What Are Discount Points On A Mortgage

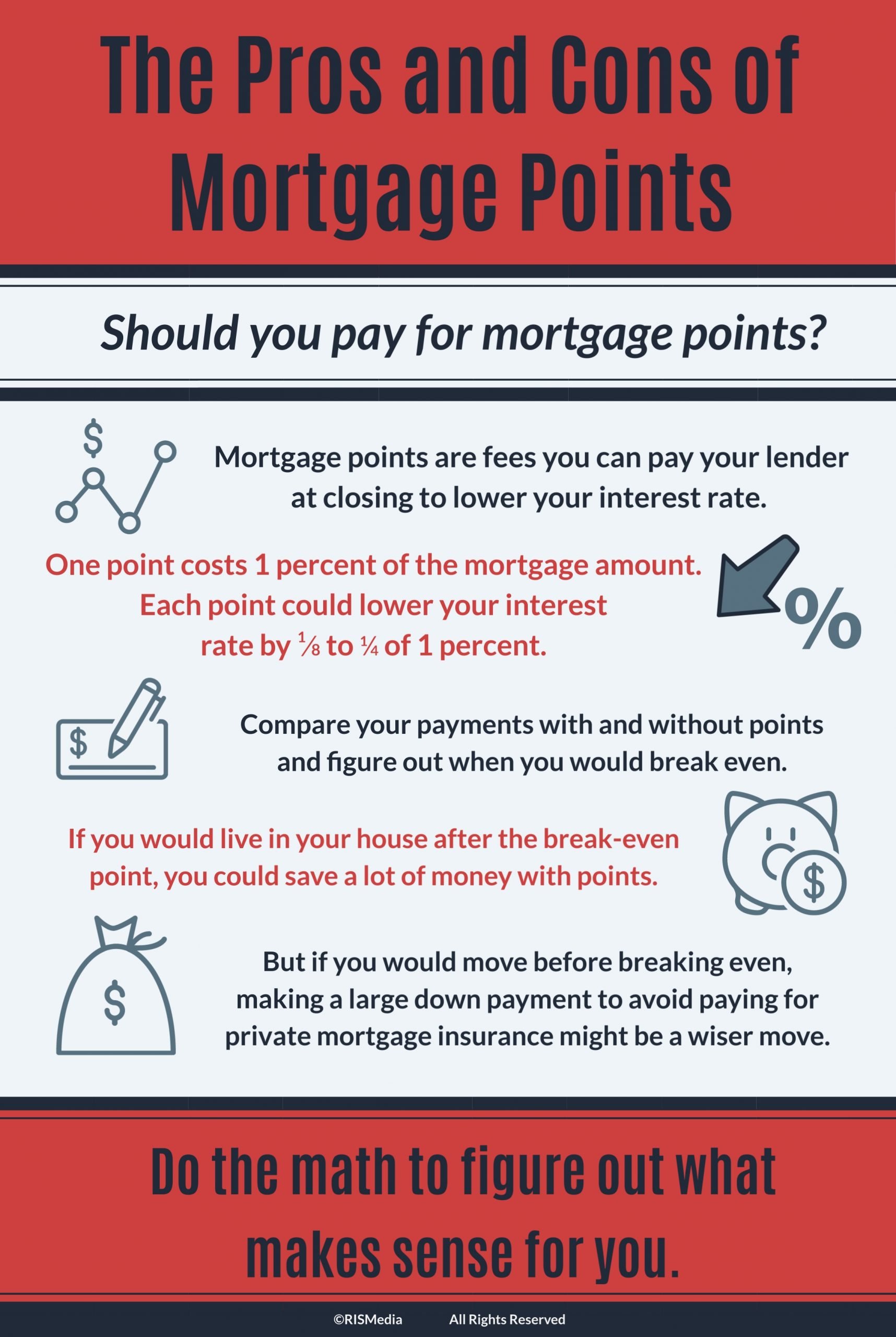

When you buy mortgage points, you pay an upfront cost at closing time in exchange for a lower interest rate that will help you reduce your monthly payments and save in total interest.

If you intend to keep your home for many years, the savings with discount points can be significant. However, if you believe youll only live in your home for a short time, the savings may not be enough to offset the cost of the mortgage points.

One mortgage point equates to 1% of the loan amount. For example, if you take out a $200,000 mortgage, one mortgage point would be worth $2,000.

If you dont buy any mortgage points, you will have a zero-point loan. Once you purchase a mortgage point, you will have a loan with one point, and your interest rate will be lower than the rate with the zero-point loan. The loan term, loan amount, and other features of the loan will remain the samethe only difference would be the interest rate.

How much lower an interest rate is because of a mortgage point varies by lender, the current mortgage market, and the type of mortgage loan. Depending on these factors, a mortgage point can reduce an interest rate significantly or insignificantly.

Should You Buy Down Your Rate As Mortgage Interest Rates Rise

Since the start of 2022, mortgage rates have risen sharply, and that might make mortgage points seem more attractive to many borrowers. The calculation is a little more complicated, however, than just figuring out how to get the lowest possible rate in the current market, McBride says.

While borrowers may give greater consideration to paying points when rates have been on the rise, the breakeven point is still nearly six years, McBride says. The benefits of paying points only truly accrue if you expect to have the loan longer than that, which might be very plausible when rates were at all-time lows near 2.5 percent, but with rates at 4.5 percent, youre more likely to be looking to refinance if we see a drop in rates.

Basically: Points could be a good way to go if you want to set and forget your mortgage, but if you plan to manage the account more actively and refi into a lower rate if the market recedes, it might not be worthwhile to buy them now.

Pros And Cons Of Buying Points On A Mortgage: Is It Worth It

Buying mortgage points is a way to lower your interest rate at closing by prepaying some interest upfront. It will also get you a lower monthly mortgage payment and youâll pay less interest overall throughout the life of your loan. The more pointsyou buy, the lower your interest rate will be.

Many home buyers are averse to buying mortgage points because they either donât trust the lender or donât want the extra expense. And itâs true that mortgage points arenât the best choice for everyone. Here are the pros and consof buying points on a mortgage so you can decide if itâs the best move for you.

Read Also: What’s A Conventional Mortgage

Should I Buy Mortgage Points

Mortgage points may not be right for every homebuyer. Figuring out the break-even point is a good start, but there’s more to consider before buying points. For example, you’ll need to come up with the money to pay for the points.

Although a point generally lowers your interest rate by 0.25%, the reduction per point can vary depending on the lender, type of loan and market conditions. Make sure to run the numbers that apply to the specific mortgage you’re considering.

Even when you plan to pay for points, you should still get competing mortgage offers to see which rate and terms are best. Paying for points from one lender could decrease your rate, for example, but it could still end up higher than a competitor’s offer.

You may find that the value of each point from the same lender changes as you compare types of loans. Additionally, if you’re considering an adjustable rate mortgage, look to see if the lender will continue to apply the interest rate reduction after your initial fixed-rate period ends.

All that said, the simplest and easiest solution may be to simply put money toward a bigger down payment.

How To Negotiate Mortgage Points

Can you negotiate points on a mortgage? In some cases, yes! While the lender makes the final decision, you can boost your chances of getting a yes by:

- Boosting your credit score

- Throwing big money at that down payment

Negotiating may be a nonstarter if your credit score isnt 750 or higher and youre making a down payment of less than 20%.

We knowwe just gave you a lot of factors to think about. Good thing we want to help you get as realistic of a picture as possible about how much you can pay on a monthly mortgage based on how much you can make on a down payment.

Don’t Miss: What Is The Maximum I Can Borrow For A Mortgage

Are Mortgage Points Tax

Mortgage discount points, which are prepaid interest, are tax-deductible on up to $750,000 of mortgage debt for homeowners who bought property after Dec. 5, 2017, or up to $1 million for those who purchased before that date. Taxpayers who claim a deduction for mortgage interest and discount points must list the deduction on Schedule A of Form 1040.

That generally isnt a problem for homebuyers, as interest on your mortgage often is enough to make it more beneficial to itemize your deductions rather than taking the standard deduction, says Boies.

However, unless you can meet a host of IRS requirements, you cant take a deduction for all of the points you paid in the same tax year. Each year, you can deduct only the amount of interest that applies as mortgage interest for that year. The points are deducted over the life of the loan, rather than all in one year.

Origination points, on the other hand, are not tax-deductible.

Points that are not interest but are charges for services such as preparing the mortgage, your appraisal fee or notary fees cant be deducted, says Boies.

Consult a tax professional if youre not sure what home-buying expenses are tax-deductible.

Is It Worth Buying Mortgage Points

Buying points and whether they will truly benefit you depends on various factors. Buying points may be beneficial if you:

- Plan to stay in your home for a long time

- You understand the breakeven point and do not anticipate the need to refinance or move before that point.

In many cases, buying points is not beneficial for the borrower. These times can include:

- You do not plan to stay in the home for the length of time required to reach the breakeven point

- You plan to pay extra on your monthly mortgage payments

- You do not have the extra money to purchase points

- Buying points will reduce the amount of your down payment a higher down payment often means a lower interest rate, reduced home mortgage insurance, and lower monthly payments.

You May Like: Where To Compare Mortgage Rates

You Could Get A Tax Break

Another upside of discount points is that they can give you a nice tax break, provided you meet certain requirements.

Any interest you prepay on your mortgage is tax deductible on the year you pay it, at least for the first $750,000 you borrow.

However, there are some terms and conditions for that tax break. Make sure you read the fine print and speak with a trusted financial adviser before buying points in the hopes of getting a tax break.

Boost Your Credit Score

A final way to qualify for a lower interest rate is to hold off on buying your home or refinancing while you work to improve your three-digit credit score, as this is one of the factors lenders consider. Five components account for your credit score: debts you owe, the length of your credit history, your payment history, new credit and the mix of credit. There are steps you can take to improve your credit score, and you can boost your score in a matter of months by paying off debt or establishing new credit. Meanwhile, recovering from big hits to your credit scorelike late payments or bankruptcycan take anywhere from nine months to up to 10 years, on average, according to a FICO study.

Boosting your credit score may be a good alternative to buying mortgage points. A higher FICO score can qualify you for a lower interest rateand even a relatively small boost to your credit score , could mean the difference of a 5.35% annual percentage rate versus a 5.128% APR, according to figures from FICO. That rate differential amounts to a $55 difference in monthly paymentsor $6,600 over the course of 10 years.

You May Like: What Is The Mortgage Payment On 500k

Some Lenders Also Offer Negative Mortgage Points

You also have the option with some lenders to apply negative points to your mortgage. Essentially, this means you increase your interest rate in order to get a credit you can use to cover closing costs.

For example, if you were taking out a $250,000 mortgage and you applied a negative mortgage point, your interest rate might rise from 3.00% to 3.25% — but you would get a $2,500 credit to cover costs at closing.

While negative points make your home cost more over time, they can sometimes make it possible to afford to close on a home when you otherwise would be tight on cash. Just be aware that it’s a costly option.

In the above example where you raised your rate from 3.00% to 3.25%, your $250,000 loan would result in a monthly payment of $1,088 and the total cost of your mortgage would be $391,686.

Compare that with a monthly payment of $1,054 and a total cost of $379,444 if you hadn’t applied negative points. You’d pay $34 more each month and $12,242 more over 30 years in exchange for having gotten $2,500 up front.

How Much Money Do You Have To Put Down At Closing

If your down payment on a conventional loan is under 20%, you may be required to pay private mortgage insurance , which can cost about 1% of the loan amount annually. In the case of a conventional loan for $150,000, the PMI will cost $1,500 a year or $125 a month.

This is important for clients who are on the fence between paying for mortgage discount points or a larger down payment. If its between discount points and boosting your down payment to 20% or over, youll want to choose the down payment most of the time. Always do the math and consider if your discount points are costing you more or less than your monthly PMI fees.

PMI rates do vary from lender to lender, so this is a question worth asking if youre shopping for a conventional loan. Its also important to know that mortgage insurance guidelines will depend on the type of loan you have .

You May Like: Can You Get A Reverse Mortgage On A Condo

Read Also: What To Look For Mortgage Loan

How Mortgage Points Work

Pamela Rodriguez is a Certified Financial Planner®, Series 7 and 66 license holder, with 10 years of experience in Financial Planning and Retirement Planning. She is the founder and CEO of Fulfilled Finances LLC, the Social Security Presenter for AARP, and the Treasurer for the Financial Planning Association of NorCal.

Mortgage points are used in the loan closing process and are included in closing costs. Origination points are mortgage points used to pay the lender for the creation of the loan itself whereas discount points are mortgage points used to buy down the interest rate of the mortgage.

Does It Make Sense For You

To determine whether mortgage points are right for you, you need to find out how much you have available for the home buying process: down payment, closing costs, monthly mortgage payments, and mortgage points.

Use our mortgage calculators to help you work out how much cash you need to close.

Buying points to lower your interest rate makes the most sense if you select a fixed rate mortgage and you plan on owning your home after youve reached a break-even point of 36 months or less.

Under the right conditions, purchasing points when you purchase a home can save you quite a bit of money over the full length of your loan term. Remember, theres a lot to think about when considering paying/buying points to lower your rate. To be absolutely sure youre making the right decision, contact one of the mortgage experts at American Financing if youre considering buying a home and leveraging mortgage points.

Read Also: How Much Percent Of Income Should Mortgage Be

Are Discount Points Right For You

Theres no one-size-fits-all approach for buyers when it comes to discount points. According to Boyles, the best thing you can do is talk to your loan officer.

A buyer needs to work with their licensed loan officer and make a very educated decision, he says.

You need to ask yourself, how long are you going to be in the home? What would you do with that money otherwise? Do you want to spend $5,000 on your mortgage, cause youre going to be in that home for the rest of your life? Or would you rather spend that money on a new couch when you actually move into your home?

Perhaps that money could be better spent elsewhere.

Another option is to ask the seller to pay points for you.

If I personally was buying real estate, I would ask the seller for a credit. If you can get free money from somebody, its worth paying the points, Boyles divulges.

Its a tactic thats paid off for him in the past. Ive gotten a credit on every deal Ive ever done. Ive never purchased a home without the seller paying at least 3%, he adds.

In fact, Boyles says its common for builders to offer points for new constructions as a way to incentivize buyers.

A seller concession may be the best of both worlds for the savvy homebuyer. Plus, it rarely hurts to ask!

When Are Mortgage Points Worth It

If you are buying a home and have some extra cash to add to your down payment, you can consider buying down the rate. This would lower your payments going forward. This is a particularly good strategy if the seller is willing to pay some closing costs. Often, the process counts points under the seller-paid costs. And if you pay them yourself, mortgage points usually end up tax deductible.

In many refinance cases, closing costs are rolled into the new loan. If you have enough home equity to absorb higher costs, you can pay mortgage points. Then you can finance them into the loan and lower your monthly payment without paying out of pocket.

In addition, if you plan to keep your home for a while, it would be smart to pay points to lower your rate. Paying $2,000 may seem like a steep charge to lower your rate and payment by a small amount. But, if you save $20 on your monthly payment, you will recoup the cost in a little more than eight years.

The lower the rate you can secure upfront, the less likely you are to want to refinance in the future. Even if you pay no points, every time you refinance, you will incur charges. In a low-rate environment, paying points to get the absolute best rate makes sense. You will never want to refinance that loan again.

But when rates are higher, it would actually be better not to buy down the rate. If rates drop in the future, you may have a chance to refinance before you would have fully taken advantage of the points you paid originally.

Also Check: Can I Get A Mortgage With A 660 Credit Score

Are Mortgage Points Tax Deductible

Because the cost of discount points represents prepaid interest, points are deductible for taxpayers who itemize. Though, the loan must be secured by your main home and meet some other criteria. You generally have to deduct them over the life of the loan though sometimes, you can deduct the points in the year you pay them. But you can usually only deduct points paid on up to $750,000 of mortgage debt .

Example. Say you take out a $1,000,000 mortgage loan and purchase one point for $100,000. You’ll only be able to deduct $75,000 the remaining $250,000 isn’t tax-deductible.

In some cases, the seller will agree to pay for points to incentivize a buyer. Points are deductible in this situation, too.

According to the IRS, origination fees are also tax-deductible, but points paid for items that are usually listed separately on the settlement sheet such as appraisal fees, inspection fees, and attorney fees, aren’t.

If You Arent In The House For Long Enough You Might Not Break Even

Again, discount points are a long game. If youre uncertain how long youll be in your home, it may be too risky to prepay interest.

Its helpful to look at your break-even point to guide your decision.

How to calculate break-even

Cost of discount points

How much money youd save each month on your mortgage payment

How many months it will take you to break even.

So, using our example above, if you bought one discount point, youd break even in around 67 months. The calculation looks like this:

$1,600 / $24 = 66.66 months

Where do you figure out your monthly mortgage payments for each scenario? You can head to a mortgage calculator to run the numbers. This is a great way to conceptualize what using discount points might look like for you.

You May Like: How Long Does It Take To Refinance A Mortgage