For Reverse Mortgage Loans With Case Numbers Assigned On Or After August 4 2014

Your lender or servicer will determine if your non-borrowing spouse qualifies to stay in the home after you, the borrower, die or move into a healthcare facility for more than 12 consecutive months . To qualify as an Eligible Non-Borrowing Spouse, your spouse must:

- Have been married to you at the time the loan documents were signed, and stay married to you up until your death. If you and your spouse were a same-sex couple and were unable to

- be legally married at the time the reverse mortgage loan was made, your spouse must show that you were legally married to each other at the time of your death.

- Have been identified in the loan documents as a non-borrowing spouse.

- Have lived, and continue to live, in the home as their principal residence after you die or move into a healthcare facility for more than 12 consecutive months.

- Continue to meet the loan requirements and make sure the loan does not become due and payable for any other reason.

How Home Equity Release Works

‘Equity’ is the value of your home, less any money you owe on it .

‘Home equity release’ lets you access some of your equity, while you continue to live in your home. For example, you may want money for home modifications, medical expenses or to help with living costs.

Ways to access equity in your home include:

- reverse mortgage

- home sale proceeds sharing

- equity release agreement

- the Government’s Pension Loans Scheme

The amount of money you can get depends on:

- your age

- the value of your home

- the type of equity release

Your decision could affect your partner, family and anyone you live with. So take your time to talk it through, get independent advice and make sure you understand what you’re signing up for.

What Can Go Wrong With A Reverse Mortgage

Foreclosure: If you dont make your property tax and insurance payments, that could trigger a foreclosure. Similarly, if you dont respond to annual correspondence from your lender, that could also prompt foreclosure proceedings.

The impact:Explore foreclosures across the U.S.

Unfortunately, minor infractions like not returning a residency postcard, missing tax or property insurance payment, or poor servicing can lead to foreclosure quickly. In those cases, seniors can face long stressful battles to hold onto their homes and sometimes they still lose them anyway.

Non-borrowing spouse: If your spouse is not a co-borrower on the reverse mortgage when you pass away, what happens next depends on when the reverse mortgage was taken out.

If it was taken out on or after Aug. 4, 2014, a non-borrowing spouse can stay in the home after the borrower dies but does not receive any more of the loan funds as long as he or she meets these eligibility requirements:

Married to the borrower when the loan closed

Remain married until the borrower dies

Named as a non-borrowing spouse in the loan documents

Live and continue to live in the home as the primary residence

Able to prove legal ownership after the borrower dies

Pay the taxes and insurance and maintain the homes upkeep

If that doesnt happen, the surviving spouse can be hard hit, receiving a foreclosure notice within weeks of their husband or wife’s death.

Shop around, too.

Don’t Miss: Rocket Mortgage Loan Requirements

Loan Limits On Condominiums

As of the year 2020, the Fannie Mae loan limit for condos stands at $510,400 in most parts of the country. Fannie Mae and Freddie Mac are federal establishments that are saddled with the responsibility of setting the rules for 30-year, 20-year, and 15-year fixed-rate loans. They usually have certain requirements for condo loans and a Fannie Mae approved condo typically implies that the condo, in that case, has either met or exceeded these requirements. Therefore, it would be eligible for federal fencing.

It is essential to know the base information on condo financing because a significant number of money sources for jumbo loans follow Fannie Mae rules regarding condos. However, if youre not financing, you do not necessarily have to meet Fannie Mae requirements. But maintaining your condo project under Fannie Mae guidelines is essential. This is because, in the event of trying to sell your condo, your buyer might want a 30-year-fixed-rate loan which is of course the most popular in America. And if your condo doesnt meet up to Fannie/Freddie guidelines, you would be unable to close the sale.

Questions To Ask Before During And After

Questions to ask before getting a reverse mortgage

If you are thinking about a reverse mortgage, the following are some important questions you should ask. Talk about them with your family. Meet with a HUD-certified housing counselor. Consult a trusted, independent financial adviser or attorney.

What questions should I ask AFTER I have decided to get a reverse mortgage but BEFORE I start the process?

What questions should I ask DURING the reverse mortgage process?

Don’t Miss: Rocket Mortgage Payment Options

What An Equity Release Agreement Costs

It’s not a loan, so you don’t pay interest. Instead, you pay fees such as:

- an application fee

- periodic service fees, potentially deducted in advance from your home’s equity

- a fee to end the agreement

Get the fund to go through projections with you, showing the impact on your home equity over time. Get a copy of this to take away, and discuss it with your adviser. Ask questions if there’s anything you’re not sure about.

Reverse Mortgage Vs Refinance: Which Is Better

Reverse mortgages can be a good idea for seniors who need more retirement income but still want to live in their homes. However, this might not be the best choice for you if you want to pass your home down to your children, or if you plan on vacating the home soon.

If you’re not sure a reverse mortgage is right for you, there are other refinancing options for seniors. For a homeowner in the right situation, one of these types of mortgages could provide a very viable or even better alternative as it accomplishes one of the major goals of a reverse mortgage accessing equity but allows more flexibility for you and your heirs.

Rocket Mortgage offers cash-out refinances. Read our guide to refinancing to see if this option makes sense for you.

Find a match.

You May Like: Monthly Mortgage On 1 Million

Can I Use A Reverse Mortgage Loan To Buy A Home

Yes. There is a Home Equity Conversion Mortgage for Purchase loan that allows people 62 and older to purchase a new principal residence with HECM loan proceeds.

A HECM for Purchase loan requires that you be 62 years of age or older and that the home you are purchasing be your principal residence. You will need to have cash available for the down payment. There will also be closing costs, which will be higher than those with other reverse mortgage loans. Some of these closing costs may be paid by the seller , so it is a good idea to shop around and talk to multiple lenders after speaking with your reverse mortgage housing counselor. For HECM for Purchase loans youll need cash to pay the difference between the HECM proceeds and the sales price plus any closing costs.

Like all reverse mortgage loans, you will not have to make monthly payments on the HECM for Purchase loan. You will still need to fulfill the reverse mortgage requirements, such as living in the home as your principal residence, keeping the home in good condition, and paying your property taxes and homeowners/flood insurance premiums on time.

Note: Not all properties are eligible for the HECM for Purchase loan program. For example, cooperative units and some manufactured homes are ineligible for the HECM for Purchase loan program.

If You Are Considering A Reverse Mortgage Consider The Following Tips:

Look at all of your options. If you need some cash, you may have other and cheaper options. For example, a traditional home equity loan or line of credit may be a better option for you.

Review costs and fees. Reverse mortgages may be costly. Lenders sometimes charge up-front origination fees and closing costs. A reverse mortgage can be expensive, especially if you only plan to live in your home a few years.

Shop around. As with any purchase, shop around for the best price. The costs associated with a reverse mortgage, including interest rates, closing costs, and origination fees, can vary among lenders.

Beware of sales gimmicks. Be extremely cautious if anyone tries to sell you somethingâbe it a new roof or a financial product like an annuity or long-term care insuranceâand suggests that you pay for it with a reverse mortgage. A lender, broker or originator cannot require you to purchase an annuity, investment, life insurance, or a long-term care insurance product as a condition of obtaining a reverse mortgage loan.

Beware of fear tactics. Some unscrupulous agents use fear to push their products. Be skeptical of agents who use fear of going into a nursing home or running out of money to sell you a reverse mortgage. Beware of lenders or agents who falsely tell you that the government has somehow endorsed the sale of reverse mortgages.

Don’t Miss: Rocket Mortgage Requirements

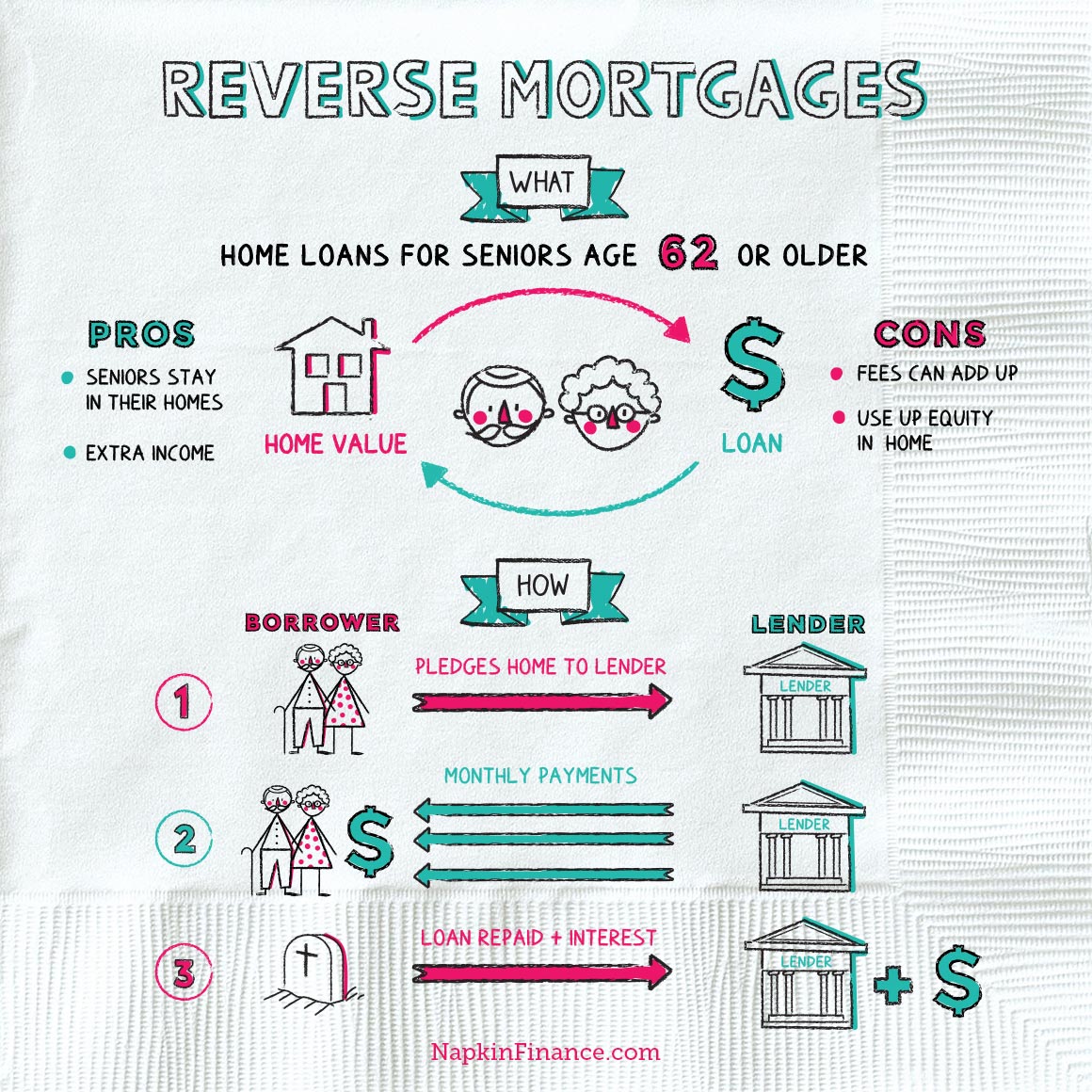

How Do Reverse Mortgages Work

When you have a regular mortgage, you pay the lender every month to buy your home over time. In a reverse mortgage, you get a loan in which the lender pays you. Reverse mortgages take part of the equity in your home and convert it into payments to you a kind of advance payment on your home equity. The money you get usually is tax-free. Generally, you dont have to pay back the money for as long as you live in your home. When you die, sell your home, or move out, you, your spouse, or your estate would repay the loan. Sometimes that means selling the home to get money to repay the loan.

There are three kinds of reverse mortgages: single purpose reverse mortgages offered by some state and local government agencies, as well as non-profits proprietary reverse mortgages private loans and federally-insured reverse mortgages, also known as Home Equity Conversion Mortgages .

How Can You Receive Your Money

There are several options for how you can receive your money if you qualify. You can access all of the money you qualify for at time of closing, in one lump sum. Or, if you prefer, you can take some of the money at time of closing and set aside the rest. The money that you have set aside is yours to access whenever you wish. All you have to do is call us up to request your money at any time!

If you would prefer to have regular deposits delivered straight to your bank account say on a monthly or quarterly basis that is also an option!

If you would like to learn more about your reverse mortgage estimate, please contact one of our Reverse Mortgage consultants at . If you would like more information about the CHIP Reverse Mortgage interest rates, click here.

Read Also: Does Rocket Mortgage Sell Their Loans

Do I Own A Condo Or A Townhouse

Condominiums are most similar to units in an apartment building however, condos are owned by the individual, not a landlord. Additionally, condominium owners have full rights to their particular unit and shared rights to the communal spaces in the condominium community. Condo owners pay substantial HOA fees to cover the costs of exterior maintenance, insurance, trash, snow removal, etc.

Townhouses are typically two stories within the unit also owned by the individual. Unlike condos, town-home owners maintain full ownership of the home as well as the land on which the home is situated. This may include a garage, backyard or front yard. Because they are responsible for their own maintenance, town-home owners typically incur lower HOA fees than condo owners.

About the Author, Tyler Plack

South River Mortgage is one of the nation’s top reverse mortgage originators. With a focus on reverse mortgages, South River Mortgage’s trustworthy advisors are able to help thousands of seniors each year.

What Are The Different Types Of Reverse Mortgages

There are three main types of reverse mortgages:

- Home equity conversion mortgage : The only reverse mortgage backed by the Federal Housing Administration .

- Proprietary reverse mortgage: Often caters to homeowners with high-priced homes and is offered by a private company.

- Single-purpose reverse mortgage: Typically has income limitations and is usually provided by local or state governments and nonprofit organizations.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

What Can Hecm Funds Be Used For

The funds from an HECM loan must first be used to pay back any money borrowed against the house. After that, the money can be used however the homeowner chooses.

For example, reverse mortgages can be used to pay for long-term care expenses, such as:

- Home care services, including help with meal preparation, housekeeping, and activities of daily living

- Assisted living, memory care, or nursing home care for a spouse or parent

- Out-of-pocket medical expenses, such as hearing aids

- Home safety modifications to help with aging in place, such as a wheelchair ramp or walk-in shower

- Adult day care services or respite care

Reverse Mortgage On Condominiums: Requirements Explained

- About Reverse Mortgages, Finance

For years condominium owners have been denied from reverse mortgages due to strict Federal Housing Administration guidelines. Fortunately, as of October 15, 2019, newly revised FHA policies were implemented to reduce barriers and increase the likelihood of applicant eligibility.

The FHA estimates to qualify 20,000-60,000 more condos with updated guidelines

Previously, less than 10% of condos in the country were approved with these new policies the FHA is confident that the number of FHA approvals will significantly increase.

Prior to applying for a reverse mortgage, condominium owners should determine whether or not their condo is already FHA approved. To do so, potential borrowers can simply visit the HUD website and enter some simple property information.

If the condo is approved, then the borrower is ready to move forward in completing the application. However, more often than not, condo associations do not have up-to-date approvals. If this is the case, borrowers can take one of two routes. They can either approach the Homeowner Association and inquire about renewing the condominiums FHA approval or receive FHA single unit approval .

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

The Bottom Line: Should You Get A Reverse Mortgage

If you can avoid getting a reverse mortgage, you should. The alternative ways to fund your retirement that weâve outlined will leave you more financially stable and with a larger estate to leave to your family when you die. Additionally, losing the equity in your home increases your financial risk if the housing market were to crash, or if something were to happen that forces you to sell.

That being said, if you fully understand the product, have spoken to a financial advisor and your family, and are confident about your decision, a reverse mortgage can be a good way to fund a more dignified retirement. Just be sure to go in with your eyes open.

Also read:

Reverse Mortgages In Canada: The Pros And Cons

Thereâs been a lot of talk about reverse mortgages over the past few years, with supporters and opponents both being very vocal. Reverse mortgages are used by older Canadians to provide a source of retirement funds, and with more than 60% of Canadians concerned theyâll outlive their retirement savings, itâs no surprise reverse mortgages are a talking point .

However, there are pros and cons to getting a reverse mortgage. Hereâs everything you need to know about reverse mortgages in Canada.

Read Also: Mortgage Recast Calculator Chase

Can You Get A Reverse Mortgage On A Condominium

Yes, you may obtain a reverse mortgage for a condo as long as you meet the requirements outlined by the HUD. A reverse mortgage allows senior homeowners to take advantage of their propertys equity and use it to settle debts, fund their retirement travel, or complete home renovations. This also provides an additional source of income for retirees to enjoy their retirement in their own homes.

Things To Beware Of In The Reverse Mortgage Process

- Sales tactics that require or suggest buying annuities, investments, long term care insurance, or other types of insurance policies with proceeds from the loan.

- Sales tactics involving contractors looking for proceeds to pay for home repairs.

- Advice to transfer title to the property out of you or your spouse’s name to qualify for the loan.

- Advice to make loan proceeds payable to third parties.

- Estate planning services offering to refer you to a lender for a fee or percentage of the loan. You get information on lenders from the DOB and Housing and Urban Development at no cost.

- Pressure to draw down all available equity into a single upfront disbursement.

Also Check: Chase Mortgage Recast