Mortgage Apr Vs Mortgage Interest Rate

When looking at your mortgage documents, you’ll see two percentages pop up: the interest rate and annual percentage rate . These are two distinct percentages, and it’s important to know the difference.

Your interest rate is the fee the lender charges you for borrowing money, expressed as a percentage such as 3.75%. Along with your mortgage principal, you’ll pay interest each month.

The is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

What Does Apr Include

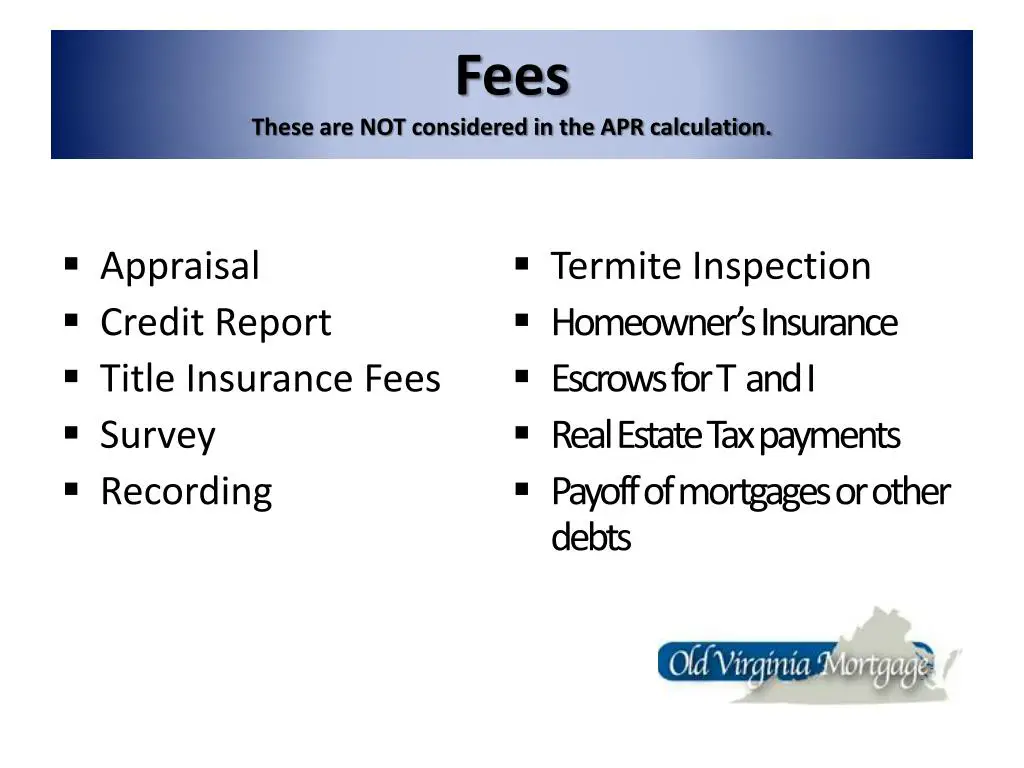

On a mortgage, your APR includes the interest rate plus any upfront costs the lender charges for processing, approving and providing the loan, in addition to annual costs like mortgage insurance. Not all lenders charge the same fees, so be sure to ask your lender for an itemized list of fees up front.

Some of the most common fees in the APR include:

- Loan origination charges, which can include pre-qualification, underwriting fees, administrative fees and processing fees

- Mortgage insurance premiums , depending on the size of your down payment

- Discount points

Some lenders may require you to make monthly payments to an escrow account to cover your property tax and homeowners insurance premiums. These costs dont impact the rate you receive and are not calculated into your APR.

Why Is The Annual Percentage Rate Disclosed

Consumer protection laws require companies to disclose the APRs associated with their product offerings in order to prevent companies from misleading customers. For instance, if they were not required to disclose the APR, a company might advertise a low monthly interest rate while implying to customers that it was an annual rate. This could mislead a customer into comparing a seemingly low monthly rate against a seemingly high annual one. By requiring all companies to disclose their APRs, customers are presented with an apples to apples comparison.

Also Check: Will I Get Approved For A Mortgage

Disadvantages Of Annual Percentage Rate

The APR isnt always an accurate reflection of the total cost of borrowing. In fact, it may understate the actual cost of a loan. Thats because the calculations assume long-term repayment schedules. The costs and fees are spread too thin with APR calculations for loans that are repaid faster or have shorter repayment periods. For instance, the average annual impact of mortgage closing costs is much smaller when those costs are assumed to have been spread over 30 years instead of seven to 10 years.

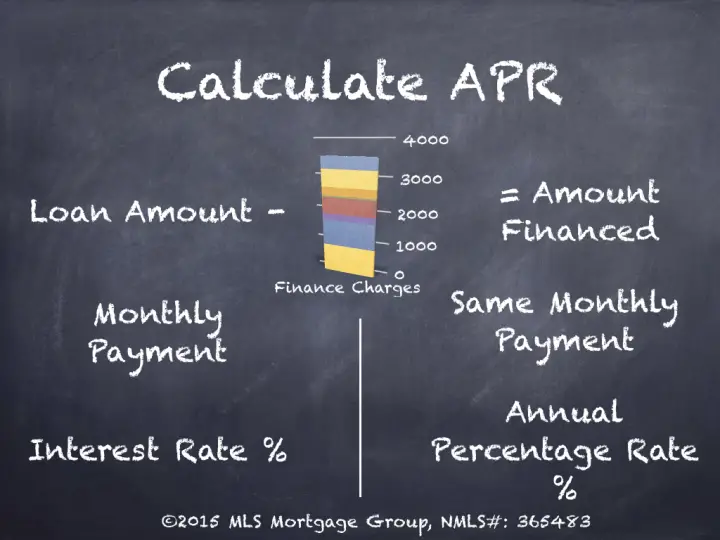

How To Calculate The Apr On A Loan

There are two ways to calculate APR: the actuarial method and the U.S. rule method. Both are acceptable according to federal regulations and, for most peoples purposes, the differences between the methods are negligible both methods will return the same results .

Youll need to use a mortgage APR calculator to determine your rate, because the calculations involve several complex variables that a basic calculator cant handle. Here are the APRs calculated for our above example loans:

| Loan A | |

|---|---|

| 5.79% | 5.84% |

We used an online mortgage APR calculator to input the loan costs and fees. As you can see, the APR on Loan A is lower, making it indeed the better deal.

Takeaway:

You May Like: Should You Shop Around For Mortgage Lenders

Whats A Good Apr On A Mortgage

The mortgage market changes on an almost daily basis, so its smart to keep an eye on mortgage rates so you can understand how they fluctuate and also learn about longer-term trends and whats considered a fair rate. Bankrates mortgage rate table can help in your research.

In general, borrowers today can expect an APR in the neighborhood of 2.5 percent to 3.5 percent, depending on the length of their loans and the strength of their borrowing credentials, Gandhi says.

What Is Interest Rate

Your interest rate is the percentage you pay to borrow money from a lender for a specific period of time. Your mortgage interest rate might be fixed, meaning it stays the same throughout the duration of your loan. Your mortgage interest rate might also be variable, meaning it might change depending on market rates.

Youll always see your interest rate expressed as a percentage. Youre responsible for paying back the initial amount you borrow plus any interest that accumulates on your loan.

Lets consider an example. Say you borrow $100,000 to buy a home, and your interest rate is 4%. This means that at the start of your loan, your mortgage builds 4% in interest every year. Thats $4,000 annually, or about $333.33 a month.

Your principal balance is high at the beginning of your loan term, and youll pay more money toward interest as a result. However, as you chip away at your principal through monthly payments, you owe less in interest and a higher percentage of your payment goes toward your principal. This process is called mortgage amortization.

Don’t Miss: What Is The Monthly Payment On A 400 000 Mortgage

Calculating Amortizing Apr On A Mortgage

Amortized loans refer to those that are not paid off at once, rather, they require making regular, scheduled payments periodically. The payments you make comprise a sum that goes to paying off the principal while the other serves as interest. As principal reduces, interest payments also gradually reduce, thereby increasing the portion of the payment that is used to pay off principal.

Calculating APR for an amortized loan does not involve using the exact amount you borrowed. Rather, the average principal balance outstanding for the entire life of the loan is used. You can derive this by simply splitting your actual loan amount into two.

In the early stages of mortgage repayments, the interest portion is usually larger and then reduces towards the end, making the principal portion increase. At the end of the day, this would make your actual average less than half.

Before manually calculating your APR, an amortization calculator can first be used to calculate actual average principal outstanding.

How Does Apr Work On A Mortgage Loan

Understanding how an APR affects your home loan is an important part of the decision-making process. You may choose one option over another based on the APR a lender offers.

When it comes to the APR of a mortgage loan, there is more involved than just interest. Along with interest, the APR can include processing and underwriting fees, mortgage points and private mortgage insurance. The APR determines the total annual cost of borrowing money from a lender. It’s important to learn as much as you can about your loan before you accept and sign because APR fees can vary from lender to lender

You May Like: How Much Interest Is Charged On A Mortgage

Can I Lower The Apr On My Credit Card

Most credit cards use a variable interest rate, which means that it changes based on a number of factors. However, sometimes you can negotiate a lower APR with your credit card company by calling them and making a formal request. This option can be extremely beneficial if youre trying to pay off your outstanding balance or reduce a significant amount of credit card debt.

Tips To Remember When Loan Shopping

Shopping around for a mortgage will help you get the best deal. In fact, nearly half of borrowers who compare multiple loan options will save money on their mortgage, according to a recent LendingTree survey. The lesson here is that, although it may be tempting to settle on one mortgage lender before combing through competitors loan offers, taking the time to comparison shop can potentially save you thousands in interest over the life of your loan.

Keep the following tips front of mind as you compare offers and prepare to get a mortgage:

1. Focus on APR vs. interest rate based on your needsIt makes sense to focus on APRs if you care most about getting the best deal on your monthly payments. On the other hand, if youre more concerned about saving money in the long haul, its logical to give more weight to interest rates.2. Ask about additional fees Although APRs can be a powerful tool as you compare loan offers, they arent foolproof. Lenders are required to include certain costs in their APR calculations, but there are additional fees for example appraisal or inspection fees that may not be represented in the APR.

Tip.

You May Like: Can You Get A Mortgage With No Job

Watch Out For Aprs On Arms

So far weve only been working with fixed-rate loans in our examples. But APR calculations become more complicated and more limited in their utility when dealing with adjustable-rate mortgages . With ARMs, interest rates will vary over the life of the loan, and at the beginning, they typically have lower interest rates than 30-year fixed-rate mortgages.

However, ARMs are structured so the lower APR is only fixed for an initial period, usually between one month and 10 years and once its over, the loan will adjust according to a benchmark interest rate known as an index. The lender will then also add a margin a set amount of percentage points to the index in order to calculate your interest rate. The timetable associated with an ARMs fixed and adjustable periods will be right in its name: in the case of a 5/1 ARM, for example, the rate is fixed for the first five years of the loan and then adjusts annually thereafter.

Calculating the APR on an ARM is a bit like trying to hit a moving target, as its very improbable that in five years, when the interest rate on a 5/1 ARM begins to adjust, the index rate will be at the exact same level it was on the day you closed. Its also practically impossible that the index rate will stay the same for the remainder of the loan term, when the rate adjusts annually.

Where Can You Find Your Apr

Banks and lenders are required to display APR information prominently. You can find your APR on your loan estimate, lender disclosures, closing paperwork or credit card statement. On your credit card statement, its usually at the bottom and is often labeled interest charge calculation or something similar.

Don’t Miss: What Is Loan Servicing In Mortgage

How Do I Get A Mortgage With A Low Aprc

Shopping around is an easy way to find mortgage deals with a low APRC. Mortgage lenders are required by law to show the APRC, so you can easily compare deals and find one that suits you.

The APRC you see when comparing deals might not be exactly the same as what youre offered when you apply.

This is because lenders take into account your circumstances when you apply for a mortgage. This includes things like your income, outgoings, and credit rating.

So, if youre concerned that you might not get a good APRC, it might be worth looking at how you can improve your credit rating.

Other things you can do to try and lower the APRC:

Commercial Loan Specialist Salary

1. Commercial Loan Servicing Specialist Salaries ZipRecruiter While ZipRecruiter is seeing annual salaries as high as $58,500 and as low as $36,500, the majority of Commercial Loan Servicing Specialist salaries The base salary for Specialist Commercial Loan Officer ranges from $112,300 to $142,700 with the average base salary of

Read Also: How To Get A Mortgage Preapproval

Why Use An Apr Mortgage Calculator

Your lender will figure your APR for you, and will advertise it in loan offers. However, you may wish to see yourself how the APR will vary if you make certain changes in the loan, such as buying more or fewer points. Or you may want to compare loan offers from lenders with different fee schedules and want to see how different fee schedules affect the APR and total cost of the loan.

FAQ: It is also helpful if you: Are working with a tight budget and need to know exactly how much you can afford.

FAQ: You want to compare the true total monthly payment required from two or more providers. For the best way to do this, .

Understanding Apr Vs Interest Rate

As you shop for loans, it may be easiest to compare mortgage offers by referencing their advertised interest rates. Like APRs, interest rates are expressed as a percentage of the total loan balance. But dont make the mistake of stopping there: Loans that appear similar on the surface sharing identical interest rates and similar monthly payments should be compared by APR to ensure youre clear on the true costs youll face over the life of each loan.

Consider the following example that compares two different 30-year, fixed-rate $320,000 mortgages. The homes purchase price is $400,000 for both loans, meaning the borrower made a 20% down payment, and they both carry a 5.61% interest rate.

Along with origination fees, both loans have mortgage points an upfront charge a borrower pays to get a lower mortgage rate. One point is equal to 1% of the loan amount, so each point in the example above costs $3,200.

At first glance, Loan A appears to be a better deal since it costs $1,600 less in points and fees than loan B. In addition, the monthly mortgage payment is about $9 lower than Loan B. However, to truly understand the cost of each loan, well need to calculate each loans annual percentage rate and compare.

Recommended Reading: Can You Finance A Pool Into Your Mortgage

Annual Percentage Rate Helps You Understand A Mortgage’s Total Cost

When you are buying or refinancing a home, it is a good idea to look at the mortgage’s annual percentage rate versus its interest rate.

That’s because the APR expresses the total cost of the mortgage. APR includes the interest charged on the monthly principal balance as well as costs and fees the lender may charge you to get the mortgage. The annual percentage rate gives you a better idea of the total cost of a loan, and helps you choose the right mortgage for you.

Understanding Mortgage Interest Rates

A mortgage payment is made up of the principal and the interest. The principal is the money you borrowed from your lender. The interest is a percentage-based fee that you pay the lender for borrowing that money. Paying the principal reduces the amount you owe, while paying the interest does not.

Rates can be fixed or adjustable. A fixed rate never changes, but the rate for an adjustable rate mortgage, or ARM, can adjust higher or lower while you have your loan. If your rate adjusts, your monthly payment will change. Adjustable rate mortgages typically have caps that limit how much and how often they can change. Most adjustable rate mortgages have a rate thats fixed for a number of years and then can adjust.

Lenders offer different rates to different borrowers. The rates youll be offered typically depend on the following:

- How much you want to borrow.

- How much youve saved to pay upfront.

- How many years youll have to repay your loan.

- Whether you usually pay your bills on time.

- The type of loan you choose.

- Where you live.

When you apply for a loan, the rates youre offered can be either floating or locked. A floating rate can change before you close your loan. A locked rate shouldnt change for 30, 45 or 60 days, depending on how long your rate lock lasts. If you wont be able to find a home and complete the loan process in that time frame, you can usually pay a fee to get a longer lock.

Also Check: What Are Mortgage Lender Fees

How To Calculate Apr On A Mortgage

If youre comparing mortgages or loans, its a good idea to know exactly how APR is calculated. Having a firm grasp of the concept will better inform your search, and it never hurts to check the math! If you know the amount of fees and interest youll be expected to pay on a loan, then determining the APR is relatively simple :

Calculating Apr On A Simple Interest Loan

To show how APR is calculated on a simple interest loan, here is an example: say you took out a loan of $200 for 30 days. Interest charged is $4, and fee paid is $1. At the end of the 30 days, you pay up the entire loan. APR meaning finance would be calculated like this:

Following the method highlighted in the example above:

First, add the origination fee and total interest paid.

$4 + $1 = $5

Then, take that number and divide it by the loan amount.

$5 / $200 = 0.025

Next, divide the result by the term of the loan.

0.025 / 30 = 0.00083333

Then, multiply that result by 365.

0.00083333 x 365 = 0.304166666667

Finally, multiply that by 100 to get the APR.

0.304166666667 x 100 = 30.41%

The APR here is therefore 30.41%.

This calculation helps you understand what APR financing is.

Also Check: How Do You Figure Out Your Monthly Mortgage Payment