File A Complaint Against A Loan And Trust Company

If you believe your loan and trust company has violated the Loan and Trust Corporations Act and/or its regulations, please follow these steps before filing a complaint with FSRA:

File a complaint with your loan and trust company and obtain a final position letter from them.

Step 1: Find your loan and trust company and ask how to file a formal complaintStep 2: Request a final position letter on your case.

If your matter is still not resolved after following the above steps, you can file a complaint with FSRA.

FSRA considers a range of outcomes when reviewing consumer complaints:

- If the matter is not something we can take action on, we will let you know or may refer you to an organization that can help

- If we need more information from you, we will contact you

- If the matter you have raised does not break any laws we enforce, we will close the case

- If the matter you have raised potentially breaks any laws we enforce, we will consider what action, if any, we should take

To file a complaint with FSRA, please complete the below Complaint Form:

For Issues Related To The Conduct Of The Agent Or Broker

Provincial and territorial insurance regulators oversee the licensing and conduct of insurance agents and brokers. Each province and territory has its own insurance regulator and all insurance companies must follow the rules and regulations of the province or territory in which they carry out business.

The Types Of Consumer Complaints We Cannot Assist You With

We may not be able to help if your complaint:

- Is based on events that occurred more than two years ago

- Is about a business-to-business transaction

- Focuses on the quality of a good or service beyond the basic guarantees in consumer protection legislation

- Is seeking a form of damages or compensation other than a refund of monies already paid or the cancellation of an agreement as provided under consumer protection legislation

If your complaint is not covered by the consumer protection laws we enforce, we will do our best to help you find an organization or government office that can assist you.

Here is who to contact for help if your complaint relates to:

Also Check: Rocket Mortgage Loan Types

Read On To Learn About Different Ways Of Filing A Claim Against Wells Fargo And What You Should Know About Each:

FILE A CLAIM AGAINST WELLS FARGO IN SMALL CLAIMS COURT

What is it? Youre not allowed to bring a claim against Wells Fargo in most courts . But the exception is small claims court, which is an opportunity to bring your claim locally before a judge, up to a certain monetary limit.

Claim Limits. Most small claims court limits range from $2,500 to $10,000 so if your claim is more than the amount your state allows you may not be able to file your case in small claims court.

Court Fees. Small claims court fees generally vary depending on the amount you claim against Wells Fargo.

What you need to do: Locate your local small claims court and follow the steps laid out by the small claims court online to learn how to file a small claims court suit. Each small claim court has its own procedure. Filing a small claims court lawsuit tends to be simpler than the regular lawsuit process.

What to expect: If you follow all the steps precisely and have a strong claim against Wells Fargo, theres a good chance youll get compensation. Additionally, Wells Fargo may even offer you a settlement in exchange for dropping the civil suit against them.

FILE A COMPLAINT AGAINST WELLS FARGO WITH THE CONSUMER FINANCIAL PROTECTION BUREAU

What is it? The Consumer Financial Protection Bureau is a federal government agency that regulates much of Wells Fargos business. The CFPB provides an informal channel for consumers to submit claims and complaints against Wells Fargo.

File A Mortgage Complaint

Mortgages on Primary Residences in Connecticut – Complaint Notice: The Department of Banking accepts complaints against any lender or mortgage servicer regarding mortgage modification, risk of delinquency, default and judicial foreclosure of a mortgage on a primary residence in Connecticut.

How do I submit a complaint?

Also Check: Chase Recast

Why You Might Want To File A Complaint

If you are not sure if you should file a complaint or not, know that the CFPBs history of helping consumers get answers is positive. The CFPBs 2021 annual report states that in 2020, the bureau sent approximately 85% of its mortgage complaints to companies for review. 98% of the companies responded.

- 88% of the companies closed with an explanation

- 2% closed with an administrative response

- 3% closed with non-monetary relief

- 4% closed with financial relief

Here are some reasons you may want to file a complaint:

To Speed Up A Resolution

If youre concerned about how youve been treated by a mortgage servicer or lender, filing a complaint with the CFPB can help you get an explanation, or possibly relief. Often, the bureau obtains a response from the company within 15 days. For Blackmon, it took approximately seven days to get a response from her mortgage service after filing a complaint, she says.

You May Like: Can You Do A Reverse Mortgage On A Condo

How To File A Complaint Against A Property Management Company

Is your property manager giving you a hard time? Do you feel like your tenancy application was unfairly declined? Or would you like to know how to file a complaint against a property management company?

If so, you are in the right place.

Generally, property managers are often responsible for all matters related to the safety, health, suitability, and usability of rental units.

Therefore, whenever they fail to provide one or more of these essentials, tenants can file complaints against them.

Luckily, every state in the country has a number of ways in which renters can voice their complaints against property managers.

If you are a renter with issues about your rental unit, here are two things you can do to get the issues resolved.

What Happens To A Complaint

In order to address your complaint some or all of the details may be sent to the Mortgage Broker, upon receiving your consent. This allows the Mortgage Broker the opportunity to provide a complete response to the complaint for our review.

Allegations of any sort of misconduct should be accompanied by some evidence to allow us to begin an inquiry. If such evidence cannot be provided, our ability to conduct any type of review of the matter may be limited.

Please note that the Freedom of Information and Protection of Personal Information Act applies to BCFSA records and information.

Also Check: Rocket Mortgage Launchpad

Whats Published And When

98% of complaints sent to companies get timely responses

Only complaints sent to companies for response are eligible to be published and are only published after the company responds, confirming a commercial relationship or after 15 days, whichever comes first. The database generally updates daily.

We do not publish complaints referred to other regulators, such as complaints about depository institutions with less than $10 billion in assets.

We publish the consumers narrative description from their complaint if the consumer opts to share it publicly and after the Bureau takes steps to remove personal information.

This database is not a statistical sample of consumers experiences in the marketplace and these complaints are not necessarily representative of all consumers experiences with a financial product or company. Complaints are not information for purposes of the Information Quality Act.

Where Do I File A Complaint About A Title Insurance Company

Before you file a complaint, itis best to first ask the insurance company to amicably settle whatever issuesyou may have. It’s best to go for a win-win situation where you and the titleinsurance company can work out a solution that is agreeable to both parties.

If you feel that your claim wasunfairly denied or that the title insurance company acted in bad faith, you cancontact the regional office of the title insurance company to appeal that theyreconsider the claim or to provide an acceptable explanation for whatever losses their perceived act of bad faith has caused you.

However, if the title insurancecompany has been uncooperative or if you are dissatisfied with any arrangementsmade, you can now go to the state insurance board to file a claim.

Mind you, the state insuranceboards take such complaints seriously. This is in their bid to provideinsurance consumers with a venue by which to help ensure the quality ofinsurance products and services.

What you can do is go to thewebsite of the state insurance board involved and complete the online complaintform. The board will contact you to give you an ID number for your complaintand will assign someone to be in charge of investigating your complaint. Youwill also be asked to forward pertinent documents that will support yourcomplaint.

| Not a bit |

You May Like: Does Rocket Mortgage Sell Their Loans

To Get Money That Youre Owed

There are other issues, though, that could result in receiving some money back. For example, if your servicer has incorrectly applied a payment, is slowing down the paperwork for a mortgage payoff or refinance, or has violated RESPA in a way that costs you money, Fleming suggests filing a complaint to see if you can be compensated. This can be especially important if a mortgage lender is costing you money because of their practices.

Submit A Complaint To Us

There is no cost involved.

When submitting a complaint online, you will also be asked to provide supporting documents. These include:

- A copy of the letter you wrote to the business about your complaint and any response they have sent back to you

- Your contract or any other related agreements

- Copies of invoices, records of payments made and any other letters, documents and e-mails

- Logs of calls from a collection agency , consumer reports or any documentation relating to the original debt relevant to your complaint

Submit your complaint on paper or by email. If you require an alternate format, please contact us.

In order to file your complaint in paper or by email, please use this PDF version of the complaint form.

Send your completed form with copies of any supporting documents by mail, fax or email to:

Ministry of Government and Consumer ServicesConsumer Services Operations Division

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

If Your Bank/lender Is A Credit Union:

If your bank or lender is a credit union, find out if it is federally chartered or state chartered. To do so, find it in the National Credit Union Administration’s Find Credit Unions web page and check the “Charter State” field. If that field says “N/A”, the credit union is federally chartered.

- If your credit union is federally chartered, you may file a complaint with the National Credit Union Administration.

- If your credit union is state chartered, you may file a complaint with that state’s regulator. Complaints about California-chartered credit unions may be filed with the Department of Financial Protection and Innovation . To find other states’ regulators, see the National Association of State Credit Union Supervisors.

Mortgage Lender Complaints Regulates Federal Regulator

If you are unable to resolve your complaint directly , you may want to contact the appropriate federal or state regulators and enforcement authorities. Depending upon their authority under applicable state or federal law, regulators may either attempt to help you resolve your complaint or record your complaint and recommend other action.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

Texas Department Of Savings And Mortgage Lending

COMPLAINTS REGARDING THE SERVICING OF YOUR MORTGAGE SHOULD BE SENT TO THE DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TX 78705.

A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT .

A complaint form and instructions may be downloaded and printed from the Departments website located at www.sml.texas.gov or obtained from the department upon request by mail at the address above, by telephone at its toll-free consumer hotline listed above, or by email at .

FREE

We have helped more than 20,000 El Paso families realize their dream of HOME OWNERSHIP.

Get a FREE Consultation

State Charted Credit Union

Some credit unions are probably regulated by a state supervisory authority where the credit union’s main branch is located. These credit unions usually:

- Do not have the word “federal” as part of its name

- Are not located in Delaware, South Dakota, Wyoming or Washington, DC

Are you unsure if your credit union is state or federal? Use the Find a Credit Union tool to search by name and look up the credit union’s charter number. Federal credit unions have charter numbers under 60000, state-chartered credit unions have charter numbers greater than 60000.

Don’t Miss: Rocket Mortgage Qualifications

How We Use Complaint Data

Complaints can give us insights into problems people are experiencing in the marketplace and help us regulate consumer financial products and services under existing federal consumer financial laws, enforce those laws judiciously, and educate and empower consumers to make informed financial decisions.

Identify And Complain About Housing Discrimination

Housing discrimination happens when a housing provider gets in the way of a person renting or buying housing because of their

- Race or color

- Familial status

- Disability

A housing provider that discriminates against someone could be a landlord or a real estate management company. It could also be a lending institution like a bank or other organization that aids in the homebuying process.

Housing discrimination is prohibited by the Fair Housing Act. Discrimination covered by the Act can take many forms beyond just raising prices or lying about availability. For example, the Act addresses wheelchair access in some newer properties. Learn what the Fair Housing Act covers, how to complain, and how the investigation process works.

Also Check: Rocket Mortgage Conventional Loan

The Office Of The Comptroller Of The Currency

The OCC regulates mortgages issued by national banks or federal savings institutions. Please note that you can only file complaints that have not been previously litigated.

Be sure to disclose: your name, mailing address, phone number, email address, name and address of the mortgage lender, account type, name of the person you contacted at the lending institution about the matter and the response , and a detailed explanation of your complaint.

To file a complaint, fill out this online complaint form or contact the OCC through the details below:

| Telephone Number |

I Have An Inquiry Or Complaint About My Mortgage Lender Originator Or Servicer

The Office of the Commissioner of Financial Regulation is responsible for regulating those who are licensed to do business in the residential mortgage industry in Maryland. If you are uncertain as to whether a company is licensed in Maryland, please review our licensing search page. If you have a complaint against a mortgage lender, originator or servicer that is licensed or a company that should be licensed by the Commissioner, please review the directions on “How to File a Complaint.”

Federally chartered depository institutions or insured depository institutions chartered in states other than Maryland are not regulated or supervised by the Commissioner. These include several national mortgage servicers such as Bank of America, Citibank, JP Morgan Chase and Wells Fargo. Please check the following list of names as we DO NOT regulate these entities. Please follow the link to the primary regulator for that company/institution so that you may ask a question or file your complaint.

If you are having difficulty paying your mortgage, please contact the MD Hope Hotline at or visitMDHOPE. See our advisory “Attention Homeowners Facing Mortgage Difficulties” for more information and how to avoid being victimized by mortgage scams.

MORTGAGE ENTITIES THAT ARE NOT REGULATED BY the Maryland Office of the Commissioner of Financial Regulation

Read Also: Bofa Home Loan Navigator

Suing A Mortgage Lender With Donotpay Is Fast And Easy

Legal matters are stressful, expensive, and time-consuming. But does this mean you cannot seek legal assistance against a mortgage lender? DoNotPay will help you file your unresolved issues against any company faster and more conveniently.

Here is step-by-step guideline on how to file complaints against mortgage lenders:

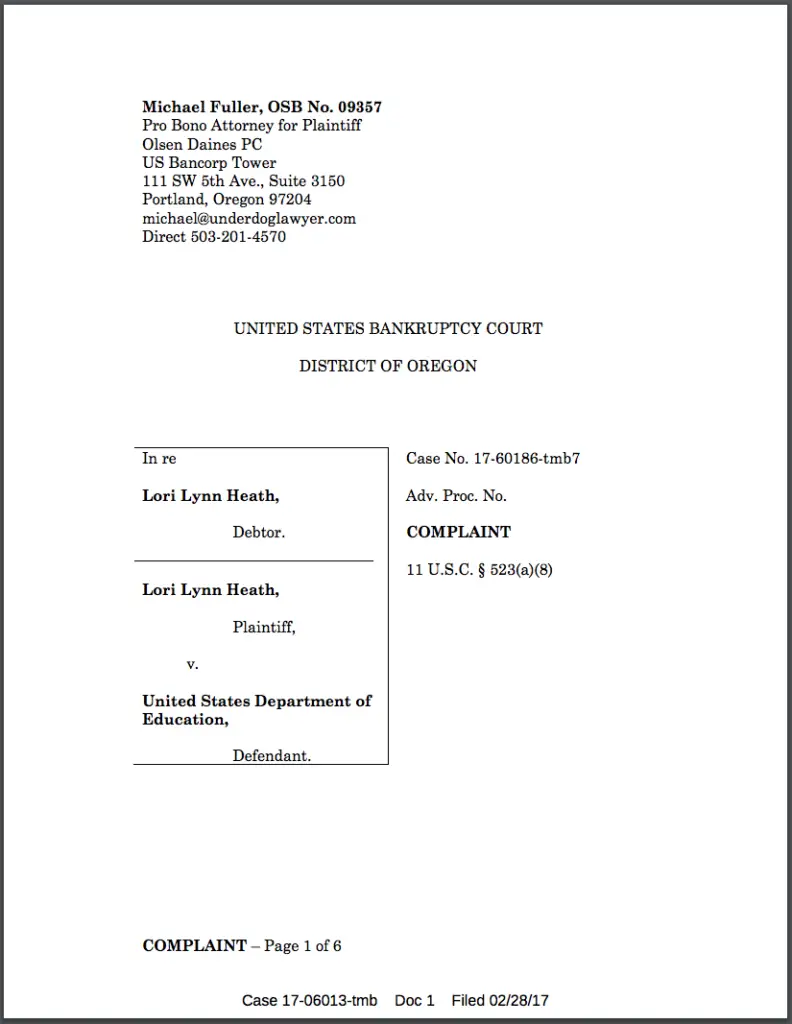

Can I File A Mortgage Lender Lawsuit

Attorneys are currently investigating several banks for potential violations of state or federal law when it comes to handling consumer disputes. These disputes may have centered around billing issues, past-due payments, foreclosures, or interest rates. Banks and credit unions included in this investigation are:

- Bank of America

- US Bank

- Wells Fargo

If you are a California customer of one of these banks and had a dispute with your financial institution within the past year, you may be eligible to join this lawyer-led investigation. You could qualify to take legal action and recover compensation.

Recommended Reading: How Does Rocket Mortgage Work

To Fill Communication Gaps

Many complaints centered around the lack of communication about end-of-program options and confusion about different notices. Government-mandated forbearance requirements and deadlines changed a few times causing confusion between involved parties. Blackmon described her communication experience as disorganized and inconsistent.

Based on complaints and company responses, it appears consumers would benefit from clearer communication from servicers over the phone and in writing, the CFPB Complaint Bulletin states.