score. Utilizing these various types of credit and paying all bills on time is the best way to build your credit score.

The Minimum Credit Score For Conventional Loan

Consumer finance emphasized that credit scores play an important role when you borrow money, so it is wise to get to know what credit scores are and how they work.

Most borrowers would agree to the fact that a good credit score will boost your chances of qualifying for a mortgage because it will reflect how you will be able to repay your loan on time.

What do these phrases mean? World Education Services presented the four levels of credit scores that you can achieve:

- Bad

- Good

- Excellent

Although most credit scores fall between 600 and 750, financial institutions and mortgage companies prefer borrowers who have Good or Excellent credit scores.

Mortgage lenders set their own requirements and rates for conventional loans, according to The Mortgage Reports.

You can find mortgage lenders that are flexible and who are willing to negotiate so that you can qualify for a conventional loan with better rates for your financial situation.

As stated by The Mortgage Reports, a 620 credit score, which is leveled as bad , is the minimum conventional loan credit score.

But with better credentials like having an excellent credit score of 740 and above with a 20% down payment, you will have the benefit of paying lower rates and a lower monthly payment.

Down Payment And Closing Costs

It should come as no surprise that to buy a home, you need to have enough funds available to cover the down payment and closing costs However, you can’t just get these funds from any old source. Your lender will need to confirm that the down payment isn’t from borrowed funds and that you’ve had the money in your possession for at least 30 days.

Exceptions can be made, but don’t plan to use the income tax refund you expect to arrive in a couple of weeks to qualify for a mortgage you’re applying for tomorrow. Here is a list of acceptable sources of down payment.

Acceptable down payment sources

- RRSPs

- Other investments

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

First Lets Talk About Credit Scores

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

What Affects Your Credit Score

The most important factors in credit scores* are:

- Payment history

- Age of credit: How long have you had your oldest credit account

- New credit: Opening new credit cards or loans right before applying for a mortgage is a red flag to lenders

We bolded the top two because these are the biggest factors in your credit score. Lenders want to see that you have a track record of paying your bills on time. Credit utilization tells them how well you manage your money. Do you max out your credit cards as soon as you open them? Or do you keep your balances low and leave most of your credit lines available?

Lenders look at your credit score and credit history to get a sense of the type of borrower you are. They want to know that if they approve you for a mortgage, youre highly likely to make your monthly mortgage payment.

Keep in mind: Your mortgage credit score may be different from the score you see through a free app. Those apps can give you a ballpark score, but lenders use strict criteria to approve home loan applications. Your mortgage credit score may be lower than what you see from a free service.

Rather than make assumptions about what youll qualify for, its best to get preapproved with a lender who will pull your score and provide an accurate estimate of how much you can borrow.

Read Also: Can You Get A Reverse Mortgage On A Condo

Do I Qualify For A Mortgage

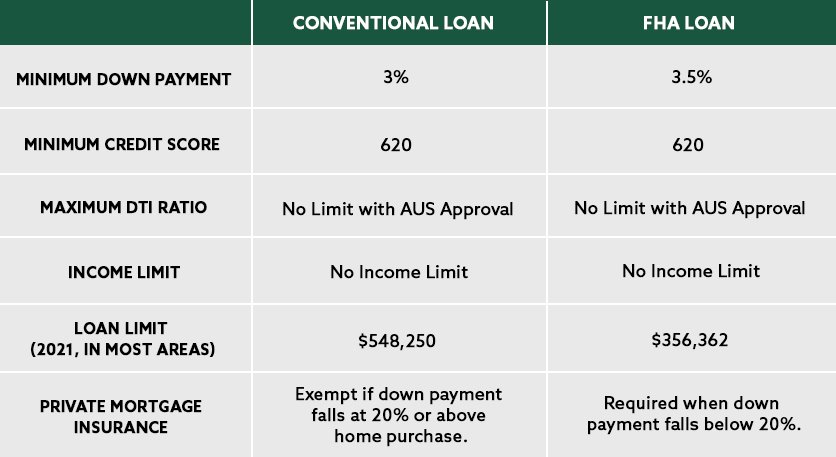

You’ll need to have a FICO® Score of at least 620 points to qualify for most types of loans. You should consider an FHA loan if your score is lower than 620. An FHA loan is a government-backed loan with lower debt, income and credit standards. … These government-backed loans require a median FICO® Score of 580 or more.

Contact An Expert That Has Experience

If youre still unsure of what to do, dont risk lowering your credit score by applying with an unsuitable lender. Each time you actively apply for credit can bring your credit score down. Furthermore, being declined can have a severe effect on your credit score. Speak to a mortgage advisor before approaching a lender yourself.

Read Also: Chase Mortgage Recast Fee

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

How Do You Qualify For A Conventional Loan

A lot of home shoppers thinkits too hard to qualify for a conventional mortgage, especially if their financialsituations arent perfect. But thats not really the case.

Just like with an easygovernment-backed loan, qualifying for a conventional loan requires you toprove:

- You make enough money to cover monthly payments

- Your income is expected to continue

- You have funds to cover the required down payment

- You have a good credit history and decent score

True, the standards toqualify for a conventional loan are slightly higher than for an FHA or VA loan.But theyre still flexible enough that most homebuyers are able to qualify.

According to loan softwarecompany Ellie Mae, the average credit score for all applicants who successfullycomplete a mortgage is around 720. This is plenty high to get approved for aconventional loan.

The minimum credit score required for most conventional loansis just 620.

We want to know that peoplepay their bills on time and are financially disciplined and good at moneymanagement, says Staci Titsworth, regional vice president sales manager withPNC Mortgage in Pittsburgh, PA.

A slightly lower credit score may pass the credit scoretest, but thelender will typically charge a higher interest rate to compensate for thegreater risk.

Applicants with lower creditmay want to choose an FHA loan, which does not charge extra fees or higherrates for lower credit scores.

Employment and income

Seasonal income is also accepted with proof in a tax return.

How Conventional Loan Rates Compare

While conventional mortgage rates are relatively low compared to alternative home loans, they typically arent as low as some government-backed mortgages.

Whats more, conventional mortgages may be more expensive than government-backed loans for borrowers who arent able to put 20% down because theyre required to buy private mortgage insurance. This insurance typically adds 0.5% to 1% to the cost of the loan every year, which is higher than mortgage insurance required by FHA and USDA home loan programs.

If you have a credit score of 700 or higher, a debt-to-income ratio of 35% or lower, and a 20% down payment for your loan, a conventional mortgage may be your best bet. If your credit score is lower than 640 or you cant put 20% down, you may want to consider an FHA or USDA loan instead.

Also Check: 10 Year Treasury Vs Mortgage Rates

Fha Loan With 620 Credit Score

FHA loans only require that you have a 580 credit score, so with a 620 FICO, you can definitely meet the credit score requirements. With a 620 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

Minimum Credit Score Required For A Conventional Mortgage

A conventional mortgage is one with a downpayment of 20% or more. Conventional mortgages do not require CMHC insurance, so there are fewer restrictions on things like a minimum credit score requirement. Each lender will have guidelines that they follow.

So, it is possible to get approved for a mortgage with a credit score as low as 600, but the number of mortgage lenders willing to approve your mortgage is going to be very small.

Read Also: Bofa Home Loan Navigator

Ways To Gain Your Conventional Mortgage Credit Score

There are plenty of reliable ways to work on your credit score so you can enjoy the benefits of lower interest rates and save money.

Consider the following standard guidelines in boosting your credit score as presented by World Education Services:

- Have a mix of different types of accounts to balance your debt-to-income-ratio

- Maintain low credit card balances which means having more credit available to you than the amount of debt you have left to repay

- Establish a long credit history that will give your lenders more information to work from to consider you as a candidate for a loan

- Make on-time payments to establish a pattern

Better Credit Can Mean Better Interest Rates

Credit scores are a significant factor in determining the interest rate youll receive. Credit scores needed for a conventional loan are higher than those for FHA or even VA loans, which are government-backed by the U.S. Department of Veterans Affairs . Thats because lenders take on more risk.

To incentivize good credit, they offer more competitive rates to borrowers with higher credit scores, lower debts, and larger down payments.

You May Like: Rocket Mortgage Vs Bank

What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

The importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

However, there is a minimum credit score youll likely need to buy a house.

How Much Deposit Do I Need To Get A Mortgage With A Poor Credit Score

It may be the case that to access your chosen lenders rates and meet their terms, you have to deposit a higher percentage of the properties market value. That being said, the amount of deposit you need to get a mortgage will vary depending on a whole host of factors including your age and the type of property you want to buy.

There isnt a typical deposit size, but some lenders ask applicants to deposit as much as 30% for a mortgage if they have a poor credit score or low affordability.

For a home valued at £200,000 that would equate to a £60,000 deposit. Large deposits arent a viable option for a lot of borrowers and thankfully there are a handful of lenders that appreciate this and may be more willing to lend under more flexible terms.

You May Like: Can You Get A Reverse Mortgage On A Mobile Home

You May Like: Who Is Rocket Mortgage Owned By

Ways To Help Strengthen Credit Scores To Buy A House

If your credit scores need work before you buy a house, consider these ways to help improve your scores:

- Make on-time payments. FICO and VantageScore both say your track record of making on-time paymentsâyour payment historyâcan be a significant factor in determining your credit rating. You could use email reminders or calendar alerts to remind yourself. And setting up automatic payments can ensure you donât miss a payment due date.

- Pay more than the minimum. Making only your comes with a cost: interest charges. And interest can add up and cost you more money in the long run. Interest can even make it harder to pay off debt. So consider this from the CFPB: âPaying off your balance each month can help you get the best scores.â

- Keep your balances low. The CFPB recommends that you not spend more than 30% of your available credit. A low âa measure of how much of your available credit youâre usingâcould be a sign that youâre using your credit responsibly and not overspending. And that could help you improve your score.

- Apply only for the credit you need. As the CFPB explains, âCredit scoring formulas look at your recent credit activity as a signal of your need for credit. If you apply for a lot of credit over a short period of time, it may appear to lenders that your economic circumstances have changed negatively.â

Take The Next Step And Get Pre

The only way to know for sure what kind of home loan you can get with your credit score is by getting a mortgage pre-approval. Once lenders take a detailed look at your finances and how much you want to borrow, youll have a much better idea of your strength as a potential homebuyer.

Credible makes getting an instant streamlined pre-approval letter easy. We let you adjust your down payment so that you can figure out how much home you can afford.

Ready to get pre-approved?

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

When Can Lower Credit Score Borrowers Apply For Fha

The new policy has been rolled out for a few years , so your chosen lender may have changed its internal policy already. But some are slower to adopt new regulations.

Typically, theres a step-down effect across the lending landscape. One lender will slightly loosen guidelines, followed by others until a majority function similarly. If the new standards work, lenders loosen a bit more.

Lower credit home shoppers should get multiple quotes and call around to multiple lenders. One lender might be an early adopter of new policies, while another waits to see results from everyone else.

Despite when lenders adopt FHAs new policy, there is strong reason to believe that they will. Thousands of renters who have been locked out of homeownership due to an imperfect credit history could finally qualify.

Want to know if you qualify now? Contact an FHA lender now who will guide you through the qualification process.

Why Is A Good Credit Score Important

When you apply for a mortgage loan, several requirements will determine whether your application will be approved or not. The down payment amount, loan size and debt-to-income ratio are just some of the requirements taken into account. But the first thing all lenders will check is your credit score. And because first impressions matter, a good credit score can bring you one step closer to homeownership.

Your credit score will also have a direct impact on your monthly mortgage payments. For instance, lenders will charge higher interest rates for bad credit scores. Similarly, they will take your credit score into account when determining your PMI cost and eligibility. As a result, you will end up paying thousands of dollars more each year if your credit score is too low.

Any type of loan is a potential risk for the lender, and your credit score will essentially be used for risk assessment. Although you can get a home with a credit score of 550, you may incur penalties as lenders try to minimize the risks associated with such a low figure. On the other hand, a credit score of 740 or higher will upgrade your mortgage terms, giving you access to perks such as lower interest rates.

You May Like: Chase Recast Calculator

When Youll Need To Pay Private Mortgage Insurance

Any borrower with a conventional loan who puts less than 20% down is required to buy private mortgage insurance , which raises the annual cost of the loan. This mortgage insurance can be canceled once the homeowners equity in their home surpasses 20%. Mortgage insurance provides protection for your lender in case you default on your loan.